Original | Odaily Planet Daily ( @OdailyChina )

By Wenser ( @wenser 2010 )

Benefiting from the pre-market launch and launch of XPL and WLFI, as well as market volatility, Hyperliquid achieved $106 million in revenue in August, a 23% month-over-month increase. Monthly contract trading volume approached $400 billion, with DEX Perp commanding approximately 70% of the market share. As a leading cryptocurrency in the industry, Hyperliquid's flagship "high-performance L1 public chain" concept has created immense potential for its stablecoin offerings.

On September 5th, Hyperliquid officially announced that the protocol's reserved stablecoin, USDH, would be released through an on-chain validator voting process. The voting process, conducted entirely on Hyperliquid L1, was similar to the delisting vote. The selected team would then participate in a regular spot deployment gas auction. Officials stated that USDH, a highly demanded regulated symbol, would be used to build a compliant, Hyperliquid-first native stablecoin . Following the announcement, major stablecoin issuers offered their own USDH issuance plans. In this article, Odaily Planet Daily will briefly analyze the various plans for Hyperliquid's native stablecoin, USDH, and the battle among the issuers behind it.

USDH becomes a hotbed for stablecoin issuers, with giants like Paxos and Agora entering the market.

On September 5, Hyperliquid officially released an announcement in the Discord community :

1. The spot market structure will be optimized in the next network upgrade. Taker fees, maker rebates, and user trading volume contributions for spot trades between two spot-quoted assets will be uniformly reduced by 80% to improve liquidity and reduce user friction.

2. The USDH stablecoin ticker currently reserved by the protocol will be released through a transparent on-chain validator vote. Voting will take place entirely on-chain via Hyperliquid L1 transactions, similar to how delisting votes work. Because USDH is a highly in-demand canonical token ticker, validators will vote to select the team most capable of building a locally minted, Hyperliquid-first stablecoin. Teams interested in using this ticker can submit a proposal in the new "usdh forum subchannel" and include the user addresses of a selected quorum of validators, which will be used to deploy USDH. Please note that approved teams must still participate in the usual spot deployment gas auction. Furthermore, officials emphasized: "The USDH ticker is a perfect fit for a Hyperliquid-first, Hyperliquid-consistent, and compliant USD stablecoin; after the next network upgrade, validators will be able to vote to allow user addresses to purchase the USDH stablecoin ticker."

3. For context, starting with the testnet, spot-quoted assets will become permissionless in the future. Staking requirements and slashing criteria will be announced later.

The official later added : "This vote is only for the USDH symbol. USDH will not receive any special privileges due to its symbolic nature. Hyperliquid's native financial primitives and universal programmability form a chain uniquely optimized for stablecoin issuance and payments. There will continue to be multiple stablecoins on the Hyperliquid blockchain, and new stablecoin teams will join the Hyperliquid ecosystem. USDH is just one of many stablecoins. As previously stated, pending technical implementation, becoming a quoted asset will become permissionless."

Regarding timing: proposals should be published before 10:00 UTC on September 10; validators should indicate who they will vote for before 10:00 UTC on September 11; validators should vote between 10:00-11:00 UTC on September 14 to allow users time to stake to a validator that matches their vote.

Voting is based on stake. Validators will vote by submitting the address corresponding to the team they support. Foundation validators will vote for the team with the most non-foundation votes based on validator commitments made on September 11th (weighted by stake on September 14th), effectively abstaining from voting.

Contestants: 3 major stablecoin issuers + 2 project parties show their talents

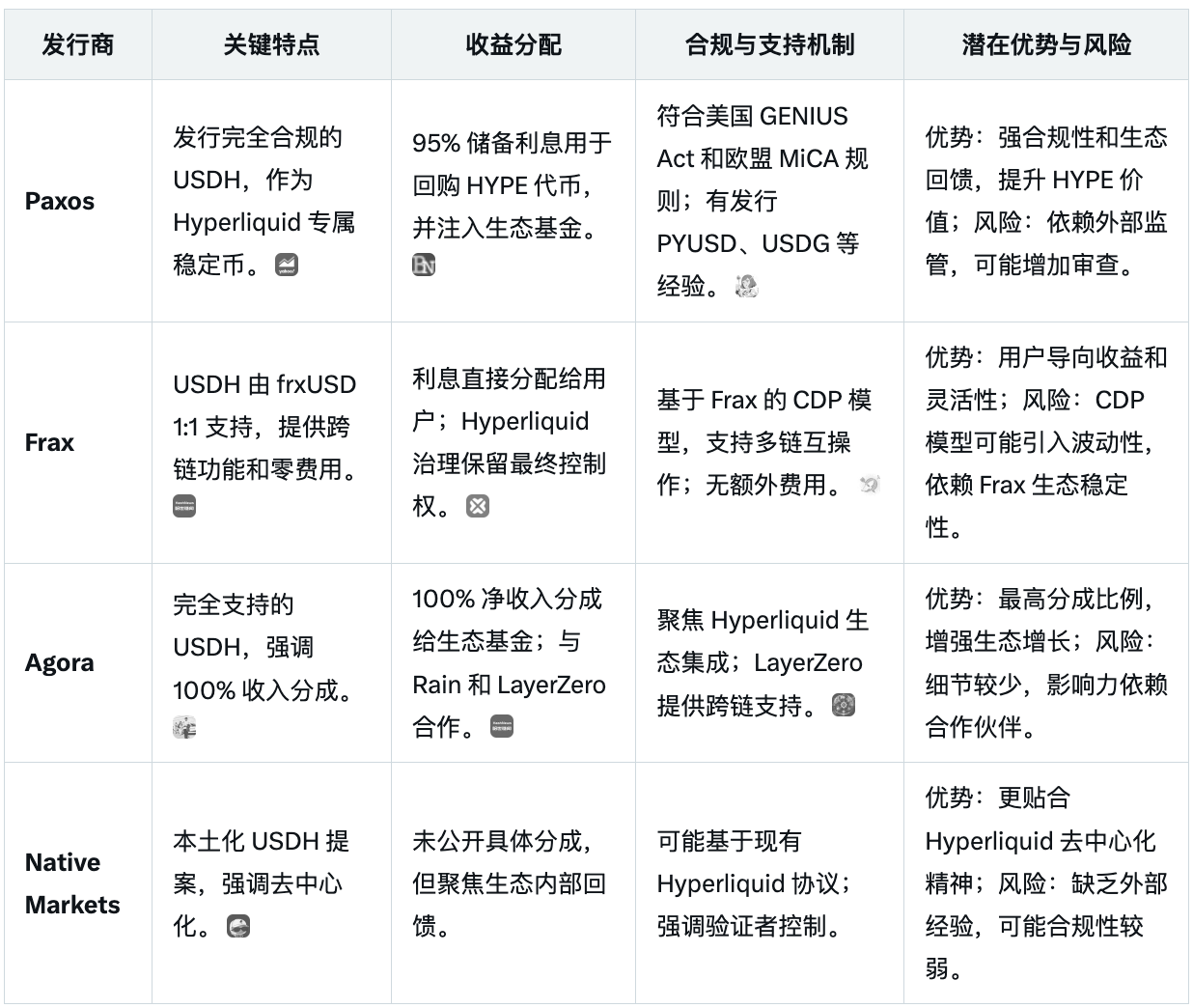

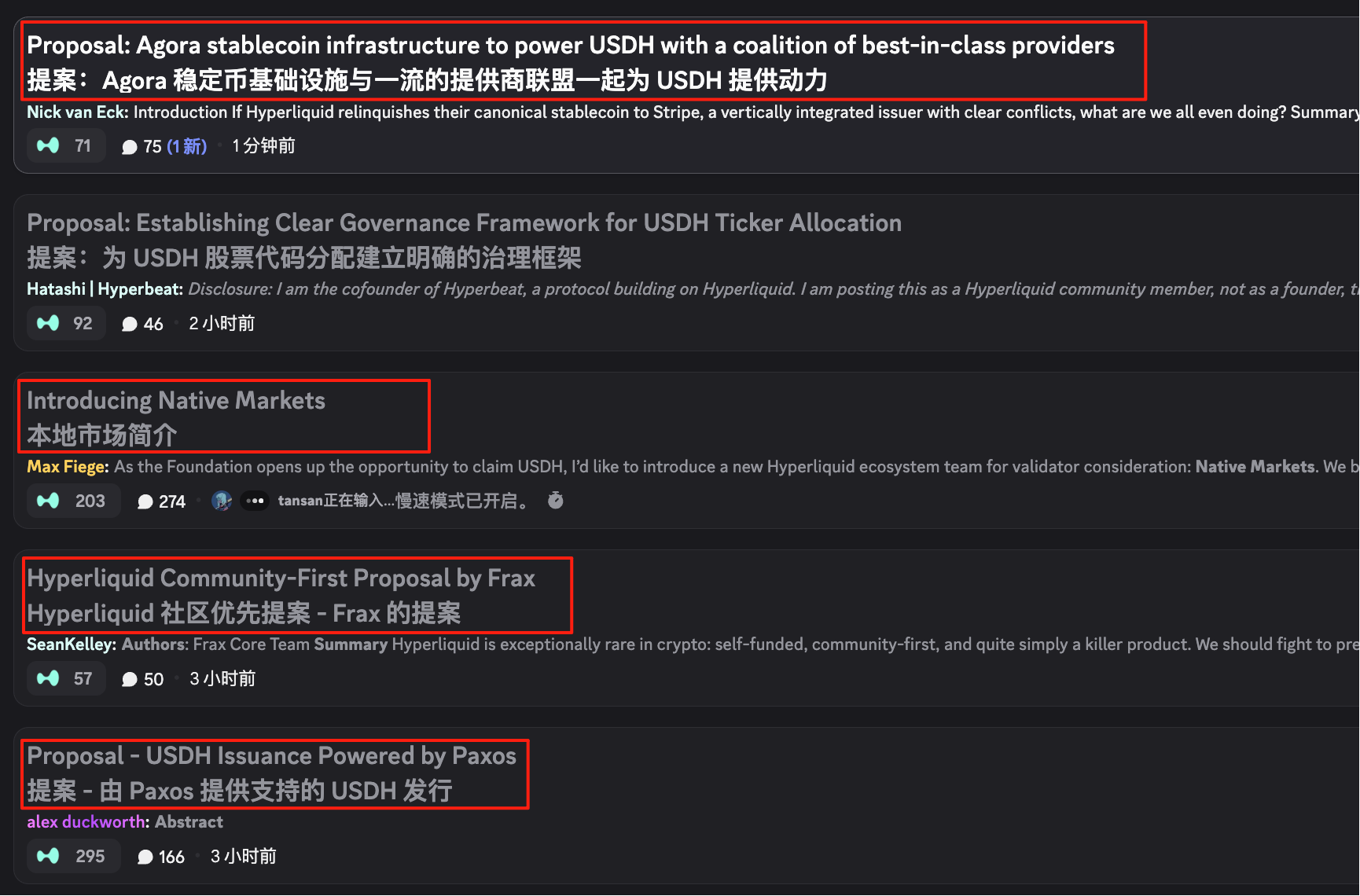

As of now, the USDH sub-channel of the Hyperliquid community has received five stablecoin issuance proposals. In addition to well-known stablecoin issuers such as Paxos, Agora, and Frax, Native Markets led by Max Fiege and the Konelia team have also put forward their own USDH issuance plans.

Based on the existing information, major stablecoin issuers have mature issuance plans and rich compliance experience, and the final winner may emerge from them.

In addition, each major publisher also briefly introduced their own advantages in the proposal:

- Paxos emphasized its compliance expertise and strong partnership network in global regions . According to Paxos Labs team members, Paxos has begun to establish partnerships in the Hyperliquid ecosystem to prepare for the successful deployment of USDH. Its initial partners include: FalconX, Looping Collective, HyperLend, Pendle, HybraSwap, Hyperswap, Neko, HypurrFi, DotHYPE, RubFi, Nunchi, etc.

- The Frax team emphasized its shared " decentralized vision " with Hyperliquid, stating: "Frax has designed, shipped, and operated billions of dollars worth of various stablecoins across various cycles with zero security incidents. Our advantage is strict incentive and mechanism design, and a strong track record. We are committed to decentralization and exceeding all unlocks for the long term, not for withdrawals, which is why USDH collateral yields will be repatriated at a 0% acceptance rate."

- Agora spokesperson Nick van Eck emphasized the company's backing from asset management giant VanEck and its partnerships with prominent platforms such as Rain, a credit card payment network with 2 billion users, interoperability infrastructure LayerZero, and EtherFi . He also emphasized Agora's neutrality as an issuer and took the opportunity to criticize Paxos, stating, "Agora does not have its own settlement network or brokerage business (Paxos, on the other hand, does)."

- Max Fiege's Native Markets emphasized its " local nature ," planning to "donate a substantial portion of its reserve income to the aid fund; USDH will be minted directly on the HyperEVM, with HyperCore transfers enabled on day one; and USDH will inherit the global compliance and issuance channels of issuer Bridge (a Stripe company)." Thanks to Max's deep involvement and reputation in the Hyperliquid community, the proposal received considerable support in the comment section.

- The stablecoin issuance plan proposed by the Konelia team was met with indifference and even ridicule from community members because it pinned its profits on the " automatic compounding yield of short-term US Treasury bonds " and emphasized the protection of MEV, which the Hyperliquid ecosystem currently does not attach importance to.

The following are the deployment addresses proposed by existing stablecoin issuers:

Paxos——0x999000B7c80550C5D3858a9C9505dd9A3654B339;

Frax——0x6e74053a3798e0fc9a9775f7995316b27f21c4d2;

Agora——0x8010f766AA84bB0Cc57e7C0bf13149cF9BC62b65;

Native Markets——0xc4bb9B6FdA3112B381Cb94f571bc72db541e7577;

Konelia - 0x274f2c145B413f76cD3ED52C05221ddAb0E582A1.

Since on-chain voting is not yet open, according to community proposal feedback, the corresponding proposals issued by stablecoin issuers Paxos and Max Fiege have relatively high support.

Hyperliquid Community USDH Sub-channel Page

It’s worth noting that Frax was previously criticized by Hyperliquid community members for its partnership with Luna’s algorithmic stablecoin UST, although it was later clarified that “the partnership was a four-token pool in Curve: USDC/USDT/UST/Frax pool, which were the top four stablecoins in the EVM at the time.”

Hyperliquid community members question Frax

Hyperliquid ecosystem projects have mixed attitudes: some are crying foul, while others are simply abstaining.

Regarding the USDH proposal vote, projects within the Hyperliquid ecosystem also expressed their own different attitudes:

The liquidity staking protocol Kinetiq officially announced that it will re-delegate all stakes to the Hyperliquid Foundation node from 12:00 PM EST on September 10th to 12:00 PM EST on September 15th to abstain from voting in this vote.

The Hyperliquid ecosystem over-collateralized stablecoin project Hyperstable team issued a statement saying that since the end of last year, it has planned to launch a decentralized and over-collateralized stablecoin supported by HYPE, HYPE LST, etc., but at that time all token names starting with USD were blacklisted, and USDH was also on this list. However, the sudden opening of USDH issuance this time highlights that many teams (such as Max Fiege) received the news in advance, which is extremely unfair. It is recommended that the USDH code name continue to be blacklisted.

USDH is about to go online, and Circle, the company behind USDC, is getting anxious.

The race for USDH issuance has yet to officially begin, but Circle, the company behind USDC, the only stablecoin in the Hyperliquid ecosystem, is already getting excited. Circle co-founder and CEO Jeremy Allaire warned against being misled by the hype . Circle will be a major participant and contributor in the Hyperliquid ecosystem. While it's exciting to see others buy into the new USD stablecoin code and compete, USDC, with its deep liquidity and near-instant cross-chain interoperability, is sure to be warmly welcomed by the market.

It's worth noting that Circle announced back in July that native USDC and CCTP V2 would be deployed on the Hyperliquid chain. However, over a month later, native USDC has yet to launch. The emergence of USDH has undoubtedly threatened Circle, and CEO Jeremy Allaire's response seems somewhat weak. Amusingly, Ethena Labs, the issuer of the stablecoin USDe , posted on the X platform today, hinting that it had sent a USDH proposal to Circle's CEO but received no response.

Stablecoin issuers are in a fierce battle to seize distribution and market share

As the US stablecoin regulatory bill "GENIUS Act" is about to be passed, the stablecoin track will usher in a new round of explosion, and the emergence of USDH provides a new piece of cake for major stablecoin issuers.

For the currently somewhat saturated stablecoin market, Hyperliquid, with its hundreds of thousands of high-frequency traders and hundreds of billions of yuan in monthly trading volume, will undoubtedly bring significant growth to the stablecoin market. This is why many issuers are vying for the right to deploy the USDH ticker symbol. BitMEX co-founder Arthur Hayes previously wrote that the key to a stablecoin's success lies in its distribution channels.

As Frax founder Sam Kazemian said , "For stablecoin issuers and infrastructure companies, the competition to submit proposals for the Hyperliquid stablecoin USDH isn't about revenue sharing; the real value lies in achieving interoperability and deep 1:1 integration with Hyperliquid's massive distribution platform. In fact, all the shortlisted proposals (Frax, Paxos, and Agora) have expressed their willingness to return 100% of their profits." (Odaily Planet Daily Note: Paxos' proposal is to use 95% of the interest generated by the USDH reserve to repurchase HYPE tokens and distribute them to users, validators, and partner protocols.)

If we use the retail industry as an analogy, Hyperliquid is equivalent to a beverage brand with its own retail channels, while Paxos, Agora, Frax, etc. are equivalent to beverage production factories. What they are competing for now is this huge retail channel network.

For the Hyperliquid community, the issue that most members are most concerned about is still how the issuance of USDH will serve the development of the Hyperliquid ecosystem, especially the allocation of corresponding income to HYPE token repurchases, and the previous activity of project team members in the Hyperliquid ecosystem and community.

It's worth noting that the issuance and application of USDH could generate up to $220 million in potential annual revenue for Hyperliquid. BitMEX co-founder Arthur Hayes predicts that the stablecoin market will reach $10 trillion by 2028. By then, driven by the growth of the native stablecoin USDH, the price growth of HYPE, the ecosystem token, is expected to continue.

At the end of the article, Odaily Planet Daily reminded HYPE pledge users to pay attention to the node voting statement to avoid missing the corresponding voting delegation.

- 核心观点:Hyperliquid开放USDH稳定币代号争夺战。

- 关键要素:

- Paxos等五家发行商提交USDH发行方案。

- USDH年收入潜力达2.2亿美元。

- 投票基于链上质押份额透明进行。

- 市场影响:加剧稳定币市场竞争与生态整合。

- 时效性标注:中期影响。