Matrixport: Implicit liquidity risks are rising in the crypto market; market capitalization is increasing but trading volume is not keeping pace.

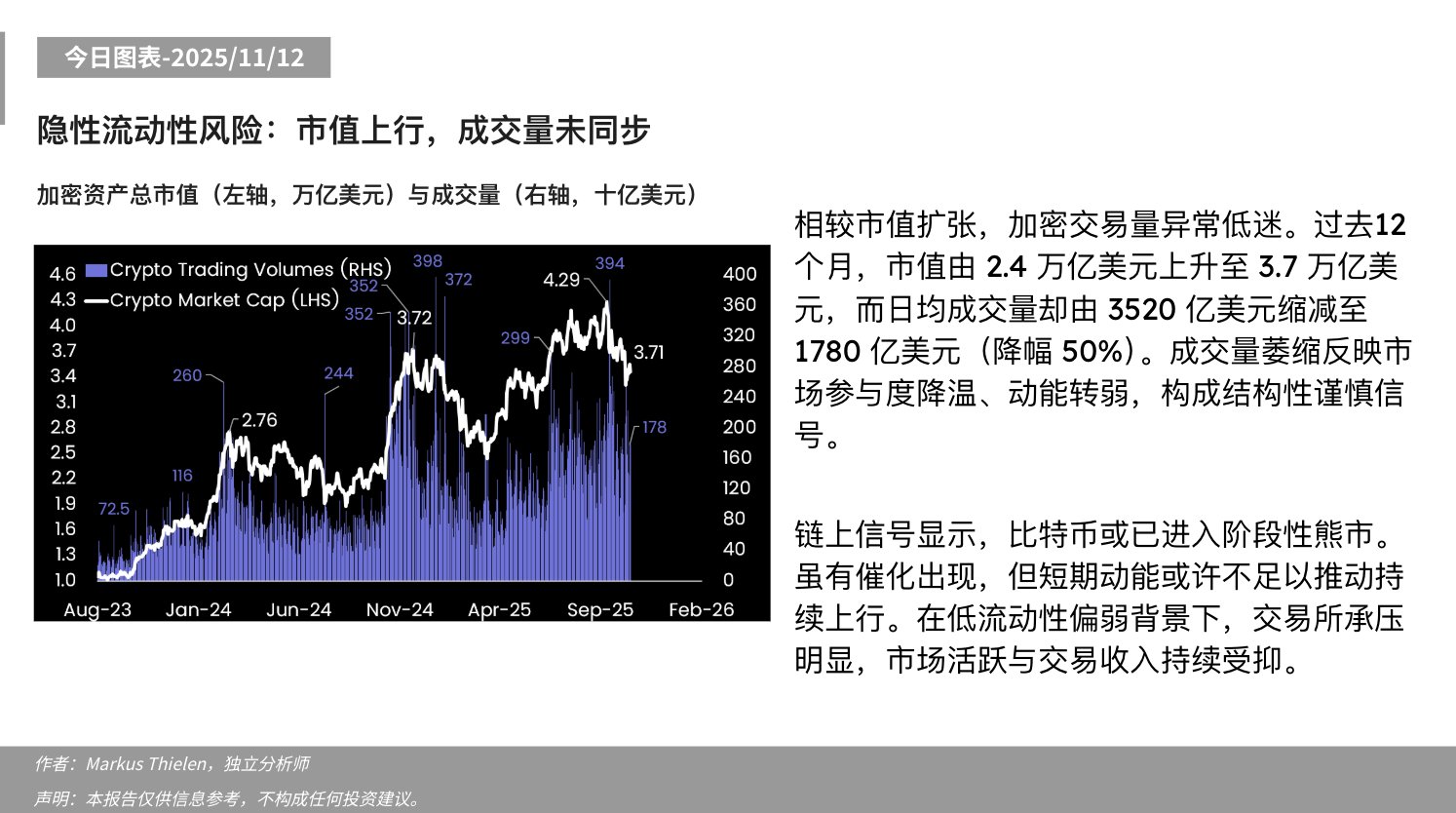

According to a recent research chart released by Matrixport, as reported by Odaily Planet Daily, while the total market capitalization of crypto assets has increased from $2.4 trillion to $3.7 trillion over the past 12 months, market trading volume has shrunk from $352 billion to $178 billion, a decrease of approximately 50%. This indicates a structural cooling of the market and a relative lack of liquidity.

The report argues that the shrinking trading volume reflects declining market participation and weakening momentum, serving as a potential signal of caution. On-chain data also suggests that Bitcoin may have entered a phase of bear market. While long-term catalysts remain, short-term momentum is insufficient to support sustained price increases. In a low-liquidity environment, increased pressure on exchanges and continued pressure on market activity and trading revenue are likely to persist.