Bitcoin mining regulation is getting stricter, how many ways do you still have to earn coins?

Under the policy of preventing financial risks and "carbon peaking" and "carbon neutrality", the domestic control of the encryption market and mining is becoming increasingly strict. The mines in Inner Mongolia can no longer be maintained, and Sichuan and other places are just waiting for the guillotine to fall. This may not have a long-term impact on the encryption market, but for Chinese encryption investors, the channels to earn Bitcoin outside the secondary market are almost blocked. Sealed.

The channels for ordinary people to earn coins are nothing more than buying mining machine hosting and cloud computing power. It is very difficult to buy mining machine hosting, and Huobi Mining Pool has stopped serving Chinese users. What is even more sad is that in the first quarter of this year, several domestic US-listed companies that are engaged in cryptocurrency mining, such as 500 Lottery, Ninth City, and Zhonghuan Shipping, all invested hundreds of millions of dollars to buy mining machines for mining, and then ran into " "Carbon neutrality" is suppressing the domestic mining industry. It is estimated that the boss's hair has turned gray. Speaking of which, the company 500 Lottery is also amazing. I don’t know what its background is, what country bans what it does.

In terms of cloud computing power, cloud computing power platforms such as BitDeer, Mars Cloud Mining, and bitfufu have also stopped serving users in mainland China, and I believe more are yet to come.

How many ways do we have left to earn bitcoins?

1. Secondary market transactions

For the currency-tuning party, this is not a good way, high risk, high requirements, and there are currently restrictions on deposits and withdrawals in the country.

2、imBTC

imBTC is issued and supervised by Tokenlon, a subsidiary of imToken Wallet. It is anchored with BTC at 1:1 and generated through locked BTC exchange. It is a centralized cross-chain BTC token. Wallet to ensure the security of BTC assets.

Users holding imBTC can earn income, which comes from the transaction fees of Tokenlon users purchasing imBTC and the handling fees of users redeeming BTC.

All of the above are centralized coin-earning channels, and the risk lies in the single point of failure and the ups and downs of the secondary market.

3. Bitcoin Layer 2 Network Stacks

Stacks is a public chain project, currently committed to building an upper-layer application based on Bitcoin, which can be positioned as layer 2 of the Bitcoin network. Stacks 2.0 utilizes and expands the Bitcoin chain with the POX consensus, and allows the Stacks 2.0 network to benefit from the security of Bitcoin. Under this mechanism, Stacks miners need to lock Bitcoin for mining, and at the same time they can obtain Bitcoin rewards.

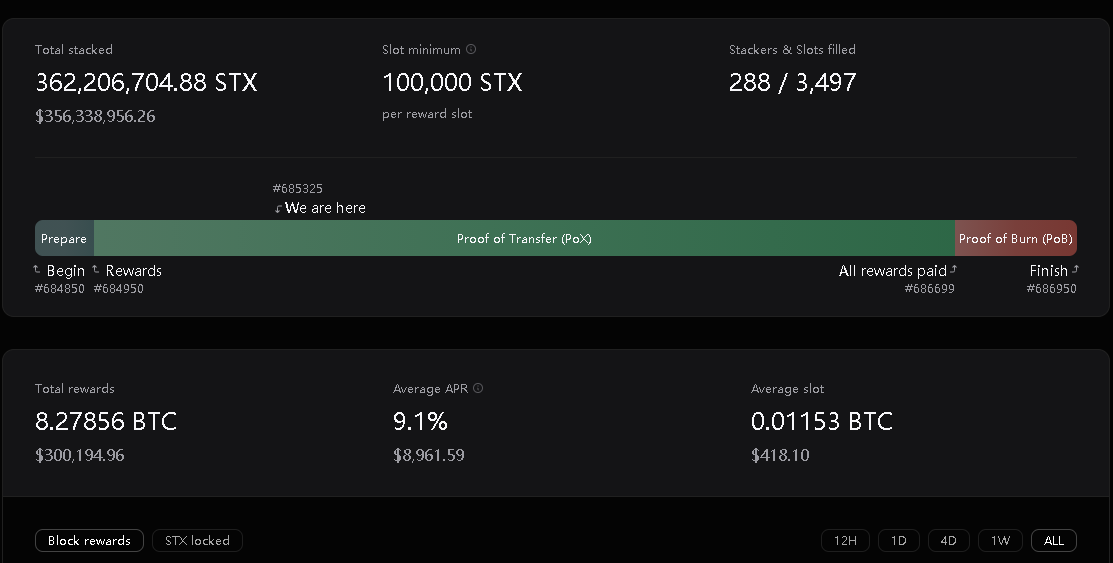

You can get BTC rewards by staking its token STX on the Blockstack official website, https://www.stacks.co/stacking. The official website data shows that the current annualized return is 9%, and the risk lies in the smart contract risk and the price fluctuation of STX tokens.

4、Acoconut

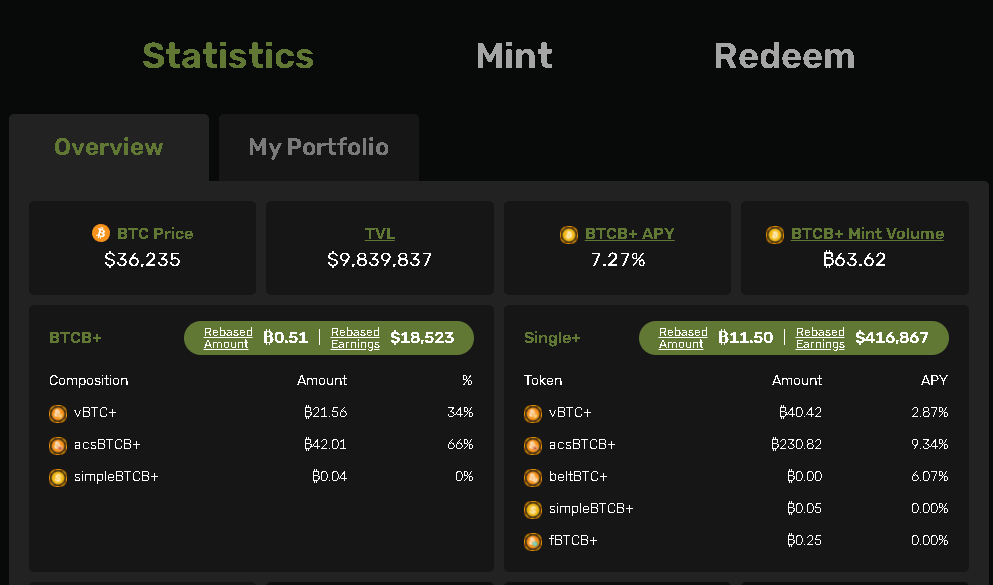

Acoconut is a DeFi protocol that can bring Bitcoin-based income to users. Acoconut is a bitcoin-only smart pool similar to YFI. It automatically finds the DeFi project with the highest income from the BTC deposited by users, and converts the income into BTC through Rebase, directly bringing currency-based income. The annualized income of Acoconut will follow the change of the overall yield of DeFi. It has previously reached the annualized income of 20% of the Bitcoin standard. Before that, more than 1,600 BTCs were locked in the Acoconut contract.

Since the launch of the V2 version on the BSC network, Acoconut has earned 63 bitcoins for its users.

5. Hashrate coins such as BTCST

HashCoin is a variant of cloud computing power. Although it has the advantage of decentralization, it still relies on mining machines for mining. If the mining machines behind it are in China, then HashCoin will be difficult to continue.

6. Others

secondary title

Digression

Recently, many domestic media have carried out large-scale reports on cracking down on mining and cryptocurrency fraud, showing a situation of blindly demonizing cryptocurrency and the mining industry.

As insiders, we know very well that there are indeed many frauds in the name of cryptocurrency in the industry. We also very much hope, look forward to, and welcome the supervision of the national government to purify the industry environment, but the prejudice, discrimination and even Slander, disgusting.

Bitcoin mining and electricity:

Bitcoin mining requires a lot of electricity, but it is not a waste of electricity. One thing that Bitcoin miners are always doing is to find cheaper electricity. In turn, the electricity is not generated by the miners, and the miners legally buy electricity for mining, and they are not in arrears.

The electricity used by bitcoin miners includes water, electricity, and thermal power. Please don’t just put on the hat of destroying the environment.

Most of the electricity used by Bitcoin miners is waste electricity and consumption electricity. The electricity used for Bitcoin mining is waste recycling. See the China Energy News report:The Dadu River was named due to the prominent problem of "abandoned water"

Blockchain and cryptocurrency are also creating value. The exchange’s handling fee, YFI’s management fee (it earns millions of dollars per quarter, and has begun to announce its financial report), Compound, AAVE to help fund flow, and the interest rate earned are all reasonable business models in the real world. DeFi allows All of this happens more efficiently and at low cost. The international transfer carried by Bitcoin is hundreds of times more efficient and hundreds of times lower in cost, all of which are advancements brought about by technology.

The mining industry has driven the development of high-performance chips. At present, TSMC's 5nm and 7nm domestic mass production is the mining machine company Bitmain. The company sells its main machines to North America, trains chip talents in China, and pays a lot of taxes to feed back the development of independent AI chip technology.

We look forward to a better industry environment and better management, not blind demonization by the media and one-size-fits-all management agencies.