Looking back on the ups and downs of Ethereum in 2020, looking forward to 2021, Ethereum may double its market

2020 is coming to an end. For some industries, this year is a year full of disasters, but for the secondary market of encrypted assets, this year is a long-lost bull market.

After Bitcoin experienced a trough of $3,000, it reached a new high of $29,000. The renewed popularity of DeFi and the landing of Ethereum 2.0 made us have to re-examine the value of Ethereum.

Recently, the price performance of ETH has been very impressive. On December 28, ETH soared from $660 to $741, breaking through the price resistance of $700, with an increase of more than 10%. On December 31, it hit a new high of $758.5, which is also the highest record since May 2018. With the rise in the price of ETH, the market value of Ethereum broke through 80 billion US dollars and reached 84.2 billion US dollars.

Events of Ethereum in 2020

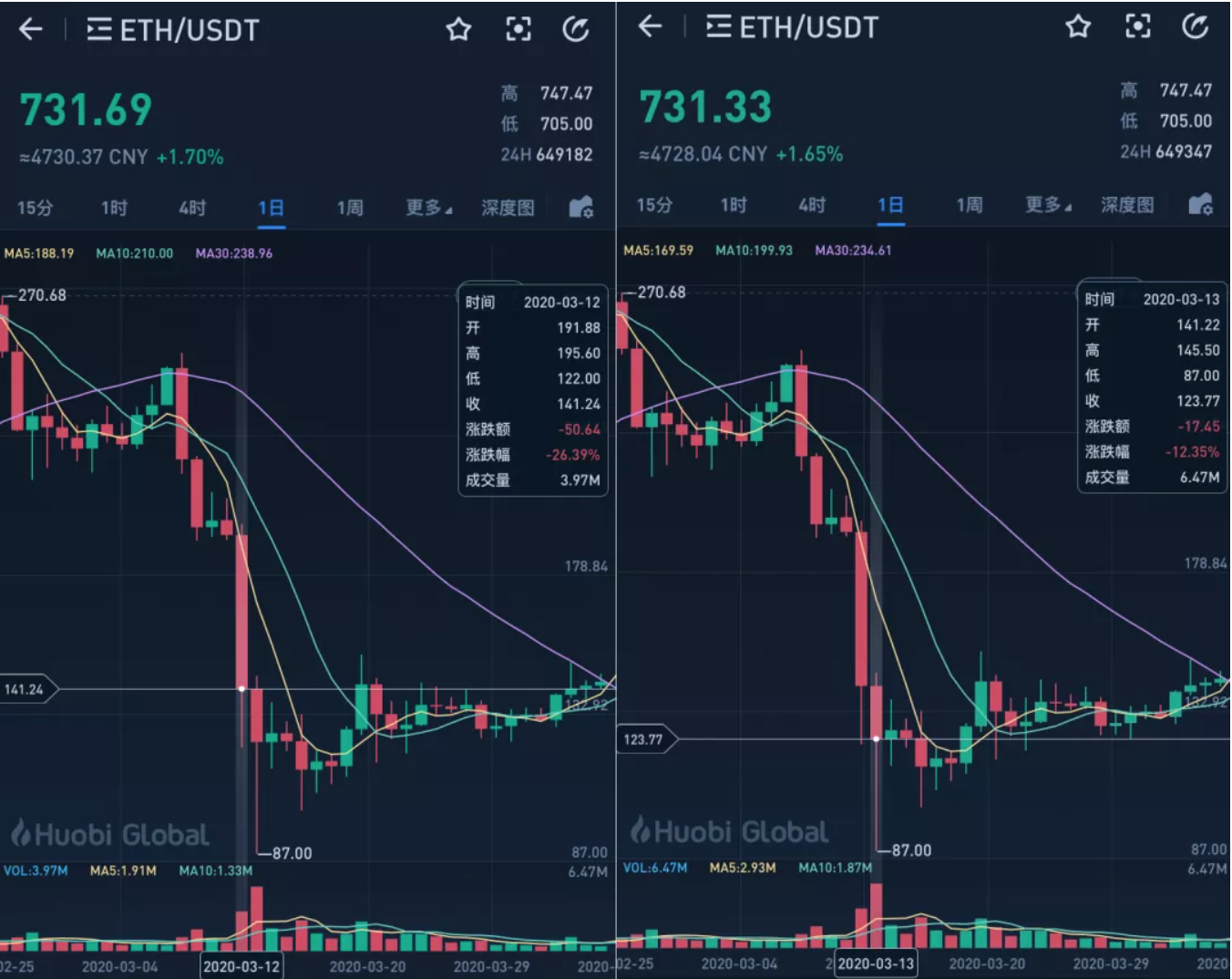

March 12: Black Thursday plunge

Affected by the rapid spread of the new crown epidemic, the panic of the global economic recession has spread, and the global financial market has not been spared. There has been a consistent plunge, and a large number of investors have suffered heavy losses.

According to Huobi data, on March 12, the biggest drop of Bitcoin was 30.4%, and the biggest drop of Ethereum was 37.4%. U.S. dollar, which fell as low as $87.

June 15: COMP ignites the DeFi boom

On June 15th, Compound launched the "loan-to-mining" distribution activity of the governance token COMP, taking the lead in carrying the banner of the DeFi market heating up. Subsequently, DeFi projects such as Uniswap, Sushiswap, Yearn.Finance, and SashimiSwap sprung up like mushrooms after rain, and DeFi quickly rose to become the new frontier of the blockchain industry.

Under the DeFi boom, the ultimate beneficiary is Ethereum. Most DeFi projects issue tokens based on Ethereum. As the most common basic asset in liquidity mining, Ethereum has a high consensus and easy transaction acquisition. In addition, the frenzy of liquidity mining attracts more funds to be locked in Ethereum In the ecology, this greatly consolidates the status and value of Ethereum.

December 1: Ethereum 2.0 is officially launched

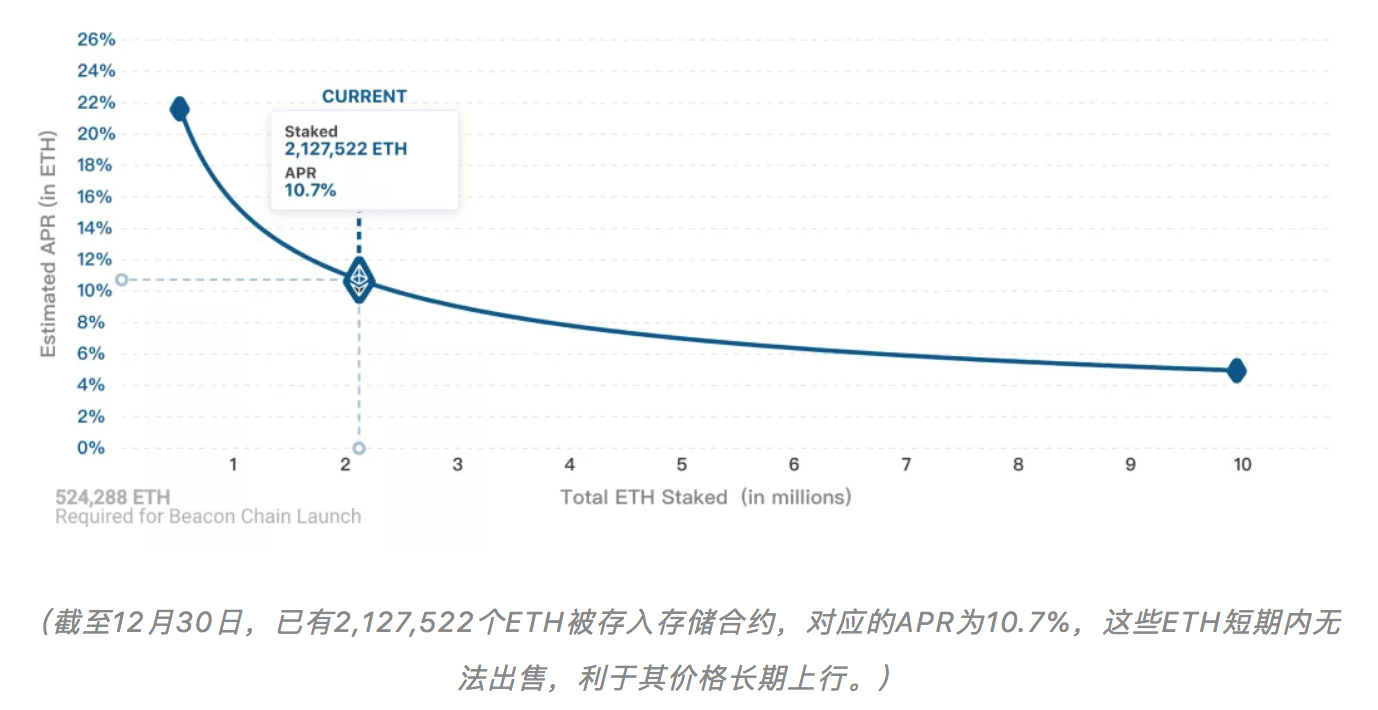

The Ethereum 2.0 genesis block was confirmed at 8:00 pm on December 1st, announcing the official launch of "Phase 0", marking the beginning of the highly anticipated Ethereum 2.0 era. The two biggest changes in Ethereum 2.0 are the adoption of the "beacon chain + shard chain" structure, and the transformation of the consensus mechanism from Proof of Work (PoW) to PoS (Proof of Stake).

On November 24th, the last day of the effective pledge period, more than 300,000 Ethers flowed into the storage contract address, making the deposit progress of the beacon chain rush from 57% to 100% within one day. At the same time, the price of Ethereum broke through the $600 mark on the same day, reaching $620, setting a new high in 29 months. It can be seen that Ethereum 2.0 has brought strong momentum to its continued price rise. In the future, with the value empowerment of the 2.0 era, the price of Ethereum is expected to go further.

Institutional investors enter

Affected by the negative impact of the epidemic, global asset turmoil and legal currency depreciation have resulted. At this time, the advantages of cryptocurrencies with anti-inflation and stable value properties are highlighted, and mainstream cryptocurrencies such as Bitcoin and Ethereum have entered the field of vision of institutional investors.

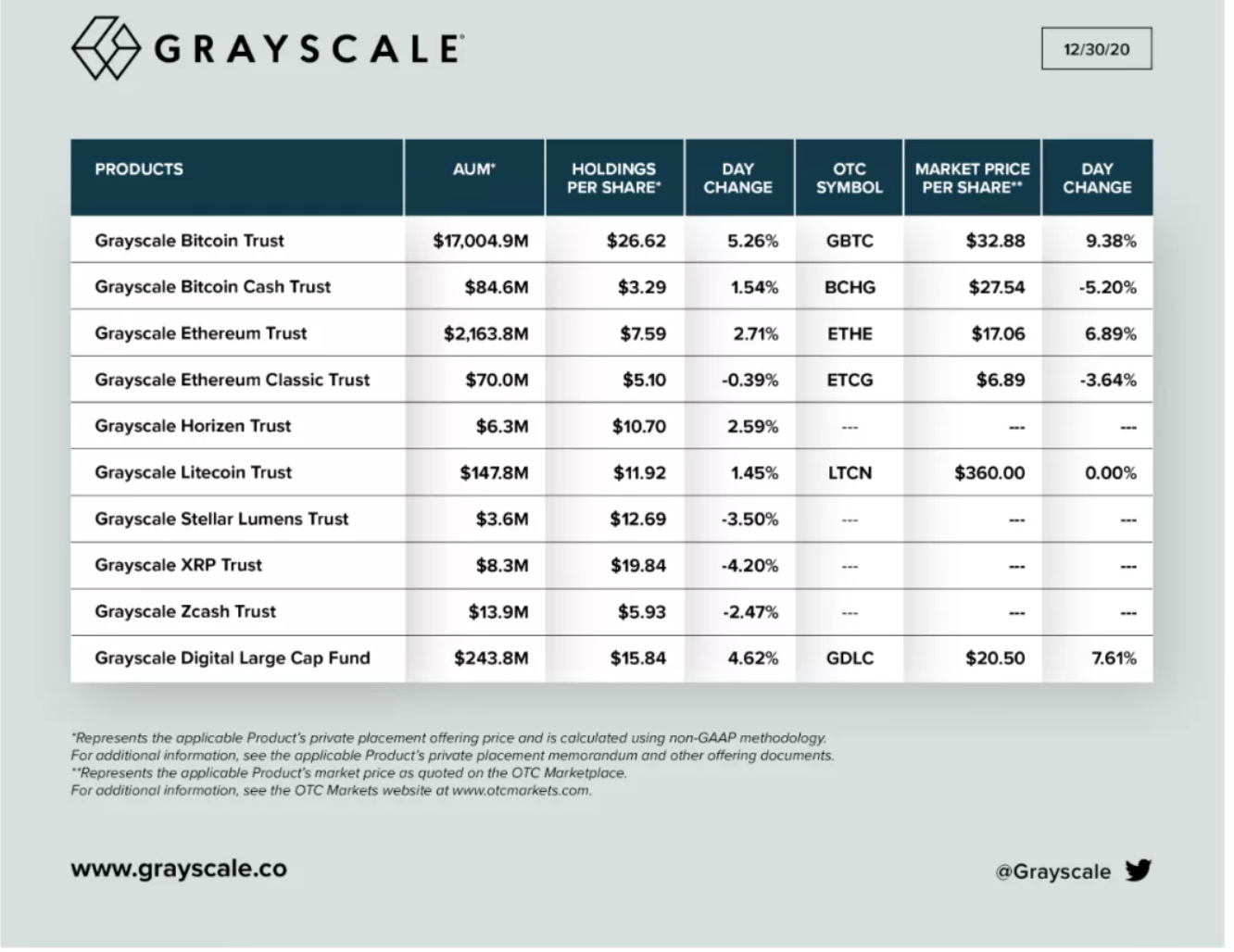

On November 20th, Grayscale officially announced that Grayscale Ethereum Trust (ETHE) has become the first publicly quoted ETH investment product in the United States. According to the latest data, the holdings of ETH-Grayscale Trust are 2,937,525 pieces. From June to now, the average daily accumulation of ETH-Grayscale Trust is about 15,310 coins, while the number of newly mined coins in Ethereum fluctuates between 15,000 and 25,000 coins per day during the same period.

The entry of institutional investors, especially the giants of financial institutions in the traditional field, has sent a positive signal for mainstream cryptocurrencies led by Bitcoin and Ethereum, which will greatly enhance investor confidence.

Ethereum is expected to double in 2021

As Ethereum broke through $700, some analysts said that the price of Ethereum is very likely to break through the historical high of $1,400 in 2021, which means that Ethereum may double its market in the next year.

There is another major news worth mentioning recently, that is, the Chicago Mercantile Exchange (CME) announced that it will start launching Ethereum futures in February 2021. The new contract will be settled in cash and is currently awaiting regulatory review. Previously, in December 2017, CME launched Bitcoin futures, which triggered the participation of institutional investors and successfully created a bull market price of nearly $20,000 for Bitcoin. It can be said that this will be an important tipping point for pulling institutional funds into ETH, and it will play a decisive role in the upward price of Ethereum.

Ryan Watkins, a researcher at Messari, a blockchain database company, also tweeted: "In 2021, we may start to see institutions buying ETH. Once everyone accepts that Bitcoin may be valuable, they will open their minds and realize that other Cryptoassets could also be valuable. This would make it easy to transition from BTC to ETH.”

This article only represents the personal views of encrypted notebooks and does not constitute any investment opinions or suggestions.

This article only represents the personal views of encrypted notebooks and does not constitute any investment opinions or suggestions.