Matrixport: Market momentum has weakened, and Bitcoin is expected to enter a consolidation phase in August

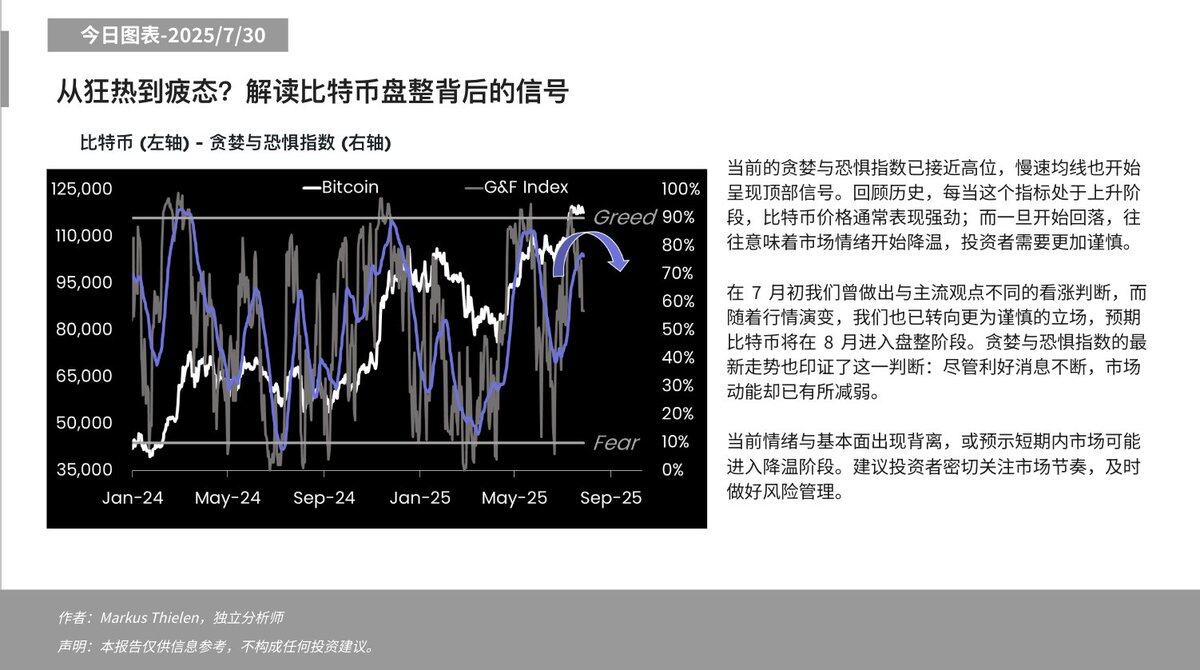

According to Odaily Planet Daily, Matrixport released a chart today stating that the current Greed and Fear Index is nearing a high, and the slow moving average is also beginning to show a topping signal. Historically, whenever this indicator is rising, Bitcoin prices typically perform strongly; however, a decline often signals a cooling of market sentiment and calls for greater investor caution.

In early July, we made a bullish call that went against the prevailing view. However, as the market has evolved, we have shifted to a more cautious stance, predicting that Bitcoin will enter a period of consolidation in August. The latest trend of the Greed & Fear Index also confirms this view: despite the continuous positive news, market momentum has weakened.

The current divergence between sentiment and fundamentals may indicate that the market may enter a cooling phase in the short term. Investors are advised to closely monitor market trends and implement timely risk management.