ETH Weekly | The market value of Ethereum once exceeded 500 billion US dollars, surpassing Visa; the difficulty bomb was delayed until December to be included in the London upgrade (5.10~5.16)

Author | Qin Xiaofeng

Editor | Hao Fangzhou

Produced | Odaily

1. Overall overview

Author | Qin Xiaofeng

1. Overall overview

Second, the secondary market

1. Spot market

Second, the secondary market

(ETH daily chart, picture from OKEx)

1. Spot market

According to OKEx market data, the price of ETH once rose above US$4,300 last week, and then the price took a sharp turn, closing at US$3,631 within the week, a month-on-month decrease of 6.3%.

image description

image description

The daily chart shows that the price is supported in the middle track of the Bollinger Band. If it stands at $3,500, it is expected to continue to hit the $4,000 and $5,000 mark; if it falls below $3,500, it will fall further to $3,000.

In terms of funds, the largest net outflow was US$1.25 billion (Thursday), and the largest net inflow was US$760 million (Monday); ETH had a net outflow of US$790 million last week, a month-on-month decrease of 142%; the price level will continue to fluctuate in the coming week Or keep calling back.

Tokenview dataimage description

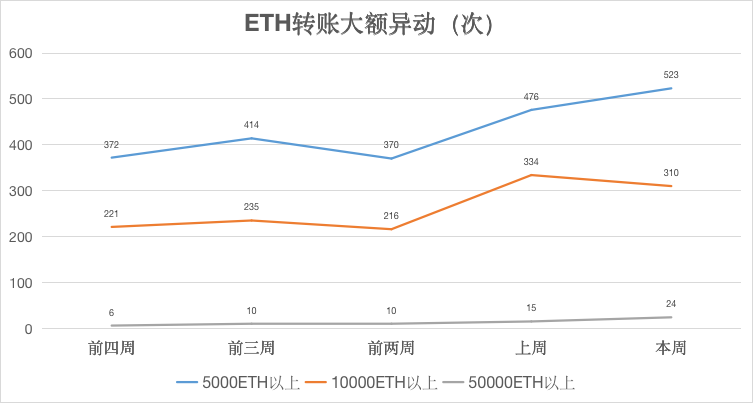

OKlink dataIt shows that the number of transfers on the chain rose slightly last week, and the number of large-value transfers of "above 5,000 ETH", "above 10,000 ETH" and "above 50,000 ETH" increased by 9.8%, 7.1%, and 60% month-on-month, respectively. Giant whales are active significantly increased.

3. Ecology and technology

1. Technological progress

It shows that the current top 300 ETH holdings hold a total of 52.24% of ETH, a month-on-month decrease of 0.15%. 0.21%; 101st to 300th, accounting for 14.7%, up 0.06% from the previous month; 301st to 500th, accounting for 6.62%, up 0.15% from the previous month; 501st to 1000th, accounting for 7.66%, down 0.01% from the previous month; After the 1001st place, accounting for 33.5%, a month-on-month increase of 0.25%.

3. Ecology and technology

(1) Ethereum has confirmed that the difficulty bomb will be delayed until December to be included in the London upgrade, and the testnet upgrade block has been confirmed

According to previous news today, protolambda launched the Eth1-Eth2 merged developer test network Nocturne for the second time, which is the same as the first Eth1-Eth2 merged developer test network Steklo, enabling 4 consensus clients: Teku, Lighthouse, Prysm and Nimbus; 3 executions Clients: Besu, Geth and Nethermind to run PoS. This testnet is still very experimental, but contains some important bug fixes since the first Steklo testnet. Despite being a testnet, protolambda says it wants to run complex transactions, make deposits, force some forks, resync nodes, etc.

2. Voice of the Community

According to official news, Vitalik Buterin, the founder of Ethereum, launched a proposal discussion on the Uniswap Governance Forum, suggesting that Uniswap can provide predictive price data for ETH/USD, and that UNI become an oracle token instead of being like other oracle machines Use ETH/USDC to feed prices. V God explained that algorithmic stablecoins need to provide asset price feeds for off-chain legal currencies, rather than on-chain USD stablecoins. The oracle machine needs to have a token to prevent Sybil Attack. The cost of this attack is half of the total market value of the token minus the value of tokens that do not participate in voting. The two project tokens with the highest market value in Ethereum Yes LINK and UNI, but Chainlink is a complex system with many functions and there needs to be a simple alternative to complement Chainlink to optimize incentives and minimize costs.

3. Project trends

2. Voice of the Community

V God initiated a proposal discussion on the Uniswap Governance Forum, suggesting that UNI become an oracle token

According to official news, Vitalik Buterin, the founder of Ethereum, launched a proposal discussion on the Uniswap Governance Forum, suggesting that Uniswap can provide predictive price data for ETH/USD, and that UNI become an oracle token instead of being like other oracle machines Use ETH/USDC to feed prices. V God explained that algorithmic stablecoins need to provide asset price feeds for off-chain legal currencies, rather than on-chain USD stablecoins. The oracle machine needs to have a token to prevent Sybil Attack. The cost of this attack is half of the total market value of the token minus the value of tokens that do not participate in voting. The two project tokens with the highest market value in Ethereum Yes LINK and UNI, but Chainlink is a complex system with many functions and there needs to be a simple alternative to complement Chainlink to optimize incentives and minimize costs.

3. Project trends

(1) ConsenSys will provide Ethereum-based managed blockchain services for Microsoft Azure

Official news, Ethereum software company ConsenSys announced that it will cooperate with Microsoft to provide managed blockchain services based on Ethereum to its cloud computing operating system Azure customers. The parties are working together to provide services based on ConsenSys Quorum, an open-source protocol layer for Ethereum development. The ConsenSys-Microsoft collaboration aims to provide customers and business partners with easy access to multi-cloud blockchain services with additional permissions to ensure the privacy of transactions. The service will enable users to easily set up blockchain nodes, reducing the cost of enterprise blockchain deployments and programming time for developers.

Member of Klaytn Governance Committee, blockchain project Ozys and Ethereum sidechain expansion solution Polygon have reached a cooperation, which will use Ozys' focus on cross-chain interoperability, experience in building DeFi protocols and existing products to expand and develop its growing DeFi ecosystem. It is reported that the protocols created by Ozys include the cross-chain platform Orbit Chain, the AMM protocol Belt Finance, and Klaytn’s decentralized and automated liquidity protocol KLAYswap.

4. Borrowing

Defipulse(3) Nahmii, the Ethereum expansion solution, completed a $3 million seed round of financing led by DARMA Capital

The data shows that last week, the value of locked collateral on the chain dropped from US$83.437 billion to US$78.431 billion, a decrease of 5.9% in the week; 62%. Specifically, the amount of ETH mortgages dropped from 10.289 million to 10.054 million last week, a drop of 2.2%; the amount of BTC mortgages rose from 165,015 to 168,559, an increase of 2.1%.

5. Mining

(data from etherchain.org)

etherchain.orgFrom the perspective of a single project, the top three locked positions are: Maker 13.24 billion US dollars; Aave 10.97 billion US dollars. Compound $9.79 billion;

image description

4. News

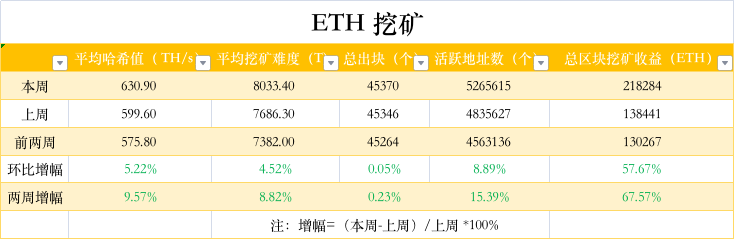

The data shows that the average computing power has increased by 5.2% month-on-month, temporarily reporting 630.9 TH/s; the average mining difficulty has increased by 4.5% month-on-month, reaching 8033 T; the activity on the chain has increased by 8.8% month-on-month; imitated by Dogecoin imitators SHIB and SHIB Due to the demand of investors, the network congestion has increased slightly, the gas fee of Ethereum has increased, and the total mining revenue has increased by 57% month-on-month.

4. News

(1) The total asset management scale of the Ethereum Fund reached a record high of 16.5 billion US dollars

Inflows into cryptocurrency funds fell by about $116 million to $373 million last week, with some investors apparently cashing out, according to a CoinShares report on Monday. Meanwhile, investor demand for Ethereum-based investment products continues to rise, with $60 million inflows last week and total assets under management hitting a record $16.5 billion. According to CoinShares, Bitcoin funds only reached this level of total assets under management in December 2020. (CoinDesk)

(2) Deribit launches ETH options with a strike price of $50,000, which is the highest strike price option for ETH

On May 10, Deribit, a cryptocurrency derivatives trading platform, launched Ethereum options with an exercise price of $50,000, which is the highest exercise price option in Ethereum history. So far, 12,500 contracts have been sold. The option expires on March 25, 2022.

(3) The market value of Ethereum exceeded 500 billion US dollars, surpassing Visa

On May 12, according to Asset Dash data, the market value of Ethereum exceeded 500 billion U.S. dollars, ranking 13th in global assets, surpassing Visa, and moving towards TSMC.

(4) V God donated 50 trillion SHIB to the Indian New Crown Relief Foundation

Previously, creators such as Shiba Inu (SHIB), Dogelon (ELON) and Akita Inu (AKITA) sent their project tokens to the Vitalik address. According to Etherscan data, V God has withdrawn liquidity funds from the SHIB pool. In addition, V God also dumped SHIB, AKITA and ELON, and exchanged them for ETH. Vitalik donated 50 trillion SHIB tokens (worth more than $1 billion) to the India Covid Relief Fund launched last month by Polygon founder Sandeep Nailwal. He gifted ELON tokens and another 1000 ETH to the Coinbase wallet of the Methuselah Foundation, a medical charity that extends human life. GiveWell received $53 million in ETH, while Gitcoin, the Ethereum-based open-source development foundation, received approximately $431 million in AKITA tokens.

In this regard, the Indian Cryptocurrency Epidemic Relief Fund tweeted thanks to V God for its generosity, and said that it will slowly cash out these tokens over a period of time in response to the epidemic relief needs after careful consideration.