Fidelity continues to deploy in the crypto mining industry, acquiring 7.4% of Marathon shares through four index funds

This article comes fromForbes, Original Author: Anthony Tellez

Odaily Translator | Nian Yin Si Tang

This article comes from

, Original Author: Anthony Tellez

Odaily Translator | Nian Yin Si Tang

The acquisition shows how institutional and individual investors are increasingly looking to gain exposure to cryptocurrencies through traditional stocks or bonds. Marathon’s stock trades at a similar price to Bitcoin (see chart below), only its returns are amplified. So while Bitcoin is up 240% in the past year or so, Marathon stock is up 660%. Thus, these Fidelity index funds can effectively gain exposure to Bitcoin without owning the digital asset directly. It could also mean that many investors in the U.S. and abroad have inadvertently gained exposure to Bitcoin and other digital assets in retirement accounts or portfolios.

image description

Bitcoin and Marathon Digital Holdings Price Comparison January-June 2021 (source YCHARTS)

With this acquisition, Fidelity joins other institutional giants such as Vanguard Group (7.58%), Susquehanna (2.7%) and BlackRock (1.59%), which also have stakes in Marathon.

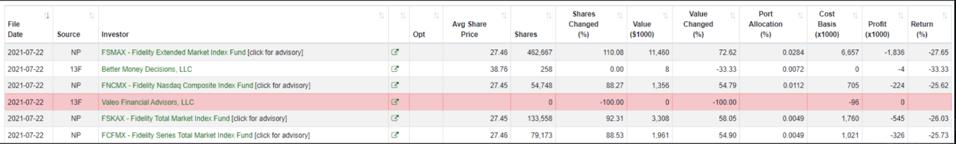

image description

Stock Purchase Details (Source: MARATHON DIGITAL HOLDINGS)

It makes sense for Fidelity to push its business in this direction, as it was one of the first financial institutions to start accepting cryptocurrencies and digital assets. In fact, several years ago, the company’s executives mined bitcoins in their offices to experiment with the technology.

"We're very excited about the agency's acquisition," Marathon Chief Executive Fred Thiel said in an interview after the Fidelity disclosure. "If you look at the change from last year to this year, even the past two quarters, the growth in institutional ownership of our stock has been dramatic," Thiel said.Announce“I think as an investor looking at mining stocks, you look at growth rates, you look at return on assets, you know it’s a very capex-intensive business,” Thiel added.

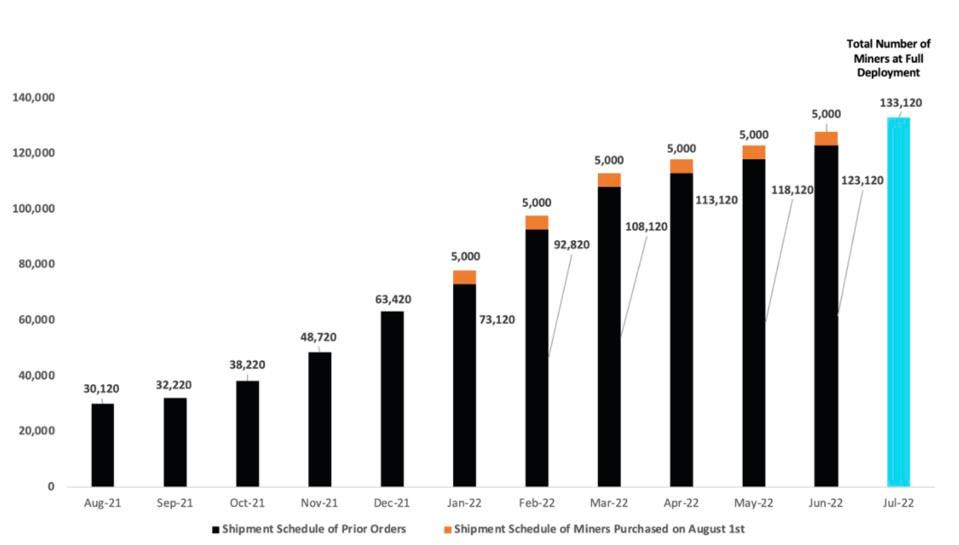

The mining company currently deploys about 19,000 mining machines in the United States and plans to deploy more than 100,000 mining machines in the next 12 months. August 2, Marathon Digital Holdings

Marathon Miner Deployment Plan (Source: MARATHON DIGITAL HOLDINGS)

In addition, according to