Odaily Frontline|Giant whale surfaced, Three Arrows Capital holds more than 1.2 billion USD in GBTC

This article comes fromThe Block、CointelegraphOdaily Translator |

Odaily Translator |

![]()

according toThe Blockaccording to

According to reports, Singaporean investment company Three Arrows Capital (Three Arrows Capital) submitted a new document to the US Securities and Exchange Commission (SEC), disclosing that it holds more than $1 billion in Grayscale Bitcoin Trust (GBTC) positions.

Ahead of the report, the Singapore-based investment firm had taken a large position in the trust to take advantage of its premium over underlying assets. Previously, the firm held a 6.26 percent stake in GBTC worth $259 million.

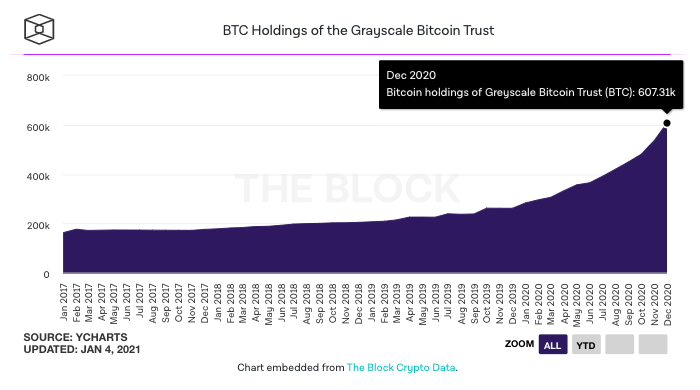

According to the latest filing, the firm holds a $1.24 billion GBTC position, equivalent to 36,969 bitcoins, or 6.1% of GBTC’s share.

Kyle Davies, co-founder of Three Arrows Capital, said, “We continue to enjoy working with the Grayscale team and look forward to making more investments in the crypto ecosystem.”

According to Three Arrows Capital, its position is the largest in the Grayscale Bitcoin Trust. As the price of bitcoin has soared, so has the assets Grayscale manages through its suite of products. Its GBTC product provides a way for investors to gain exposure to Bitcoin through a security-structured vehicle.

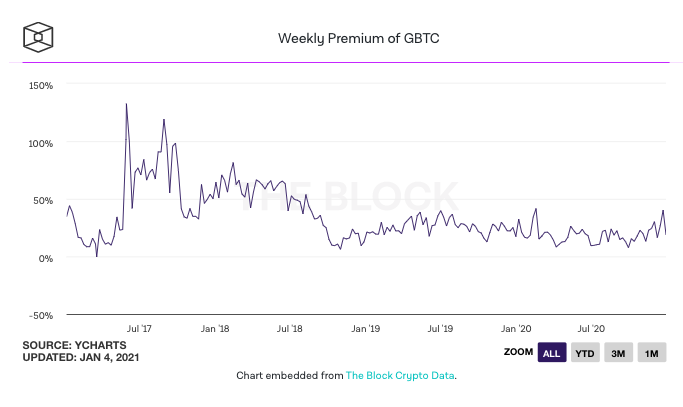

Shares in the product typically trade at a high premium, which allows traders to engage in arbitrage transactions by borrowing shares in the trust. GBTC’s weekly premium has decreased over the past few years, from 100% in the summer of 2017 to 18% now.

secondary title

In the past year, as institutions entered the market to "buy, buy, buy", the total asset management scale of Grayscale has become a data that the cryptocurrency industry pays close attention to, and people have also witnessed the soaring of this data.

PreviouslyPreviouslyGrayscale CEO Barry Silbert tweeted

: "You all obviously want Grayscale to reach $20 billion in total assets under management (AUM) in 2020. Then I'll take care of it." Data at the time showed that as of December 29, 2020, Grayscale's AUM The scale is 18.8 billion US dollars.On January 1, 2021,。Silbert Announces Successful Delivery of PromiseAccording to official twitter

, as of December 31, 2020, the total scale of grayscale assets under management reached 20.2 billion US dollars, compared with only 2 billion US dollars a year ago.

On the same day, data analyst Coin98 Analytics tweeted that the number of bitcoins purchased by Grayscale in December 2020 was more than 2.5 times the number of bitcoins mined by miners during the same period. Last month, Grayscale AUM added a total of 72,950 BTC (approximately $2.132 billion). During the same period, miners produced only 28,112 BTC (approximately $821.7 million), which is equivalent to 38.5% of the amount purchased by Grayscale.Cointelegraph article says, the data underscores what many are calling bitcoin's developing liquidity shortage, with big buyers absorbing all available supply and removing it from circulation, sending it into cold storage for long-term holding. Grayscale remains the largest institutional player in the bitcoin space, with a combined $17.475 billion in bitcoin holdings that far outstrip any other market player. Although the newly entered MicroStrategy is not an investment company,(approximately 2.06 billion U.S. dollars).

Odaily note:Odaily note:According to The Daily Hodl

, MicroStrategy founder and CEO Michael Saylor revealed in an interview that 88,000 bitcoins have been purchased through MicroStrategy or entities he controls, and have never been sold. At a price of about $29,000, the bitcoin he purchased was worth more than $2.5 billion.

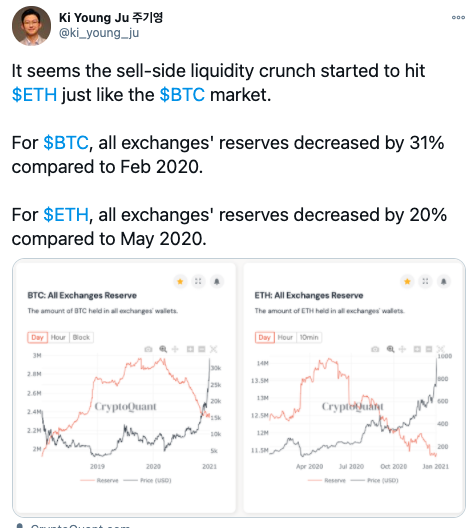

Analysts predict that in the future, more demand for a fixed supply of "new" bitcoins from miners will only lead to bidding wars and drive up prices.In addition, the problem of liquidity shortage does not only appear in the Bitcoin market. The price of ETH once broke through 1100 USDT on Monday (January 4).CryptoQuant CEO Ki Young Ju tweeted,