Editor's Note: This article comes fromBabbitt Information (ID: bitcoin8btc)Editor's Note: This article comes from

Babbitt Information (ID: bitcoin8btc)

, Author: The Defiant, Compiler: Wendy, published with permission.

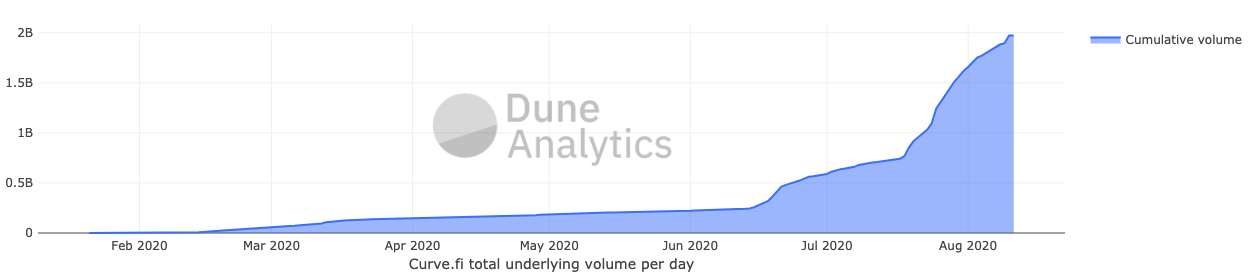

Curve, the third largest decentralized exchange (DEX), with a cumulative transaction volume of nearly $2 billion and the center of a yield farming frenzy, is preparing to distribute its own CRV governance token this week— It could be in just a few days - and the yield farmers can't wait.

image description

(Curve Cumulative Trading Volume)

Curve contributor Michael Egorov said:

“Let’s talk after the token is live. If I’m busy answering everyone’s questions right now, it might delay the launch.”<>After COMP, BAL and YFI, traders poured hundreds of millions of dollars into lending protocols including Curve, while the prices of these tokens soared amid growing speculation that CRV would be the next big hit DeFi tokens.<>renBTC。

As the liquidity mining boom heats up, Curve has been quietly being a liquidity provider (LP) in the CRV pre-launch program. Liquidity providers will receive CRV in proportion to their assets deposited on Curve.

Curve uses a unique AMM curve design (hence the name Curve, that is, curve) to reduce the slippage of specific trading pairs, such as USDC

Curve earns income by providing lending collateral to Compound, Aave, and dYdX—providing LPs with 0.04% transaction fees + attractive interest.

Many projects have turned to using Curve as a way to stabilize their native tokens. One of the best examples is Synthetix and its sUSD and sBTC pools, which offer SNX, REN, and BAL rewards based on lending rates.

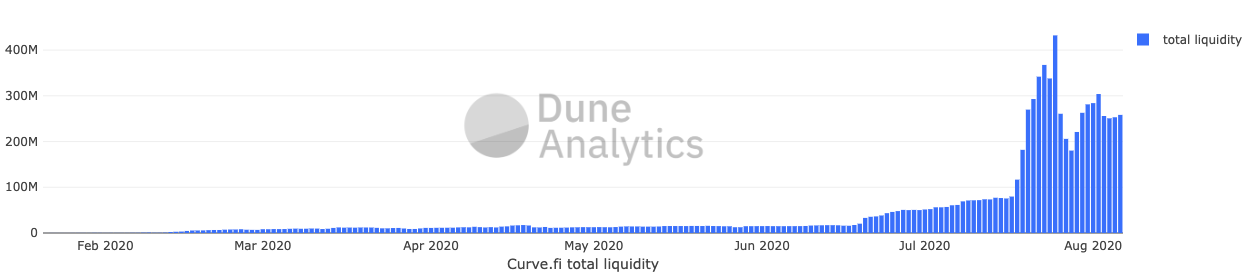

image description

(Curve Liquidity)

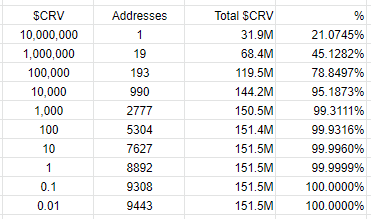

There are a total of 151.5 million CRV—5% of the total amount, which can be gradually distributed to LPs within 1 year. At present, only 990 addresses have obtained more than 10,000 CRV, among which a giant whale occupies the largest share, obtaining 21% of the early CRV rewards.

image description

(CRV allocation)

The pre-launch stage will be unlocked in real time, which means that after the first 24 hours, early LPs will be able to claim 1/365 rewards. Let's take a look at how the initial 1.3 billion CRV (43% of the total) is distributed:

30% distributed to investors after a 2 to 4 year lock-up period

5% allocated to early CRV LPs after 1 year lock-up period

5% as CurveDAO community reserve

3% distributed to employees after a 2-year lock-in period