Doug Colkitt, founder of Ambient Finance

Compiled by Odaily Planet Daily ( @OdailyChina ); Translated by Azuma ( @azuma_eth )

Editor's note: On October 11, the cryptocurrency market experienced an epic crash (see " 1011 Horror Night: Crypto Market Plummets Instantly, $20 Billion Wiped Out " for details).

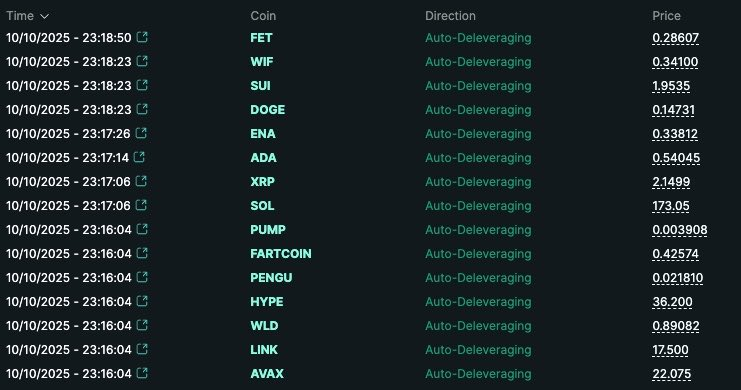

Although the market has shown signs of recovery, discussions surrounding large-scale liquidations and various perpetual contract exchanges have not cooled down, especially after Hyperliquid confirmed that the protocol had implemented the "auto-deleveraging" (ADL) mechanism for the first time since its two-year operation. ADL quickly became the focus of market discussion.

What exactly is ADL? Why are my profitable trades being automatically reduced or even closed? Doug Colkitt, founder of Ambient Finance, recently provided a simple and detailed explanation of this mechanism on his personal account. The following is Doug Colkitt's original article, translated by Odaily.

During the big drop the day before yesterday, many people woke up to find that their perpetual contract positions had been forcibly liquidated, and wondered, "What exactly is the automatic deleveraging mechanism (ADL)?"

Here's a concise yet comprehensive explanation of the mechanism. What is ADL? How does it work? Why does it exist?

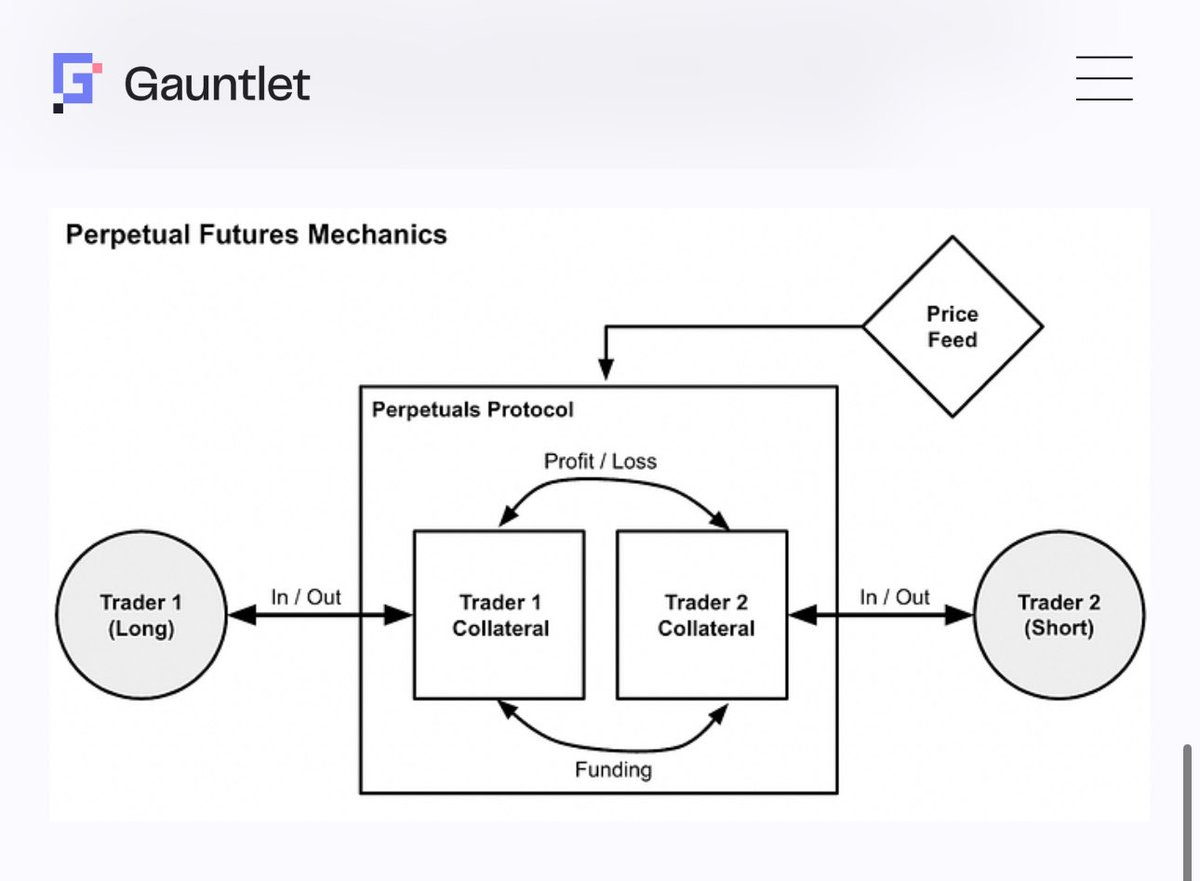

First, we need to take a step back and think from a more macro perspective - what exactly is the perpetual contract market and what does it essentially do?

For example, when you see a perpetual contract market for BTC, there is actually no real BTC in the market, only a lot of idle cash in the system.

What the perpetual swap market (or derivatives market more broadly) does is essentially redistribute a pile of cash between participants. It moves this pile of cash back and forth between participants using a specific set of rules, and in this way constructs a synthetic asset that "looks like BTC", even though no real BTC actually exists in this system.

The most important rule is that there must be both long and short positions in the market, and the total long position must be perfectly balanced with the total short position —otherwise the entire system will not work. Both long and short positions deposit cash into the pool as margin, which is then redistributed based on the rise and fall of the BTC price.

During this process, if the BTC price fluctuates too much, some participants may lose all their cash. At that moment, they will be kicked out of the system - the so-called "margin call".

Remember, longs can only make money if shorts lose money, and vice versa, so when one party has no more money to lose, they can no longer stay at the table.

Furthermore, every short position must be precisely offset by a solvent long position. If a long position in the system no longer has funds to lose, then by definition, the corresponding short position no longer has funds to profit. And vice versa.

Therefore, when a long position experiences a margin call, one of two things must happen to the system:

- 1. A new long position appears in the system, adding new cash to the fund pool;

- Second, the corresponding short position in the system is closed, thereby restoring the entire market to a state of equilibrium.

Ideally, this would all happen smoothly through normal market mechanisms. As long as willing buyers can be found at a reasonable price, no one would need to be forced to take action. During a typical margin call, the system would simply execute using the same order book as a regular perpetual contract.

In a healthy and liquid perpetual swap market, this process is perfectly fine. When a long position is liquidated, its position is sold into the order book and taken by the highest bidder in the market. This bid then becomes the new long position in the system, adding new cash to the liquidity pool. The market is thus rebalanced, and everyone involved achieves their desired outcome—all is well, and everyone is happy.

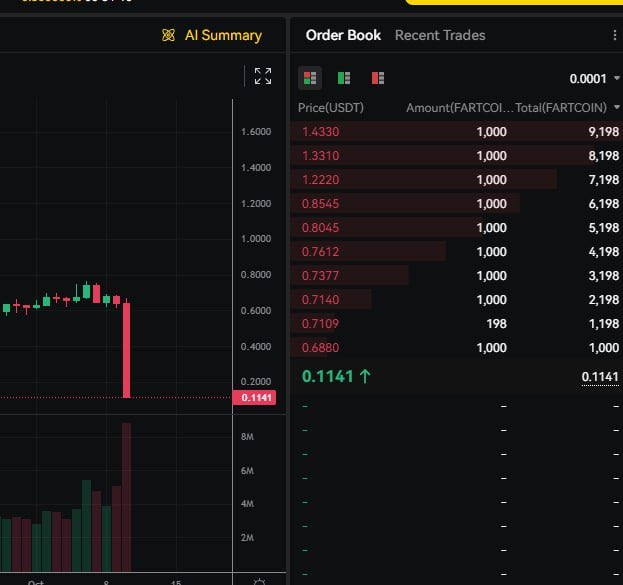

But sometimes, the market isn't liquid enough. Or at least, the order book isn't deep enough to close out a position without exceeding the remaining funds in the original position . This becomes a problem because it means there's not enough cash in the pool to cover everyone's profit and loss.

Typically in this situation, the system enters the next level of the "waterfall model"—a "vault" or "insurance fund" steps in. This vault is often a special pool of funds supported by an exchange that steps in and assumes the counterparty's position of forced liquidation in the event of an extreme liquidity event.

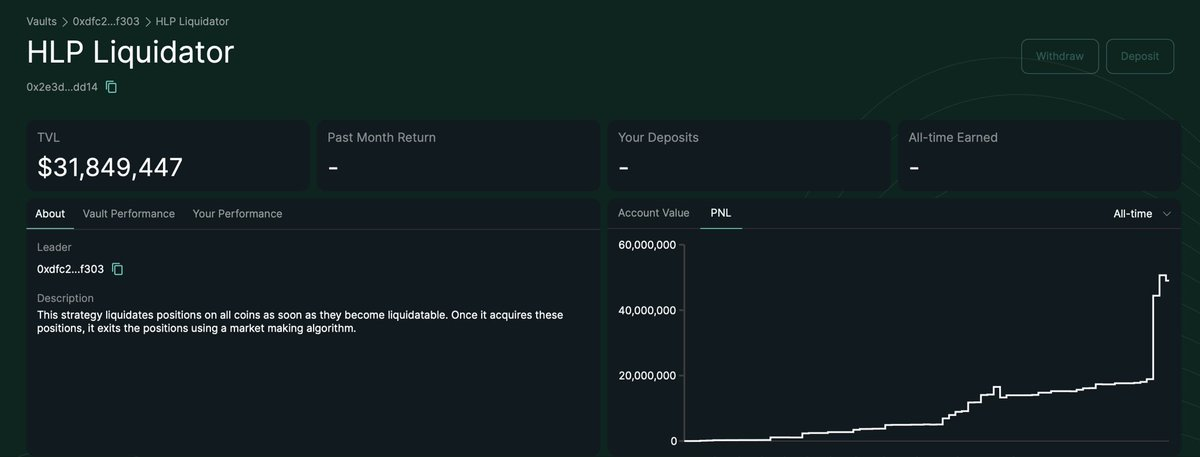

Typically, vaults are quite profitable in the long run because they can buy at deep discounts and sell during periods of high volatility, profiting from the spread during extreme market fluctuations. For example, Hyperliquid's vault generated approximately $40 million in profits in just one hour during tonight's market.

But it's important to understand that the vault isn't magic; it's just another participant in the system. Like any other trader, it must place cash into the pool, abide by the same market rules, and operate only within its limited risk tolerance and capital. Therefore, this mechanism must have one final step.

The ADL is the final step. It's the final line of defense in the waterfall model and is often considered a "last resort" because it doesn't involve market matching, but rather forces some traders to liquidate and exit their positions. It occurs so infrequently that even experienced perpetual swap traders often have little or no intuition about it.

You can think of ADL like an overbooked flight. The airline will first address the overbooking issue through market-based methods—they'll continually increase the compensation in the hope that passengers will be willing to rebook to a later flight. But if no one is willing to give up their seats, the airline will eventually be forced to remove some passengers from the plane.

In the perpetual contract market, the situation is similar. If the long positions have run out of funds and no new funds are willing to enter the market to take over their positions, the system has no choice but to force some short positions to "get off the plane" - that is, to close their positions in order to restore the balance of the entire system.

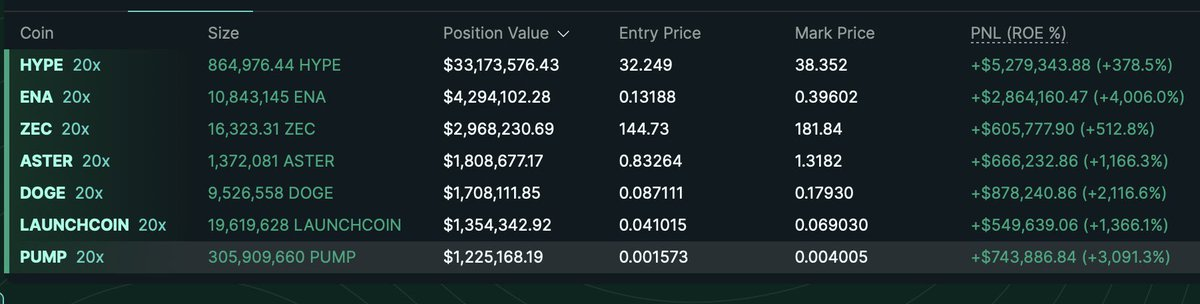

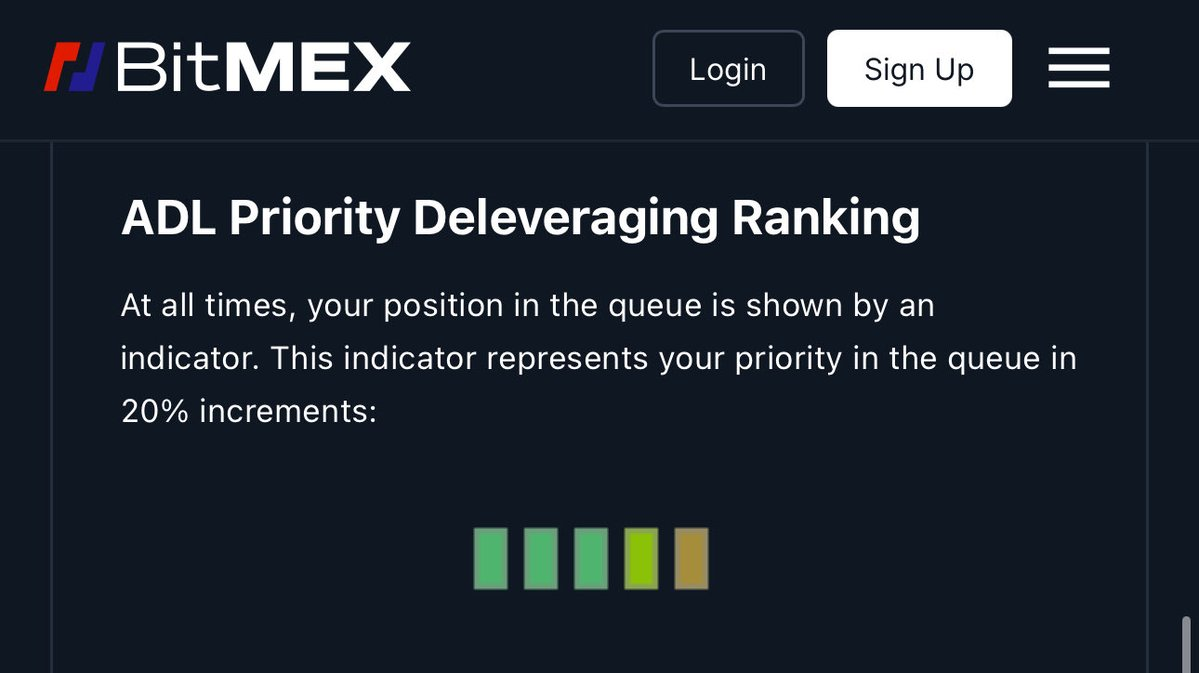

The selection of positions and the price at which these forced liquidations are executed vary considerably between exchanges. Generally speaking, the ADL system selects positions to be liquidated from those with the greatest likelihood of winning, with the specific ranking typically based on three criteria:

- Profit (profit) — the more profitable the position, the higher it is in the front;

- Leverage — the higher the leverage, the closer it is to the front;

- Position size (size) - the larger the position, the higher it is.

In other words, the "big players" who earn the most, have the largest positions, and have the highest leverage will be the first to be forced to close their positions by the system.

Naturally, people often resent ADL because it does seem unfair—you're the one winning the most and performing the best, yet you're forced out of the market. However, this mechanism must exist to some degree. No matter how good an exchange's system is, it can't guarantee an infinite number of "losers" in the market to satisfy the profits of the winners.

Think of it like playing Texas Hold'em. You go into a casino and win at table after table. Once you've destroyed one table, you move on to the next, and the next—and eventually, everyone else in the casino has lost everything. That's the essence of ADL.

The true beauty of the perpetual swap market is that it's a zero-sum system, meaning the entire system can never go bankrupt. There's no actual Bitcoin to depreciate, just a pile of cash that's constantly being redistributed. Just like the conservation of energy in thermodynamics, in this closed system, value can neither be created nor destroyed.

In some ways, ADL resembles the ending of The Truman Show. The perpetual contract market constructs an incredibly realistic and sophisticated simulation of the spot market, but ultimately, it's all virtual. Most of the time, we don't need to be aware of this "fiction." But occasionally, when the market reaches its limits, we hit the "edge of the simulation."

- 核心观点:ADL是永续合约市场极端情况下的强制平衡机制。

- 关键要素:

- 当流动性枯竭且保险基金不足时触发。

- 强制平仓盈利最高、杠杆最大的仓位。

- 确保零和系统在多空失衡时维持运作。

- 市场影响:增强对衍生品市场风险机制的理解。

- 时效性标注:长期影响