Original | Odaily Planet Daily ( @OdailyChina )

Author | Ethan ( @ethanzhang_web 3)

RWA Sector Market Performance

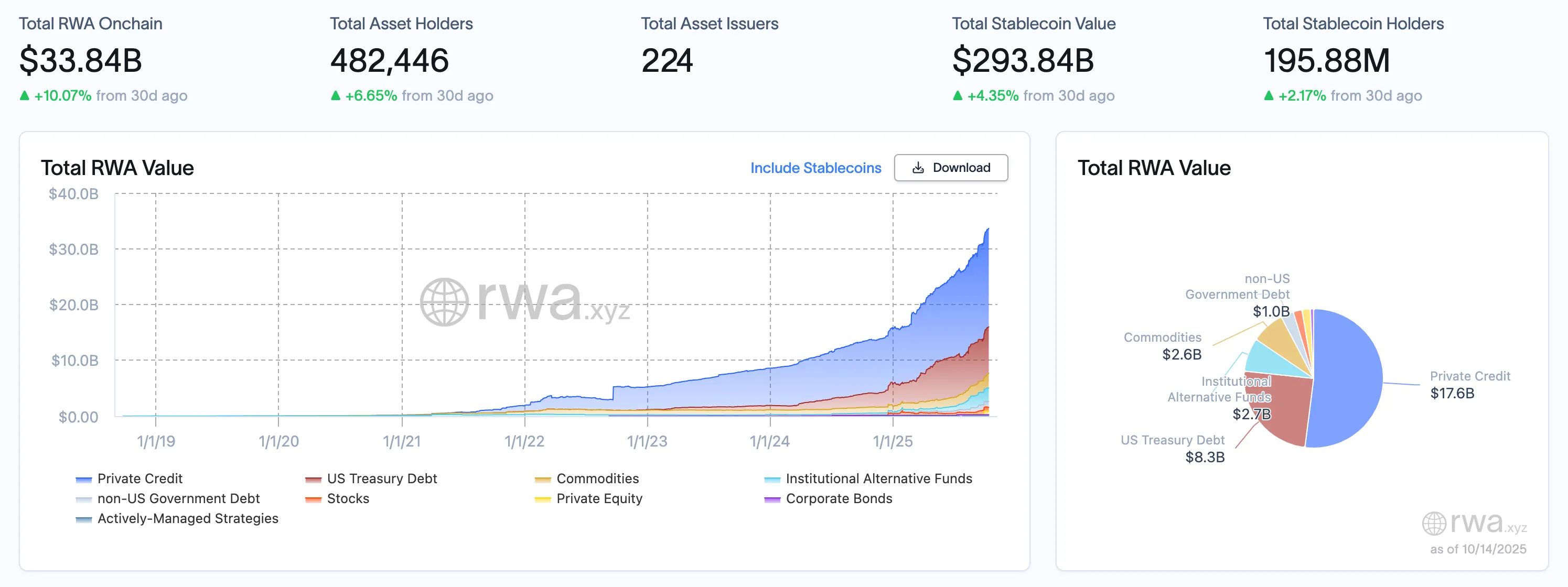

As of October 14, 2025, the total value of RWA on-chain reached $33.84 billion, an increase of $170 million, or 0.51%, from $33.67 billion on October 10. While the growth rate slowed compared to the previous week, it remained on an upward trajectory. The total number of asset holders increased from 422,820 to 482,446, a net weekly increase of 59,626, a 14.1% increase and the largest weekly user growth in recent months. The number of asset issuers remained unchanged at 224, with the pace of project expansion remaining stable. In the stablecoin market, the total market capitalization fell from $318.36 billion to $293.84 billion, a $24.52 billion drop, or 7.7%, marking the first decline in nearly a month. The number of stablecoin holders increased from 195.38 million to 195.88 million, an increase of approximately 500,000, or 0.26%.

In terms of asset structure, private credit saw a $100 million increase this week, from $17.5 billion to $17.6 billion, a 0.57% increase, maintaining its market capitalization share above 50%. U.S. Treasuries saw a slight decline, from $8.4 billion to $8.3 billion, a $100 million decrease, or 1.19%. This may be due to rising secondary market interest rates, leading to some short-term capital withdrawals. Commodity assets continued to grow, rising from $2.5 billion to $2.6 billion, a 4% increase, indicating that market sentiment towards real asset allocations has not weakened. Institutional alternative funds saw a 3.85% increase, from $2.6 billion to $2.7 billion, indicating continued institutional interest in diversified non-standard assets. Other sectors, such as non-U.S. government debt, remained at $1 billion. Smaller sectors like corporate bonds and equities accounted for relatively small proportions and showed no significant changes.

What are the trends (compared to last week )?

Overall, the RWA market this cycle exhibits the characteristics of a new phase characterized by "market capitalization consolidation combined with explosive user growth." On the one hand, market capitalization saw a slight but slowing increase, primarily driven by commodity assets and alternative funds. On the other hand, the significant increase in user numbers, nearly 60,000, was a major highlight of the week, likely related to the launch of new products and incentive mechanisms by some platforms. The decline in stablecoin market capitalization is likely related to short-term liquidity adjustments and cross-platform transfers, and has had no substantial impact on the RWA main market.

Key market concerns include: first, whether the stablecoin market capitalization can stabilize, which will determine the strength of on-chain funding; and second, whether user growth is sustainable and can drive a synergistic increase in the protocol layer's TVL. Overall, the RWA market is in a phase of "user-driven growth + gradual structural expansion" and still has strong momentum.

Review of key events

The White House is close to announcing its nominee for the new chairman of the U.S. Commodity Futures Trading Commission (CFTC), with Mike Selig, chief legal counsel for the SEC's crypto task force, currently the most likely successor.

Sources indicate that Selig remains the administration's preferred choice, and the White House has begun reviewing potential commissioners to rebuild the five-member commission, currently led by Acting Chair Caroline Pham. The nomination is seen as a crucial milestone in the crypto regulatory landscape, coming as Congress moves forward with the Market Structure Act, which would expand the CFTC's oversight of the crypto market.

Selig, currently a senior advisor to SEC Chairman Paul Atkins, previously served as an associate commissioner at the CFTC and spent ten years in the digital assets group at Perkins Coie and Willkie Farr & Gallagher.

Coingecko data shows that as spot silver broke through $53/ounce to set a new record high, the market value of the tokenized silver sector has exceeded $200 million, currently at $206,065,942, up 5.6% in the past 24 hours.

(Note: Tokenized silver refers to the digital representation of physical silver on a blockchain platform)

European Commission: Existing cryptocurrency rules already address stablecoin risks

The European Commission said on Friday that European cryptocurrency rules are sufficient to address stablecoin risks and saw no need for major adjustments after the European Central Bank called for more safeguards. Europe already has landmark cryptocurrency-specific regulations, but lawmakers in Brussels are under pressure from the European Central Bank to block the "multi-issuance" stablecoin model. At issue is whether multinational stablecoin companies can treat tokens issued within the EU as fungible with tokens held outside the bloc. On Tuesday, six cryptocurrency industry associations, including Circle, wrote to the European Commission calling for guidance to confirm the multi-issuance model and clarify how it operates under the Markets in Crypto Assets Directive (MiCA). A European Commission spokesperson said MiCA provides a strong and proportionate framework for addressing stablecoin risks and that clarification is being provided as soon as possible.

Ethena Labs: USDtb smart contracts have been transferred to Anchorage Digital

According to official news, USDtb's smart contracts have officially migrated to Anchorage Digital today. This migration marks the completion of the stablecoin's "localization" compliance process, making it a compliant stablecoin issued under the US federal regulatory framework under the GENIUS Act.

Kenya passes virtual asset bill, plans to build Africa's crypto finance portal

The Kenyan Parliament has passed the Virtual Asset Service Providers Bill, which aims to establish a regulatory framework for the digital asset industry, attract investment and regulate market transactions.

The bill authorizes the Central Bank of Kenya to license the issuance of stablecoins and other virtual assets, while also placing the capital markets regulator in charge of licensing crypto exchanges and platforms. The government hopes to attract investment from international platforms like Binance and Coinbase, establishing Kenya as Africa's gateway to crypto finance.

Circle: No plans to issue a Hong Kong dollar-denominated stablecoin, but open to collaboration

Circle, the issuer of USDC, said that professional investors in Hong Kong can still use USDC under the existing framework without additional regulation. Circle has no plans to issue a Hong Kong dollar-denominated stablecoin and is currently focusing on the US dollar stablecoin USDC and the euro stablecoin EURC.

Chen Qinqi also pointed out that Circle remains open to cooperation related to the Hong Kong dollar stablecoin, has started negotiations with a number of institutions, and looks forward to the launch of the Hong Kong dollar and other stablecoins in the Hong Kong market in the future.

Hot Project Dynamics

Plume Network (PLUME)

One sentence introduction:

Plume Network is a modular, Layer 1 blockchain platform focused on tokenizing real-world assets (RWAs). It aims to transform traditional assets (such as real estate, art, and equity) into digital assets through blockchain technology, lowering investment barriers and increasing asset liquidity. Plume provides a customizable framework that supports developers in building RWA-based decentralized applications (dApps) and integrates DeFi with traditional finance through its ecosystem. Plume Network emphasizes compliance and security, and is committed to providing solutions that bridge traditional finance and the crypto economy for institutional and retail investors.

Recent Updates:

On October 8th, Plume announced the acquisition of Dinero, an institutional-grade staking protocol on Ethereum . This acquisition will integrate ETH, SOL, and BTC staking functionality into the Plume ecosystem, enabling institutions and DeFi users to earn returns and manage tokenized assets on the same platform.

Plume Network previously received approval from the U.S. Securities and Exchange Commission (SEC) to become a registered transfer agent . As a registered transfer agent, Plume will now manage digital securities and shareholder records directly on-chain, supporting interoperability with the Depository Trust & Clearing Corporation (DTCC) settlement network. Furthermore, it will facilitate a range of use cases, including on-chain IPOs, small-cap financings, and registered funds. Following the news of Plume Network's SEC approval as a registered transfer agent , PLUME surpassed 0.13 USDT, a 35% increase over the past 24 hours.

MyStonks (STONKS)

One sentence introduction:

MyStonks is a community-driven DeFi platform focused on tokenizing and trading Reliable Warrants (RWAs) such as US stocks on-chain. Through a partnership with Fidelity, the platform offers 1:1 physical custody and token issuance. Users can mint stock tokens like AAPL.M and MSFT.M using stablecoins like USDC, USDT, and USD 1, and trade them 24/7 on the Base blockchain. All trading, minting, and redemption processes are executed by smart contracts, ensuring transparency, security, and auditability. MyStonks is committed to bridging the gap between TradFi and DeFi, providing users with highly liquid, low-barrier-to-entry on-chain investment in US stocks, and building the "NASDAQ of the crypto world."

Previous news:

On September 16th, the MyStonks platform officially launched Hong Kong stock futures trading . Users can trade directly with USDT/USDC using their wallets, with up to 20x leverage. The new contracts cover a number of high-quality Hong Kong stocks, including Guotai Junan International ( 1788.HK ), BYD Co., Ltd. ( 1211.HK ), Xiaomi Group ( 1810.HK ), Mixue Group ( 2097.HK ), Meituan ( 3690.HK ), Tencent Holdings ( 700.HK ), Pop Mart ( 9992.HK ), JD.com ( 9618.HK ), and SMIC ( 981.HK ). These stocks span multiple industries, including technology, automotive, retail, internet, and semiconductors, meeting users' diverse asset allocation needs.

On September 25th, the MyStonks platform announced a brand upgrade , officially changing its domain name to msx.com , marking its entry into a new era of global fintech. The announcement stated that this upgrade not only simplifies access and facilitates user connectivity, but also demonstrates the company's transformation from a meme-based platform to a professional international financial brand, demonstrating its commitment to digital financial innovation and global expansion. The msx.com team stated that it will continue to prioritize users, drive technological innovation, and enhance the security and efficiency of digital financial services.

Related links

Sort out the latest insights and market data for the RWA sector.

Crazy RWAs going to Hong Kong: Financing or "Momentum Integration"?

According to an incomplete review by a reporter from the First Financial Daily, from 2024 to the present, 13 institutions or companies have successfully carried out RWA, including Longxin Group, Xunying Group, Hua Xia Fund, and Pacific Insurance. The underlying assets include funds, bonds, physical gold, real estate mortgage loans, agricultural products, etc., and technical partners include Ant Digital Technology, OSL, and HashKey.

Web 3 and digital finance concepts are becoming more mainstream.

- 核心观点:RWA市场呈现用户爆发式增长态势。

- 关键要素:

- RWA用户单周净增近6万人。

- 链上总价值达338.4亿美元。

- 私人信贷占比超50%持续主导。

- 市场影响:推动传统资产上链加速发展。

- 时效性标注:中期影响