The road to financialization of NFT

Although NFT (non-homogeneous tokens) existed as early as the beginning of 2018, it was only a collection of encrypted cats by cryptocurrency enthusiasts, an edge use case in the edge community, and the usage scenarios were very limited. Now in the past three years, the NFT field has begun to see its scale, with artists, designers, game developers, musicians and writers.

NFTs like bitcoin and distributed finance (DeFi) are financial, social and political movements. They enable the ownership and provenance of digital content that people can buy from creators around the world with near-instant transfer of value. This movement is particularly driven by individuals from industries or parts of the world where it is difficult to directly monetize their work. This article is supported by the Baked Boys Alliance.

That said, we are still far from mainstream adoption and realizing the full potential of this technology, and while the first phase of adoption involves the tokenization of off-chain and native on-chain media assets, the second phase will involve using DeFi protocols to These assets are financialized to improve their value proposition and enable new use cases.

secondary title

DeFi boosts NFT

“Financializing” NFTs through DeFi protocols solves many of the problems NFTs face today, in particular:

Accessibility

fluidity

fluidity

Having a liquid marketplace of buyers and sellers of a particular NFT leads to better price discovery, as it increases the speed at which NFTs are traded in secondary markets (i.e. the more trades, the better the perception of the NFT's fair market value). This makes it easier for sellers to monetize their work, and it makes it easier for inexperienced buyers to enter new markets because they can pull out more easily if they want to.

Publicity

secondary title

The Synergy of DeFi and NFTs

DeFi and NFTs can work well together, with multiple use cases:

collateral

Banks have been lending against traditional art since the 80s, and it’s big business; Deloitte estimates the global value of art-secured loans at $21–24 billion in 2019.

One could do the same for NFTs by offering non-recourse loans for digital art, collectibles, virtual land, and other content. Rocket experimented with this in early 2020, and NFTfi* is building a two-way marketplace on Ethereum today. However, it is still early days and NFTfi has about $2.5 million in loans to date.

Accepting NFTs as collateral in lending protocols increases the utility of NFTs to owners while increasing the economic activity of the protocol; it's a win-win situation.

crowdfunding

crowdfunding

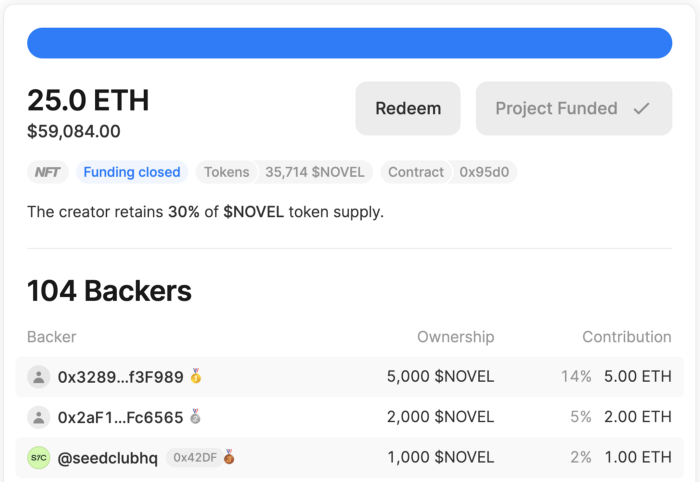

ICOs are the first killer app on Ethereum, as the platform is well suited for global capital formation and distribution; this use case applies to NFTs as well. Users from all over the world can invest in creative works at different stages of the life cycle, which may lead to the renaissance of digital art and provide new business models for various content creators.

For example, an author named Emily Segal was able to crowdfund approximately $50,000 (25 ETH) for her next novel, gifting 70% of the work in $NOVEL tokens, which represent fractional ownership in an NFT. If the NFT is sold at a higher price on the secondary market, the 104 $NOVEL token holders are entitled to a proportional share of the profits, along with other benefits such as the acknowledgment mentioned in the book.

Source: Mirror

Owning written content could also offer a new business model for publishers. For example, an NFT for a New York Times column recently sold for $560,000, likely much more than the company earned from advertising for the article.

cooperative system

In the traditional business world, a cooperative is a company owned by its members, who typically require financial contributions to join. Decentralized Autonomous Organizations (DAOs) are the crypto-native analog for this and have become the standard way of governing DeFi protocols. DAOs will be even more important for NFTs as the assets and communities formed around them will increase by an order of magnitude.

We’ve already seen the appeal of these “collectors’ cooperatives,” as they allow groups to invest in NFTs that would be cost-prohibitive for any one individual. DAOSaka experimented with this in late 2019, and FlamingoDAO is doing just that today, both pooling funds from individuals and collectively deciding which NFTs to buy and sell. Collector cooperatives can form spontaneously and grow organically. For example, PleasrDAO initially pooled funds to purchase specific NFTs, and later purchased NFTs from Edward Snowden for $5.5 million,thereby expanding the scope. In both cases, the DAO outbid a single wealthy buyer to win the auction.

economic affiliation

Public provenance records enable use cases that were previously impossible or difficult to execute, such as royalties on artwork and other assets sold on secondary markets.

Rarible*, SuperRare, and Zora all implement royalties with varying degrees of functionality and interoperability. Mirror achieves this at the application level through a feature called "splits," which allows authors to distribute some of the economic value of their work to others when it is sold.

Royalty may apply to content other than digital art and music. For example, the "Traitor" dance on TikTok made Charli D'Amelio an overnight star. While both Charli, which now has more than 112 million followers, and TikTok have benefited financially, the person who created the dance, a 14-year-old girl named Jalaiah, has received no recognition for her work. NFTs can solve this problem by providing the ability to tokenize this content and provide creators with economic attribution when monetizing it. In the future, athletes, dancers, photographers, and other creators will directly mint their content through NFTs to receive credit and compensation for the work they are producing.

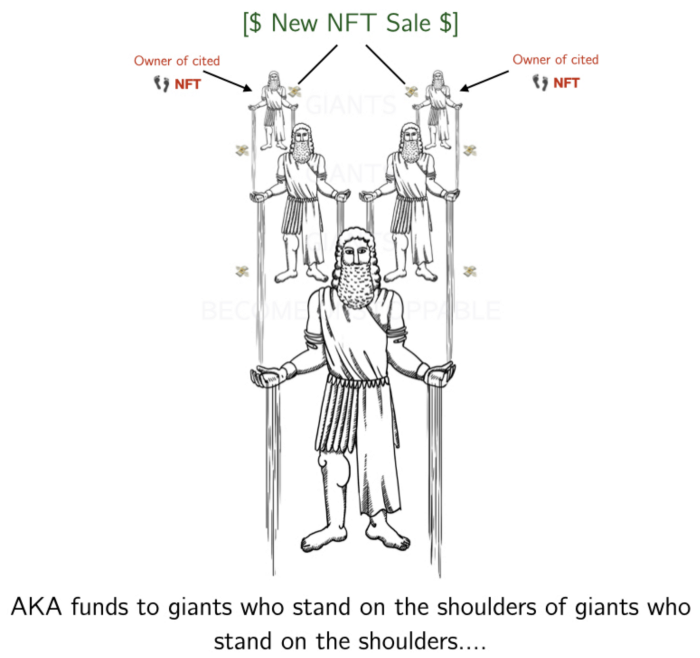

Economic attribution can also be programmatically assigned to multiple specific NFT owners. Plank recently experimented with the concept by publishing scientific findings as NFTs, and will implement a feature called "SplitStream," which allows NFTs to direct a portion of future sales to other NFTs.

Source: Matt Stephenson

exchange

exchange

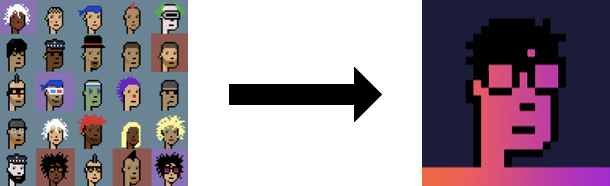

The ability to swap one NFT for another is important because it increases liquidity and price discovery by opening up the range of potential trading pairs, but this is difficult to achieve due to the illiquid nature of NFTs by design.

The 0x protocol first addressed this issue in 2019 with ZEIP-28, which enabled NFT-to-NFT to trade on its orderbook-based exchange by enabling buyers to pay for listed NFTs using another NFT as a fee token. , but this still requires the buyer to specify the NFT they want to buy. 0x later implemented property-based order books, which enable buyers to create offers to buy any asset with a specific set of properties. Effectively, this pooled liquidity (but still decentralized liquidity for a given "type" of NFT) is based on certain properties.

Other solutions attempt to facilitate transactions by utilizing intermediate fungible ERC20 tokens. NFT20 implements this concept by minting ERC20 tokens representing different types of NFTs and pooling these tokens according to their type. These NFT types can then be traded across multiple pools via CFMM routing using common numbers.

For example, if there is a MASK20/ETH pool and a MCAT20/ETH pool, users can instantly swap MASK for MCAT on Uniswap. This solution is especially useful for collectibles with a small number of valuable assets and a long list of lower value assets with an understandable reserve price.

In addition, due to the atomicity of Ethereum transactions and the composability of DeFi protocols, developers can "chain together" multiple intermediate tokens and liquidity pools in a single transaction to enable transactions across various NFTs.

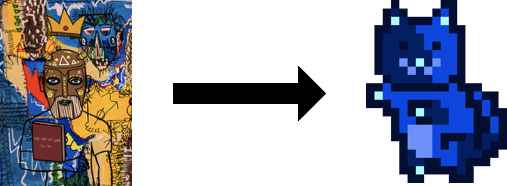

partly owned

Fractional ownership is an effective way to democratize asset acquisition and has historically been used for high-value assets such as vacation properties. Otis deals with traditional art and collectibles by purchasing assets, storing them in vaults and issuing shares representing ownership of those assets.

NIFTEX* is also doing this for NFTs. It allows the owner of a particular NFT to deposit that NFT into a smart contract and issue "shards" (ERC-20) representing that asset. The underlying NFT can be redeemed by acquiring all "shards" or via a buyout clause.

It is also possible to subdivide the ownership of a group of assets. Metakovan does this with the B.20 token, which contains 28 assets, including Beeple's cryptoart and Cryptovoxels, Decentraland Digital Land, and Somnium Space.

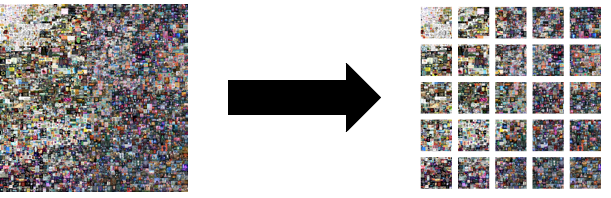

index fund

Index-based investing in traditional financial markets has exploded in popularity over the past decade, as it provides a transparent and low-cost way to diversify across various markets.

Likewise, an NFT-focused index fund could give investors exposure to a specific class of NFTs without requiring them to evaluate a particular NFT.

NFTX does this by creating index funds for various collectibles, such as Cryptopunks, where each fund is backed 1:1 by the underlying NFT; for example, a PUNK-ZOMBIE ERC20 can be redeemed for a zombie from the pool at any time CryptoPunk.

NFT-focused index funds could also improve the liquidity and price discovery of the underlying NFTs by attracting additional demand and trading activity from a larger user base.

lease

Sometimes people want to rent rather than buy, and the art world has accepted that fact for decades — the Museum of Modern Art, for example, has been lending its art since 1957. Artists and collectors gain an additional source of income, while renters are able to enjoy art at lower prices.

Source: Ottawa Magazine. March 15, 1980

This model can also be applied to NFTs such as Art and Digital Land. ReNFT is trying to do just that today with a peer-to-peer marketplace for NFT leases. As with most DeFi protocols in crypto - this is currently an over-collateralized solution; borrowers can lease NFTs by depositing collateral equal to the NFT's market value plus an additional rental fee. In other words, the EIP-2615 proposal is being improved at the protocol level, which itself supports the leasing function of the ERC-2615 token itself, and no deposit is required.

Yield Guild Games does this using a slightly different model within the game environment by lending Axies to new players in exchange for a percentage of the SLP tokens they earn while playing the game. In effect, players are renting Axies in exchange for a share of future revenue.

synthetic material

A synthetic asset is a financial instrument that mimics other instruments. Although most NFTs today are not true financial instruments in the traditional sense, the concept can still be used to enhance liquidity and market access for these NFTs.

One of the problems with minting NFTs on multiple blockchains is that it becomes more difficult to purchase the asset. Additionally, there may be a group of buyers who just want to speculate on the price of the NFT and not actually own it. For these users, there is an opportunity to provide synthetic price exposure to specific NFTs. For example, a price oracle could be used to provide Ethereum users with price exposure to the NBA Topshot asset on Flow.

The future of NFTs

The future of NFTs

Over time, we will see more unique, complex, and interconnected crypto mediums leveraging multiple DeFi protocols to enable value propositions and use cases that were impossible in the traditional world. Design patterns here can be but not limited to:

Bundling²: Index Coop* can provide retail users with an easy way to gain exposure to a variety of NFTs by creating an equal weighted index of NFTX's AXIE, MASK and PUNK index funds (as they are already ERC-20).

Fractionalizing+Bundling: Split Axie, Catalog records, Cryptopunk, and Sandbox* land into 100 ERC-20 tokens each, and deposit 25 tokens of each asset into Charged Particles to mint an NFT representing the package Diversified assets.

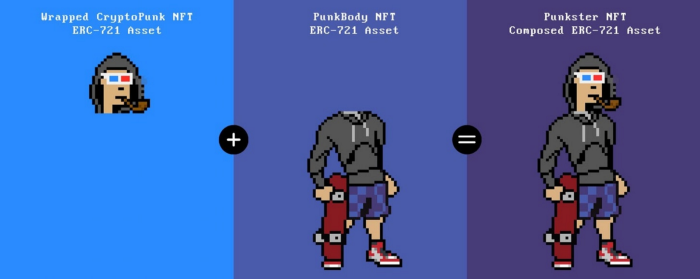

Combination: Multiple NFTs can be combined together, or additional utility and value can be added to existing NFTs. AlchemyNFT achieves the latter with AutographNFT by providing the ability to "sign" existing NFTs with digital signatures. Punkbodies works by allowing users to combine their Wrapped CryptoPunk (an ERC-721) with a PunkBody (also an ERC-721) to create a Punkster that they can download or mint. This implementation locks the original ERC-721 to mint PunksterNFT, and users can burn the combined NFT to unlock the original. These composed NFTs inherit the provenance and utility of their original versions, while providing additional functionality or utility.

Source: No Bank

There will be a series of experiments around these concepts over the next few years, and it will be exciting to see how developers, creators, and the community work together to bring them to life.