Belonging to the blockchain revolution of DeFi, the application of blockchain is beyond the imagination of ordinary people

Roast Boy Creators Alliance | There are already applications on the blockchain beyond the imagination of ordinary people.

The first one is DeFi.

DeFi stands for Decentralized Finance, where financial behaviors such as deposits, loans, and transactions are carried out without centralized institutions and threshold restrictions.

Take deposits and loans as an example.

In DeFi, when you go to the "on-chain bank" to deposit, you don't need the bank to open an account for you like traditional banks, and you don't need to disclose any personal information. You only need to link your wallet to the bank's smart contract, and then complete the deposit operation.

In traditional finance, many departments of the country set and adjust interest rates. Among DeFi lending, these are handed over to smart contract codes and the market for adjustment.

The specific implementation is roughly like this. When there are more and more borrowings, that is, the utilization rate of funds is high, then in order to prevent the run-on problem, the interest on loans will increase at this time, and the interest on deposits will also increase, thereby stimulating more people to deposit. The risk of a run is even smaller. When the capital utilization rate is low, the smart contract will automatically reduce the borrowing interest, thereby stimulating people to borrow, allowing the capital to flow and exert its value.

Does it look like the central bank is regulating the economy? But the difference is that these tasks on the blockchain and DeFi only need a series of codes to complete, which is fast, efficient, and has a high utilization rate of funds.

Take stock trading as an example.

Early stock trading relied on manual bookkeeping. We saw scenes in some Wall Street movies. In the noisy market, people shouted loudly how many XX stocks I want to buy/sell, and then the bookkeeper quickly wrote it down in the notebook. , After some checks, help the stock trader to complete the transaction.

After Nasdaq developed stock trading software, the trading scene we saw became a stock trader facing the computer and making a phone call in the exchange.

Now, there are decentralized exchanges in the DeFi world.

One of them is called Uniswap, which brought in $153.9 million in May.

As a decentralized exchange, Uniswap has the same business model as Nasdaq, a well-known stock trading market. By providing transaction matching services, Uniswap collects a handling fee from each transaction.

Uniswap's product is 500 lines of code. It has more than 20 employees. In a market with a total market value of no more than 2 trillion US dollars, it earned 153.9 million US dollars in a month.

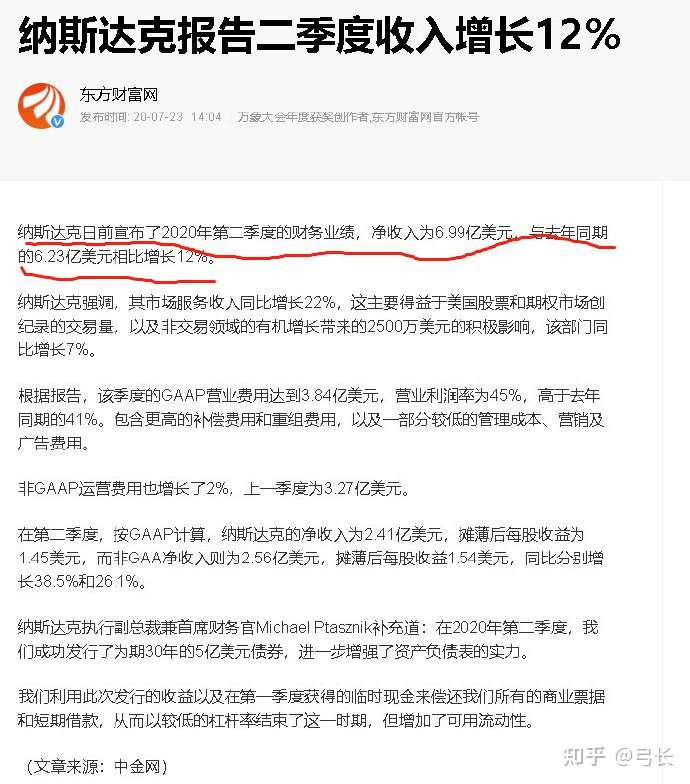

With 50 years of accumulation, Nasdaq has more than 4,000 employees, and in a market of more than 20 trillion U.S. dollars, its total revenue in the second quarter of last year was 700 million U.S. dollars.

Similarly, you do not need to disclose any information to trade through Uniswap, and there will be no capital threshold for transactions and investments.

At the same time, in the decentralized exchange on the blockchain, you really control your own assets, instead of depositing them in the hands of others, they can be traded at any time, and the liquidity is extremely strong: whether it is US stocks or A shares, when When the exchange does not help you with transactions, you cannot trade your own assets. Imagine that at 5 pm on a weekend or a weekday, the stock market is closed, and you need a sum of money urgently. There are Moutai stocks in your account. But you can only wait for the exchange to go to work and the market to open before selling.

This is a disruptive change.

This gap in efficiency and convenience is a blow to dimensionality reduction. Over time, the latter (Nasdaq) will not have any resistance.

In the traditional stock trading market, there is a very important role called market makers, who help people complete transactions and collect commissions from them. They often require a lot of capital and manpower to collect transaction information in the market, so as to find profitable trading opportunities, and then make markets and provide liquidity.

In DeFi, everyone can play this role and obtain this income, without the absolute limit of the amount of funds. This is called AMM (Automatic Market Making Mechanism). Combined with smart contracts, it allows everyone to become a market maker, utilize their idle funds, let smart contracts help us earn income, and greatly improve the utilization rate of funds.

Another decentralized exchange, DODO, researches on the utilization rate of funds, which can increase our utilization rate of funds beyond imagination.

DODO uses the PMM algorithm to concentrate liquidity around the market price to provide excellent liquidity. The PMM algorithm can leverage huge trading volume with very little capital. Under the trend of higher and higher blockchain network performance, the advantages of DODO's PMM algorithm will become more and more obvious.

The substantial increase in the turnover rate has made DODO dare to significantly reduce the transaction fee rate in order to provide better prices. When DODO currently only sets a 0.05% handling fee in BSC's PMM fund pool, the quotation is extremely advantageous.

This value can be dynamically adjusted according to the market environment, and does not exceed 0.15% when the market is highly volatile, which makes DODO's current pricing advantage very attractive.

Wootrade is the first professional market maker to cooperate with DODO. They have established five fund pools in DODO, including BTC, ETH, BNB, DOT, and LINK. In the case of only using 1.7M US dollars of funds, it can generate 20M transactions per day and obtain a profit of about 10,000 US dollars.

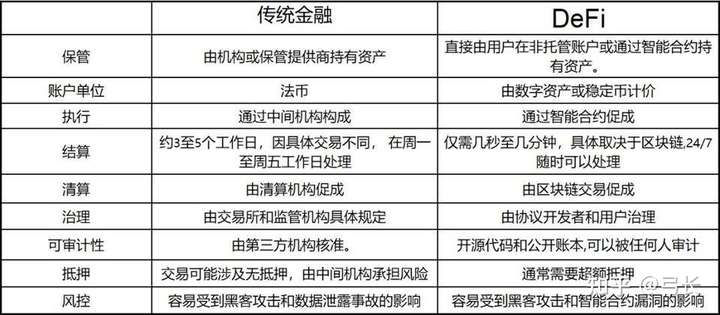

The following is a comparison between DeFi and traditional finance summarized by Chris McCann, co-founder of venture capital fund Race Capital, to feel the difference.

Encrypted assets are not scourges. They achieve higher benefits at lower costs. This is the blockchain revolution that belongs to DeFi.