This article will briefly introduce the origin of the encrypted art market in a semi-scientific way, what hinders the encrypted art market and some feasible solutions.NFT (Non-Fungible Token) is a general term for encrypted art (let’s understand it first), it is a certificate, and it is a certificate for the ownership of encrypted artworks derived from the Ethereum platform. We know that artworks are very sacred "A work of art cannot be cut, and the value it embodies is a manifestation of its unique characteristics.In the encrypted world, we have been instilled with features such as "divisibility" and "substitutability", such as Bitcoin, Ethereum and many other ERC20 tokens, which have the property of being infinitely divided. This superposition of financial ductility leads to Provides the convenience of asset interaction. For example, one eth can be exchanged for about 0.03 BTC. As the price fluctuates, the number of possible exchanges will increase or decrease. This is "substitutability", which is essentially two of the same attribute The exchange of assets, they are also called FT (Fungible Token).So what about non-homogeneous tokens? In fact, they cannot be divided and are unique and unique. The unit is always 1 asset.NFT can be a piece of audio, a funny GIF, a website domain name, game props, virtual collectibles, virtual real estate, etc. Since each artwork is unique, you cannot replace them with interchangeable assets.NFT has this concept as early as 2017. Veteran players may be more familiar with CryptoKittits in 2017, which once caused the paralysis of Ethereum. In one fell swoop, the community price of the public chain Flow token to which it belongs has risen from 0.1 US dollars to the current 31 US dollars, and the rate of return is a terrifying 300 times. Not to mention the collection value of the NBA top shot electronic card itself after integrating the blind box gameplay It's straight up."On September 17 last year, a star card of James was sold for a high price of US$3,999, which was the highest transaction price at that time.

On January 20, James' star card was sold for $47,500, a record high. The card is numbered 23, the same number as James' jersey.

On February 23, James' card once again broke the record with $208,000. "All in all, NBA top shot can’t get out of the circle without the huge traffic body of NBA. In the final analysis, it is the IP effect and fan economy. Now I am more looking forward to the IP out of Bandai and Nintendo. After all, besides the NBA, there are only these two companies It can make our generation willing to pay for it.

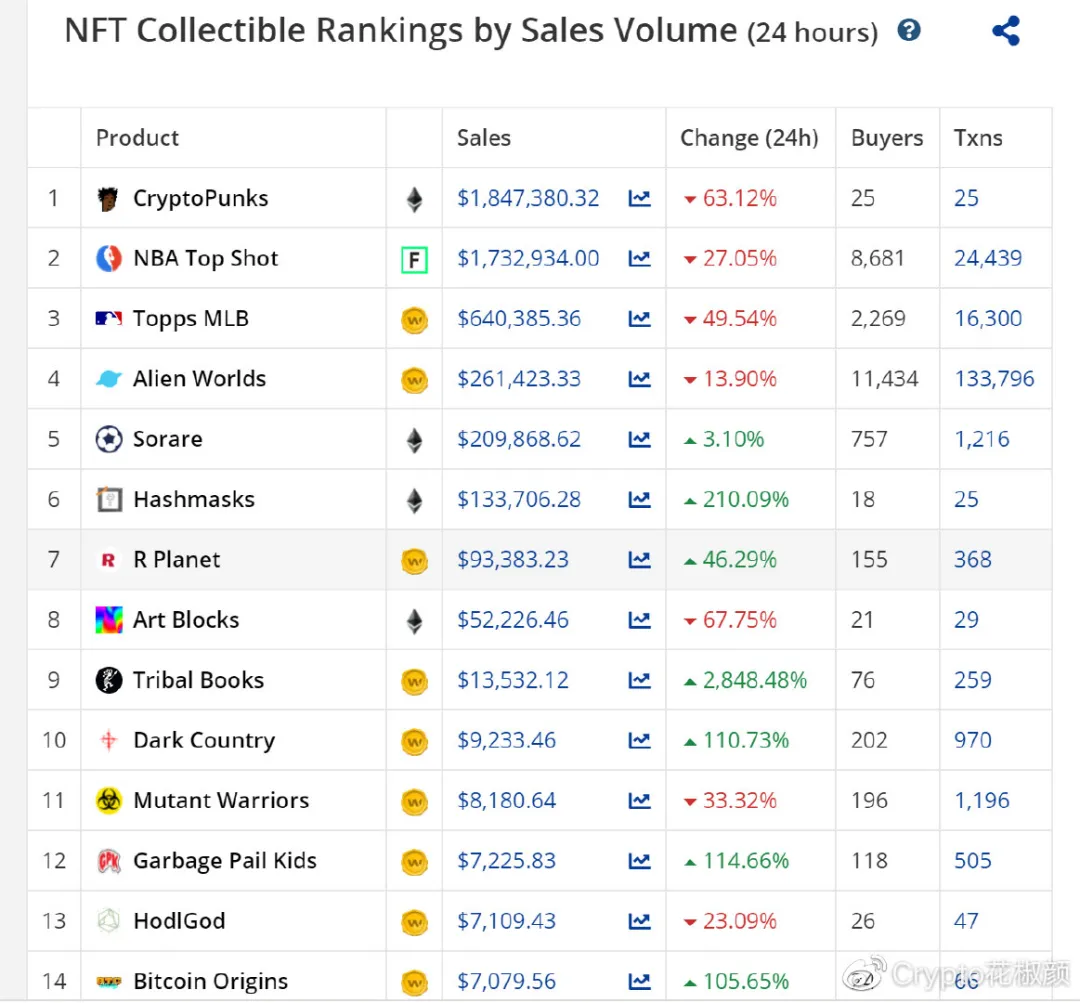

According to the data from CryptoSlam, among the top ten projects with historical transaction volume, the total transaction volume of the bottom eight projects is only tied with NBA Top Shot. The current market polarization is very serious, and most NFT projects are still tepid Not popular. Some time ago, MEME, DEGO and other projects broke the dimension wall and merged DEFI + NFT to create a new combination, which also made the market crazy. But without solving the ecological problems of Ethereum, NFT is always just a game paradise for the small crowd .Layer2 + NFT = Encrypted Art Market Renaissance 2.0?Layer2 + NFT = Encrypted Art Market Renaissance 2.0?

According to the arrangement of Lianwen, there are mainly several problems surrounding Ethereum and the NFT ecosystem:

Scalability (3 to 5 transactions per second)

User experience (transactions take a few minutes to confirm)

Costs (NFT transaction fees currently run upwards of $30+)

Liquidity (most NFTs have no trading volume at all)

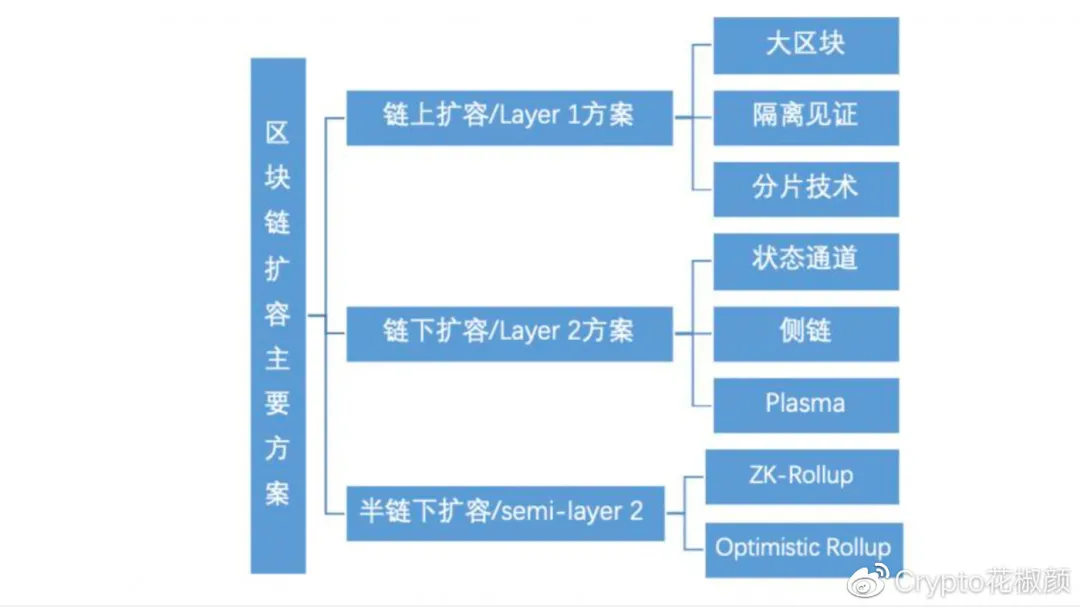

Developer experience (NFT projects are mostly solving technical problems, ignoring the improvement of the project itself)Environmental impact (barriers to mainstream acceptance)Therefore, if you want to solve the problem of NFT, you still have to return to Ethereum, and choose the most suitable expansion plan for the NFT ecological circle from the existing expansion plans.The expansion schemes here mainly include on-chain expansion and off-chain expansion schemes. The on-chain expansion schemes are all called layer1 schemes. Specifically, it provides transaction expansion to solve the problem of transaction congestion.Common solutions include: expanding the capacity of blocks (such as the maximum limit of transaction records), isolated witness (separation of digital signatures and transaction data), fragmentation technology (such as cutting blocks into small pieces, each small block is responsible for a state or a single record, etc.).And Layer 2 is an off-chain expansion solution, which includes side chains, state channels, plasma (Plasma), Validium, etc. We can understand Layer 2 in this way, the transaction process and business processing are completely separated from the main chain (off chain), and on-chain It only reflects the result of the transaction, and the main chain does not make any records in the intermediate process. The advantage of this is that it can connect and interact with other ecosystems, which greatly increases the interactivity of decentralized finance. The disadvantage is that it only has local stability and security performance There can be no 100% consensus.Another type of rollup is Optimistic rollup. Its challenge program is to encourage fraud reporting, which requires a lot of reasoning. However, the fraud proof model itself has many flaws, and the compatibility cannot be particularly well reflected.

Projects that do not support Optimistic rollup are applied to NFT because the rollback data withdrawal cycle is 1 week to 2 weeks. It cannot have a good market incentive effect for NFT products that are inherently illiquid. This year, Matter labs also proposed ZK sync, and ConsenSys and Iden3 also proposed Zk rollup. It is believed that ZK rollup can bring better performance.

Main schemes for blockchain expansion, source: OKEx Research InstituteAs Vitalik said: "In the medium and long term, in all use cases, ZK Rollup will eventually win." As a solution combining layer1 and layer2, ZK rollup can better ensure data security and availability.