Reflections brought to us by CRV and YAM incidents

Original link:

Original link:https://doseofdefi.substack.com/p/crv-yam-distribution-costs-and-games

Last week was a wild one, and maybe we need to come up with a new collective term to describe the horde of DeFi users popping up on Twitter and telegram. The launch of YAM and CRV tokens has triggered a battle for income. Many users are afraid of missing the entry time. Even in the case of high GAS fees, a large amount of assets flow into Yam.Finance and Curve.fi to obtain YAM and CRV.

Farmers (here refers to those who earn income by providing liquidity for DeFi) if they get returns from YAM and CRV, they must decide whether to harvest them and sell them to investors who clamor for new tokens, or continue farming to avoid high prices. The gas fee cost.

secondary title

financial game

Finance and cryptocurrency blogger JP Koning said this: "Most people aren't investing in bitcoin, they're playing with it", although some of last week's activity could be considered an investment activity. Obviously, most users participate because it's fun and fun, and this is especially true for YAM.

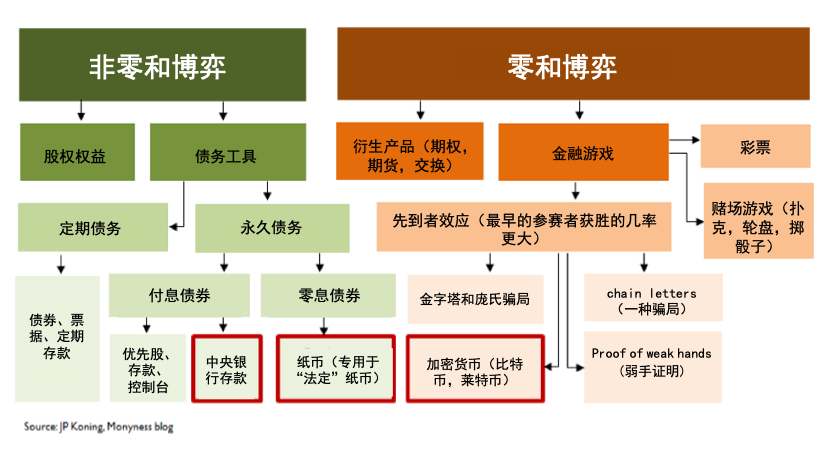

Koning created the following diagram [1] to divide Bitcoin and other financial assets into zero-sum outcomes and non-zero-sum outcomes (Win-win-opportunities).

Note: [1]"Bitcoin as a Novel Financial Game":https://www.aier.org/article/bitcoin-as-a-novel-financial-game/

CRV and YAM can be placed in several different places on the icon. Perhaps they gain value in governance similar to equity or debt instruments, but there is definitely some “first comer effect” component to this token offering frenzy. DeFi users are eager to reap the high yields of new tokens, hoping that others will follow suit, grow crops, and value the token.

Koning likened Bitcoin to a game, as last week’s YAM craze wasn’t the “rehearsal of the revolution” many had hoped for. It's true that new technologies often seem like a joke at first, but they can actually revolutionize the entire financial system.

In addition to YAM, Based.Money launched last week, however, it more clearly positions itself as a DeFi game, and describes itself as "DeFi game of chickens" and "degenerate game theory". Like YAM, it uses an elastic supply mechanism pioneered by Ampleforth.

The daily rebase adjustments of YAM, BASED, and AMPL are excellent opportunities to gamble, and some even call them "dopamine secretion periods". Risk-averse token holders can hold tokens through the elastic supply mechanism, even if the supply of tokens changes, their tokens will have the same share of the network, token holders (players) can take advantage of Rebase as a trading opportunity.

distribution mechanism

distribution mechanism

Compared with YAM, CRV does not rely on gamification to attract market attention. Curve has monopolized the StableCoin (stable currency) & mirror (mirror asset) swap market and provides a better product than centralized solutions.

Like Compound, Curve also has two goals:

Use of Curve.fi is encouraged

Distribute CRV governance tokens

It appears to have succeeded on its first goal, more than quadrupling its total value locked (TVL) to over $1 billion, and more than doubling its weekly transaction volume to $511 million (No. 1 Uniswap rose 65% to $1.6 billion). It is worth noting that Curve does not adopt an incentive mechanism, and Balancer, another liquidity mining project, also does not adopt an incentive mechanism, and needs to guide its liquidity from 0.

The conclusion of the second objective has not yet come out. Curve will gradually distribute 5% (151.5 million) of the total amount of CRV governance tokens to early users within one year, and users who provide liquidity on Curve will receive CRV as a liquidity provision reward.

CRV was originally intended for Curve users, but the recent DeFi boom has attracted the attention of various crypto communities, and within an hour of launching CRV on Thursday, Poloniex, Binance, and Huobi all announced support for trading CRV. Curve also cooperates with Matcha, the official decentralized trading platform launched by 0x, to launch CRV/USDC trading pairs.

Of course, since there is no pre-mining, vested and harvested CRV is the only circulating supply, and with limited supply and high demand, it is no surprise that CRV prices are skyrocketing.

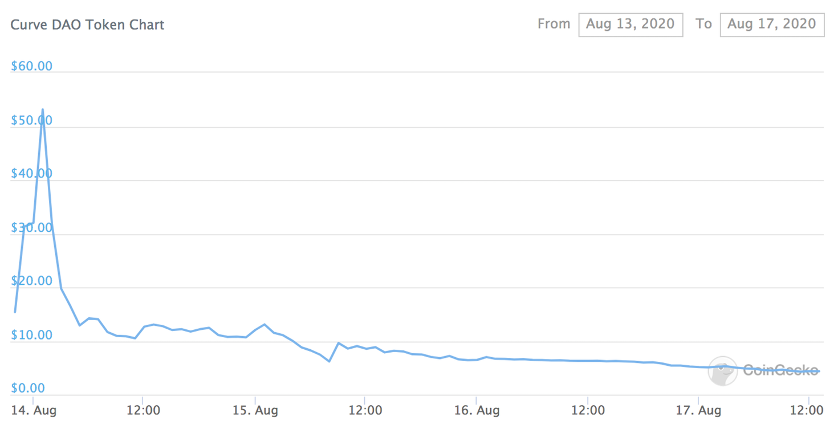

This is a windfall for whales, who can sell their harvested CRV for more than twice the market value of Ethereum. This resulted in somewhat dismal prices for the first week:

Currently priced at $4.35, CRV tokens have a diluted market cap of $14.4 billion, more than double the market cap of COMP, MKR, BAL, SNX, and LEND combined. With more CRV releases next year, selling pressure will continue. This could be stressful for CRV holders.

The high price/valuation of CRV is not one of the goals of Curve's liquidity mining, and one could argue that there will be no higher price unless more tokens are unlocked.

The overarching question is whether Curve has achieved its second goal of distributing CRV governance tokens. This is to reward loyal users of the platform with CRV, but due to the high demand and limited supply of CRV, users have a strong incentive to sell immediately to obtain income.

To some extent, early Curve super users acted as CRV distributors, but their motivation was profit, not better governance of Curve as token holders.

Note: Fans in the community contribute original/translated popular science articles, which do not represent the official position of Cortex. The above opinions are for sharing only, please do not take them as investment advice! ! !