Bitcoin: The Next Stop of Financialization|Baked Star Selection

In the past few decades, the degree of economic financialization in various countries has been increasing (especially in developed countries), and residents' financial awareness has gradually deepened. The concepts of "financial management", "finance" and "investment" have long been deeply rooted in the hearts of the people. In the eyes of many people, inflation will exist for a long time, and money will always depreciate, so wages should be used for financial management and investment. This is the so-called savings, but in fact, this kind of financialization has been wrongly standardized. Globalization has turned savers into venture capitalists, blurring the lines between saving (not taking risks) and investing (taking risks) to the point where most people think they are the same.

The existence of financial need depends largely on the loss of value of money over time. And future retirement funds not only need to be saved for a rainy day, but also need to be invested and exposed to constant risk, often to keep up with central bank-manufactured inflation. An over-financialized economy drives monetary inflation, induces perpetual risk-taking, and depresses saving. A system that reduces the incentive to save and forces people to take risks creates instability, is neither productive nor sustainable, and undermines the incentive structure of the monetary medium of all economic activity.

Fundamentally, there is nothing intrinsically wrong with a joint stock company, bond issue, or any collective investment vehicle. While individual investment vehicles may be structurally flawed, value can often be created through collective investment vehicles and capital allocation functions. Merger risk is not an issue, nor is the existence of financial assets. Rather, the underlying problem is the degree to which the economy has been financialized, and it is increasingly the unintended consequence of a rational response to a broken and manipulated monetary structure.

What happens when thousands of market participants learn that their money is artificially but intentionally designed to lose 2% in value every year? Either accept currency depreciation, or try to keep up with inflation with riskier investments. This cycle persists as currency debasement never abates. Essentially, people take risks in their day jobs and are then trained to put all the money they manage to save into risking just to keep up with inflation, or even that - run hard just to stay in the same place.

financialization

Whether considering the rigging game or simply acknowledging that continued currency debasement is a reality, economies around the world have been forced to adapt to a world of devalued currencies. Although the aim is to attract investment and stimulate growth in "aggregate demand," there are always unintended consequences when economic incentives are manipulated by exogenous forces. Even the greatest cynic might hope to solve the world's problems by printing money, but, only children believe in fairy tales. Instead of printing money once and making the problem magically disappear, the adage gets knocked down over and over again. The economy has changed structurally and permanently based on money creation.

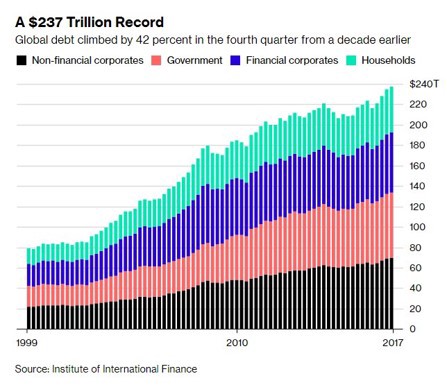

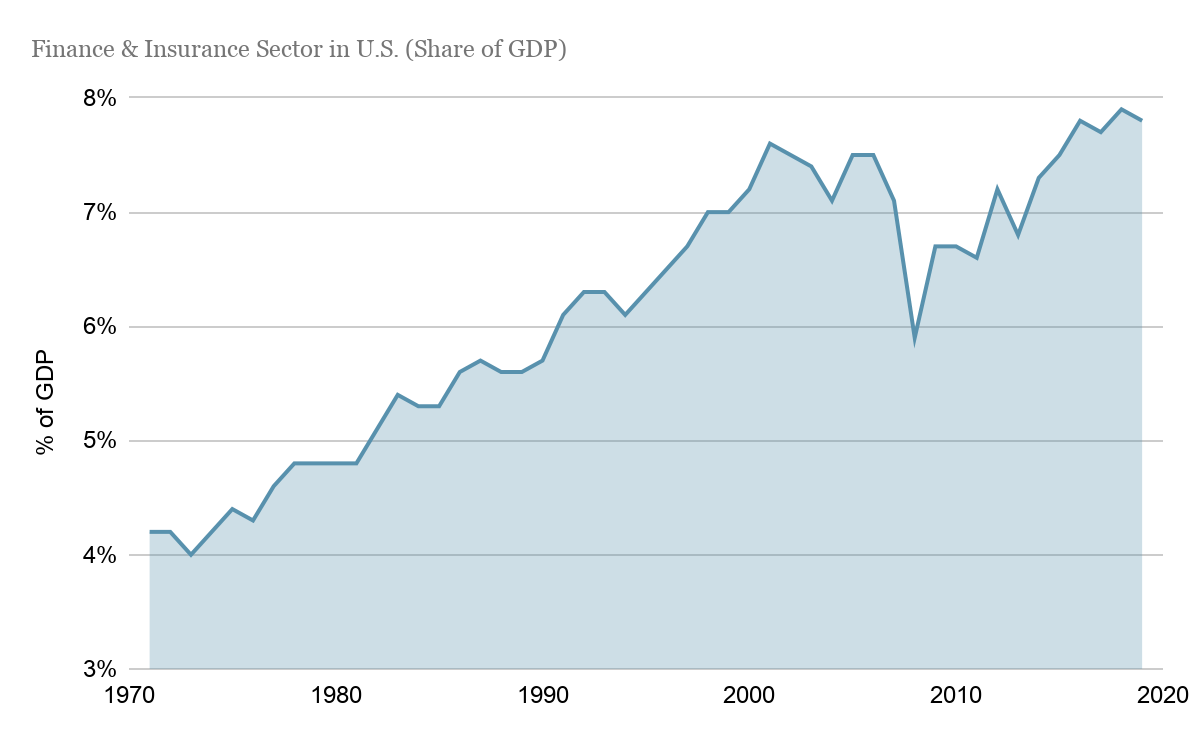

The Fed may think it can print money as a means of inducing productive investment, but what is actually produced is an underinvested and overfinancialized economy. The economy is increasingly financialized as a direct result of currency devaluation and the effect of manipulating the cost of credit. One will have to turn a blind eye and not see the connection between them: the necessary causality between the loss of value of manufactured money, the disincentive to hold money, and the rapid expansion of financial assets, including within the credit system.

image description

Image source: Statistica

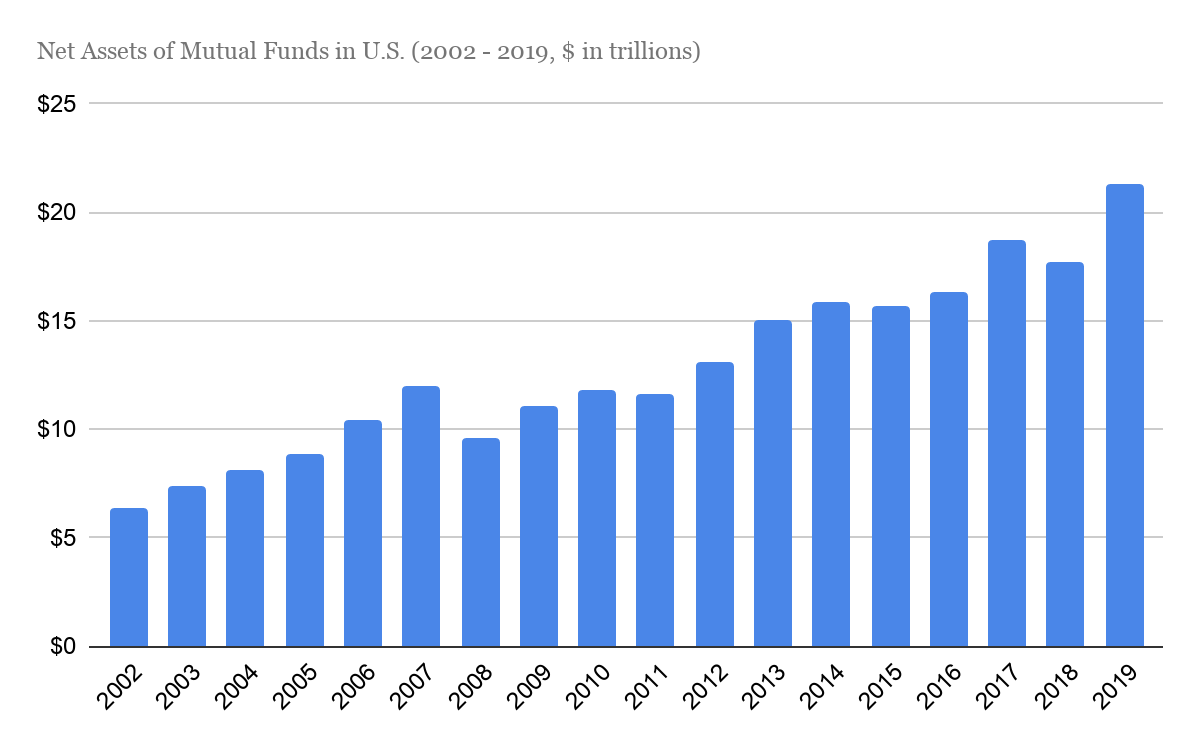

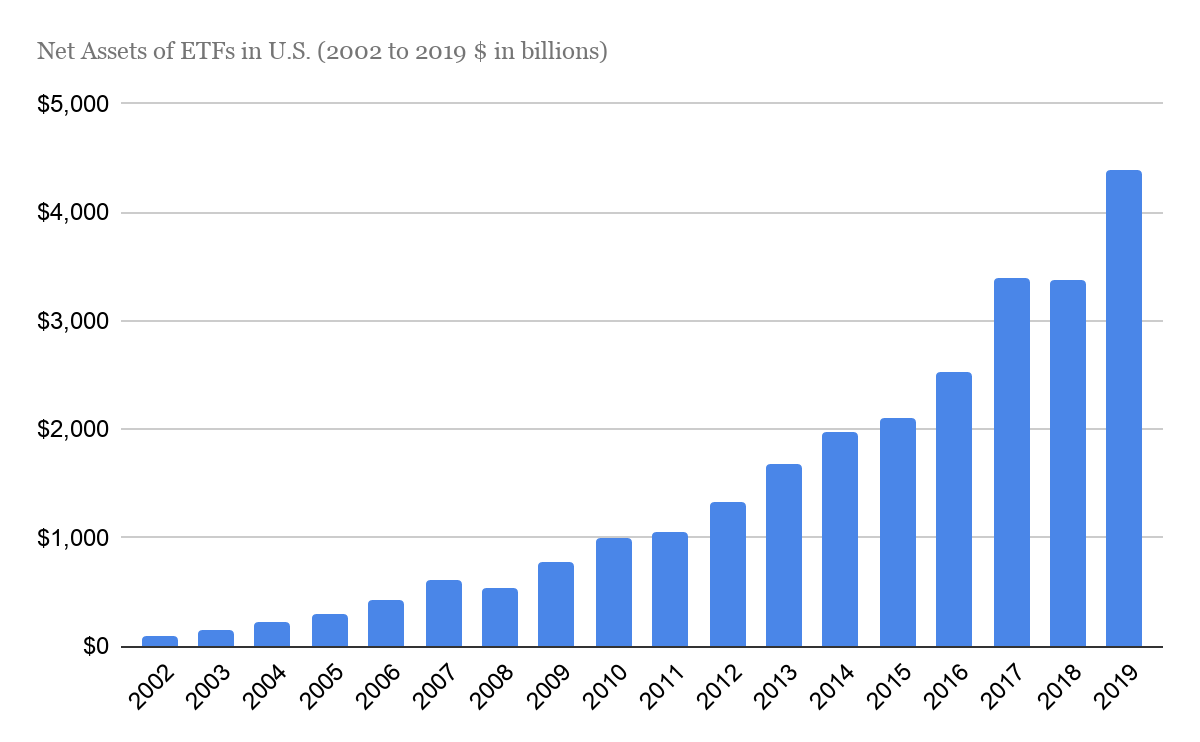

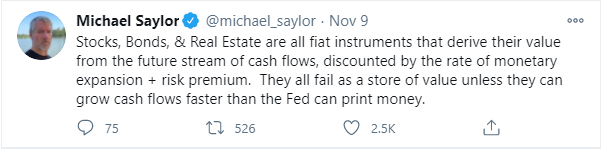

Over time, in a devaluing world, the financial industry has taken a greater share of the economy due to the growing demand for financial services. Stocks, Corporate Bonds, Treasury Bills, Sovereign Bonds, Mutual Funds, Equity ETFs, Bond ETFs, Leveraged ETFs, Triple Leveraged ETFs, Fractional Shares, Mortgage Backed Securities, CDOs, CLOs, CDS, CDS, Synthetic CDS/CDX, and more. Some of these products represent the financialization of the economy, and they become increasingly important (and in greater demand) when the function of money is disrupted.

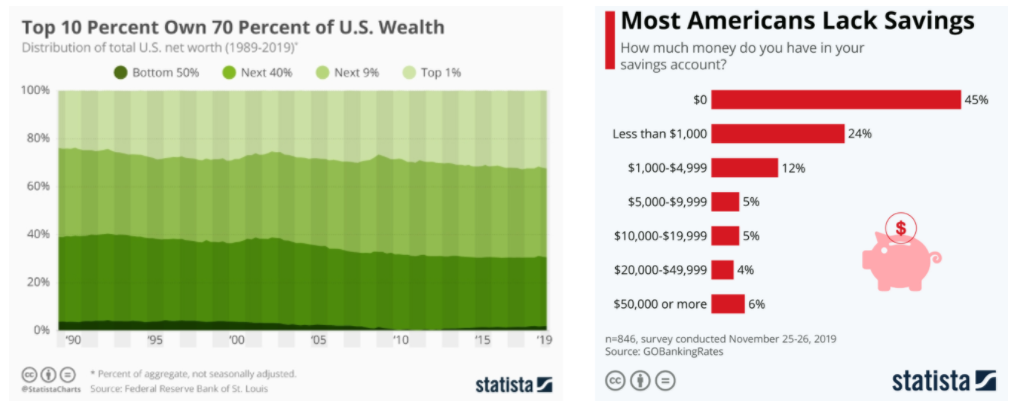

image description

Image source: Statistica

image description

Image source: Statistica

The overall effect is massive investment mistakes; people would not invest in those activities if they were not forced to take unwise risks, but only to cover the loss of recurring savings expected in the future. On an individual level, it's the doctors, nurses, engineers, teachers, butchers, grocers, builders, etc. who become financial investors, putting much of their savings into Wall Street financial products that take on risk while taking risk. No. Over time, stocks can only go up, real estate can only go up, and interest rates can only go down.

It doesn't matter how or why is a mystery to World David Day traders because it's just the way people think the world works and everyone acts accordingly. Rest assured, it will all end badly, but most people have come to believe that investing in financial assets is simply a better (and necessary) way to save, which dictates behaviour. A "diversified portfolio" has become synonymous with saving, and as such is considered neither risk-taking nor risk-taking. While this couldn't be further from the truth, the choice is either to take the risk by investing, or to leave savings in the medium of money, ensuring that fewer and fewer purchases will be made in the future. From a practical savings standpoint, if you do, you've met the damn place.

Forms of money, represented by Bitcoin, provide a sure way for all individuals to opt out and escape the vicious cycle.

what is the result of not saving

Forcing everyone to live in a world where money loses value creates a negatively reinforcing feedback loop; it makes the sum of all outcomes more unfavorable by removing the possibility of saving money as a winning proposition. Just holding money when money is designed to lose its value is an uncredible threat. People still do it, but it's a hit and miss by default. Perpetual risk taking is thus a forced substitute for saving. In fact, all hands are off the hook when one of these options doesn't win by saving money. Recall that every rich person has risked it in the first place. A positive incentive to save (as opposed to invest) does not equate to rewarding those who do not take risks, quite the opposite.

In a free market, money may increase or decrease in value within a specific time frame, but guaranteeing that money loses value has extremely negative consequences, and most participants in the economy lack real savings. Because money loses value, opportunity cost is often thought of as a one-way street. Spend money now because you will buy less tomorrow. The idea of holding cash (formerly known as savings) has been framed as an almost insane proposition in mainstream financial circles because money is known to lose its value. How crazy is that? Although money is used to store value, no one wants to hold it because the major currencies in use today do the opposite. Everyone is just investing instead of looking for a better form of money!

"I still think cash in particular is a waste relative to other options, especially those that would retain their value or increase their value during inflation." - Renowned Economist Ray Dalio (April 2020 )

Even the most respected Wall Street investors are prone to madness and can act stupid. Risking inflation for the sake of inflation is no better than buying a lottery ticket, but that is a consequence of creating an incentive to save. Economic opportunity cost becomes more difficult to measure and assess when monetary incentives are broken down. Today, decisions are made rational due to weak incentives. Investment decisions and purchases of financial assets are often made solely in anticipation of a devaluation of the dollar. However, the results go far beyond saving and investing. Every point of economic decision-making is compromised when money fails to fulfill its intended purpose of storing value.

When money continues to lose its value, all spending and saving decisions, including everyday consumption, are biased negatively. By reintroducing a more explicit opportunity cost of spending money (i.e. an incentive to save), everyone's risk calculations are bound to change. Every economic decision becomes more informed when money fulfills its proper function of storing value. When the monetary medium is reliably expected to keep value at a minimum, even if value does not increase, the decision to spend versus save per transaction becomes more centralized and ultimately leads to a better uniform incentive structure.

"One of the greatest mistakes is to judge policies and programs by their intent rather than their results" - Milton Friedman

Keynesian economists worry about the world, believing that if there is an incentive to save, there will be no investment. The flawed theory is that if people are incentivized to "hoard" money, no one will spend it and make investments deemed "necessary". Unemployment will go up if no one spends money and makes risky investments! Indeed, economic theory is reserved for the classroom. While not quite Keynesian, the risk will be in the world as an incentive to save.

Not only that, but since both consumption and investment would benefit from undistorted price signals, and since the opportunity cost of money is more explicitly priced by free markets, investment quality would actually be higher. When all spending decisions are evaluated against the expectation of likely greater (not less) future purchasing power, investment will be directed to the most productive activities and everyday consumption will be scrutinized.

Conversely, you can financialize when the investment decision point is heavily influenced by not wanting to hold dollars. Likewise, when consumption preferences are guided by the expectation that money will lose its value rather than increase in value, investments are made to cater to those distorted preferences. Ultimately, short-term incentives beat long-term incentives. Established companies are favored over new entrants, and the economy is stagnant, which increasingly drives financialization, centralization, and financial engineering rather than productive investment. This is causation; expected behavior with unintended but foreseeable consequences.

Making money loses value and people do stupid things because doing stupid things becomes more rational if it is discouraged. People who would otherwise save are forced to take incremental risk as their savings lose value. In that world, saving becomes finance. When you create an incentive not to save, don't be surprised to wake up in a world where very few people have savings. Empirical evidence suggests exactly this, and while it may shock a tenured economics professor, it is predictable that the lack of incentives to save is a major source of inherent fragility in the traditional financial system.

The Paradox of a Fixed Money Supply

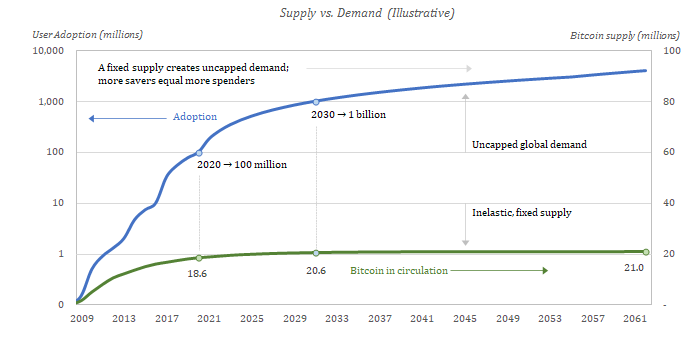

Lack of savings and economic instability are both driven by the incentives of the underlying currency, which is the main problem Bitcoin solves. By removing the possibility of currency debasement, the incentive to break is made consistent. There will only be 21 million, and that alone will be enough to reverse the financialization trend. While each bitcoin can be divided into 100 million units (or as small as 8 decimal places), the nominal supply of bitcoin is capped at 21 million. As more and more people adopt Bitcoin as a currency standard, Bitcoin can be divided into smaller and smaller units, but no one can arbitrarily create more Bitcoins.

Consider a terminal state where all 21 million bitcoins are in circulation; technically only a maximum of 21 million bitcoins can be kept, but as it turns out, there is always someone holding 100% of bitcoins at any given point in time . Bitcoins (including parts thereof) will be transferred from person to person or from company to company, but the total supply will be static (and completely inelastic).

By creating a world with a fixed money supply, so that aggregate saving is never too much, the incentive and propensity to save measurably increases on an individual level. This is a paradox. More people are saving individually if not saving more money overall. On the one hand, this seems like a simple statement that individuals value scarcity. But really, it's more explained that the incentive to save saves creates savers, even if not saving more money overall. In order for someone to save, someone else must spend existing savings.

After all, all consumption and investment comes from saving. The incentive to save creates savers, and the existence of more savers in turn enables more people to have the means to consume and invest. On an individual level, if someone expects a unit of money to increase in purchasing power, he or she may reasonably defer consumption or investment into the future (the key word is "deferred"). This is the incentive to save to create savers. It doesn't eliminate consumption or investment; it just ensures that decisions are more carefully evaluated in anticipation of future increases in purchasing power rather than decreases. Imagine everyone using this incentive at the same time, compared to the opposite that exists today.

Despite the Keynesian fear that a stronger renminbi would favor savings and harm the economy as a whole by disincentivizing savings and investment, in reality, free markets are actually better than they would be with a flawed Keynesian approach. In practice, despite the fact that an appreciating currency is used every day to boost consumption and investment, because there is an incentive to save. The current high demand for consumption and investment is driven by positive time preferences, with a clear incentive to save. Everyone is always trying to earn other people's money, and everyone needs to consume real goods every day.

Time preference as a concept is described at length in Standard Bitcoin by Saifedean Ammous. While this is a must read without any summary to tell the truth, individuals can have a low time preference (weighting the future) or a high time preference (weighting the future), but each individual's time Preferences are all positive. As a tool, money is simply a tool in coordinating the economic activities necessary for people to produce the things that people actually value and consume in their daily lives. Given that time is inherently scarce and the future is uncertain, even those who plan and save for the future (with low time preference) tend to value the present at the margin.

Going to extremes just for the sake of illustration, if you make money and never spend a dime (or a meal), it doesn't do you any good. Thus, even though the value of money increases over time, on average, current consumption or investment is less likely than future There is still an inherent bias. think).

7 Billion People Competing + 21 Million Bitcoins = Currency Appreciation + Constant Spending ✔

Now, imagine that this principle applies to everyone at the same time, and it does so in a Bitcoin world with a fixed money supply. Over 7 billion people and only 21 million bitcoins. Everyone has an incentive to save because money is finite and everyone has active time preferences as well as day-to-day spending needs. In this world, there will be fierce competition for money. Each would have to produce something of enough value to entice others to part with their hard-earned money, but he or she would be incentivized to do so because the roles would be reversed. That is the contract that Bitcoin provides.

There is an incentive to save, but the existence of saving necessarily needs to generate the value that others demand. If you don't succeed at first, try and try again. The interests and incentives between those who own the currency and those who provide goods and services are a perfect fit, especially since the script is flipped on the other side of every exchange. Paradoxically, in a world where saving more money is technically impossible, everyone would be incentivized to "save more." Each person will hold less and less notional money on average over time, but will buy more (not less) per notional unit over time. The ability to defer consumption or investment and reap the rewards (or just get away with it) is key to aligning all economic incentives.

Bitcoin and the Great Definancialization

The main motivation for saving bitcoins is that it represents the right to own a fixed percentage of all the world's currencies indefinitely. No central bank can arbitrarily increase the money supply and reduce savings. By creating a set of rules that humans cannot change, Bitcoin will be the catalyst for a reversal of the trend toward financialization. The degree of financialization of economies around the world is a direct result of misaligned monetary incentives, and Bitcoin reintroduces the appropriate incentives to promote saving. More directly, the debasement of monetary savings has been the main driver of financialization. When the dynamics responsible for this phenomenon are corrected, it is not surprising that the opposite set of operations naturally corrects.

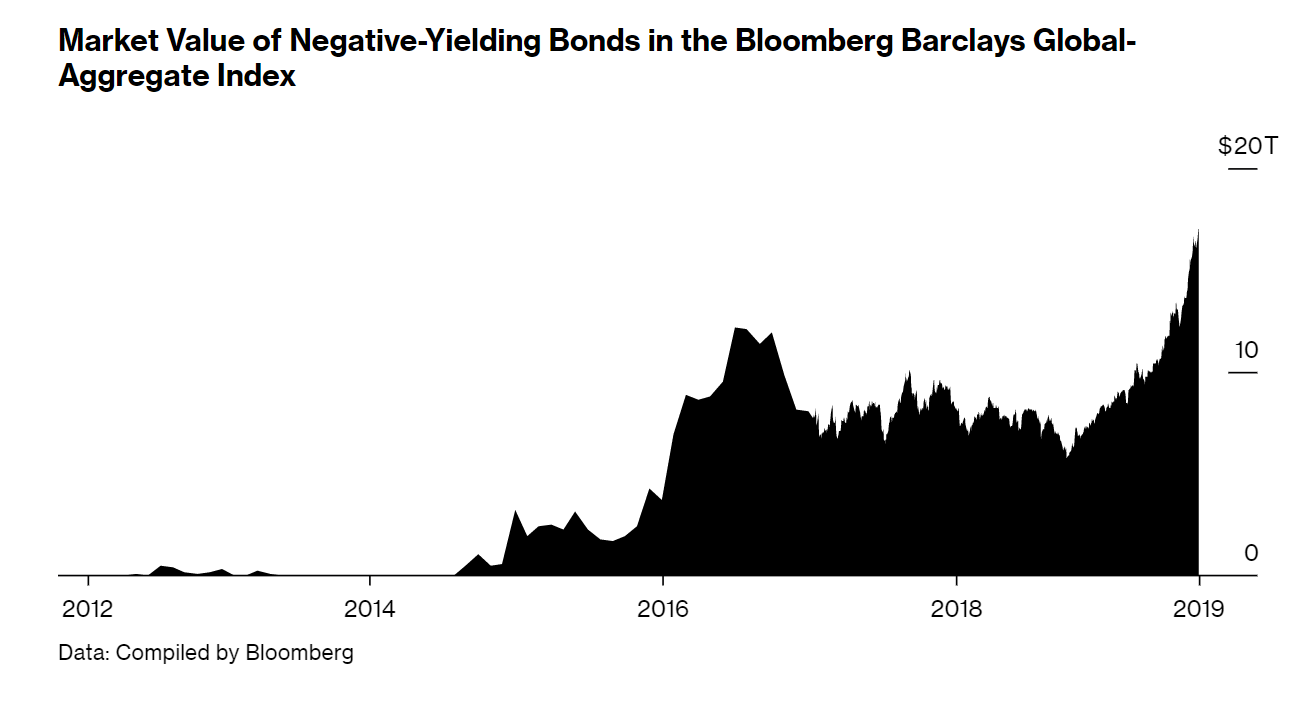

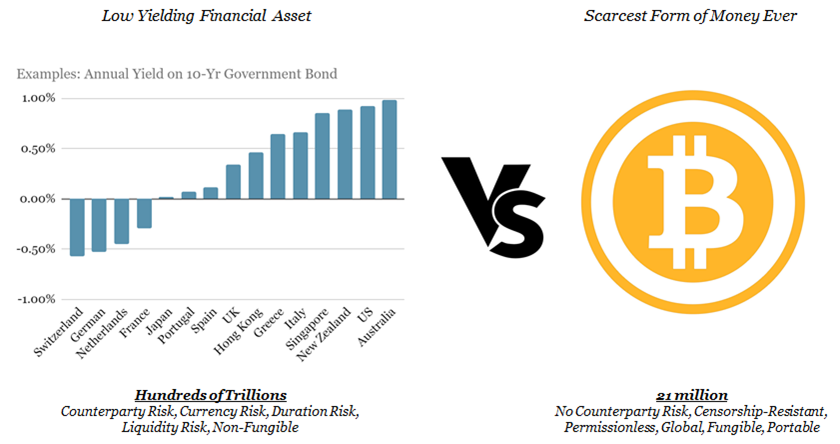

If currency debasement led to financialization, it was logical that a return to sound monetary standards would have the opposite effect. The tide of financialization is already ebbing, but the tide is only just beginning to build because most people haven't seen the writing on the wall. For decades, conventional wisdom has been to invest the vast majority of all savings, and it won't happen overnight. But as the world learns about Bitcoin, at the same time the global central bank creates trillions of dollars, negative yielding bonds and other anomalies of $17 trillion in negative value continue, the dots are becoming more and more connected .

"Market capitalization of the Bloomberg Barclays Global Negative Yield Bond Index rose to $17.05 trillion (November 2020), the highest level on record, slightly surpassing the $17.04 trillion reached in August 2019." - Bloomberg News

More and more people are questioning the idea of investing their retirement savings in risky financial assets. Negative-yielding debt makes no sense. It also doesn't make sense for central banks to create trillions of dollars in just a few months. All over the world, people are starting to question the entire construction of the financial system. This may be conventional wisdom, but what if the world didn't have to do that? What if this whole time went backwards, and instead of everyone having no savings to buy stocks, bonds, and layered financial risk, all that was really needed was a better form of money?

If everyone could use a currency that had no plan to lose value, instead of taking open-ended risk, sanity could eventually be restored in a crazy world, and the by-product would be greater economic stability. Just a thought exercise. How reasonable is it for almost everyone to invest in large public companies, bonds or structured financial products? How much of this is consistently a function of destructive monetary incentives? How much of the retirement risk-taking game is the need to keep up with currency inflation and dollar debasement? Financialization was the instigator and the main cause of this severe financial crisis.

The incentives of the monetary system, while not simply responsible, lead to a high degree of financialization of the economy. Ineffective incentives increase the amount of highly leveraged risk-taking, creating a general lack of savings that is a major cause of vulnerability and instability. Few people have savings for a rainy day, and everyone knows that there is a huge difference between monetary assets and financial assets during a liquidity crisis. The same played out in early 2020 as the liquidity crisis re-emerged. Lie to me, shame on you. Fool me twice, humiliate me, as the saying goes.

It all boils down to the collapse of the monetary system and the moral hazard created by the financial system due to misplaced monetary incentives. Make no mistake; instability in the wider economic system is a function of the monetary system, and as more and more of this continues to play out, more and more people will continue to seek better, more sustainable way forward.

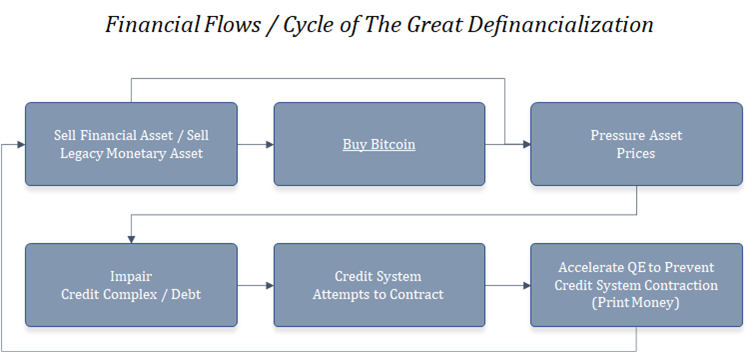

Today, with Bitcoin increasingly in the spotlight, there is a market mechanism that will definancialize and fix the financial system. As wealth stored in financial assets is converted into Bitcoin, and as each market participant increasingly prefers to hold a more reliable form of money than risky assets, a process of de-financialization will occur. Definancialization will primarily be observed through increased Bitcoin adoption, appreciation of Bitcoin relative to all other assets, and deleveraging of the overall financial system. As bitcoin is adopted as the monetary standard around the world, almost everything loses its purchasing power in bitcoin.

Most immediately, Bitcoin will gain share from financial assets that act as near stores of value; assets that have long been used as money substitutes will increasingly be converted to Bitcoin, which is in line logical. As part of this process, the size of the financial system will be reduced relative to the purchasing power of the Bitcoin network. The existence of Bitcoin as a sounder monetary standard would not only result in a rotation of financial assets, but would also dampen future demand for the same type of asset. Why buy sovereign debt with near-zero yields, corporate illiquidity or equity risk premiums when you can own the scarcest asset (and form of money) ever?

It may start with the most obviously overvalued financial assets, such as negative-yielding sovereign debt, but everything will be on the chopping block. As the rotation occurs, there will be downward pressure on the prices of non-Bitcoin assets, which will likewise put downward pressure on the value of debt instruments backed by these assets. Credit demand will be weakened broadly, which will cause the entire credit system to contract (or attempt to contract). In turn, this will accelerate the need for quantitative easing (increasing the base money supply) to help maintain and shore up credit markets, which will further accelerate the transfer of financial assets into Bitcoin. The process of de-financialization will continue and accelerate due to the feedback loop between the value of financial assets,

More substantively, as time passes and knowledge spreads, individuals will increasingly prefer the simplicity of Bitcoin (and its fixed supply of 21 million) over the complexity of financial investment and structured financial risk. Financial assets bear operational and counterparty risk, whereas Bitcoin is a bearer asset whose supply is fully fixed, highly divisible and easily transferable. The utility of money is fundamentally different from the utility of financial assets. A financial asset has a claim on the income stream of a productive asset, denominated in a specific currency. Holders of financial assets are taking risks with the goal of earning more money in the future. Owning and holding money is just that. It is very valuable in the ability to exchange goods and services in the future. In short, money can buy groceries.

There has always been a fundamental difference between saving and investing. Savings are held in the form of monetary assets while investments are savings that are at risk. With the financialization of economic systems, these lines may have blurred, but Bitcoin will blur the lines and make the distinctions sharp again. A currency with the right incentive structure will overwhelm the need for complex financial assets and debt instruments. The average person would very intuitively and overwhelmingly choose the safety provided by a monetary medium with a fixed supply. As individuals opt out of financial assets and opt for Bitcoin, the economy will become definancialized. It naturally shifts the balance of power from Wall Street to Wall Street.

Instead of remaining at the center of the economy as a rent-seeking endeavor, banking will compete more directly with all other industries for capital. Today, monetary capital is largely tied to the banking system, which will no longer be the case in a bitcoinized world. As part of the transition, the flow of money will increasingly be separated from the banking sector; money will flow more freely and directly between economic actors who actually contribute value.

The functions of credit markets, stock markets and financial intermediation are still there, but all in appropriate sizes. As the financialized economy consumes fewer and fewer resources, and monetary incentives are more aligned with those that create real economic value, Bitcoin will fundamentally restructure the economy. Removing the incentive to save has had social consequences, but now the ship is moving in the right direction and toward a brighter future. In that future, gone are the days when everyone is constantly thinking about their stock and bond portfolios, and more time can be spent getting back to the basics of life and the things that really matter.

text

Refenrence:

The Bitcoin Times(Parker Lewis)