Looking at the value and prospects of lending agreements from the perspective of the overall DeFi system |

As ETH breaks through the previous high, the transaction fees on Ethereum are even more embarrassing. When the network is not blocked and the gas is not high, an ordinary small transaction requires a handling fee of nearly 30 US dollars, which is distressed by large investors, and small investors must carefully calculate every transaction. It is already a trend for DeFi ecology to escape from Ethereum, whether it is going to Ethereum Layer 2 or going to the new public chain.

The popularity of the Huobi ecological chain MDEX has made people see the suppressed potential of the DeFi market. It is destined that there will be bright new dark horses in the new DeFi ecology who will become the new leaders. The unique location and fierce competition in the loan agreement track have a high probability of giving birth to such a dark horse blue chip. Hard based on KAVA, Acala, which has received much attention in the Polkadot ecosystem, and Flux on the Conflux chain all have such potential.

The lending agreement is at the center of the DeFi system

It has been more than 3 years since DeFi was proposed and developed, and it has formed a relatively complete system, subdivided into DEX, lending agreement, aggregator, stable currency, derivatives, insurance, index fund... in traditional finance. Financial products appear on the chain in the form of DeFi one by one. DEX is a stock and stock exchange, lending agreements correspond to banks, aggregators are funds and trusts, and the rest are mappings of various trading products.

Various DeFi protocols are also closely related, and mutual combination is an important gameplay and charm of DeFi. Regardless of whether it is in the traditional financial world or in the overall DeFi system, banks and lending agreements are at the foundation and core. The data performance also illustrates this point.

The price of AAVE tokens, an Ethereum-based lending protocol, has continued to rise, reaching a unit price of 220 US dollars. The market value has entered the top 20 of the cryptocurrency rankings, becoming the second project in the DeFi protocol to reach this position. At the same time, in Debank's DeFi project TVL data list, there are three lending agreements Maker, AAVE and Compound in the top ten, which is the track with the number of projects second only to exchanges.

Flexible mobility endows strong application scenarios

Lending protocols can occupy such a core position because of their high asset liquidity and utilization. This kind of flexible liquidity is crucial in the entire financial system, whether it becomes your leverage tool to expand your income in an upward market, or hedging risks in a downward market.

Lending protocols provide the necessary liquidity for other DeFi. DeFi decentralized lending can transfer assets from those safe investors to those investors with high risk appetite in the form of loans, and the latter become users of DeFi protocols such as options, futures, and derivatives.

By depositing your assets in the loan agreement, you can borrow flexibly while maintaining the deposit income, and then use the loan to reinvest, and use the leverage effect to amplify the income. Protocols such as AAVE and Flux lend out native assets such as DAI, USDT, etc., rather than various xTokens similar to YFI deposit principal and interest certificates. These xTokens are difficult to trade, while the borrowed assets can flow easily and have more usage scenarios. The difference between the two is like the difference between cash and stocks, national debt or even IOUs.

The role of hedging risk is even more critical. Assuming that your current contract transaction margin is insufficient, if you need to increase the margin, you can borrow from agreements such as Flux, increase the margin to keep your position, wait for the market to reverse and make a profit, and then repay the loan. In this way, you can avoid the risk of the position being liquidated, obtain the contract profit, and keep the deposit income. But if your assets are stored in an aggregator such as YFI, you cannot use your locked funds as your own risk hedging tool. The difference between the two is like the money you keep in the bank, and the locked funds you hand over to funds, trusts, stock brokers, etc. One can be used for emergencies at any time, and the other has a lock-up period. Although YFI got rid of the restrictions such as the lock-up period, it still cannot achieve the same function as the lending agreement in this case.

Borrowing ratios indicate market risk

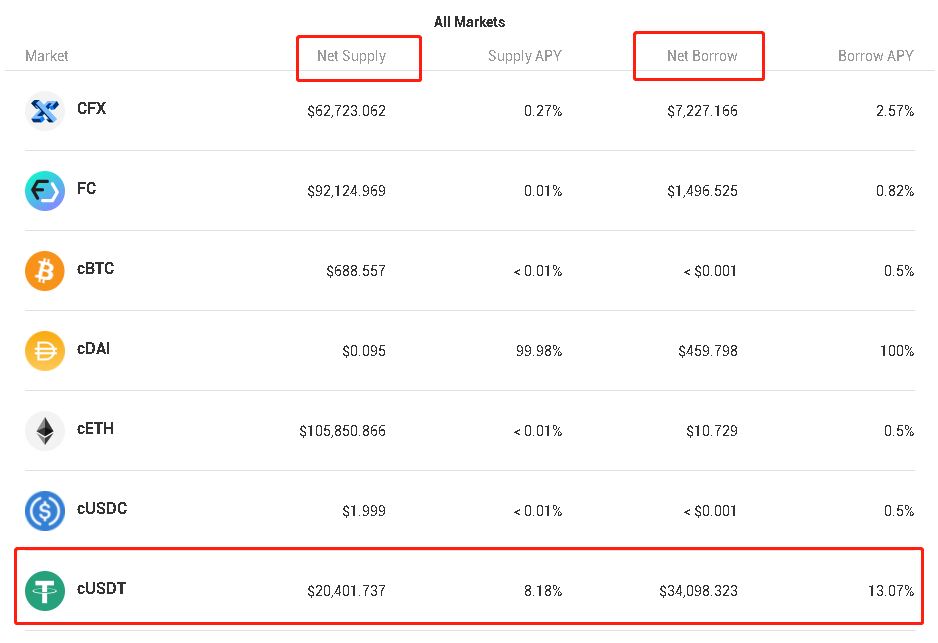

image description

Total deposits, total loans, and borrowing rate data can reflect the degree of leverage in the market

Borrowing is also a form of leverage. Since the bubble is accompanied by a large amount of new funds and leverage, when the borrowing rate is higher and the utilization rate of deposit funds is higher, it reflects the high leverage ratio of the current market. When the bubble reaches a certain level, risks may appear in the market at this time. At this time, these indicators of Flux can be used as a tool to help us judge risks.

Finally, in real life, we save money because we trust the bank, or trust that an institution is strong enough not to run away with the money. For example, when Yu'e Bao was popular, we dared to withdraw money from the bank and deposit it in Yu'e Bao because we believed that Jack Ma, the richest man at that time, was rich enough to not run away because of deposits. Also in the DeFi world, any lending agreement must make people believe that in addition to code security and decentralization, the high price of project tokens is also an important element for investors to trust, whether it is MKR, COMP or AAVE, other Token prices are very high, which gives people a sense of security.

Corresponding to the traditional financial system, the lending agreement is a bank in the DeFi system, which undertakes the most basic and common financial activities of deposits and borrowings, provides flexible liquidity for the entire financial system, promotes its development and growth, and at the same time provides financial support for the entire system. Provide certain security guarantees.

From the perspective of the user scale, you will find that the market for lending protocols such as Flux is the broadest. Whether it is aggregators, DEX, insurance, or derivatives, there are specific user groups with different financial management and investment styles, and deposits and loans are financial activities that everyone will come into contact with.

From the development history of DeFi, we can also see the important position of lending agreements in it. Maker and Compound are both early DeFi protocols on Ethereum, and have spawned many projects. There are many Polkadot ecological projects, but the most concerned one is still Acala, and the first application on the KAVA chain is Hard. Flux is a lending protocol belonging to the high-performance POW public chain Conflux network. They are all basic protocols in the DeFi ecology of their respective networks and have a first-mover advantage.

Whether it is from the perspective of user range or practical use, the lending agreement has a good development prospect.