In the 30 days since Merlin Chain, the second-tier Bitcoin network, was launched on its main network, TVL has reached an astonishing magnitude. It is known as the mysterious power from the East and has become a well-deserved hit. With the launch of M-Token on March 19, more than 3.2 billion US dollars of liquidity will be released soon, and various ecological projects in the Merlin system have also announced important actions.

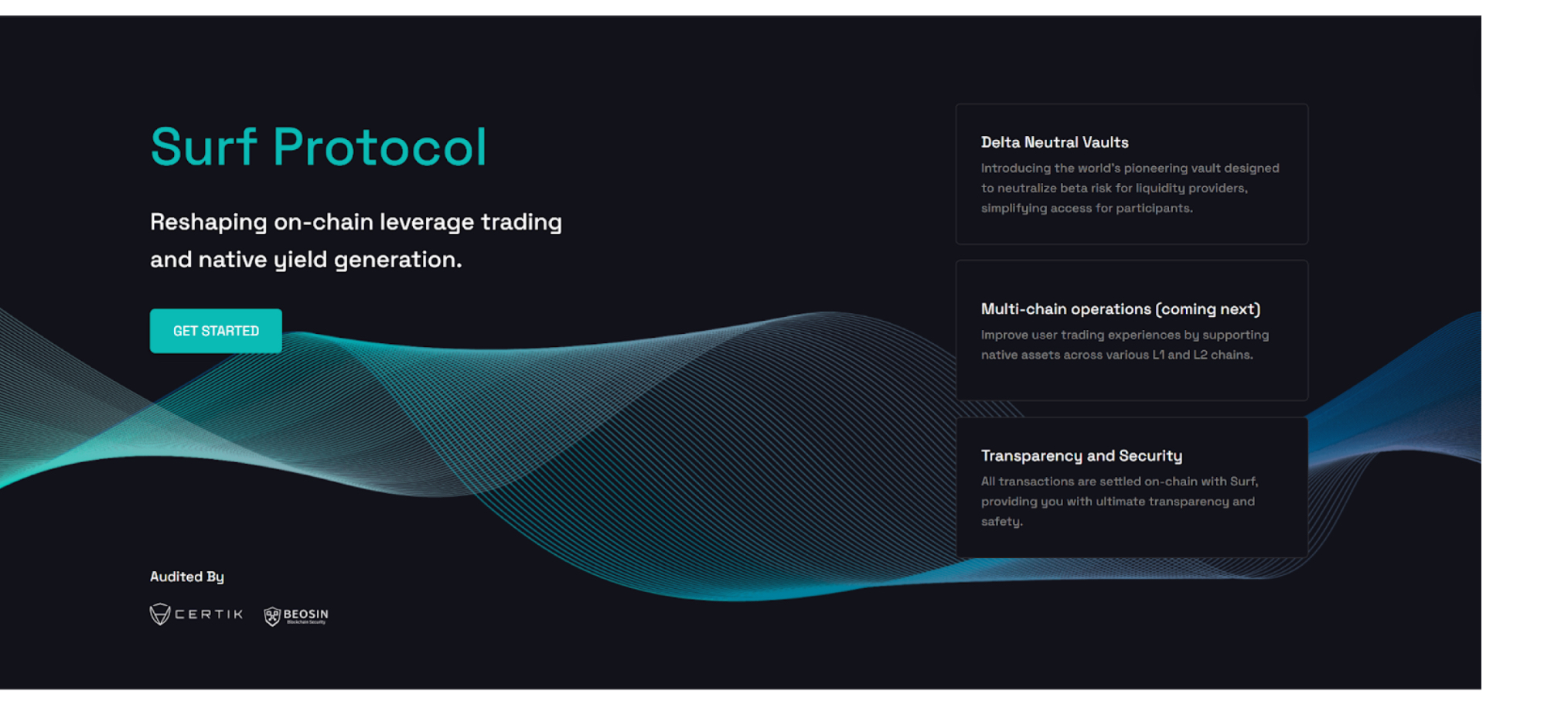

There are more than 200 Dapps across various tracks, which is dazzling. Which one should you choose? How to rush? This article will list five projects worthy of tracking from the aspects of fundamentals, economic benefits, and integration with Merlin ecology, trying to be as detailed and easy to understand as possible. Let’s focus directly here:

DaaS focusing on Merlin ecology and powered by iZUMiMerlinSwap

Web3 Genshin Impact produced by MOBOX, the leader of Binance chain gamesDragonverse Neo

BTC native engraving tool officially invested by MerlinUniCross

Derivatives trading protocol selected for Binance MVB Accelerator ProgramSurf Protocol

The over-collateralized stablecoin known as Bitcoin’s “MakerDAO + Compound”bitSmiley

DeFi: Merlin Swap

Summary of highlights

The team has been deeply involved in the DeFi field for many years and has launched a number of products and innovations in the Ethereum ecosystem.

In-depth cooperation with Merlin Chain to occupy a strong DEX ecological niche.

The Meme coins $VOYA and $HUHU previously launched through MerlinSwap have performed well in the market.

Team background

iZUMi Finance, the DeFi team that provides support for MerlinSwap, has launched many products and innovations such as Liquidbox and Iziswap Pro in the Ethereum ecosystem, providing leading liquidity mining models and DL-AMM models to improve the capital utilization of on-chain transactions. and user experience.

In December 2021, iZUMi tokens will be listed on Bybit, Kucoin, MEXC, Gate.io, BingX and other exchanges.

Financing status: Investment from more than 20 funds and individual investors including Hashkey Capital, GSR, Gate Labs, and Bixin Ventures.

Product business

MerlinSwap Protocol provides DaaS (DEX as a Service) for the Merlin Chain ecosystem and has the following characteristics:

1) Cutting-edge DL-AMM model: Utilize advanced liquidity algorithms for fast and efficient asset swaps, thereby increasing asset utilization and optimizing returns.

2) Adaptive liquidity mining: Provides static and dynamic liquidity mining options, allowing users to implement dual incentives in any price range, thereby minimizing unused liquidity.

3) Smooth user experience comparable to CEX

Community on-chain performance

As a veteran DEX project, iZUMi has been deployed on multiple ETH L2s and achieved top results in terms of transaction volume. It currently has an on-chain transaction volume of nearly 9 million US dollars in a single day. In recent months, MerlinSwap has facilitated over $200 million in transactions on the Merlin Chain and rewarded over 400,000 $VOYA to early users through airdrops.

Economic Model Latest News

White paper portal:https://docs.merlinswap.org/

The first BRC-20 token $VOYA, which was previously launched fairly through MerlinSwap, performed very well in the market. The transaction volume exceeded 42 million US dollars in seven days, and the number of wallets held reached 339,000, surpassing NVDA, SORA and JUP on Solana. Therefore, the communitys expectations for the release of MerlinSwaps native tokens are also very high.

On March 18, MerlinSwap announced the white paper and economic model, and will issue the token $MP on the Merlin Chain. The maximum supply is 21, 000, 000, 000, of which 6% will be used for public sale and 24% will be used for trading rewards. , 20% is used for airdrops.

MerlinSwap will launch an airdrop on March 27. A total of 840 M (4%) of esMP tokens will initially be allocated to the community. The remaining 16% of the airdrop share will be determined through community proposals and voting in the future, and can be followed in MerlinSwap 1: 1 Redeem to $MP. In addition, MerlinSwap also revealed in its official tweet that it will empower Merlin ecological assets such as $VOYA and $HUHU in subsequent plans. The initial 4% airdrop of tokens includes:

3% airdrop allocated to early traders of MerlinSwap

0.4% airdrop allocated to MerlinSwap’s Liquidity Providers (LP)

0.2% is allocated to the Launchpad MerlinStarter of the Merlin Chain ecosystem

1% airdrop allocated to the iZUMi community, including $iZi and $veiZi holders

More details: MerlinSwap Airdrop Details

Game: Dragonverse Neo

Summary of highlights

BTCs first 3D open world, the game quality is extremely high, breaking the stereotype that the application of BTC ecosystem is rough.

Binance Labs investment and Binance Launchpool project, the leader in blockchain games, the OG team has been deeply involved in blockchain games for more than 6 years.

With global operations and a community dominated by overseas players, it is expected to bring highly active and high-net-worth overseas game users to BTC L2.

The free and fair-launched Inscription Dragon Ball has become the top four leading asset in BRC-420 by market value within one month.

The game L3 on Bitcoin will be built, and native tokens used in games and L3 will be issued, bringing a very high degree of freedom and imagination to the empowerment of ecological assets.

Team background

The team behind Dragonverse Neo is MOBOX, which is well known in the gaming Dapp circle. In 2018, the industry started making games when it was still very early. From the well-known Ethereum Legend to ChainZArena, one of the most popular chain games of the year, to the now even higher quality Dragonverse Neo, MOBOX can be regarded as one of the few successful time travels compared to the projects that debuted together at the same time. The OG game team that is bullish and bearish, is still continuing to build, and is open to embracing new narratives.

In 2021, MOBOX was listed through Binance Launchpool, and currently holds more than 200,000 currency addresses.

Financing status: Binance Labs, Animoca Brands, DWF Labs

Product business

Dragonverse Neo is the first game launched by MOBOX in the Bitcoin ecosystem. It is famous for its exquisite art and smooth graphics. It has a grand world view and integrates popular works such as Pallu, Zelda, Genshin Impact, and Pokémon. gameplay, and provides powerful UGC tools, allowing the game to quickly iterate and even allow users to participate in the iteration.

Judging from the actual game demo clips currently released on the official Twitter, it is difficult not to be attracted by its strong anime style at first glance. Different from the single mechanism of traditional games, Dragonverse Neo adopts an open economic design, which can accommodate different mini-games and economic models to exist in parallel and resonate symbiotically in the open world. This also empowers the Merlin Chain and a series of assets in the MOBOX ecosystem. Brings great space and freedom.

In addition to games, MOBOX also revealed a product roadmap to build a game-specific L3 based on BTC L2, and a game-specific three-layer network based on Merlin Chain, aiming to provide a basic foundation for game projects and creators interested in deeply exploring the Bitcoin ecosystem. The one-stop support from facilities to game production and distribution makes Bitcoin a chain suitable for building games. The gameplay of the chain derived from it, such as game nodes and private servers, may bring new sources of income and wealth effects to users on the chain.

Community on-chain performance

MOBOX has accumulated a deep community foundation. $MBOX currently has more than 200,000 currency-holding addresses, and on-chain indicators such as transaction volume rank first among BNB Chain game projects all year round.

On February 3, MOBOX launched the inscribed Dragon Ball for free and fairly at BRC-420, with a total quantity of 100,000 pieces. Without any pre-heating publicity, the Bitcoin network went down that night due to excessive minting. As of the time of writing, the price of Longzhu Flooring is US$136.15, with a market value of US$13.6 million, ranking fourth among all BRC-420 assets. As the first test of the Bitcoin ecosystem, the successful release of Dragon Ball is a good start.

It is worth mentioning that MOBOX has the foundation that most current Bitcoin ecological projects are difficult to achieve in a short period of time - global operations. MOBOXs product line supports dozens of minor languages including Brazilian, Turkish, and Russian. Since the beginning of Ether Legend, European and American players have accounted for more than half of the market share, including many krypton gold tycoons and large asset owners. This is not easy. People often jokingly call Bitcoin and Ethereum a confrontation between Eastern and Western forces. Chinese are the backbone of the Bitcoin community. It is undeniable that most current Bitcoin projects are also dominated by Chinese users. Perhaps games are a good medium that can transcend language and cultural differences, allowing MOBOX to bring highly active and high-net-worth overseas game players to the Merlin ecosystem, allowing the West to see the power of the Bitcoin community.

economic model

It is reported that Dragonverse Neo will issue native tokens on BTC, and the specific mechanism will be revealed in an upcoming white paper. According to the official disclosure in the AMA, the following points can be confirmed at present - the games native token becomes the ecological golden shovel, the Dragon Ball serves as the golden key throughout the game and the entire MOBOX L3 ecology, and the economic model is closely related to the gameplay.

Latest News

Dragonverse Neo will publish a white paper in late March, and then launch the fair launch of native tokens. The game is expected to be officially launched on Merlin Chain in April.

Infrastructure: UniCross

Summary of highlights

In-depth cooperation with Merlin Chain and official investment from Merlin Chain.

The team has deep experience in the development of BTC Ordinals and has successful product experience with BTC Inscription.

The officially released UniCross Genesis collection has performed well, with a market value of over US$10 million.

Team background

UniCross team members are deeply involved in the BTC Ordinals and EVM ecology, and have accumulated knowledge of BTC protocol assets and product implementation capabilities, as well as rich experience in smart contract development.

The founding team members have built the largest Inscription casting platform in the BTC Ordinals ecosystem, with the minting volume exceeding 25% of the total Inscription volume, and its Marketplace transaction volume exceeding 500 BTC.

Product business

UniCross is a platform that supports the casting of BTC L1 assets on BTC L2 and supports the casting, trading and launch of BTC L1 assets in Layer 2.

Minting: Supports asset casting on Layer 2 including BRC-20, Runes, ARC-20, BRC-100, BRC-420 and other BTC L1 multi-protocol assets. Currently, BRC-20 and Runes protocol assets are supported.

Trading: A Marketplace that provides order book trading. Currently, stToken trading is open.

Swap: Provides Swap for stToken and ERC-20 Token of cross-chain BTC assets.

LaunchPad: Provides the launch of BTC layer assets in L2.

UniCross has excellent product capabilities, including the following advantages

User-friendly: The cross-chain casting is completed in one go, and the operation is simple. The casting is completed in two steps and the transaction is completed in three steps.

Multi-asset payment: supports more BTC protocol assets including BTC, BRC-20 and other BTC protocol assets as well as multi-chain asset payments

Multi-chain: More than 90% of BTC Layer 2 and more other public chains will be supported in the future

Instant transactions: One layer of casting is completed and can be traded instantly on the Marketplace without waiting for cross-chain completion.

Better liquidity: BTC L1 assets will receive better liquidity on BTC Layer 2 infrastructure.

Community on-chain performance

Previously, UniCross released the UniCross Genesis collection through the Ordinals protocol and airdropped it to all users who participated in the internal beta. As of the time of writing, the floor price is: 0.115 BTC, and the market value reaches a maximum of 10 million US dollars.

Latest news ecological cooperation

On March 20, UniCross was officially launched on the Merlin Chain mainnet, supporting multi-asset payments such as BTC, WBTC, iUSD, Voya, HUHU, RATS, MMSS, BTCs, and AINN.

In addition, UniCross announced that it will launch LaunchPad this week (before March 24) and start the first phase of launch: $RUFI, the first rune token on Merlin Chain. $RUFI introduces the concept of Rule Exchange , supports 1:1 exchange of BRC-20 tokens for Runes tokens. It is reported that $RUFI will airdrop 25% to Merlin Chain users and 75% for fair launch.

As BTCs native on-chain tool, UniCross has established extensive cooperation with BTC ecological projects. Including Merlin ecological projects such as MerlinSwap, Bitsmiley, Surf Protocol, and Influpia, as well as BRC-20 communities such as RATS, MMSS, AINN, and BTCs, it will expand more possibilities in asset payments, liquidity solutions, application scenarios, and more.

Derivatives: Surf Protocol

Summary of highlights

It is one of the Binance MVB Accelerator Program projects and has received investment from well-known institutions such as ABCDE.

Merlin Chains first native derivatives project has designed many product mechanisms that adapt to the BTC ecosystem (LP single asset provides liquidity, satoshi-based margin model, etc.).

It has good innovation (fund reuse of LP certificates, pre-market market for unreleased projects, etc.).

Team background

The Surf Protocol team is composed of founders and core members from top industry institutions such as Amber and Huobi. As one of the projects of Binance’s Most Valuable Developer (MVB) accelerator program, it has received awards from well-known institutions such as ABCDE and Inception Captial. investment.

Product business

A permissionless AMM derivatives trading protocol, focusing on BTC L2. Its product line not only includes derivatives trading, but also extends to pre-market trading, spot leverage trading, etc., thereby meeting the different needs of users from multiple perspectives.

As a native BTC L2 project, Surf Protocol has made many innovative mechanisms in product design to adapt to the BTC ecosystem, including:

LP single asset provides liquidity

Fund reuse of LP certificates

Satoshi-based margin model

The connotation of point-to-pool model

Pre-market trading market for unreleased projects

Community on-chain performance

As of this writing, there is no traceable on-chain data.

economic model

Surf Protocol has not yet announced its token issuance plan. There are currently two ways to play:

1) Perform leveraged trading, supporting up to 50 times leverage

2) Manage money, become an LP, deposit single coins into the liquidity pool, and earn transaction fees.

It is reported that in the initial stage, currencies with larger market capitalization and more stability, such as $BTC, $ETH, $ORDI, $SATS, etc. will be listed first, and the focus will be on contract leverage trading in derivatives, and more products such as options will be included in the later stage.

Latest News

On March 20, Surf Protocol announced Testnet online, please wait and see for subsequent developments.

Stablecoin: bitSmiley

Summary of highlights

“MakerDAO + Compound” of the Bitcoin ecosystem.

Its over-collateralization mechanism has leverage attributes, thereby improving the fund utilization rate of the Bitcoin ecosystem.

The bitDisc-Black NFT card market discovered by free minting is doing well, and early participants may receive potential airdrops.

Team background

It has received investment from many leading institutions such as OKX Ventures, ABCDE, CMS, ArkStream Capital, and Foresight Ventures.

Product business

bitSmiley is a BTC-native over-collateralized stablecoin project that currently includes the following product business lines:

1) BitUSD: Decentralized stablecoin protocol. Users can generate bitUSD by depositing Bitcoin into bitSmileys smart contract. If they need to withdraw the deposited Bitcoin, they need to repay the generated bitUSD and pay a certain fee. If the price of the collateral is lower than a certain threshold, liquidation will be triggered. , and executed on BTC L2.

2) Lending protocol bitLending: A fully decentralized peer-to-peer lending protocol, users can choose to lend out any bitRC-20 tokens, including bitUSD, using high-value and highly liquid cryptocurrencies such as Bitcoin as collateral.

Community on-chain performance

bitSmiely has launched the OG NFT bitDisc series as a voucher for early participants, which is divided into two series, including bitDisc-Gold with a total amount of 100 and an invitation system, and bitDisc-Black with a total amount of 10,000 and launched by Free Mint.

As of the time of writing, the floor price of bitDisc-Black is $3,467.79, with a market value of $34.67 million. It has officially joined Merlin Chain’s staking mining activity Merlin Seal.

economic model

Portal:bitSmiley White Paper

It is reported that OG NFT bitDisc, as a voucher for early participants, may be empowered with potential airdrops and points in the future.

Latest News

On March 13, bitSmiley announced that it would start staking M-bitDisc-Black on bitSmiley to earn bitJade and unlock a series of benefits. On March 19, bitSmiley announced the launch ofClosed internal testing of testnet。