DeFi Science Popularization: Compound protocol, a short-term lending market without intermediaries

Currently, the cryptocurrency market is in an embarrassing situation of stagnation, but the demand for mortgage lending continues to increase. Bloomberg Financial Information Company reported that with the stagnation of the cryptocurrency market, many people began to pay attention to the cryptocurrency mortgage lending market. In 2018, roughly $215 million was lent in crypto assets like ETH, DAI, and REP in crypto-backed loans, according to Blockboard Research.

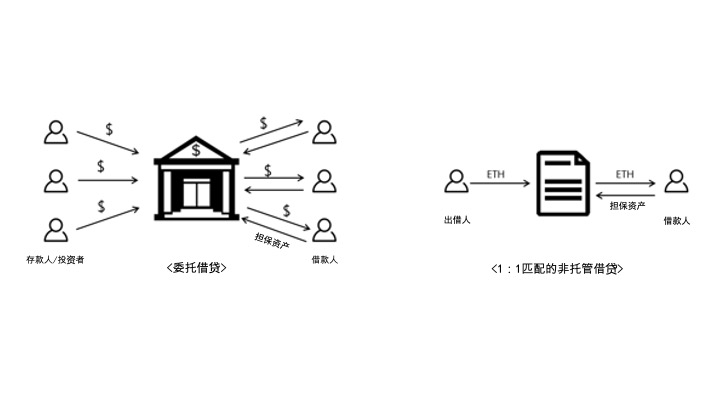

Cryptocurrency collateralized lending is a lending method in which the borrower uses cryptocurrency as collateral to borrow fiat currency (such as USD) or other cryptocurrencies. There are two ways of custodial (custody) lending and non-custodial (non-custody) lending in cryptocurrency collateral. Escrow lending is done through centralized traditional financial institutions, whereas non-custodial lending is done from decentralized lending protocols. Non-custodial lending does not require the intervention of intermediaries, and its advantages such as low intermediary fees and low risks have attracted the favor of many investors.

text

text

text

text

secondary title

Problems in P2P Escrow Lending

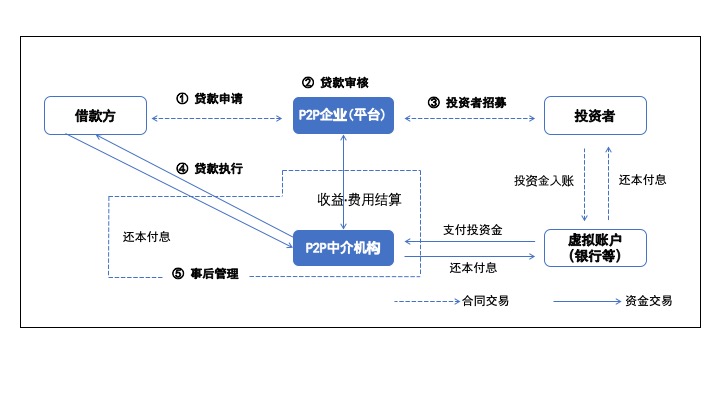

P2P loan business structure Source: Financial Supervisory Service

In recent years, problems with P2P lending companies have emerged one after another. For example, in some P2P platforms, many investors have suffered losses due to lenders posting false information. For example, a P2P lending company released false news without providing guarantees, causing many investors to suffer property losses (reference: a P2P company was sued for alleged fraud)

As shown above, what exactly is wrong with the current P2P lending structure?

Synthetix allows users to generate any asset (including currency, gold, stocks, etc.) through the system's own native token SNX as collateral. A great advantage of this is that there is no need to introduce these off-chain assets (including currency, gold, and stocks) into the chain, but only need to process these synthetic assets. From this perspective, MakerDAO is actually a synthetic An asset protocol where ETH is the underlying collateral and DAI is the generated synthetic dollar.

1) Opacity/Lack of Transparency

This problem exists when there are fake loans between P2P lending companies and borrowers, or when borrowers cannot recover their principal due to bad credit and false collateral assessments.

2) Counterparty Risk (Counterparty Ris)

Investments and collateral managed by the P2P lending company's fiduciary management can be misappropriated, and it is difficult for investors to get their assets back when the P2P lending company voluntarily shuts down its business.

Of course, not all P2P lending platforms have the above-mentioned problems, but when it comes to choosing lenders and asset custody, investors have no choice but to choose to trust intermediaries (P2P lenders).

secondary title

Non-custodial 1:1 cryptocurrency asset mortgage and liquidity issues

1) Custodial Loan VS Non-custodial Loan

To sum up, P2P lending has a form of escrow collateral. In other words, intermediaries are entrusted by individuals to choose and determine borrowers, loan interest, and collateral to manage funds. The intermediary intervening in the loan contract between the two parties can make it easier for individual investors to manage their funds, but the cost of trust in the intermediary structure is extremely high. Trust costs arise when the borrower does not provide collateral or principal, or when the lender remits funds to the borrower in advance, and when such transactions between the lender and the borrower are unreliable.

Instead, non-custodial lending is possible on the blockchain. This is because the management and delivery of loans and mortgage assets can be realized through smart contracts (codes), and transaction details will be recorded in immutable public ledgers, which allows individuals to proceed safely even without intermediaries (trustees). trade.

The way to make a loan through a smart contract is as follows. For example, a 30-day mortgage loan contract is signed between two users through a smart contract, and the lender deposits the loan amount into the smart contract in advance, so that when the borrower's collateral assets that meet the terms of the contract are deposited into the smart contract, the loan will be automatically transferred to the borrower. In addition, if the borrower deposits the principal and interest in the smart contract and repays the loan within the 30-day deadline, the collateral in the smart contract can be retrieved. This eliminates the need for intermediaries responsible for managing loans and collateral on the blockchain.

2) Pros and cons of non-custodial staking

2) Pros and cons of non-custodial staking

The advantage of non-custodial mortgage is that it omits the intervention of intermediaries, and can realize its low risk and low intermediary fees. Of course, there are still some problems, such as lenders need to find borrowers who meet their conditions among the loan requests on the order book, and most of the current encrypted asset lending only supports ERC20 encrypted currency assets, etc.

Among them, the "liquidity problem" is also the main disadvantage of non-custodial lending. The custodial collateral system used by traditional financial institutions has a liquidity pool (liquidity pool), which is composed of funds from multiple people (investors or depositors). Thus, financial institutions are able to process loan contracts under various conditions through the funds collected in the liquidity pool. However, in the non-custodial lending system that matches borrowers and investors 1:1, it is difficult to sign a loan contract until they find a borrower and investor that meet the loan requirements.

secondary title

A Feasible Solution to Liquidity Problems: Compound Protocol

The Compound protocol attempts to solve the liquidity problem through the money market fund (MMF) system. The Compound protocol has its own liquidity pool like existing financial entrustment institutions, the difference is that individuals can manage their assets in the liquidity pool. Users of the Compound protocol can query their balance through Etherscan, and users can manage assets in the protocol through their private keys and public chain addresses.

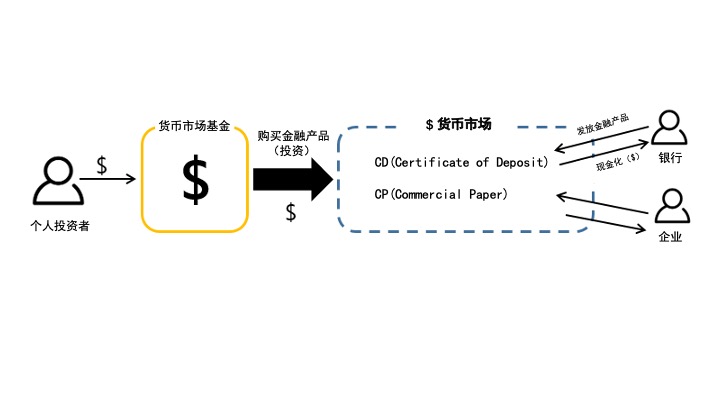

1) What is a money market?

The money market refers to the short-term financial asset trading market with a maturity of less than one year. The market is mainly for banks, securities companies and enterprises with good credit to temporarily issue short-term securities, which can not only meet the short-term funding needs of borrowers, but also ensure the liquidity of financial assets. The money market can obtain sufficient liquidity from money market funds (MMF). Funds are funds raised for investment, and MMFs are funds raised for investment in short-term financial products issued in the money market. Therefore, the more money a money market fund raises, the better its liquidity in the money market.

The money market refers to the short-term financial asset trading market with a maturity of less than one year. The market is mainly for banks, securities companies and enterprises with good credit to temporarily issue short-term securities, which can not only meet the short-term funding needs of borrowers, but also ensure the liquidity of financial assets. The money market can obtain sufficient liquidity from money market funds (MMF). Funds are funds raised for investment, and MMFs are funds raised for investment in short-term financial products issued in the money market. Therefore, the more money a money market fund raises, the better its liquidity in the money market.

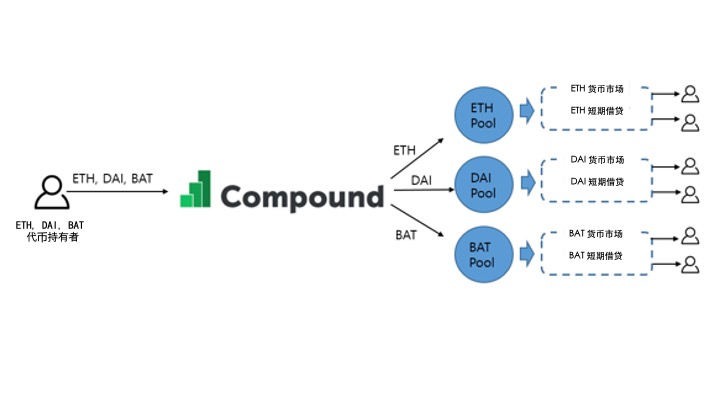

2) What is the currency market of the Compound protocol?

The Compound protocol, like the existing currency market, aims to establish a currency market that can provide short-term loans whenever encrypted assets are needed. The protocol seeks to address the liquidity problem in the short-term lending market (money market) by establishing a money market fund for the money market. Unlike money markets that are limited to one national currency, the Compound protocol handles various types of crypto assets. Therefore, the Compound protocol needs to establish a liquidity pool for the currency market of a specific encrypted asset and fully maintain it to ensure the normal operation of each currency market.

The Compound protocol, like the existing currency market, aims to establish a currency market that can provide short-term loans whenever encrypted assets are needed. The protocol seeks to address the liquidity problem in the short-term lending market (money market) by establishing a money market fund for the money market. Unlike money markets that are limited to one national currency, the Compound protocol handles various types of crypto assets. Therefore, the Compound protocol needs to establish a liquidity pool for the currency market of a specific encrypted asset and fully maintain it to ensure the normal operation of each currency market.

3) The operation mode and advantages of the Compound protocol currency market

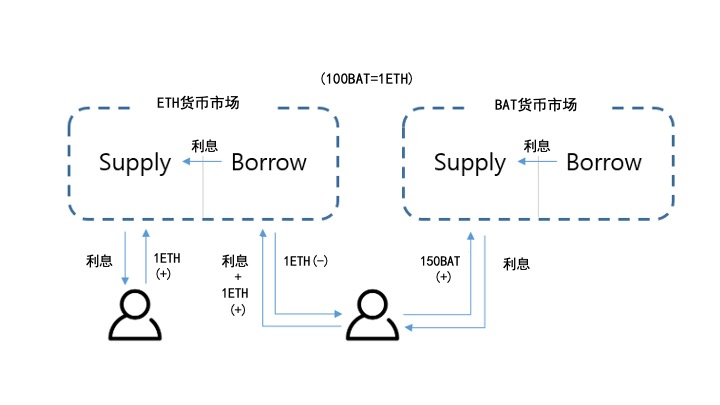

When individuals or institutions entrust crypto assets to the Compound protocol's money market, the protocol provides collateral for borrowers. The borrower provides 1.5 times more cryptocurrency than the total value of the loan asset, and then the required cryptocurrency can be borrowed. In the Compound protocol, the interest generated by lending is distributed to users who entrust encrypted assets to the money market, and the loan interest paid by the borrower is accumulated and continues to be used as collateral in the money market.

When individuals or institutions entrust crypto assets to the Compound protocol's money market, the protocol provides collateral for borrowers. The borrower provides 1.5 times more cryptocurrency than the total value of the loan asset, and then the required cryptocurrency can be borrowed. In the Compound protocol, the interest generated by lending is distributed to users who entrust encrypted assets to the money market, and the loan interest paid by the borrower is accumulated and continues to be used as collateral in the money market.

For example, if the exchange rate between ETH and BAT is 150, a user who wants to borrow 1ETH can provide 150BAT to the BAT currency market of the Compound protocol and borrow 1ETH from the ETH currency market. Individuals receive accumulated debt interest from the ETH money market, while deposit interest accumulates in the BAT money market that provides BAT.

In this way, users using the Compound protocol can experience some advantages that are not available in 1:1 matching lending.

Always provide interest: Individuals who provide assets to the Compound protocol money market accumulate interest at 1/2102300 of the annual rate provided by the money market within each Ethereum block interval (15 seconds).

Eliminate friction in lending contracts: In the Compound protocol money market, lending rates are determined automatically by an algorithm. Likewise, any cryptoasset can be borrowed if the total value of cryptoassets provided by the user as collateral on the Compound protocol exceeds 1.5 times the borrowed amount, so there is no need to negotiate or negotiate with investors.

No minimum payment: Unlike 1:1 matching loans where borrowers must borrow a specific amount, Compound users have the flexibility to provide crypto assets to the money market as needed.

Deposit and withdraw: In 1:1 matching lending, it is difficult for investors to get their funds back until the borrower repays the loan. Instead, Compound users can deposit and withdraw assets from money market liquidity pools at any time.

4) Compound protocol liquidity adjustment mechanism

Even though Compound money markets can respond to short-term lending needs faster than 1:1 matched non-custodial lending, there may still be liquidity shortages.

When do potential liquidity problems in currency markets arise?

- When the demand for loans is significantly higher than the funds available in the money market

- When the user often does not repay the loan, or when it is difficult to recover the principal through the collateral due to bankruptcy

The Compound protocol uses two mechanisms to regulate liquidity shortages in money markets:

a) Alignment of money market liquidity through an algorithm-based interest rate model

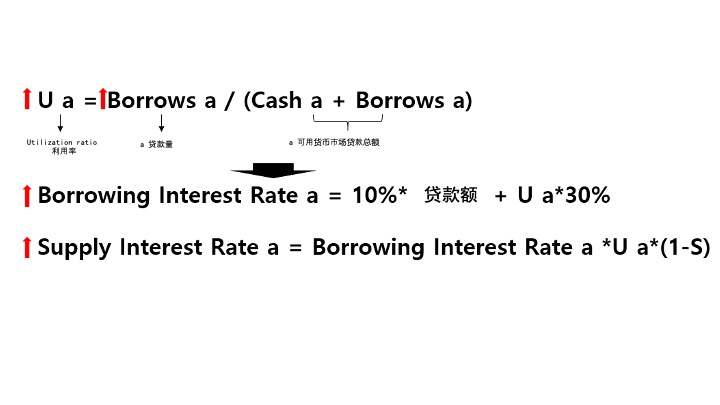

The Compound protocol adjusts the interest rate by using the Utilization ratio to match the supply and demand of encrypted assets in the money market. The Utilization Ratio is "Total Loan Balance (Total Debt Balance / Total Available Credit)" divided by "Total Loan Amount (Lenders)". These utilization ratios indicate how much the market can fund for loans. For example, a high utilization rate means that few loans will be available in the future because more loans have been executed than are available in the money market.

The Compound protocol adjusts the interest rate by using the Utilization ratio to match the supply and demand of encrypted assets in the money market. The Utilization Ratio is "Total Loan Balance (Total Debt Balance / Total Available Credit)" divided by "Total Loan Amount (Lenders)". These utilization ratios indicate how much the market can fund for loans. For example, a high utilization rate means that few loans will be available in the future because more loans have been executed than are available in the money market.

Therefore, when utilization increases, lending and deposit rates also increase. In this way, the interest burden on the borrower increases, which may speed up loan repayments or reduce the need for additional loans. On the contrary, it can provide more crypto assets, because this is an opportunity to increase the profit of the asset provider. In summary, the Compound protocol can prevent illiquidity by adjusting interest rates in the money market.

For reference, "S (spread)" in the deposit rate formula is a commission rate adopted by the Compound protocol. The S value is usually 10 to 15%. The commission will continue to accrue and be used in the future when the borrower defaults on the loan and a liquidity crisis hits.

b) Prevent Collateral Bankruptcy by Liquidating Collateral

The Compound protocol attempts to prevent the loss of principal due to the bankruptcy of collateral by liquidating account collateral that does not meet the minimum collateralization rate.

Collateralization ratio refers to the ratio of collateral price to loan amount. For example, the protocol requires a minimum collateralization rate of 150%, and users wishing to borrow 100ETH from the Compound money market must provide at least 150ETH worth of other crypto assets as collateral. The reason why the Compound protocol requires more collateral than borrowed assets is to allow the lender to recover the principal by liquidating (selling) the collateral even if the borrower cannot repay the principal.

So how to check mortgage ratio? In the Compound protocol, oracles are used to manage current prices and exchange rates for secured and loaned assets. Oracles get price information from the top 10 exchanges to determine the value of their assets. For example, if a user wants to borrow 2ETH as collateral for BAT tokens, since Oracle currently has 1 BAT (0.2$) and 1 ETH (150$), the user must provide 1.5 times (450$) of the loan amount (300$). $), that is, 2,250BAT as collateral.

A decrease in the value of the mortgaged asset or an increase in the value of the loaned asset may result in the loss of the collateral, and even if the collateral is liquidated, it is difficult to recover its principal. Therefore, in the Compound protocol, we want to quickly identify accounts whose collateral value does not meet the minimum mortgage rate to prevent mortgage bankruptcy. To do this, the Compound protocol checks its "account liquidity" every time. Account liquidity is the total assets provided by users to the Compound protocol minus the loan amount multiplied by the mortgage rate (1.5).

Account Liquidity = Total Supply Assets - Total Borrowing Amount * Mortgage Rate

An account liquidity of 0 means that the assets provided by the user are exactly at the minimum collateralization rate. Therefore, accounts with account liquidity deficits (negative) do not meet the minimum collateralization ratio, so they must post additional collateral or repay the amount borrowed by liquidating the collateral currently provided.

end

end

So far, some features of the Compound protocol have been roughly explained. The Compound protocol tries to apply the money market system to censorship-resistant cryptocurrencies to solve the liquidity problem, but the Compound protocol still has the following limitations.

1) High reliance on the Compound Foundation

It is especially important to determine the exchange rate between the mortgaged asset and the borrowed asset in the loan and to liquidate the mortgaged asset. However, these are all decided by the Compound Foundation. Additionally, the Compound Foundation can decide which currency markets to stop (Compound's goal is to decentralize all processes)

2) Does not provide all types of crypto asset loans

Currently, the Compound protocol only supports money markets for a handful of crypto assets. Therefore, users can only borrow and receive interest on the encrypted assets supported by the Compound protocol, and the encrypted assets that can provide collateral are limited to the encrypted assets supported by the platform.

3) Money market deposit rate may be 0

One of the advantages of the Compound protocol is the continuous provision of interest. On the other hand, if the demand for loans in the money market is small compared to the supply, then the interest rate on deposits in the money market may be zero.

Can the Compound protocol replace the traditional bank lending system? The main users of the Compound protocol are only those who own crypto assets or aim to go short/long with crypto loans. But what is certain is that crypto-backed loans are undoubtedly one of the forces changing the way lending is done in the future, and there is still a long way to go before incumbent banks and credit card companies switch to a cryptocurrency-based financial system. This is because the knowledge and understanding of cryptocurrencies, laws and regulations and their uses must be improved from the current level.

Compound protocol, a blockchain-based financial application, can gradually increase people's financing channels, such as improving financial transaction processes, etc. The future of financial systems grafted to blockchain technology is worth looking forward to.

Author: Lucia Kim

Original link:

Original link:https://medium.com/