Will decentralized robo-advisors be the next wave?

foreword

foreword

This article will introduce decentralized finance (DeFi) and Robo-Advisor (Robo-Advisor), that is, financial investment advisory. These two topics have only increased in popularity in the market in recent years. The industry has had a big impact. But what exactly would a collision be if the two were combined? What kind of reaction will it bring to the market? What kind of help will it give investors? With these questions in mind, they will be introduced one by one below.

secondary title

What is Robo-Adisor

Robo-Adisor is a computing system based on artificial intelligence based on big data. It automatically calculates and provides portfolio configuration suggestions through investment analysis methods such as modern portfolio theory and machine learning. It is a kind of financial advisor for online investment portfolio management services. It provides automated investment consulting and asset management services. It uses a series of intelligent algorithms to optimize theoretical models for user portfolios, provides investment advice for users, and dynamically detects market changes. , to provide regular or irregular adjustments to asset allocation, and at the same time perform automatic rebalancing operations according to certain rules to improve the rate of return of asset portfolios.

Robo-advisory services can be broadly divided into three levels:

The first level, the simplest, provides investment advice on market dynamics in a general sense through a large amount of data analysis, which will not vary from person to person;

The second level, according to the characteristics or preferences of the client, gives personalized investment advice, but does not conduct transactions;

The third level, on the basis of the second level, provides trading services for service objects, including fully automatic trading, artificial investment consultant assisted trading and self-executed trading.

The robo-advisor that is generally understood is generally the intelligence that provides the second to third levels of services. The ages, investment goals, investment periods, and risk preferences of robo-advisors are different, and even the basic investment methods they prefer are also different. Therefore, for a large number of service objects, the investment advice given by robo-advisors will vary from person to person. varies.

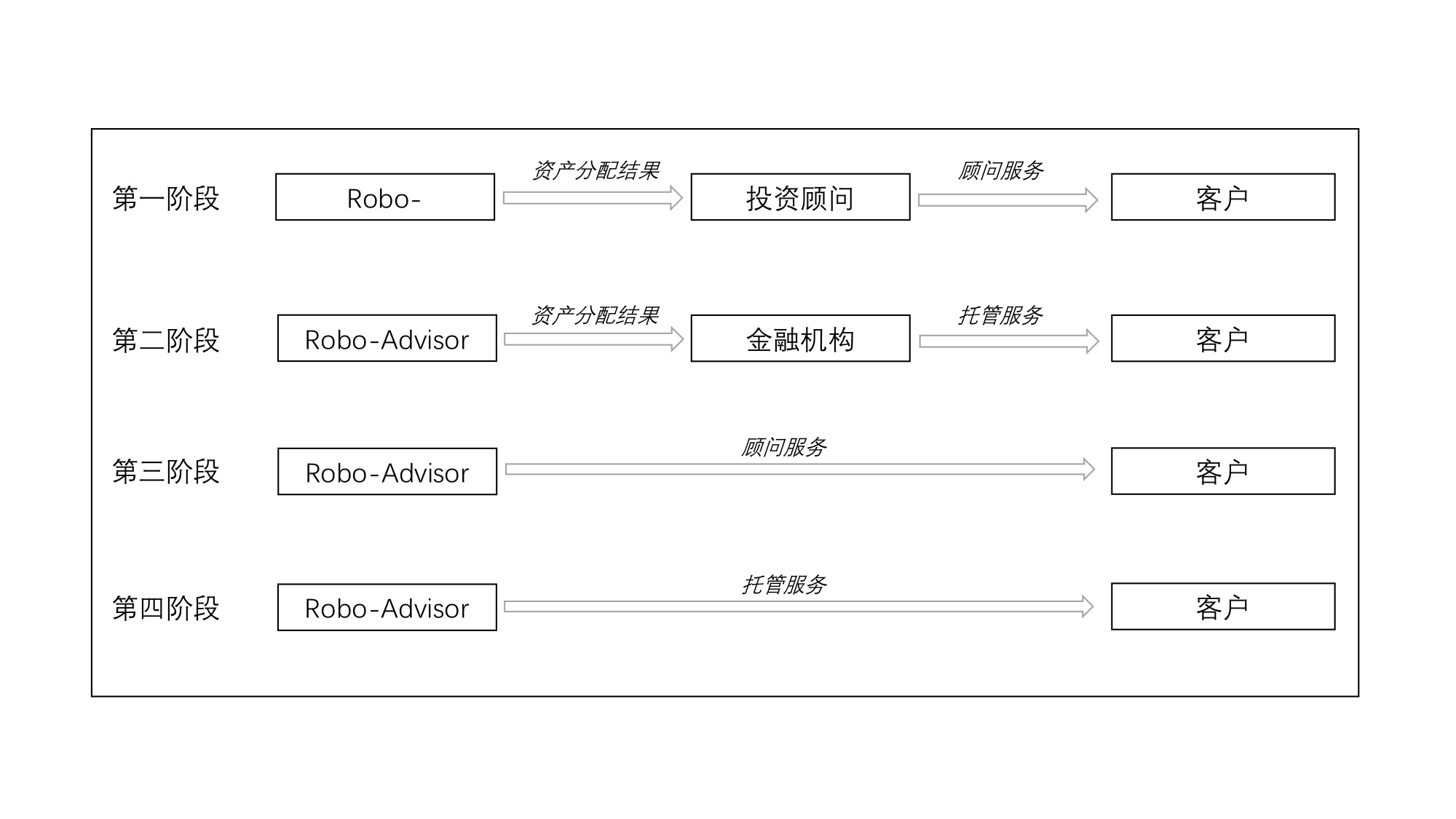

The development stages of robo-advisors can be roughly divided into four types:

The robo-advisor we are talking about today is the second to fourth stages. Advisory/custodial services or whether there is a third-party agency, using computer program systems to provide customers with financial advice through algorithms and products to build data models based on their own financial needs. . It has the characteristics of low cost, no emotion, and large scale.

secondary title

What is Decentralized Finance (DeFi)

"DeFi" sprouted in August 2018, representing Decentralized Finance (De-Fi). Decentralized finance is an open source technology, financial smart contracts and protocols, which aim to improve the current financial system in all aspects by introducing a decentralized layer to disintermediate and eliminate "trusted third parties". Simply put, decentralized finance is to provide financial services with the help of the features and functions of the blockchain, thereby creating a more open and transparent financial system. Therefore, decentralized finance is characterized by open source and interoperability, openness and transparency, inclusiveness and accessibility.

- Open source and interoperability: the commitment of software developers and the systems they create to open source and share with each other.

- Openness and transparency: All participants have access to the same information while emphasizing the protection of personal privacy. In the DeFi system, governments and institutions cannot restrict the dissemination of information, or mislead, monitor, and suppress the service objects of this system.

- Inclusion and Accessibility: Enabling anyone in the world to access the financial system and its vital products such as mortgages, insurance, and business loans.

In the past two years, the popularity of DeFi has only increased, especially in the first half of this year, it has become the most watched star track in the entire encryption market and blockchain.

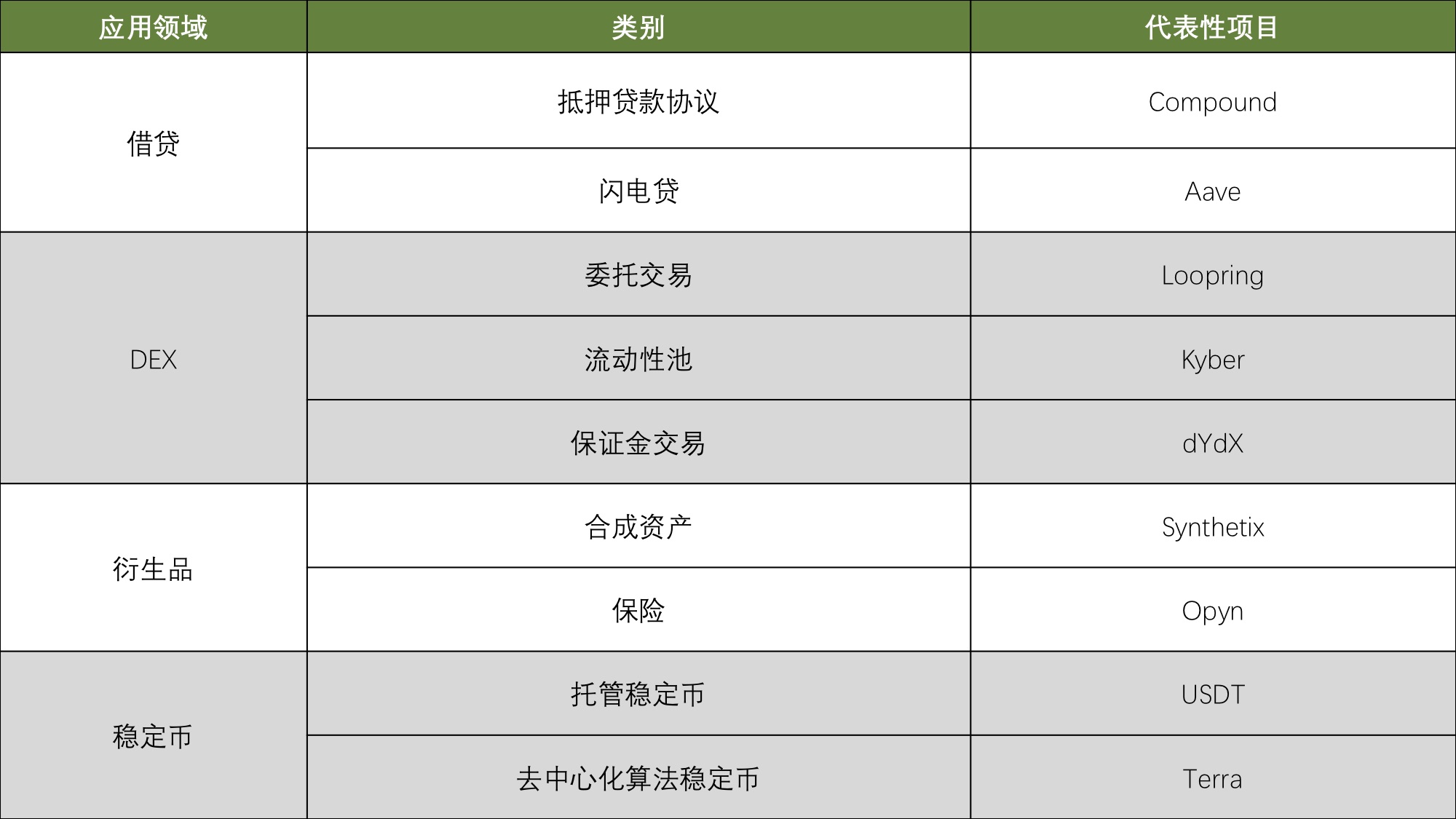

Below, it is organized and classified according to projects, and popular projects in various fields are cited, as shown in Figure 3:

【Attach a DeFi dynamic and project link here, so that everyone can check and understand:】

【DeFi Trend Research - Messari's Summary and Outlook for the DeFi Market】

Is it really impossible to achieve unsecured lending of decentralized encrypted assets without KYC?

secondary title

What effect will the combination of decentralized finance (DeFi) and robo-advisor (Robo-Adisor) have?

In this way, the openness, transparency, authenticity and credibility of the product are ensured, credit risk is effectively reduced, and the situation where the product content and operation methods are opaque and the rights and interests of customers cannot be guaranteed due to lack of supervision and risk control is avoided.

There are very few companies that combine DeFi and robo-advisors, and the power of the robo-advisor market that uses AI and big data for trading and investment management cannot be underestimated. Especially in the DeFi market, robo-advisors can play an icing on the cake.

secondary title

Facing the problems existing in the DeFi market, how to improve and solve the problems of decentralized intelligent investment

I believe that many investors have encountered many problems in the face of DeFi, a brand new investment field, as follows.

- Investors' understanding of the DeFi market is still mature

- DeFi projects emerge in endlessly and unevenly

- Investors have different risk tolerance

- time difference, poor operation

- Facing the real-time fluctuating DeFi market, it is difficult to predict accurately

- Investors lack effective guidance, are prone to emotional operations, and make irrational judgments

So, what will be the effect of grafting robo-advisory technology to decentralized finance?

Not only that, but decentralized robo-advisors can judge the overall credibility and risk coefficient through the comparison of the rate of return and change trends of different platforms, the size of the total fund pool, activity, and third-party word-of-mouth data, etc., by integrating all information. Analyze and more accurately calculate the investment weight of each type of investment portfolio. In addition, other users can also customize personalized and exclusive investment plans according to their own needs, and weigh their own assets to screen the investment strategies they want to use.

From this point of view, compared with traditional robo-advisors and DeFi platforms, the product of the combination of the two can provide a full range of judgments and recommendations, and provide objective and efficient investment suggestions and strategies, and further realize the benefits for investors through smart custody. The automatic management of personal assets makes inclusive finance possible.

secondary title

The Development Potential of the Decentralized Smart Investment Advisory Market

The development of robo-advisors in foreign countries is relatively mature. At present, the number of companies providing robo-advisory services in the world is mostly, and their business forms are also diverse, covering the United States, Europe, Canada, Australia, Singapore, India, South Korea and other countries. In comparison, domestic robo-advisors started relatively late, but their development momentum is rapid. The late start does not mean that the development is slow.