Matrixport: Options No Longer Dominate Price Movements, Market Positions Shift to Caution

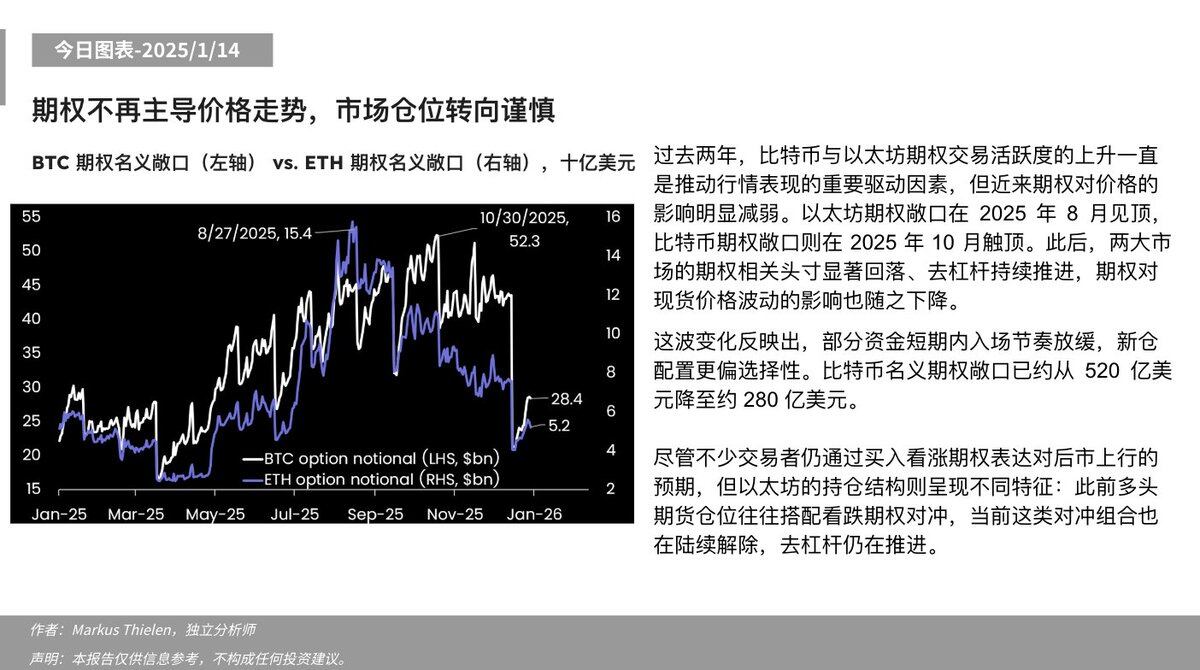

Odaily News Matrixport released a chart today stating that over the past two years, the increased activity in Bitcoin and Ethereum options trading has been a significant driver of market performance. However, the influence of options on prices has noticeably weakened recently. Ethereum options exposure peaked in August 2025, while Bitcoin options exposure reached its peak in October 2025. Since then, options-related positions in both major markets have significantly declined, deleveraging has continued to progress, and the impact of options on spot price volatility has consequently diminished.

This wave of changes reflects that some capital has slowed its entry pace in the short term, and new position allocations have become more selective. Bitcoin's notional options exposure has decreased from approximately $52 billion to around $28 billion.

Although many traders still express expectations for future upward movement by buying call options, Ethereum's position structure shows different characteristics: previously, long futures positions were often paired with put options for hedging. Currently, such hedging combinations are also being unwound one after another, and deleveraging is still underway.