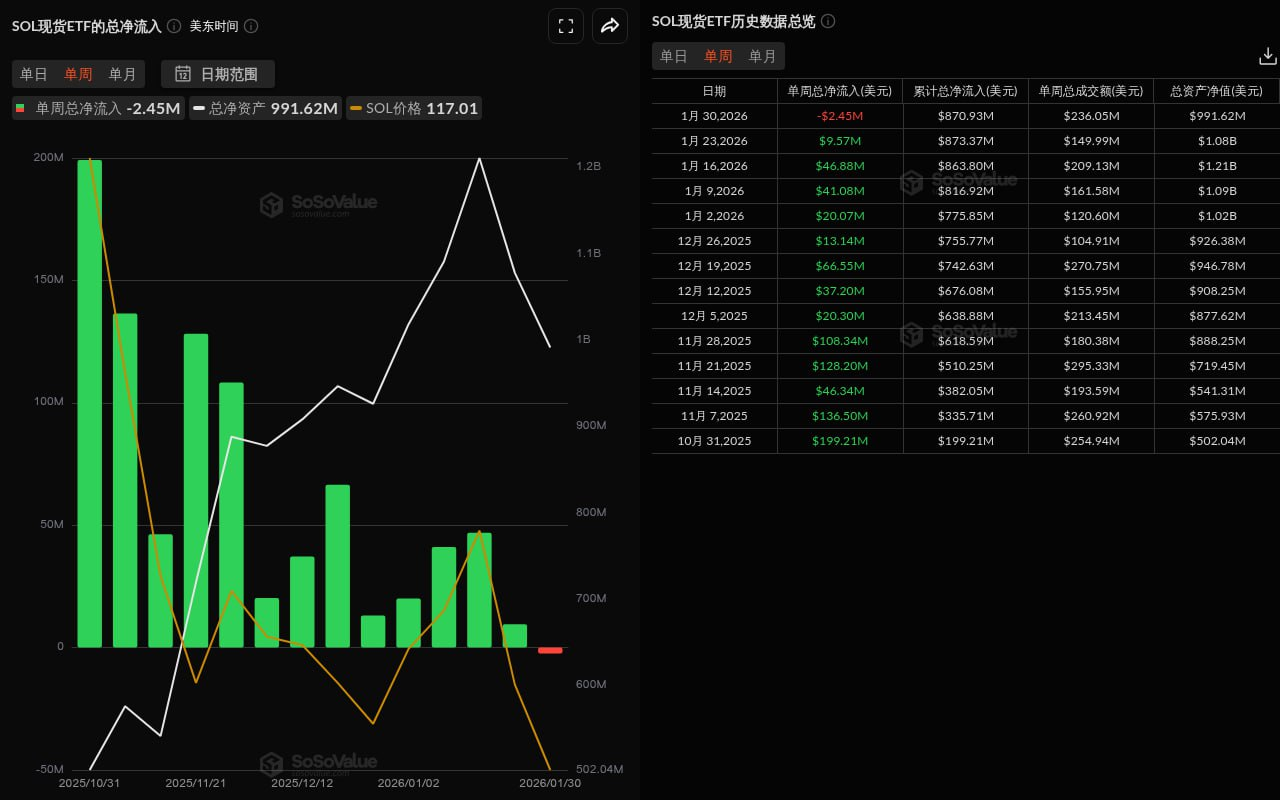

SOL Spot ETFs See Net Outflow of $2.45 Million This Week

Odaily News According to data from SoSoValue, during this week's trading days (January 26 to January 30, Eastern Time), SOL spot ETFs experienced a net outflow of $2.45 million.

The SOL spot ETF with the largest net outflow this week was the Grayscale SOL Trust (GSOL), with a weekly net outflow of $5.492 million. The historical total net inflow for GSOL currently stands at $114 million. This was followed by the Bitwise ETF (BSOL), with a weekly net outflow of $3.5821 million. The historical total net inflow for BSOL currently stands at $678 million.

The SOL spot ETF with the largest net inflow this week was the Fidelity ETF (FSOL), with a weekly net inflow of $5.1398 million. The historical total net inflow for FSOL currently stands at $153 million.

As of the time of writing, the total net asset value of SOL spot ETFs is $992 million. The ETF net asset ratio (the proportion of ETF market value to SOL's total market value) has reached 1.50%, and the historical cumulative net inflow has reached $871 million.