Standardized stablecoins in the future will speed up the rise

A stablecoin is a cryptocurrency pegged to a stable asset class, so proponents argue that stablecoins are immune to volatility.

The rise of stablecoins is inevitable. In this turbulent parallel financial world, the industry creates endless possibilities. Not only have they brought liquidity to the ecosystem, they have driven significant innovation and created many other use cases to further the cryptocurrency industry.

One of the main reasons for the rapid rise of stablecoins is that people believe that stablecoins are a reliable means of payment. In addition, stablecoins have many other potential advantages, such as: low cost, global coverage, and higher processing efficiency. In addition, stablecoins can also seamlessly use blockchain-based assets for payment and be embedded into digital applications through its open architecture, without the need to go through the traditional transaction system of the bank.

Among the many stablecoins, the USDT issued on the Ethereum blockchain dominates the stablecoin landscape. The major stablecoins took off in early March and pushed up the market cap of the entire stablecoin market. By the end of April, it was second only to Bitcoin (BTC) and Ethereum (ETH) in size. Its current market capitalization accounts for about 85% of the total stablecoin market capitalization.

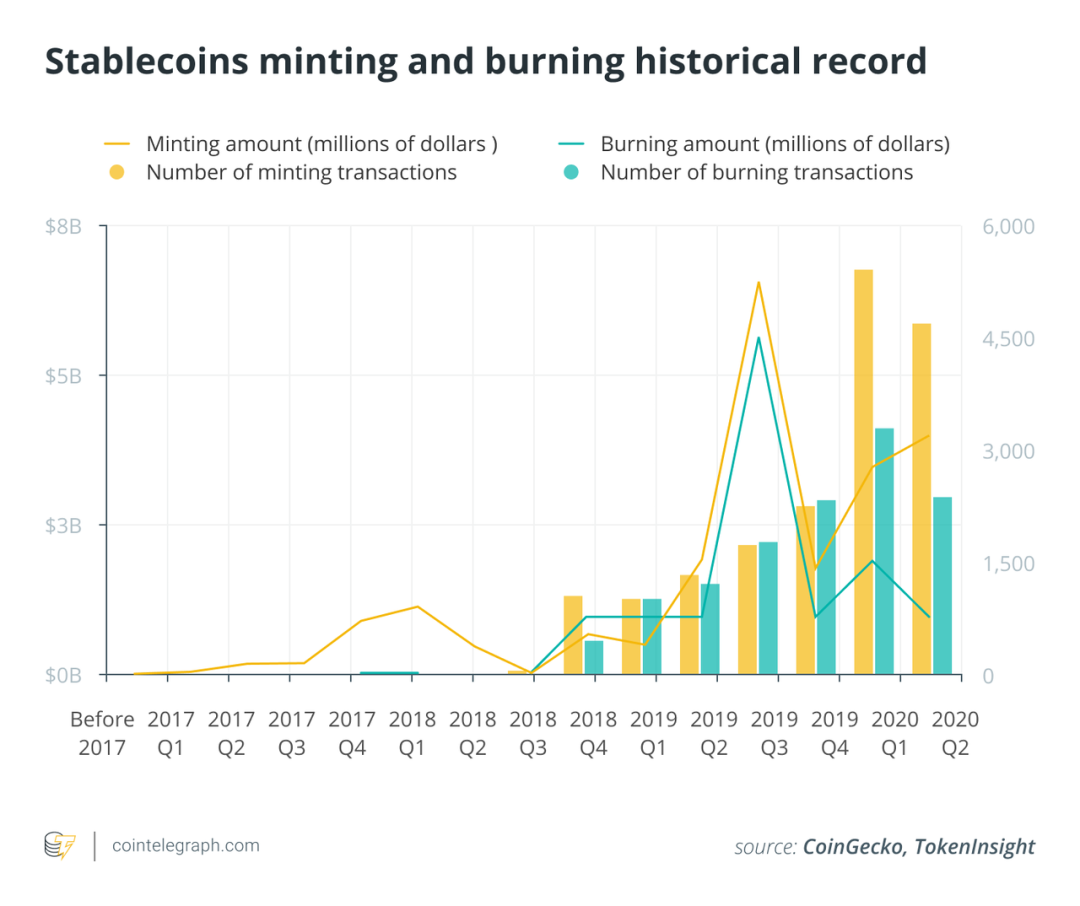

During the most volatile period, March 2020, the volume of minting and burning activity peaked, as did the dollar value of newly issued tokens.

In terms of flaring activity, nearly 5,600 flaring events have been reported in 2020, with a combined value of more than $3 billion.

Check quarterly minting and burning records since early 2017. The dollar value minted and burned was at an all-time high in Q3 2019, and the number of minted and burned activity was at an all-time high in Q1 2020.

Based on these figures, if the trend continues, the amount of minting and burning activity in Q2 2020 will be at least on par with Q1 2020.

One of the most attractive features of stablecoins, though, is that they can make payment transactions as easy as communicating on social media. Payment is not just about transferring money, it becomes an essential social experience that connects people. Stablecoins present an opportunity to better integrate us into our digital lives, and there are already companies designing many user-centric features. Large tech companies with large global user bases can provide ready-made networks that allow this new payment service to spread quickly.

It should be noted that stablecoins also have many risks. Therefore, policy makers must create an environment that maximizes benefits and minimizes risks. In addition, policy makers in different countries and different cross-functional departments in the same country need to innovate and collaborate with each other.

Although stablecoins face many challenges, they also have great potential for development, so policymakers need to be "smart" and develop a regulatory system that can meet the challenges and have a vision.

Stablecoins have a future. Stablecoins are digital assets that bring something of value to the market, and a standardized stablecoin may emerge.

But the future of stablecoins is not the future of cryptocurrencies. The risks of stablecoins are the same as those of holding banknotes in traditional bank accounts. Stablecoins talk about your ideals are nonsense.

Only true cryptocurrencies, and the evolution of the blockchain distributed ledger technology that runs them, will change the world we see today.