Beware of Three Kinds of NFT Scams|New Scams

Since Christie's 450 million yuan auction of Beeple's NFT art work "Every Day: The First 5000 Days", NFT art has been hotly hyped in China. Recently, four "NFT payment code skins" including Dunhuang Feitian and Jiuselu were sold in limited quantities on the Alipay applet "Ant Chain Fan Granules". The price is "10 Alipay points + 9.9 yuan". , was sold out quickly, and the hot sale inevitably aroused heated discussions in the society.

It is undeniable that NFT, a new technology product, has brought new trends and opportunities to the market. At the same time, we must be more vigilant to avoid letting new things fall into the blind spot of supervision. Once the monitoring is not effective, NFT will become the next legal disaster area.

What exactly is NFT? NFT (Non-fungible Token) refers to a non-homogeneous pass, which is a virtual currency rights and interests certificate derived on the basis of blockchain technology. It can provide intellectual property marks for artistic data such as digital images and digital music. Alterable, indivisible, irreplaceable, unique features.

The characteristics of NFT related technology make it firstly applied in the field of art investment. After artists convert their digital works to NFT, they will have a unique "ownership certificate", so that the source, price, transfer process and other information of the work will be recorded in the subsequent circulation.

Since NFT perfectly solves the problem of confirming the rights of digital artworks, it is regarded by many people as a big business opportunity, and therefore develops rapidly. At present, it has involved games, collectibles, virtual worlds, encrypted artworks, etc., and the related market has shown a Prosperity.

So behind the popularity, what will the criminals do? Let's look at the following cases:

Scam 1 Hype the concept to lure investors into the game

Due to the support for NFT token transactions, the relevant market has gathered a large number of virtual currency transaction investors. From the recent popular NFT auction transactions, we found that most of the buyers who bought NFT works at high prices were not artists, but people in the currency circle.

For example: On March 11, 2021, Vignesh bought Beeple's NFT work at a sky-high price of US$69 million. It is worth noting that this Vignesh from Canada is not a traditional art collector, but a person in the currency circle with 8 years of experience in the virtual currency market, and was once suspected of running away from the exchange.

In 2013, Vignesh founded the virtual currency exchange coins-e.com in Canada. When browsing virtual currency forums, we can easily see information about users suing the exchange for running away. Many of them have lost millions of virtual currency users. The exchange has now closed down.

In 2014, Vignesh issued a coin named LST, which sold 50,000 ETH worth of ETH within two days in January 2018. However, the good times did not last long. The price of LST tokens plummeted after a short period of glory, and now it is even worse , tends almost to zero.

In 2020, the concept of NFT is in the ascendant. In 2021, Vignesh will issue the currency again called B20. According to the issuer, the team will purchase valuable works of art from the market, and holding B20 is equivalent to holding works of art. On the surface, it looks very good, but according to Vignesh's previous operation methods, this may be the "leek" (artwork NFT) that Vignesh once again extended his sickle to.

It is understood that Vignesh has bought Beeple's works more than once at the auction, and Beeple holds 2% of the total B20, which is quite a lot. Then we will wait and see how Vignesh will use the NFT hype concept to carry out cash operations in the future. Whether B20 will repeat the same mistakes is also worthy of continued attention.

Scam 2 Using NFT MLM

The victim, Ms. Lu, is a creator of digital art. Not long ago, she was introduced by a friend to an encrypted art auction platform called Foundation (https://foundation-inc.app). Users need to publish their works on The auction is carried out on the platform, but before the auction starts, a certain fee needs to be paid for the works put on the shelf. The platform implements an invitation mechanism to attract people to the platform to give rebates. The more people you attract, the more rebates you will get. The platform is currently inaccessible.

According to Ms. Lu, when she first came into contact with Foundation, she suspected that the platform was an MLM platform because of the invitation mechanism, and she also checked a lot of relevant information. But out of curiosity and curiosity about NFT, she still chose to believe, and then created several works and published them on the platform.

Not long after, Ms. Lu found out that one of her works had been photographed, and she was excited for several days. With the experience of this auction, Ms. Lu completely let go of her guard. Next, she introduced a few NFT-loving friends to participate in the creation of NFTs and publish them on the platform. "Deep pit".

Later, Ms. Lu posted her NFT works on Moments to attract attention, and more and more people joined, even many of whom Ms. Lu was not familiar with.

After another period of time, Ms. Lu found that her work was always in the state of waiting to be photographed, and no one cared about it for a long time. In desperation, she contacted the customer service of the platform to ask why. The reply was that her NFT works were not influential enough. She suggested Recharge for generation promotion to increase popularity.

In order to increase her influence, Ms. Lu recharged 100,000 RMB on the platform successively, attracted more than 30 people, and invested a lot of time and energy. It was not until one day that the website could not be opened that Ms. Lu suddenly realized that she had been cheated. Many friends around her Also because of the loss of interests in this incident, Ms. Lu's personality completely collapsed.

From the case of Ms. Lu being deceived, it is not difficult to find that the platform claiming to be Foundation is false, and the real website of the Foundation trading platform is https://foundation.app/, not https://foundation-inc.app.

Fraud gangs use fake URLs and platforms to lure victims who are not familiar with NFT into the game, and use pyramid schemes to get more people involved. Ms. Lu believes that NFT using blockchain technology can provide herself with a more advanced and safer transaction method, which led to being deceived, but she forgot that new technology is often a "double-edged sword".

The methods of the fraud gang in the case are novel, and they have worked hard in the vertical field of NFT art, so investors must be cautious before investing.

Scam 3 Fake NFT

Criminals counterfeiting artwork or content related to hot topics in the real world has become a current concern.

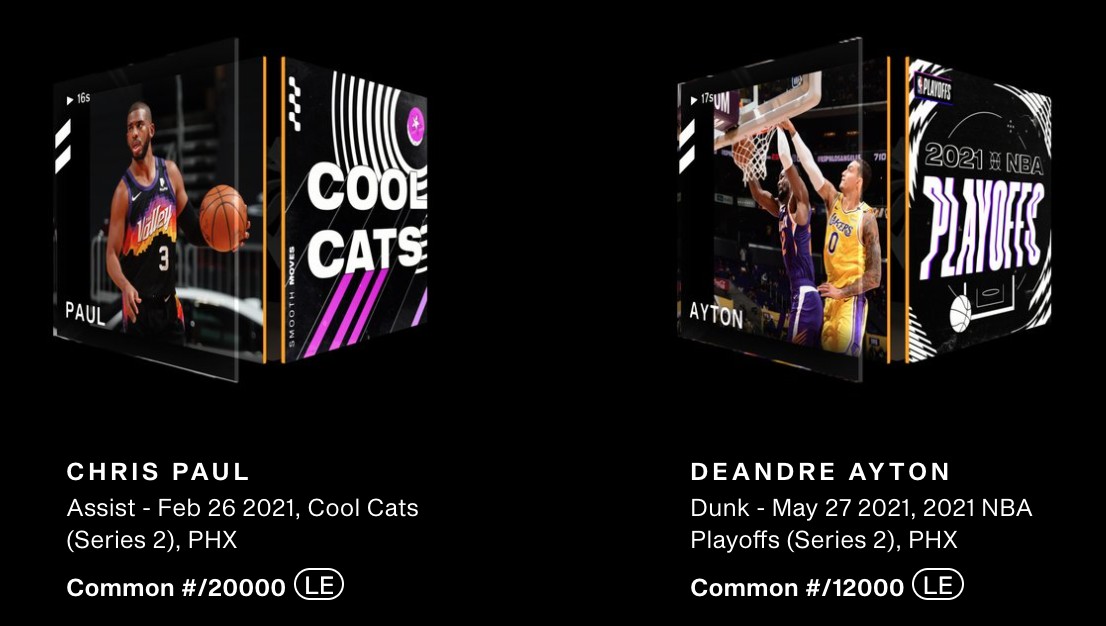

Remember the star cards in junior high and high school? Owning a Jordan card, you will become the object of worship of the whole class. Recently, a company called Dapper Labs has obtained the authorization of the NBA, and jointly launched NBA Top Shot with the NBA - the world's first blockchain star trading card platform. The platform distinguishes the scarcity of star cards and launches ordinary cards, Rare and legendary cards. Many fans who collect physical star cards have turned to collecting this kind of NFT star cards. At present, the number of players who have star cards has reached more than 460,000.

At present, a large part of the people who dabble in NFT are "new wave players" or young people who are keen on chasing hot spots, and they are easy to fall into the trap of counterfeiting NFT.

Next, we will share a case where the victim, Ms. Luo, is a loyal fan of "Brother" (Leslie Cheung). In the fan group, I saw an NFT work of Leslie Cheung when he was a child. Out of the idea of collecting, Ms. Luo clicked the group link to enter the platform.

The platform claims that the published works are unique, and the ownership belongs to itself after purchase, which is extremely valuable for collection. It also has an irresistible slogan: "If you like him, you will own him". Under the background of these contents, Ms. Luo was a little bit "upper" and started to operate the purchase. However, she ignored that the real NFT transaction should be completed on a formal exchange, not a private address transfer. After the purchase was completed, Ms. Luo was surprised to find that what she got was just an online copy.

After receiving Ms. Luo's request for help, Zhifan Technology found out by tracking the transaction address based on the clues provided by the victim that the address was a high-risk address of an overseas fraud gang.

safety reminder

safety reminder

Since NFT entered the public eye in 2020, domestic NFT teams have also begun to participate. There are many speculators in these teams, which bring risks to the stability of the market. Some of the above cases are just a microcosm of the chaos in the NFT market. Professional investors are betting that the value of this NFT will appreciate in the future. For the public, what is the value of this investment? We tentatively consider this a compromise in the era of "lazy design".

The frequent occurrence of NFT cases is worrying. Fortunately, although the concept of NFT is popular, the identification of criminal gangs and the detection of related cases are not that difficult from the bottom of the technology.

Zhifan Technology believes that in the field of encrypted art NFT, if fans want to collect or create their own NFT for a long time, they need to carefully screen to reduce risks. After all, even OpenSea, the largest NFT trading platform at present, still stores its NFT files on its own server (this is not in line with the original design intention of NFT decentralization).

So how should we identify risks when conducting NFT transactions? There are two tips: on the one hand, if you find that the NFT work can be edited after being sold, then there must be something wrong with the transaction, because it does not conform to the non-tamperable characteristics of NFT; on the other hand, casting the NFT The blockchain public chain should have sufficient decentralization and have the strength of long-term survival. Based on the above two points, it can be basically judged whether this NFT transaction is reliable.