secondary title

What are Curves?

To put it simply, Curve is a decentralized exchange with great advantages in stable currency exchange, and will soon issue governance token CRV.

Curve is an exchange pool protocol developed based on Ethereum, providing stable currency transactions with low slippage (good depth). The Curve algorithm is specially designed for stable currency exchange, which can achieve low slippage and low handling fee (0.04%).

While providing liquidity, Curve liquidity providers can not only obtain transaction fees, but also obtain additional income from other DeFi protocols (such as Compound, Yearn, Synthetix, RenBTC, etc.).

secondary title

Principle introduction

How does Curve achieve low slippage in stablecoin transactions?

Curve uses the same AMM automated market maker mechanism as Uniswap, uses algorithms to imitate the trading behavior of traditional market makers, and smart contracts act as counterparties.

Uniswap's constant product market maker model is not suitable for all types of assets, and using Uniswap for stablecoin transactions will cause a lot of losses.

Mainstream stablecoins are anchored at US$1. Although there are fluctuations, stablecoin exchange should be lossless in the long run. Based on this assumption, Curve invented the StableSwap market maker algorithm specially for stablecoin transactions based on Uniswap. The curve of Uniswap is smoother, and the slippage of stablecoin transactions can be very low.

How does Curve achieve higher annualized returns?

As long as someone trades on Curve, liquidity providers will evenly distribute the transaction fee income obtained by the platform. As Curve's transaction volume increases, the annualized income will also increase.

But more income comes from depositing liquidity funds into lending agreements such as Compound, which can earn additional interest in addition to Curve transaction fees.

secondary title

CRV Token

Curve's governance token is CRV. CRV holders can participate in the online governance of Curve in the future.

token issuance

62% distributed to liquidity providers

62% distributed to liquidity providers

5% as community reserve

3% to team members, unlocked linearly over 2 years

5% as community reserve

5% distributed to early Curve liquidity providers, unlocked linearly within 1 year

5% distributed to early Curve liquidity providers, unlocked linearly within 1 year

5% as community reserve

3% to team members, unlocked linearly over 2 years

5% as community reserve

The initial Curve liquidity mining has ended at block height 10627591 (Beijing time: 2020.08.10 03:24:29 AM). Users who provided liquidity in Curve before this time can check their initial CRV amount at https://www.curve.fi/earlyCRV. These CRVs will be unlocked linearly over 1 year.

At the beginning of the launch, the circulation of CRV is 0, and the initial release rate is about 2 million CRV per day. The 2 million CRV mainly consist of the following:

The CRV held by liquidity providers and team members in the initial issuance will be gradually released

secondary title

text

As an ordinary user, there are two ways to obtain CRV:

Provide liquidity on Curve and obtain CRV as a liquidity provider

For specific operation methods, please refer to the "How to Become a Liquidity Provider to Obtain CRV" section of this article.Buy on exchanges that support CRV

To learn about exchanges that support CRV, please follow Curve's official announcement.

Anti-fraud reminder: As of 2020.08.13, CRV tokens have not been officially issued. Follow this link to learn about the CRV contract address: https://www.curve.fi/contracts. Beware of fake CRV tokens issued by scammers.

How to use Curve for currency exchange

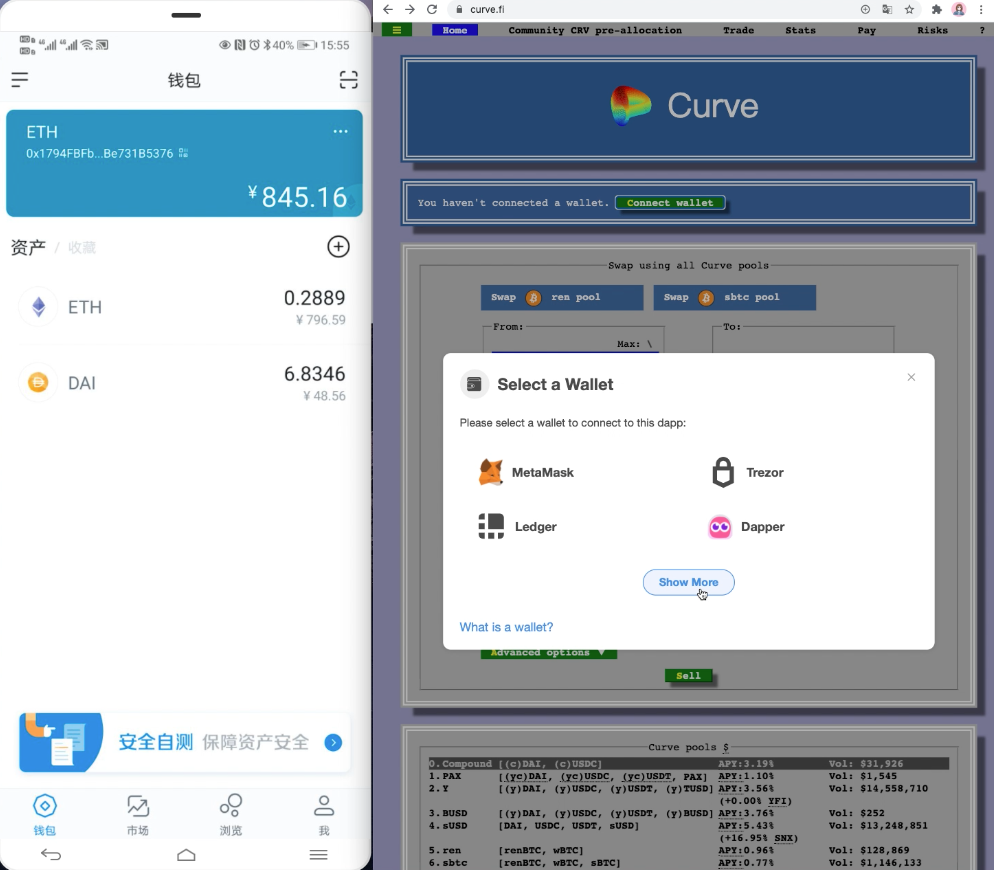

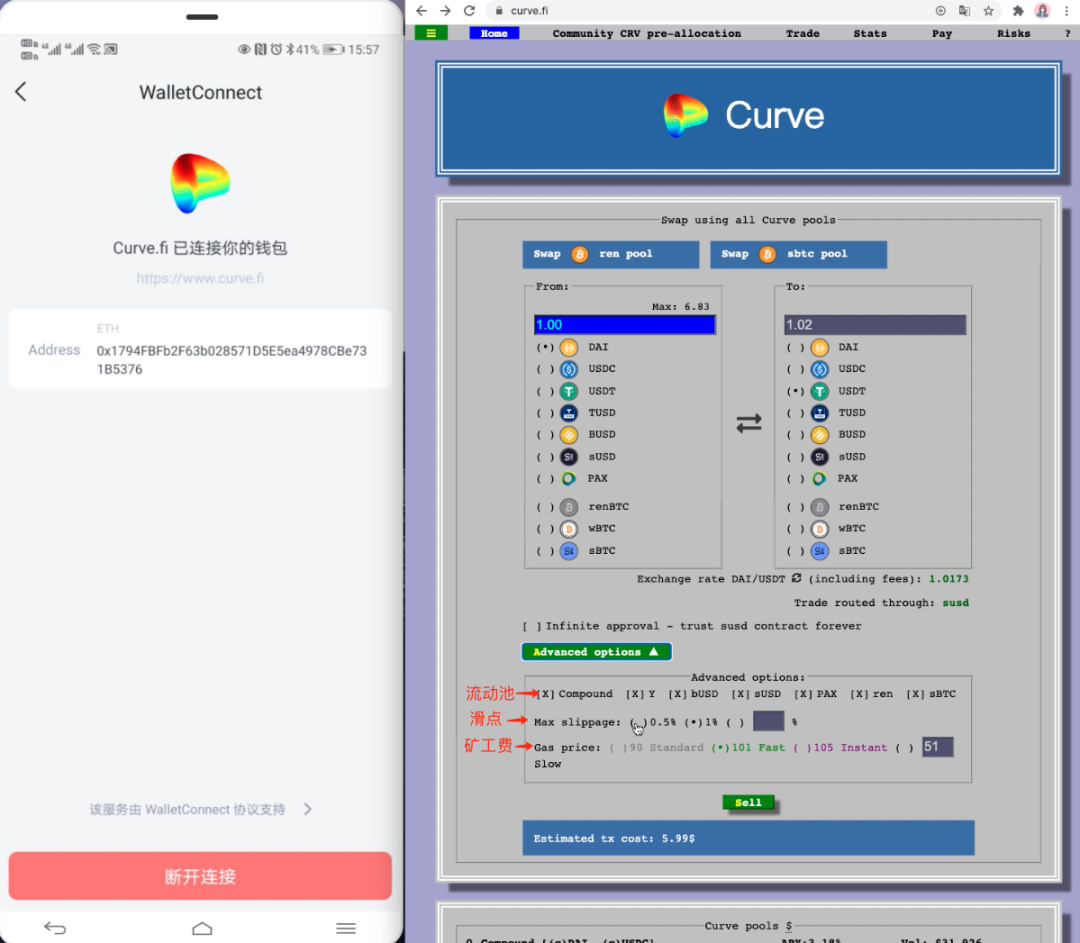

1. Open the imToken application and the Curve webpage:https://www.curve.fi/

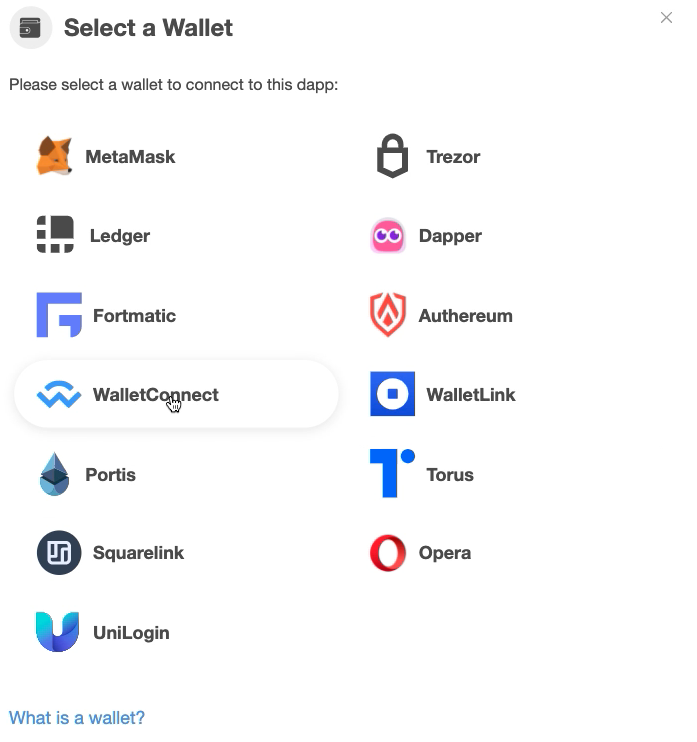

2. Click "Connect Wallet" on the Curve webpage, click "Show More" in the pop-up window, and then click the "WalletConnect" icon.

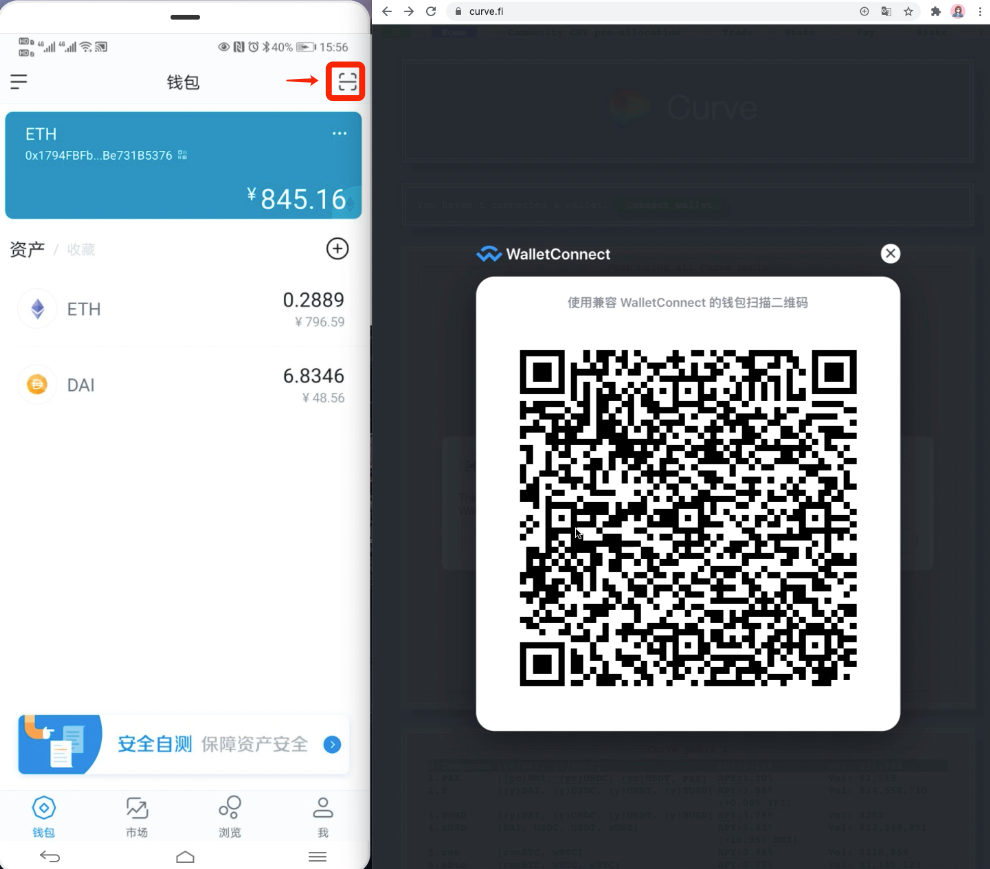

3. Click the QR code icon in the upper right corner of the imToken software, scan the QR code on the web page, and authorize the DApp connection on the mobile phone.

4. After the connection is successful, select the tokens and quantity to be exchanged in the "From" and "To" columns, click "Sell" to perform currency exchange, and you can check the estimated handling fee at the bottom of the page.

Click Advanced options Advanced options,

You can choose a liquidity pool and customize the maximum acceptable slippage and gas fee

Slippage: It can be simply understood as the price difference, that is, the difference between the actual transaction price and the current price.

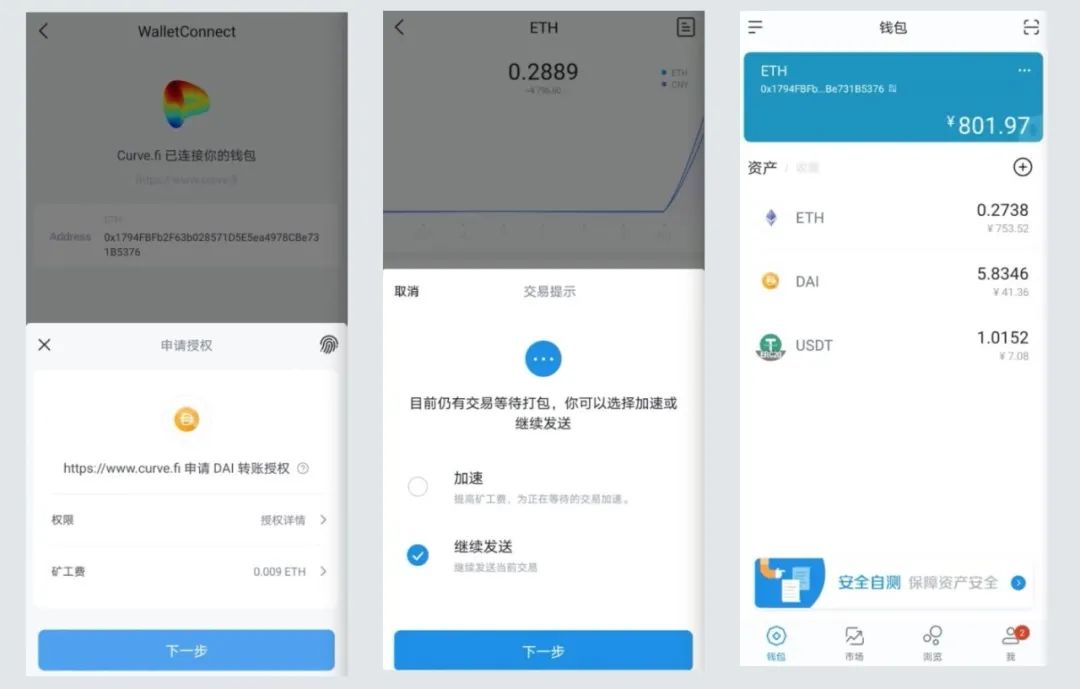

5. Click "Next" on imToken to authorize the transaction, select "Continue to send" after authorization, and click "Next".

secondary title

How to become a liquidity provider to obtain CRV

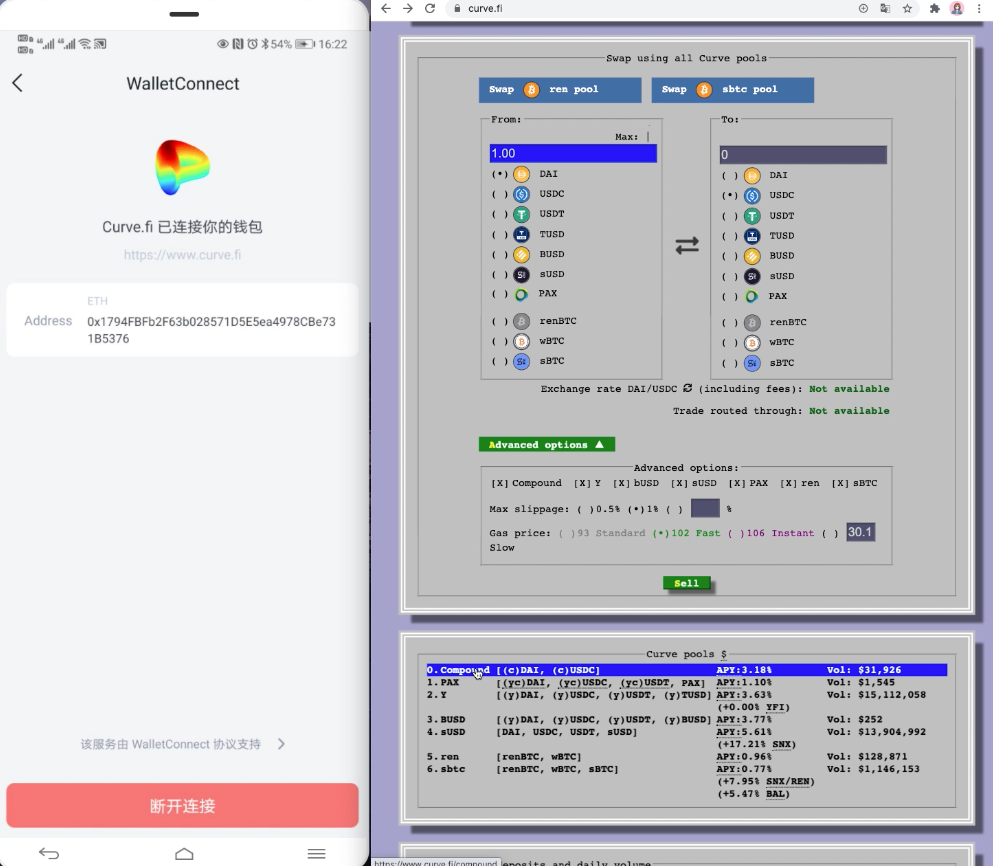

There are many ways to become a Curve liquidity provider, and here is one of the simpler operations, taking joining the Compound pool as an example.

First, follow the steps 1-3 in the "How to use Curve for currency exchange" section, scan and authorize the Curve web page connection through WalletConnect on imToken.

1. After the connection is successful, select a liquidity pool in Curve Pools, here take Compound as an example, click Compound.

In actual operation, if you participate, it is recommended to choose a liquidity pool with a larger amount of funds and a higher rate of return

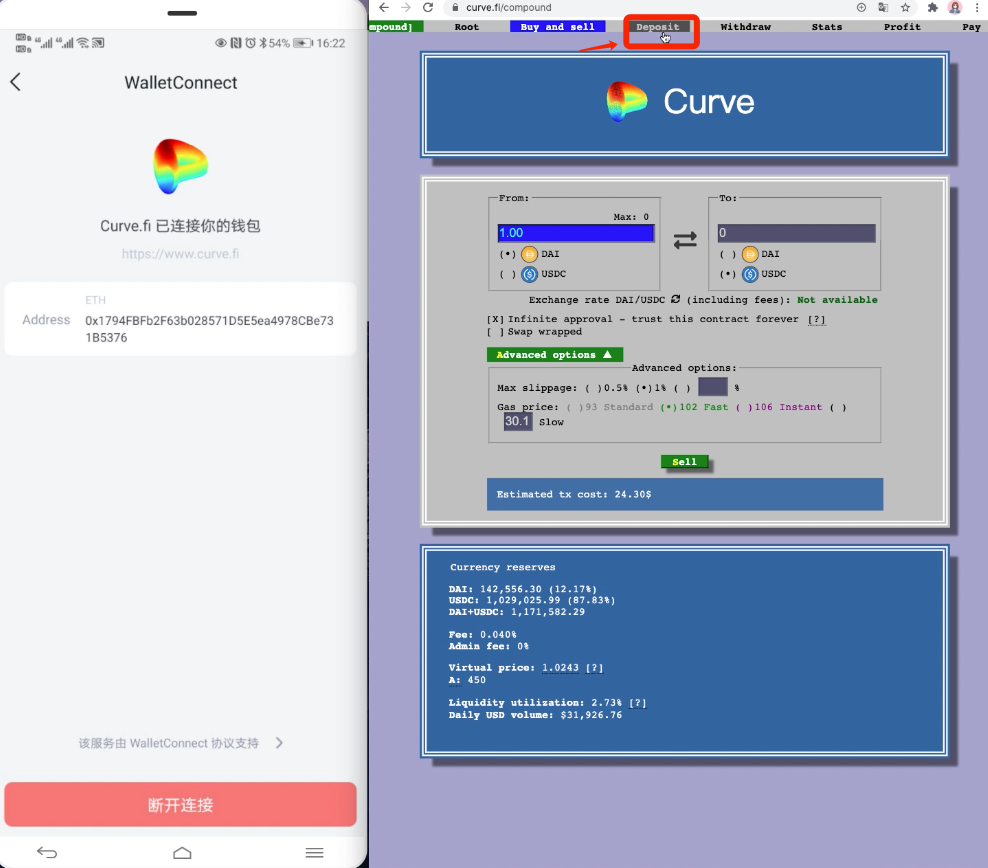

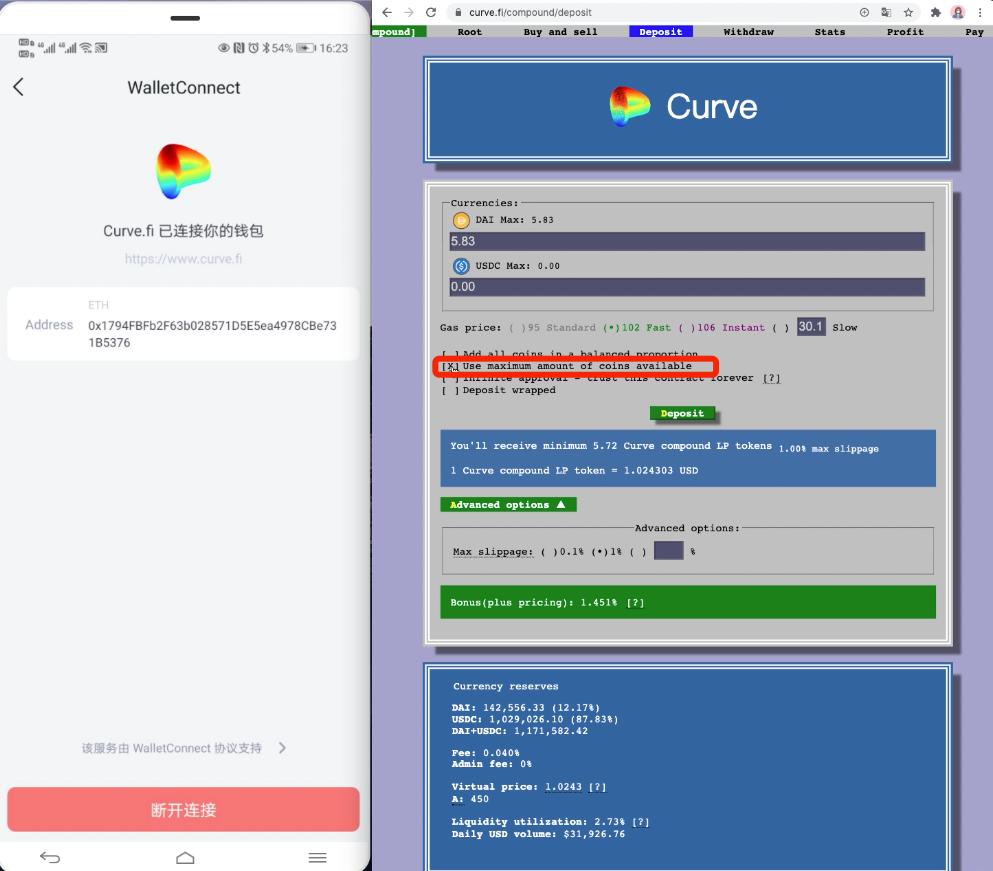

2. After entering the Compound pool, click "Deposit" in the menu bar at the top of the page.

3. The Compound pool supports the deposit of stable coins DAI and USDC, and deposits all DAI and USDC in the wallet by default. If you want to customize the amount of stablecoins deposited into the liquidity pool, you can click "Use maximum amount of coins available" to make the X in the option box disappear and enter the custom mode.

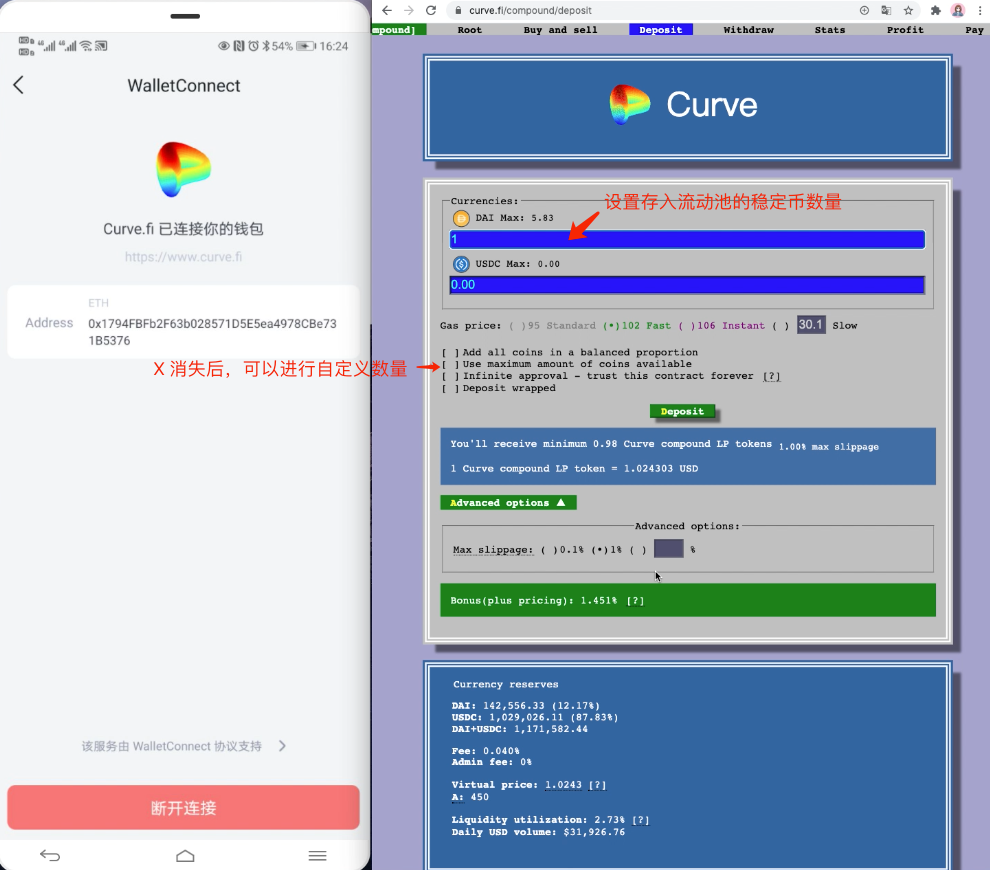

4. After the X in the box disappears, enter the custom mode, and the two input boxes of DAI and USDC will change from dark gray to dark blue. At this time, we can manually set the amount of stablecoins deposited in the liquidity pool.

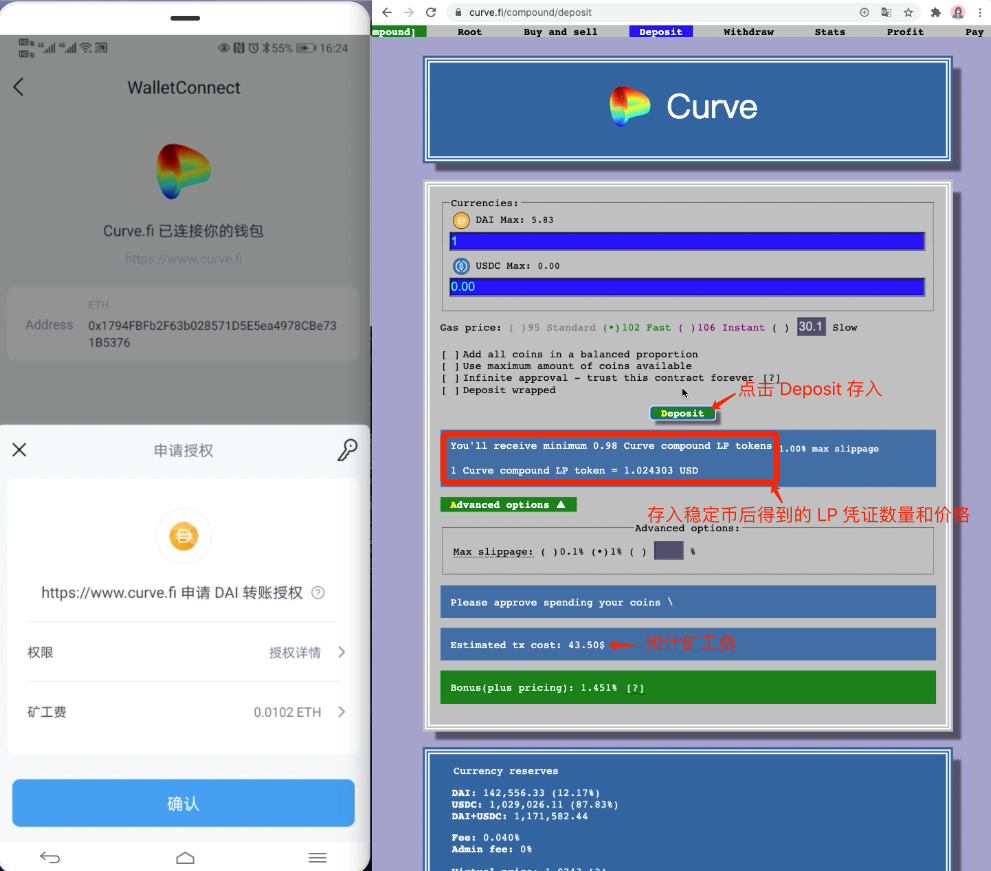

5. Click Deposit to deposit, and click "Confirm" on imToken to authorize the transaction. On Curve’s web page, you can view the quantity and unit price of LP tokens (which can be understood as deposit certificates) obtained after the stablecoins are deposited in the liquidity pool, as well as the estimated miner’s fees.

Due to the recent surge in miner fees, it can be seen from the figure that a miner fee of 300 to 400 yuan is required to deposit stablecoins into the liquidity pool. Therefore, if the amount of stablecoins deposited is too small, there may be a final profit The problem of not being able to cover the miner's fee resulted in losses. Therefore, please calculate whether your final income can cover the miner fee you paid.

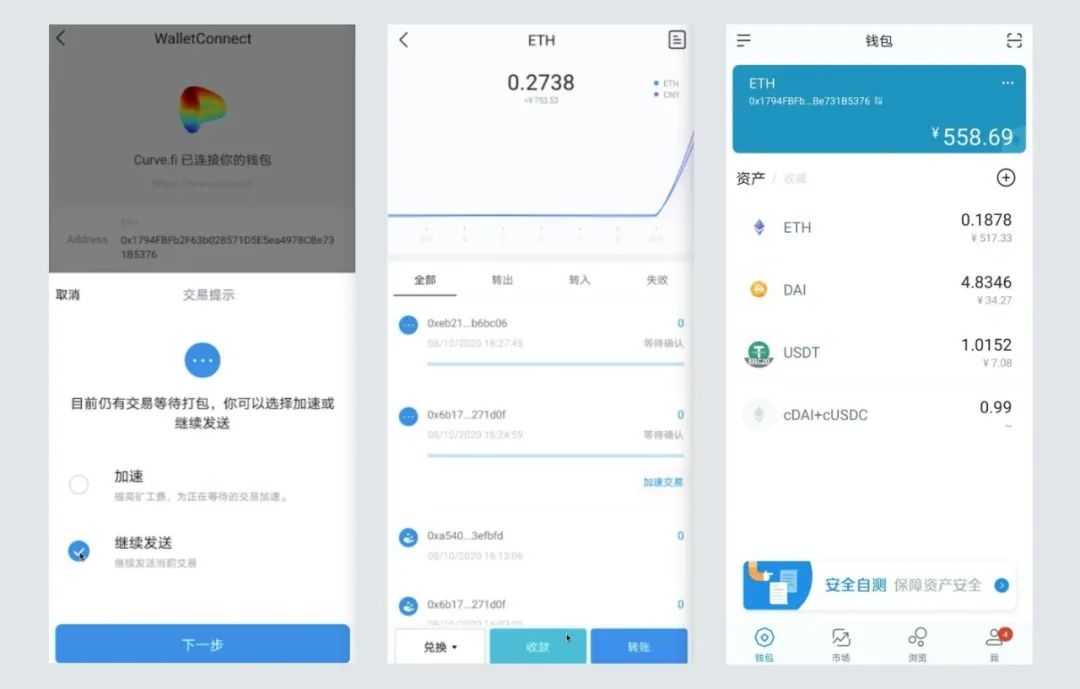

6. After authorization, select "Continue to send" and click "Next". After the transaction is sent, you can see two transactions waiting to be packaged in the ETH historical transaction interface, which are the authorized transaction and the stablecoin DAI converted to LP Token. trade. After the two transactions are successful, you can view the received LP Token on the asset interface. The token name corresponding to the LP Token obtained from the Compound pool is "cDAI+cUSDC".

The above only takes the Compound pool in the Curve liquidity pool as an example, and the operation methods of different pools are slightly different. Before operation, it is necessary to do research to avoid misuse.

Precautions

Precautions

Contract risk: Although Curve has passed the security audit, it does not mean that it can avoid all risks.

Impermanent loss: As a liquidity provider, you need to pay attention to impermanent loss. Learn about "impermanent loss": https://zhuanlan.zhihu.com/p/141925803

Exchange rate risk: Pay attention to the exchange rate fluctuations of stablecoins, there may be risks.

learn more:

learn more:

Curve official website: https://www.curve.fi/

Curve white paper:

https://www.curve.fi/stableswap-paper.pdfCurve Blog: https://guides.curve.fi/

Curve official community:

https://discord.com/invite/9uEHakc