Original | Odaily Planet Daily (@OdailyChina)

Author|Azuma (@azuma_eth)

On the afternoon of September 8th (Beijing time), Nasdaq-listed Forward Industries (NASDAQ: FORD) officially announced that it has secured $1.65 billion in cash and stablecoin commitments to launch its SOL-centric digital asset treasury strategy through a PIPE transaction (Private Equity Offering). The financing was led by Galaxy Digital (NASDAQ: GLXY), Jump Crypto, and Multicoin Capital, with participation from C/M Capital Partners, one of the company's largest existing shareholders.

On the afternoon of September 8th (Beijing time), Nasdaq-listed Forward Industries (NASDAQ: FORD) officially announced that it has secured $1.65 billion in cash and stablecoin commitments to launch its SOL-centric digital asset treasury strategy through a PIPE transaction (Private Equity Offering). The financing was led by Galaxy Digital (NASDAQ: GLXY), Jump Crypto, and Multicoin Capital, with participation from C/M Capital Partners, one of the company's largest existing shareholders.

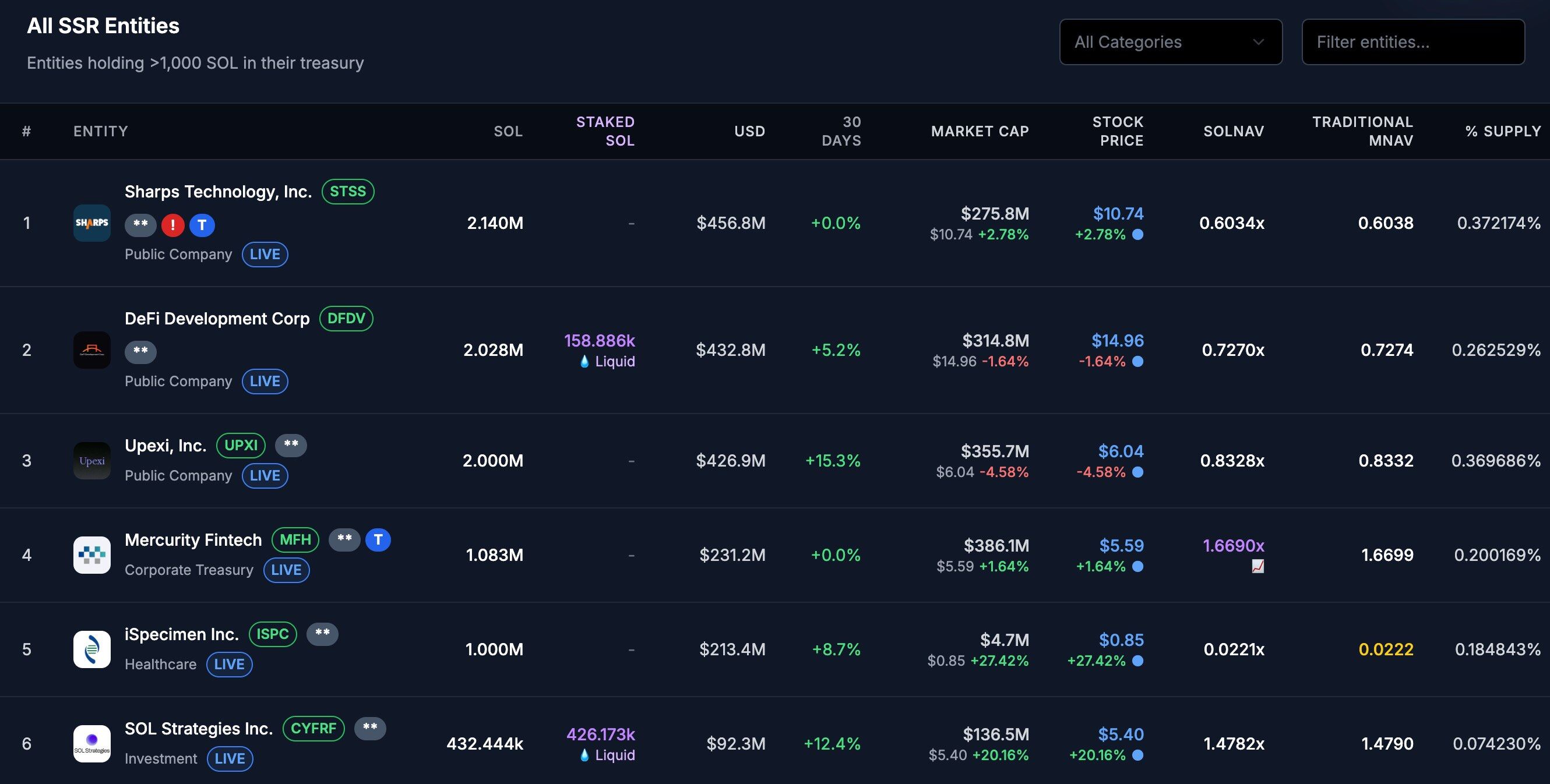

Strategic SOL Reserve data shows that among the current SOL treasury companies, the largest holdings are Sharps Technology (STSS), DeFi Development Corp (DFDV), and Upexi (UPXI), with holdings of 2.14 million SOL (US$457 million), 2.03 million SOL (US$433 million), and 2 million SOL (US$427 million), respectively. Based on this calculation, if Forward Industries continues to buy quickly, it will quickly become the largest SOL treasury with a holding of US$1.65 billion.

In its funding announcement, Forward Industries stated that Galaxy, Jump Crypto, and Multicoin will provide both financial and strategic support to help Forward Industries design and execute its Solana treasury strategy, with the goal of becoming a leading, publicly listed institutional participant in the Solana ecosystem. Leveraging these investors' resources, Forward Industries will strive to achieve differentiated on-chain returns within the Solana ecosystem and create long-term value for shareholders through active participation in its development.

As the three leading investors in this round of financing, Galaxy, Jump Crypto and Multicoin all play a vital role in the Solana ecosystem, and can even be regarded as the institutions with the strongest voice in Solana at present.

- Galaxy : Currently one of the largest validators in the Solana ecosystem, Galaxy operates a mature, institutional-grade digital asset service system. Galaxy will provide Forward Industries with trading, lending, structuring, staking, and blockchain infrastructure services. Galaxy will also actively manage Forward Industries' treasury strategy using its comprehensive suite of products and risk management systems.

- Jump Crypto : We are committed to building and maintaining the core infrastructure that supports Solana's growth. We are currently developing Firedancer, Solana's next-generation, high-performance client, designed to improve the throughput, resilience, and efficiency of the Solana network. We are also a core engineering and network contributor to key infrastructure projects such as DoubleZero and Shelby.

- Multicoin : Founded in 2017, Multicoin is a top-tier VC firm focused on long-term, high-conviction investments. An early seed investor in Solana, Multicoin led the first three funding rounds before Solana's 2018 launch and has invested in over 25 projects within the Solana ecosystem.

Following the completion of this financing, Multicoin co-founder and managing partner Kyle Samani is expected to assume the role of Chairman of Forward Industries' Board . Given Kyle Samani's years of frequent theoretical reflections and narrative visions on industry development, and his strong personal charisma and influence across the cryptocurrency landscape, he is expected to become a leading voice in the Solana ecosystem, similar to Tom Lee (Chairman of BitMine, the largest treasury company in Ethereum).

This positive news has significantly boosted the price of SOL in the short term, reaching 215.3 USDT at the time of writing, a 5.87% increase over the past 24 hours. Looking ahead, as Forward Industries officially begins purchasing reserves, the price of SOL is expected to continue to see strong buying support for a period of time.

- 核心观点:Forward Industries获16.5亿美元启动SOL财库。

- 关键要素:

- Galaxy、Jump Crypto、Multicoin领投并提供战略支持。

- 财库规模将超现有最大SOL持仓公司。

- Multicoin创始人Kyle Samani将任董事会主席。

- 市场影响:为SOL提供长期买盘支撑,提振生态。

- 时效性标注:中期影响。