Taihe Observation: A Brief History of DeFi

The following article will briefly discuss about what Defi has been gone through、popular things on Defi and what Defi might be look like in the future

"A trusted third party is a security hole", it has been more than 20 years since Nick Szabo proposed smart contracts in the 1990s. However, based on the situation at that time, it has not been put into practice until it is mentioned in the Ethereum white paper in 2013 : Ethereum is designed as a (Bitcoin) alternative protocol to cater to many decentralized applications born during the rapid development period. Its embedded Turing complete programming language allows anyone to write smart contracts and decentralized applications . The Ethereum protocol realizes applications far beyond currency functions, and the concept of DeFi, which has been flourishing in the past two years, has also begun to take shape at this time.

This article will describe the journey of DeFi from scratch according to the above timeline:

1. In 2017-2018, many established projects emerged

1.1 2017.12 MakerDao launched - Defi's own stable currency

1.2 2018.9 Compound launched - the former king

1.3 2018.11 UniSwap launched - AMM's weapon to subvert the trading model

1.4 2018.11 Synthetix launched - a bridge linking the traditional world

2. 2019-2020 new ways to play a hundred flowers blossom

2.1 2019.1 WBTC goes online - BTC opens the door

2.2 2019.7 Chainlink launched - a bridge connecting real data

2.3 2020.1 AAVE goes online - the flash loan has not ended, it has not started

2.4 2020.312 - Systematic 'stress testing'

2.5 2020.6 Liquidity Mining - Unsustainable Hotspot

3. Looking forward to the future of Defi

3.1 Liquidity staking - releasing the liquidity of pledged assets

3.2 Derivatives—maybe the next tipping point

3.3 New Species—On-chain processing methods that meet actual needs

secondary title

1. In 2017-2018, many established projects emerged

The DeFi ecology is also known as decentralized finance. Although it is small in scale compared with traditional finance, all aspects of traditional finance have been gradually mapped to DeFi to form a financial Lego of the blockchain. It has been five years since the concept of DeFi first took shape in 2013 to when Dharma Labs founder Brendan Forster first proposed the concept of decentralized finance or open finance Decentralized Finance in 2018. This period is also the embryonic stage of the entire blockchain ecology.

1.1 2017.12 MakerDao launched - Defi's own stable currency

In November 2014, the stablecoin USDT issued by the centralized entity Tether was launched. Users can exchange USD 1:1. Its 'claimed' 100% credit endorsement and 'completely transparent' approach make it the anchor of the most mainstream exchanges However, Tether has not released an audit report since 2018.

Then the first DeFi project MakerDao launched its mainnet in December 2017, and its stable currency is of great significance. In addition to the functions of the centralized stable currency, the decentralized stable currency Dai also has the following characteristics:

Anti hyperinflation: Argentina's inflation rate is as high as 37.2%. The dollar-pegged nature of the stablecoin Dai has made it a tool for many Argentines to store their wealth.

Alternative financial channels: Based on the decentralized nature of DeFi, users do not even need to hold bank accounts to complete functions such as transfers, transactions, and even payments.

In addition, Dai also has features such as no censorship, a 7*24 hour market, and tax avoidance. In other words, Dai can do what USDT can do, but USDT can’t do what Dai can do. Decentralization, public auditing, complete transparency, and on-chain checks are all things that USDT can do. At present, Dai is not only the pricing currency on many exchanges, but also the default stable payment method used by many Dapps. Maker, as the first project in the entire ecology, issues stable coins to lay the foundation for the future of the entire Defi ecology. It does not need to rely on bank accounts, credit ratings, or even USDT. Our Defi has its own stable currency, which is The reason why Dai has always ranked first in Defi TVL.

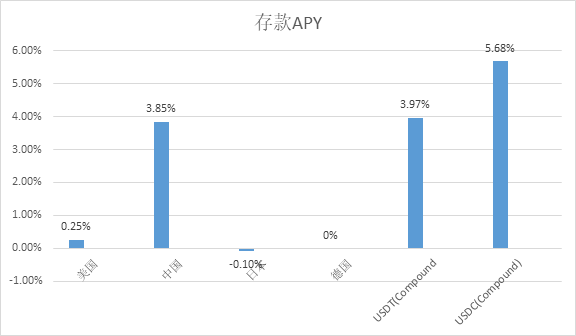

The opacity of USDT can provide better liquidity in many cases:

image description

Data source: debank

1.2 2018.9 Compound launched - the former king

image description

Data source: Trading Economics

Due to the popularity of Compound, we can temporarily conclude that a qualified DeFi project needs to have the following qualities:

Permissionless

Is there any counterparty risk Counter-Party Risk

Is the fund trusted by a trusted third party?

Applying the above points to Compound can be used one-to-one, and anyone can use it without (Know Your Customer) KYC. Compared with the 1.7 billion people without bank accounts, this may be a good choice. Secondly, Compound has no counterparty risk. The counterparty of the user's transaction is a smart contract. Because the smart contract is open and transparent on the chain, every step of the operation can be checked. In the end, user funds are on the chain rather than in the hands of the project party, so they are relatively more credible. Although it has only been 3 years since 2018, in that emerging era, Compound’s status as the first commercial bank was enough to attract well-known investment institutions such as Coinbase. The fact is that Compound has been firmly seated as the leading lending platform until this year Aave Comparing it online, you will feel that Compound is actually completely crushed.

1.3 2018.11 UniSwap launched - AMM's weapon to subvert the trading model

The exchanges in the traditional market serve as the medium for investors, and financial products in the secondary market such as stocks, futures, and options have always been the underlying assets of investment. In view of the tamping of the underlying technology of the blockchain and the improvement of Ethereum, the entire ecology is in a preliminary state of rapid development, and the digital currency exchange assumes the role of releasing investors' enthusiasm.

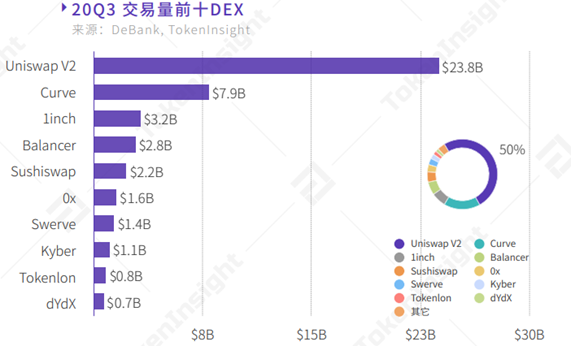

A Defi trading system that does not require an oracle

In November 2018, UniSwap was launched. In Q3 of 2020, UniSwap has already far surpassed other DEXs to become the leader of the track. Abandoning the order book model, there is no problem of difficulty in matching buy and sell orders due to insufficient liquidity, and there is no deep problem that limited price orders have not been traded all the time. AMM brings together liquidity and realizes market making based on algorithms. According to its CFMM formula, even pricing is not at all An oracle is required. The counterparty of the user is the fund pool, and the user's money is 100% safe on the chain, so there is no need to worry about problems such as running away from the exchange. This is a problem that centralized exchanges will never be able to solve.

Extremely simple virtual monopoly

image description

Data source: TokenInsight

The uncertainty of UniSwap is the certainty of Sushiswap

Recently, with the expiration of UniSwap mining and the uncertainty of the community voting to restart mining, a large amount of funds poured out. Sushiswap rose by 30 points on November 15. The reason: the uncertainty of UniSwap is the Sushiswap certainty. Sushi also increased the rewards of USDT/ETH, WBTC/ETH and other pools accordingly to attract UniSwap's recent outflow of funds. It is obvious that according to Defi Pulse statistics, the daily change of UniSwap’s total locked-up TVL is -43.99%, and the corresponding daily change of SushiSwap TVL is +69.14%, but the DeFi TVL has not decreased significantly. ).

1.4 2018.11 Synthetix launched - a bridge linking the traditional world

With the improvement of the entire DeFi ecosystem, from stablecoins to lending platforms to DEX, users can almost see another traditional financial world, but in this world, there is a lack of traditional financial fields such as stocks, commodities and other derivatives investments target. If users want to participate in investment in traditional fields, they must return to traditional exchanges and there are restrictions such as regional supervision. With the launch of Synthetix, it is almost a channel to open up traditional financial assets. Similarly, the entire project is decentralized without barriers to entry.

Increase portfolio diversity

image description

secondary title

2. 2019-2020 new ways to play a hundred flowers blossom

In fact, it is not difficult to see that 2017-2018 is the period when various projects drive the ecology. Traditional finance is mapped to the blockchain, accompanied by projects such as lending, exchanges, derivatives, stable coins and anchor coins to establish a complete underlying laying . 2019-2020 is the period when innovative applications help the ecological development. It is the period when imitation disk challengers are born. Such as lightning attack, liquidity mining, and liquidity attack are all new methods derived from the previous basis, and these new methods The traditional world never existed, nor could it exist.

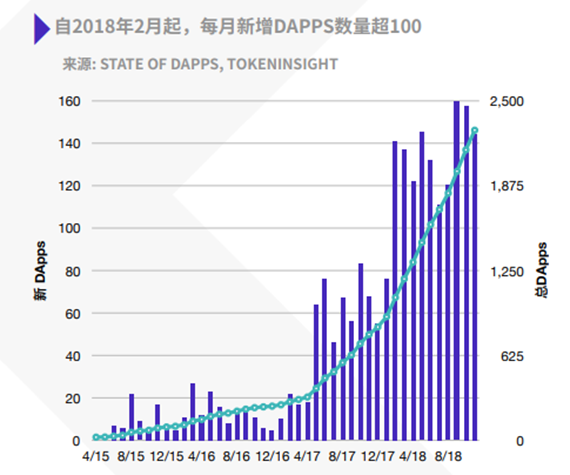

2.1 2019.1 WBTC goes online - BTC opens the door

image description

Data source: State of DAPPS

2.2 2019.7 Chainlink launched - a bridge connecting real data

At that time, smart contracts could only retrieve data on the chain, and the growth of scale was naturally accompanied by a need to interact with the real world. Interaction means connecting with the real world. In July 2019, the first project of the oracle track was launched on Chainlink, the main network of Ethereum.

As the current DeFi project with the largest market value, Chainlink is not only a partner of many traditional companies such as Google and Oracle, but also an oracle machine for most DeFi projects such as Aave, Synthetix, and Yearn Finance. Presumably many people know that Compound’s 90 million assets were liquidated on November 26. Since it does not have an oracle, it anchors the prices of Coinbase and OKEx. On the other hand, because Aave uses Chainlink’s oracle, its liquidated assets have decreased on a large scale under extreme market conditions.

Challenger Nest forms data directly on-chain

The quotation of miners’ real gold and silver forms the off-chain facts directly on the chain. Since the quotation scale of the miners’ chain game is an integral multiple of the transaction scale, the cost of doing evil has increased exponentially, and the incentive mechanism rewards high-quality data providers to ensure data security. Reliability and system stability form a perfect closed loop. Just as V God emphasized that the oracle machine should focus on obtaining real data, Nest's quotation model caters to this very well.

2.3 2020.1 AAVE goes online - the flash loan has not ended, it has not started

In 2020, the DeFi ecology has begun to take shape, track projects emerge in endlessly, and competition in the industry is intensifying. Many challengers are trying to carve up market share. For example, Aave, formerly known as EthLend, was launched in January 2020. As a challenger on the lending track, many people will compare Maker, Compound and Aave. I personally think that Maker can be classified as a lending track, but it is not suitable for comparison with other lending projects. Its role as a stable currency is beyond deposits and loans, although Dai is essentially an over-collateralized loan.

The code says: no end is equal to never beginning

Flash loan, a revolutionary financial tool, originated from Aave. The reason why it is called a financial tool is that it is the same as derivatives such as futures and options rather than a complete set of profit strategies. It never ends and never starts: users only need to complete the repayment and interest within about 13 seconds of an Ethereum block time, and it will be considered a successful flash loan. If the code logic is incomplete or cannot be returned on schedule, the flash loan will be never started. The flash loan launched by Aave can be said to subvert the traditional cognition. Logically speaking, there will be results only after the beginning, but the end of the flash loan can only see the beginning. Defi has mapped from the passive traditional financial industry one by one to relying on the advantages of the blockchain to innovate something that is not and impossible in the traditional field, which is interesting.

The law of the jungle is cruel, but it is also the normal state of ecological development

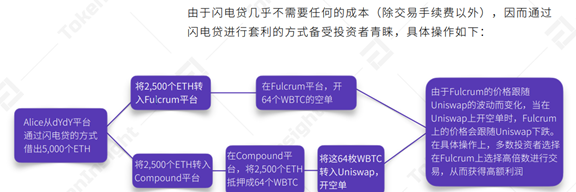

Regarding flash loans, there are two thresholds for ordinary users that have to be mentioned:

Users need to know a little about programming to use Solidity to operate

The key to a successful flash loan is to find viable arbitrage opportunities

As shown in the figure below, bZx's smart contract error allows the existence of an under-mortgage state, which is the core of the successful attack of the entire process. In addition, most of the current applications of flash loans are used for arbitrage. Arbitrage opportunities can be large or small almost everywhere. Flash loans are used as arbitrage tools to smooth price differences, which may be a big step in promoting the positive development of the ecology. Even though lightning attacks occur frequently, the tool itself is not wrong, but it can just eliminate those agreements with loopholes in smart contracts for the entire ecology. The law of the jungle is cruel but it is also the norm of ecological development.

Looking at Aave today, it can almost be said that it is a relatively successful challenger, regardless of whether its stable lending rate allows users to have multiple choices, or it is an innovative financial tool such as flash loans that cannot be replicated by traditional finance. As a lending platform, interest rates are obviously the most concerned issue for users, and the deposit and loan interest rates of most currencies provided by Aave are better than those of Compound. The Aave protocol provides more functions than Compound, and the more complex things are more likely to go wrong, this is probably the only thing that can defend Compound.

2.4 2020.312 - Systematic 'stress testing'

Since the financial crisis in 2008, the Federal Reserve has continued to implement quantitative easing policies, and such policies will cause the yield curve to shift to the right, which means that investors need to take more risks with the same return, and investors will turn to hedging when there are extreme market conditions Safe-haven assets have caused liquidity to dry up. In the week of March 12, affected by the epidemic, US stocks triggered circuit breakers twice, the Federal Reserve cut interest rates and the Bank of England cut interest rates, and global economic panic spread to the entire market.

image description

Data source: GF Securities

2.5 2020.6 Liquidity Mining - Unsustainable Hotspot

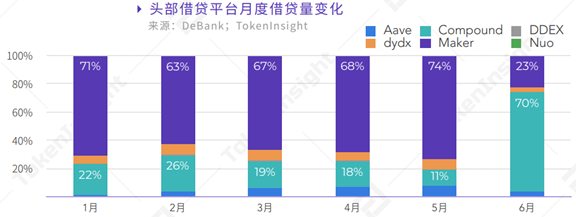

image description

Data source: TokenInsight

A dying project suddenly experienced explosive growth in loan volume in June. Compound is not the first project to launch liquidity mining, but why it can bring about fission. The reason is that users discovered the BAT arbitrage model at that time, the Compound token The distribution reward is set to be proportional to the amount of COMP tokens received in each market according to the accrued interest in the market, that is, the higher the interest paid, the more COMP you will get. At that time, BAT's deposit and loan interest rates on Compound were as high as 23.77% & 31.88%. Compared with BAT's listing on Compound on May 23 - June 18, BAT's deposit and loan interest rates have been only about 0.06% & 2.75%.

Distort the real interest rate and squeeze the original loyal users

No physical value support

Long-term value, but not long-term mining

secondary title

3. Looking forward to the future of Defi

3.1 Liquidity staking - releasing the liquidity of pledged assets

In order to ensure the security of the platform, Defi currently adopts an over-collateralization mechanism, that is, depositing 150% of assets as a deposit before lending out 100% of assets. The pledged assets have begun to take shape as the locked-up amount of Defi has reached the 10 billion mark. However, the pledged assets will lose their liquidity and thus lose their value, although over-collateralizers lend assets for specific purposes such as mining. In response to PoS issues, Kira aims to release liquidity for pledged assets. Kira supports all tokens, and each node has equal voting rights.

Derivatives pledge to regain liquidity

DEX that supports any token

The lock-up period and payback cycle for different purposes of different projects can be as long as dozens of days, and some can be as long as several months. Liquidity staking, a traditional market that has never had a concept, has a promising prospect. Although the current DEX is more transparent and simpler than centralized exchanges, DEX can only provide ERC20 Token transactions, which greatly limits the breadth of transactions. Kira's derivatives trading system supports all tokens, and on-chain transactions greatly improve the liquidity and utilization of assets.

3.2 Derivatives—maybe the next tipping point

The preconceived concept of this industry is very strong. The derivatives track is small in scale but growing fast. It is an important track in Defi but has not seen significant growth. At present, derivatives transactions in the cryptocurrency industry are mainly concentrated in mainstream currencies such as BTC and ETH, while thousands of other currencies have derivatives transactions such as option futures contracts, but problems such as lack of liquidity due to difficulty in matching buy and sell orders still exist Just stay at the stage of existence.

Friendly interface

Parameter setting such as time limit and price

Whether the market liquidity is sufficient, matching efficiency

At present, there are some derivatives market projects in the market, covering such as futures and options swaps, underlying assets such as interest rates and foreign exchange. There are many bottlenecks in these projects. Can Defi use the blockchain to gather option sellers into the fund pool to smooth potential losses? Secondly, the primary consideration for any exchange is whether the trading depth and sufficient liquidity can be provided to the options trading platform, how to price it, whether oracle machines are needed, and how to prevent oracle machine attacks. Whether the trillion-dollar market in the traditional world can shine in the way of Defi is worth looking forward to.

3.3 New Species—On-Chain Processing to Meet Actual Needs

secondary title

4. Conclusion

quote

quote

2020 DeFi Industry Research Report Part1. (November 2020).Retrieved from: TokenInsight

Capital Hill Chain. (October 2020). Retrieved from: ChainNews

EthereumGroup. (2013). ethereum whitepaper

Gains in Financial Inclusion,Gains for a Sustainable World. (May 18, 2018). Retrieved from: The World Bank

tradingeconomics. (2020). Retrieved from: tradingeconomics

Pan Chao. (May 2018).Dry goods | About USDT and stable currency, most people are wrong. Retrieval Source: Encryption Economic Research Institute