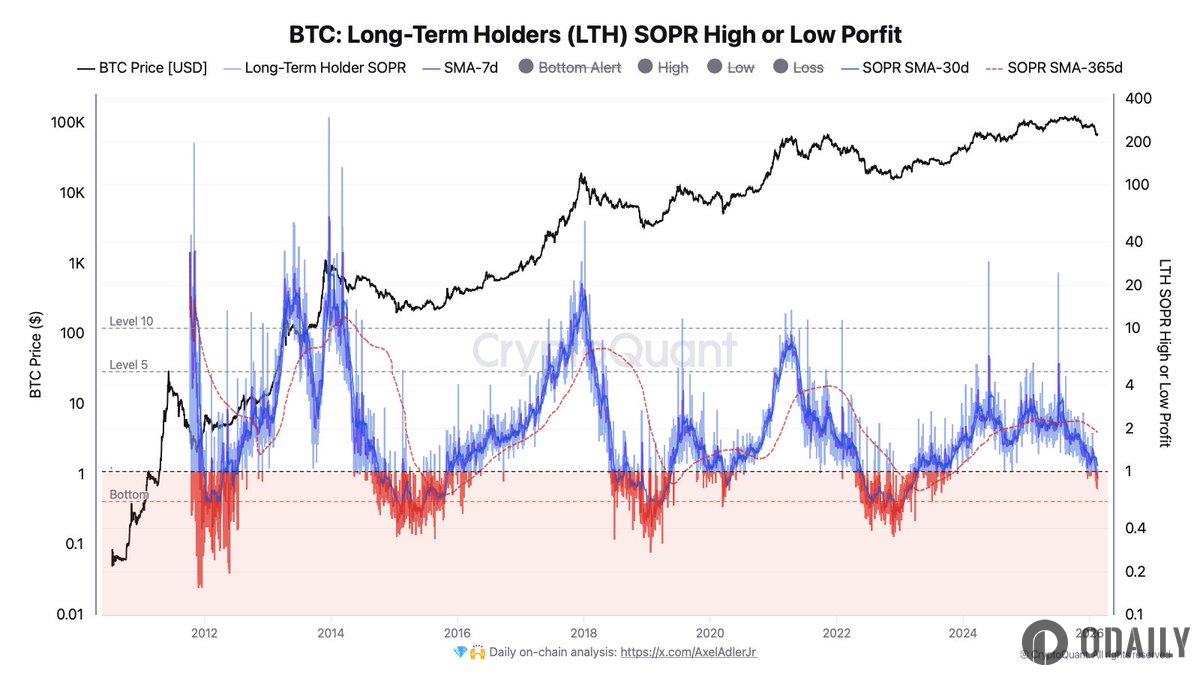

Analysis: Long-Term Holder SOPR Falls Below 1 for the First Time Since the End of the 2023 Bear Market

Odaily News Cryptocurrency analyst Darkfost posted on platform X, indicating that Long-Term Holders (LTH) are showing early signs of stress. As the market correction continues, based on the SOPR (Spent Output Profit Ratio) indicator, long-term holders are beginning to face pressure. Although the annual average SOPR for long-term holders is 1.87, the indicator has now fallen below the threshold of 1 to 0.88, marking the first occurrence since the end of the 2023 bear market. This suggests that long-term holders are gradually starting to sell at a loss, reflecting increasing market pressure.

However, this trend is not yet fully established. Looking at the monthly average, SOPR remains at 1.09, indicating that over a broader timeframe, most sales are still profitable. Therefore, the market has not yet entered a true capitulation phase for long-term holders. These are merely early signs of weakening sentiment, which could subside if the market stabilizes, or intensify if selling pressure persists.