【Deribit Options Market Broadcast】0729——Skew Negative Bias

【Daily Review】

【Daily Review】

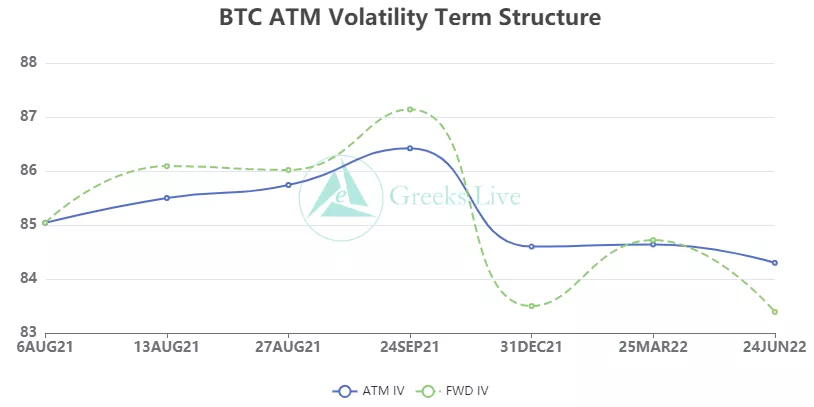

【BTC Options】

【BTC Options】

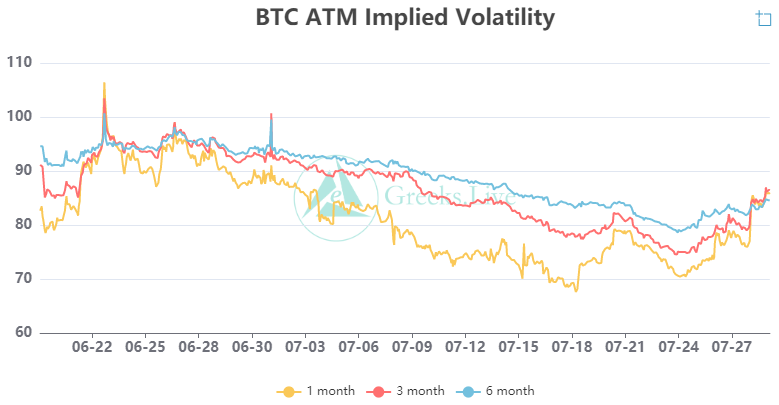

Implied volatility for each normalized term:

【Historical Volatility】

10d 79%

30d 60%

90d 95%

1Y 77%

【IV】

Implied volatility for each normalized term:

Today: 1m 86%, 3m 85%, 6m 84%, DVol 95%

7/28:1m 85%, 3m 84%, 6m 83%,DVol 89%

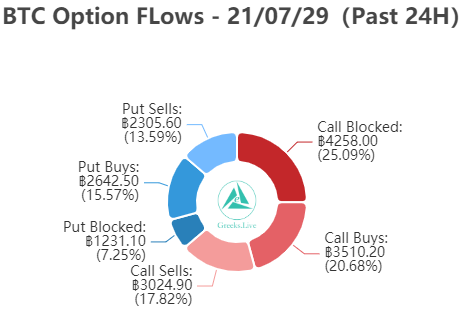

【Option Flows&Bulk Transaction】

【Option Flows&Bulk Transaction】

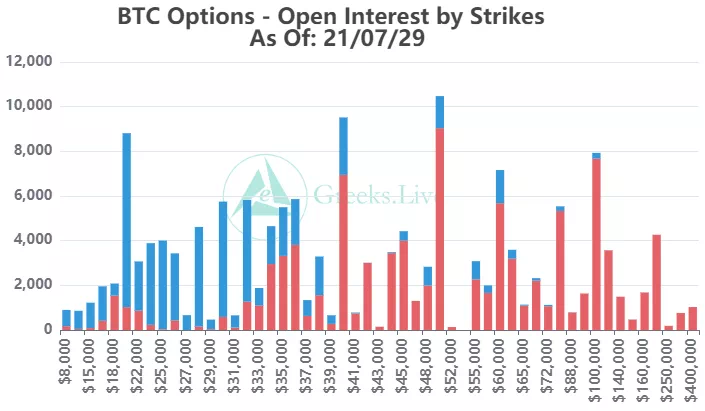

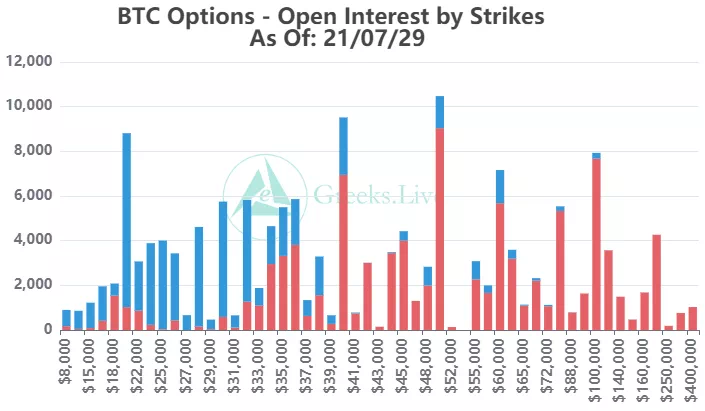

【Option position distribution】

【Option position distribution】

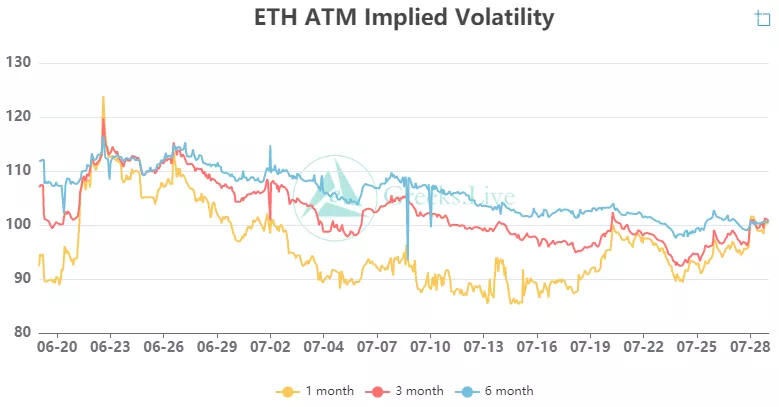

【ETH Options】

【ETH Options】

Today: 1m 100%, 3m 100%, 6m 100%

【Historical Volatility】

10d 83%

30d 83%

90d 140%

1Y 109%

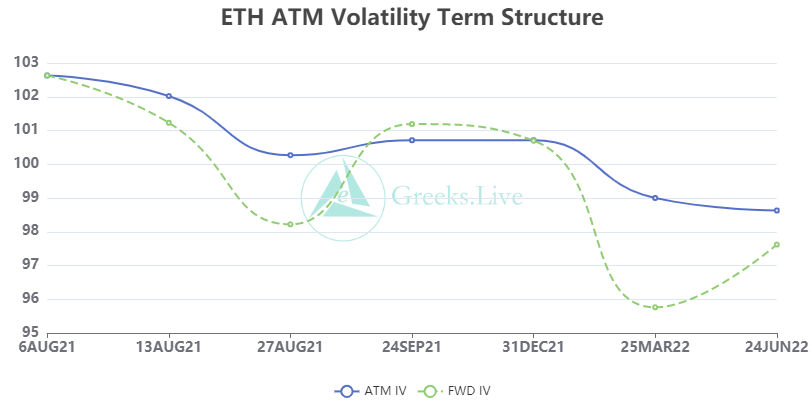

【IV】

Each standardized period IV:

Today: 1m 100%, 3m 100%, 6m 100%

7/28:1m 102%,3m 101%,6m 100%

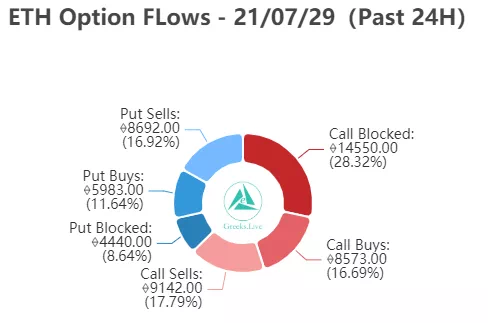

【Option Flows&Bulk Transaction】

【Option Flows&Bulk Transaction】

【Option Flows&Bulk Transaction】

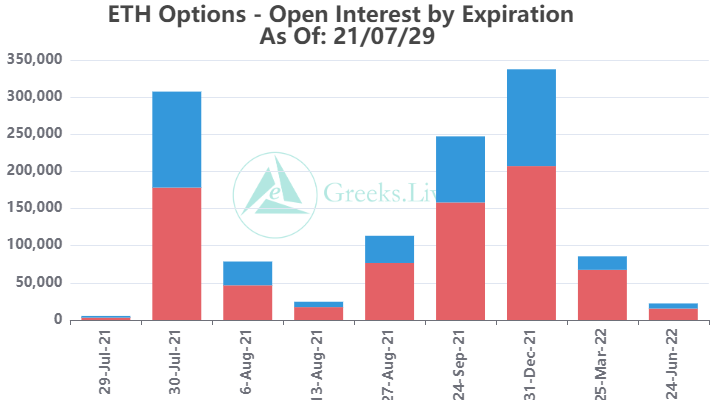

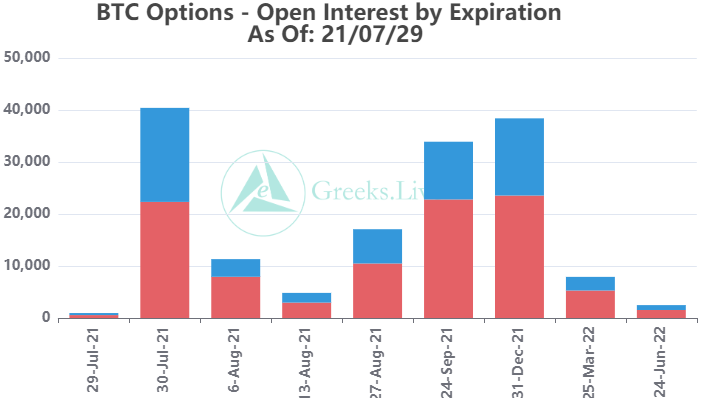

【Option position distribution】

【Option position distribution】

The July option is about 310,000 coins, of which the call option is 178,000 coins, and the monthly position has skyrocketed.