DEX governance tokens skyrocket, which one can mine more safely? | Roast Star Selection

DEX governance tokens such as Uniswap, Sushi, Crv, 1inch, and DODO have recently completely ignored the trend of Bitcoin and have been rising fiercely. The actual trading volume of each DEX has also increased. The advantages of decentralized exchanges are being reflected.

In addition to providing us with safer transactions, major DEXs have another major advantage is the automatic market maker (AMM) mechanism, so that every ordinary user participating in it can capture the income of transaction fees, supplemented by liquidity mining With the cooperation of mines, it is often possible to easily obtain rich farming income.

But there will be no business that only makes money but does not lose. Hidden behind the fee income captured by AMM is "Impermanent Loss". Sometimes, it will cause you serious losses.

To understand impermanence loss, you need to understand the constant product equation of K=x*y in Uniswap’s AMM mechanism. Under the action of this equation,The impermanent loss can be understood as, which coin price in the pool is rising, you sell the coinimage description

The impermanent loss is manifested as the exchange of tokens in the pool

Another factor for Uniswap’s impermanent loss is that the transaction price in the AMM pool relies on arbitrage to correct it. This is the direct cause of impermanence loss.

Suppose you injected 1 ETH and 100 DAI into the ETH-DAI pool of uniswap for liquidity, and the price of ETH doubled two days later. When you withdraw the liquidity, the token you can get back is only 0.5 ETH and 200 DAI.

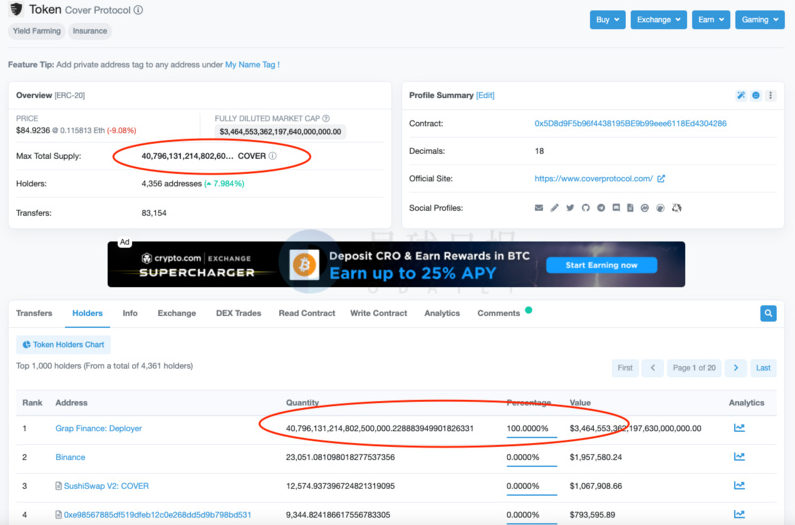

In the case of all mainstream currencies, we may be able to accept such a loss, but if one of them is an air currency or is controlled by a large number of people, the loss will be serious. The most recent example is the Cover incident. A large number of newly issued Covers were injected into the ETH-Cover pool, and the ETH of the liquidity provider was exchanged, and a bunch of newly issued and unrecognized Covers were obtained. Fortunately, they got compensation in the end.

Because most DEXs do not set thresholds for listing coins and building pools, such situations happen frequently, and many scammers will take advantage of impermanent losses and use air coins to arbitrage mainstream cryptocurrencies. Major DEXs have also been trying various solutions to solve the problem of impermanent loss.

The method adopted by Bancor is to use their governance token BNT as compensation, and give BNT to users who suffer impermanent losses. At the same time, it will also increase the selling pressure of BNT tokens. An inappropriate metaphor for this solution is that you have an unhygienic meal at a restaurant and the restaurant gives you a coupon as compensation. There are also some similar solutions, such as tokenizing impermanent losses, but how to solve the liquidity of these tokens and how to realize them is a problem.

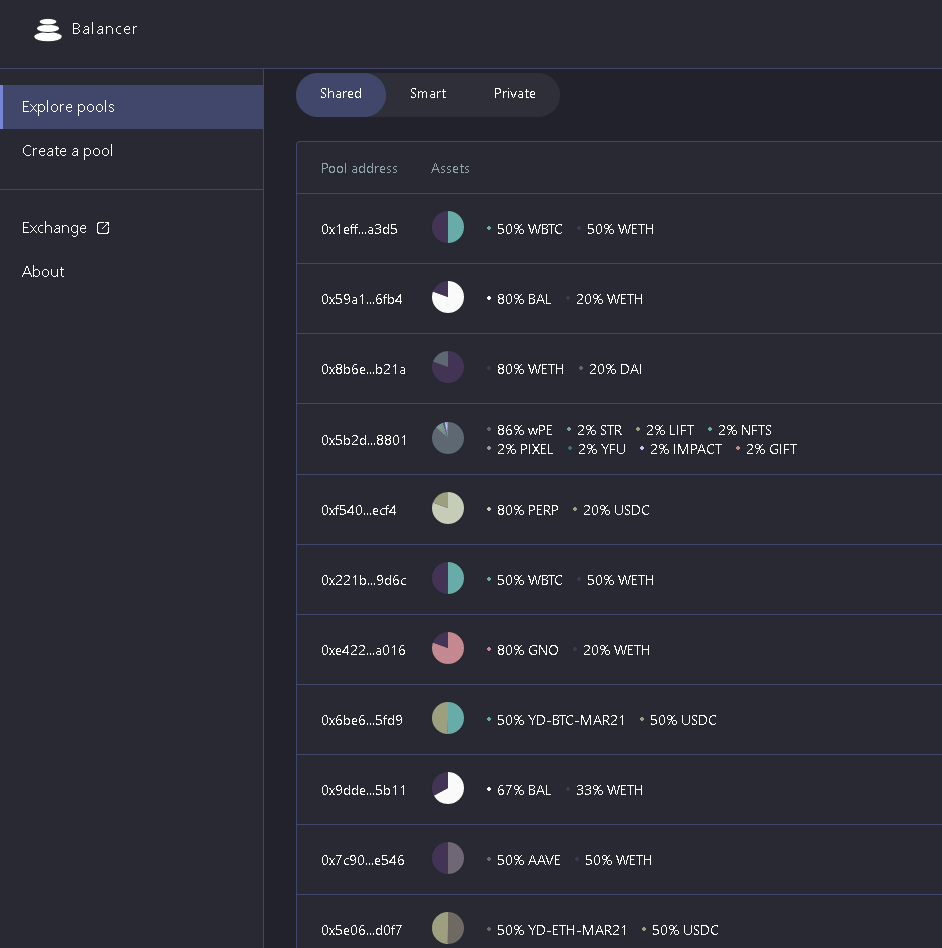

image description

Balancer uses a multi-currency portfolio to reduce the impact of impermanent losses

Curve has relatively no impermanence loss, but its improvement to the AMM pool algorithm is instructive for avoiding impermanence loss. Since the pool in Curve is a transaction of stable coins close to 1:1, it gets rid of the limitation of constant product equation, so Curve changed the constant product equation of AMM into a constant sum equation according to its own business characteristics, that is k=x+y, which simply guarantees the completion of the bottom slippage of the stablecoin transaction.

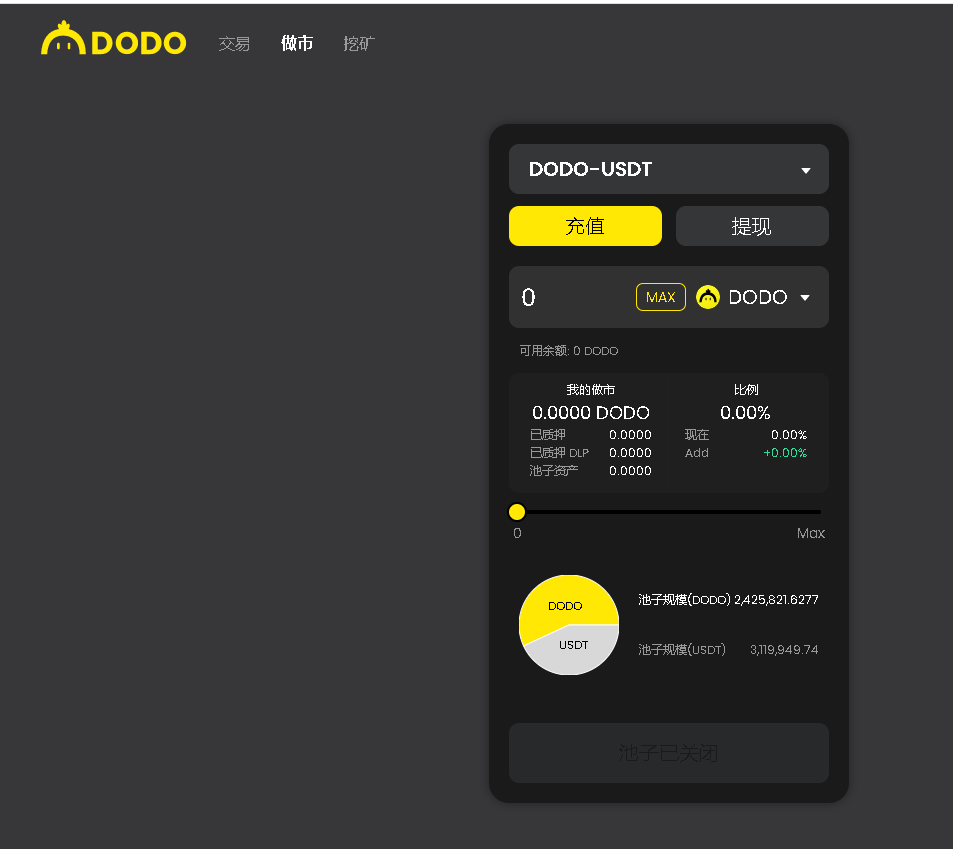

image description

DODO allows users to make unilateral market

DODO introduces the oracle machine to quote the trading pool, which directly reduces the risk of impermanent losses. However, it is prone to insufficient liquidity of a certain asset in the pool. DODO’s solution allows users to make a unilateral market, that is, only provide a certain type of token to inject into the pool, so as to achieve a balance, reduce transaction slippage, and users suffer impermanent losses risk is also lower.

The solution to the impermanent loss problem will directly affect the TVL and transaction depth of each DEX, thereby affecting the user's transaction experience. AMM DEX that can provide better solutions can go further.