從安全視角分析SocialFi賽道新專案TOMO和New Bitcoin City

原文來源:Beosin

Friend.tech 的持續爆火讓市場再一次注意到了SocialFi 賽道。目前,各條鏈的Friend.tech 競賽層出不窮,Linea 鏈的TOMO 和NOS 鏈的New Bitcoin City 憑藉自身創新,在短時間內其TVL 均突破1 百萬美元,成為SocialFi 賽道新秀。

在此類SocialFi 項目如火如荼地發展時,相關的安全風險受到了社群的廣泛關注。 8 月底Friend.tech 因API 存取設計導致了隱私洩漏;10 月7 日,Avalanche 鏈上的Stars Arena 存在重入漏洞,駭客在其合約中重入呼叫0x 563 2b 2 e 4 函數,導致sellShares 函數最終計算的結果異常大,協議損失約290 萬美元。

在此之前,Beosin 對Friend.tech 的設計機制與潛在安全風險進行了詳細地分析。今天Beosin 安全團隊為大家分析新秀專案TOMO 和New Bitcoin City,幫助大家了解其中的潛在風險。

TOMO 介紹

TOMO 是Linea 二層網的Friend.tech 競品,在Friend.tech 的基礎上推出了「Vote」機制。 Vote 是推特用戶在TOMO 註冊前的憑證,其他用戶可以直接交易未註冊用戶的Vote。在使用者註冊後,對應的Vote 會轉為Key。

Vote 的引入一定程度上避免了搶跑機器人的氾濫,無需監聽推特用戶進駐並濫發交易。同時交易Vote 中5% 的收益會分配給Vote 對應的推特用戶,該用戶只要註冊TOMO 便可領取該收益。這為推特用戶進駐TOMO 提供了經濟誘因。

TOMO 風險分析

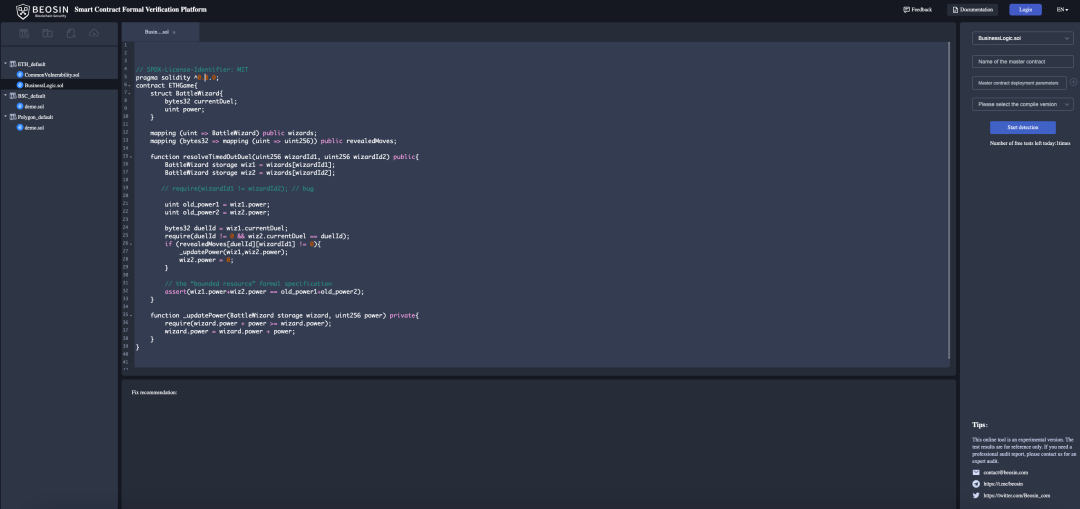

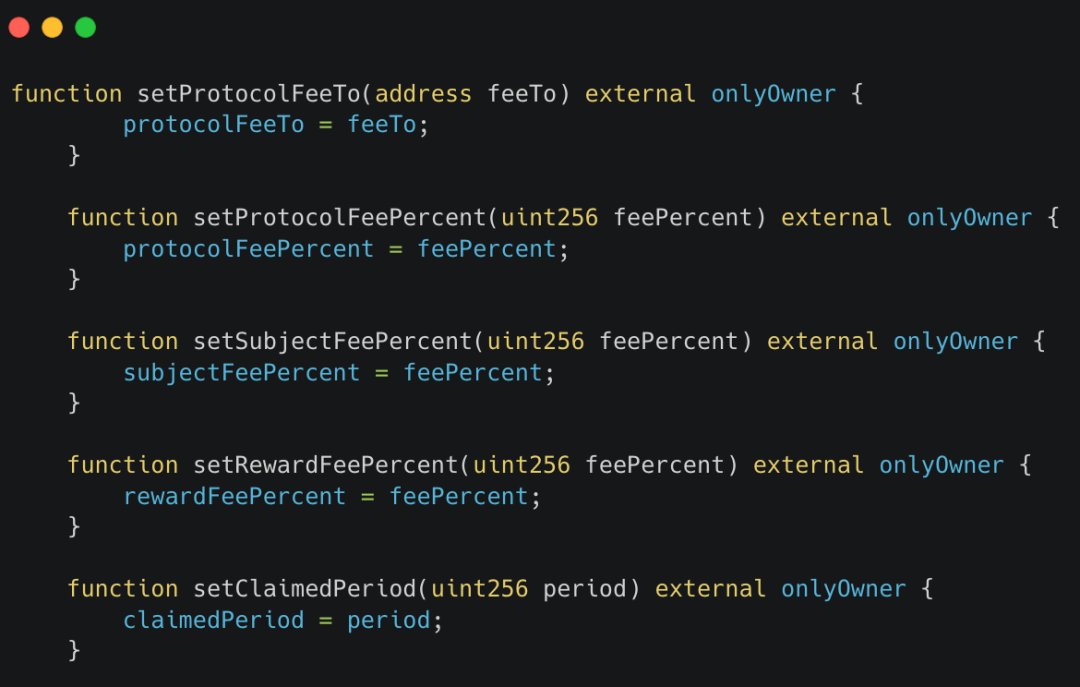

Beosin 先前完成了對Linea 公鏈上最大的衍生性商品交易所Tifo.trade 的審計。本次我們透過Beosin VaaS工具掃描TOMO 業務合約,結合Beosin 安全審計專家的分析,發現TOMO 有以下風險:

1.業務風險

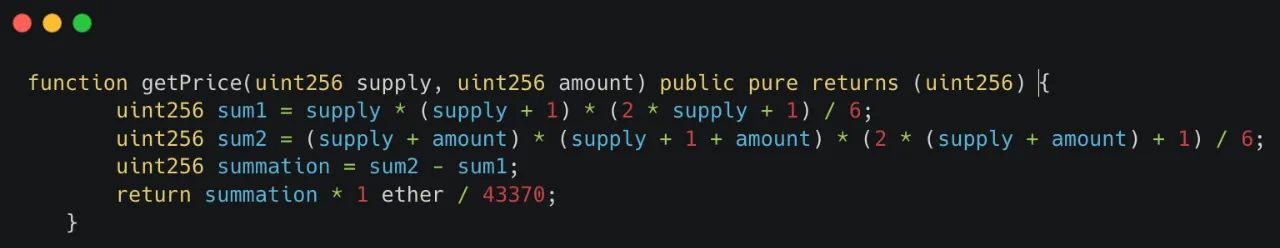

TOMO 的業務合約已經開源,查看其合約代碼可以發現其基礎的定價模式與Friend.tech 類似。若S 為目前持有量,TOMO 的Key 價格模型為S^ 2/43370 ,而Friend.tech 的價格模型為S^ 2/16000 。這讓TOMO 的Key 價格上漲得更緩慢,一定程度吸引更多用戶參與交易。

但實質並沒有改變,由於Key 總量越大買價和賣價都越高,可能存在早期用戶購入大量Key,後期的用戶購買的股權則可能產生虧損,參與投資需注意風險。

TOMO 的定價模型

Friend.tech 的定價模型

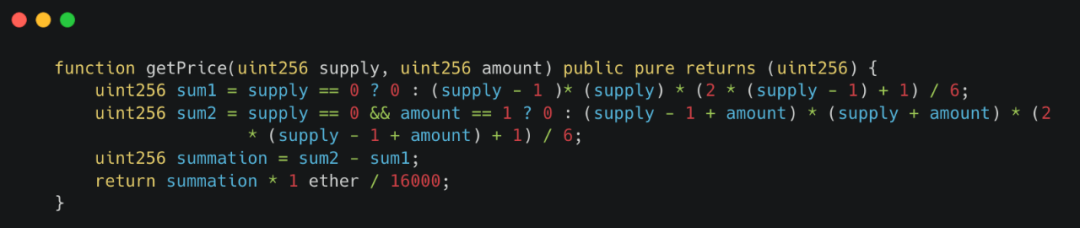

2. 中心化風險

與Friend.tech 風險類似,TOMO 的中心化風險不可忽視。合約的owner 可以無限制的調整手續費率,從而收取高昂的手續費,甚至可以設定100% 的手續費讓用戶收不到賣出的錢,也可以設定超過100% 的手續費率來暫停買入賣出功能。

source: https://lineascan.build/address/0x9e813d7661d7b56cbcd3f73e958039b208925ef8

3. 私鑰風險(ERC-4337 錢包)

根據TOMO 展示的資料,TOMO 對於用戶註冊後產生的錢包為ERC-4337 錢包(帳戶抽象錢包)。社群對於此類錢包的資產安全性提出了質疑。

首先Friend.tech 及大部分競品如Stars Arena 均使用EOA 皮夾,即普通的外部擁有皮夾。 EOA 錢包需要對發起的每筆交易都用私鑰簽名,互動應用時相對麻煩。同時用戶難以安全地保存私鑰,先前Deribit 熱錢包被偷走2,800 萬美元,Beosin 對如何確保錢包安全進行了詳細分享。

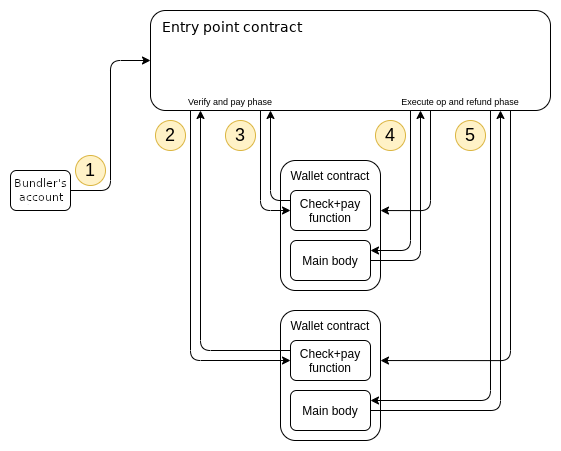

為解決以上種種問題,ERC-4337 提案透過引入稱為「UserOperation」的交易物件來實現帳戶抽象,使用者可以使用同時具備智慧合約和EOA 功能的單一錢包帳戶(帳戶抽象錢包)。不同的使用者將UserOperation 物件傳送到UserOperation 記憶體池中。由Bundler 打包交易並提交到以太坊內存池。被打包的交易會經由Entry Point 合約進行驗證,然後呼叫特定的Wallet 合約執行特定操作,隨後上鍊。流程如下圖所示:

source: https://eips.ethereum.org/EIPS/eip-4337

透過ERC-4337 的工作流程,我們可以知道帳戶抽象錢包有以下潛在的風險點:

(1)合約風險

Entry Point 合約和Wallet 合約需由專案方自行實現,目前TOMO 並未開源相關合約。 Entry Point 合約負責驗證Bundler 提交的交易的合法性,並根據交易調用特定的Wallet 合約。如果Entry Point 合約和Wallet 合約存在業務邏輯漏洞,則駭客可以透過建構特定的交易進行攻擊。

(2)私鑰相關風險

在ERC-4337 方案下,如果使用者遺忘私鑰,可能有其它解決方案恢復錢包(根據專案方的方案設計)。但私鑰被盜/洩漏給他人同樣有可能造成用戶的資產損失。 10 月18 日,TOMO 開放了匯出錢包私鑰的功能,用戶需匯出私鑰並防止私鑰被盜。

New Bitcoin City 介紹

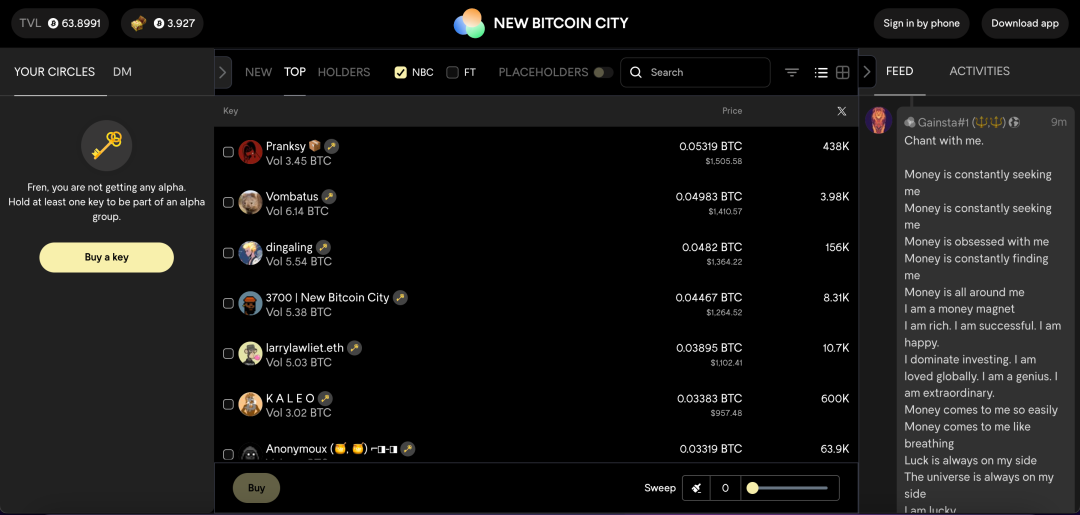

New Bitcoin City(或稱Alpha)是基於比特幣二層網路NOS 的類似Friend.tech 的社群應用,支援網頁端和行動端。用戶可以在New Bitcoin City 中交易New Bitcoin City 和Friend.tech 的Key。在此之前,New Bitcoin City 團隊也推出GameFi 專案Mega Whales 和DeFi 專案New Bitcoin DEX。

link: https://pro.newbitcoincity.com/

New Bitcoin City 風險分析

1.業務風險

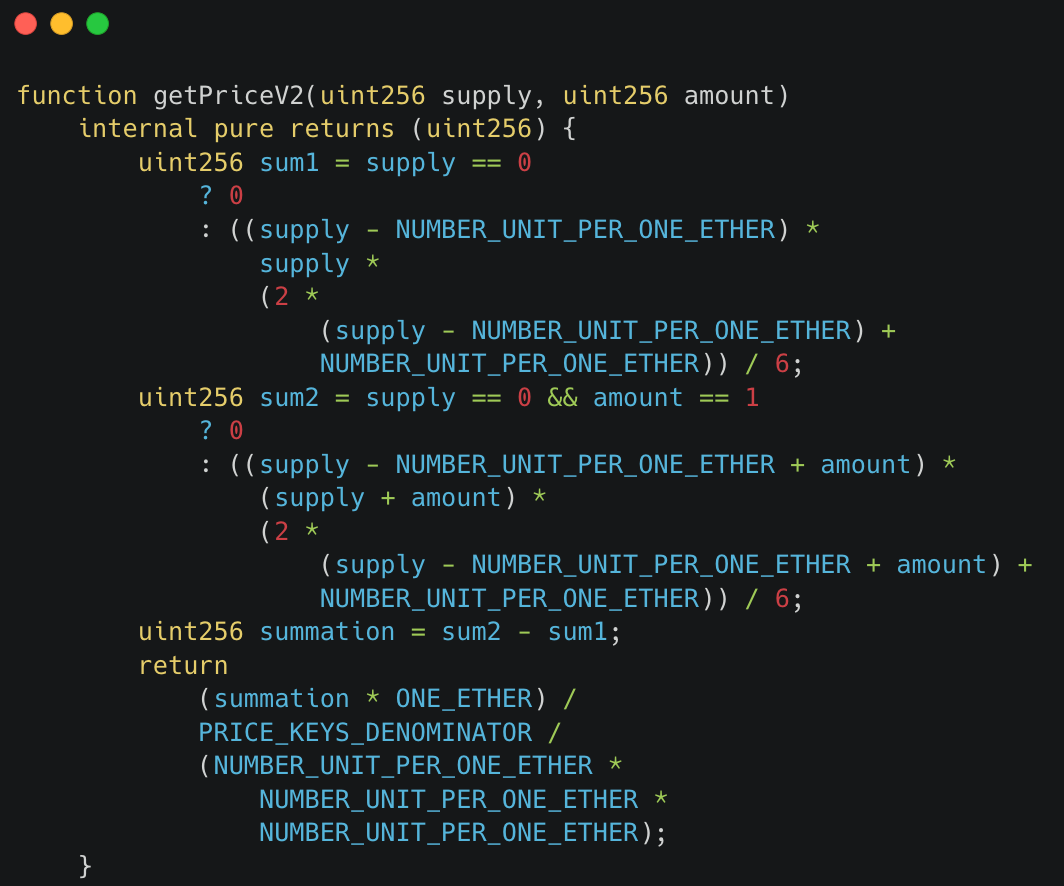

New Bitcoin City 也同樣採用了與Friend.tech 類似的定價模型,代碼中的PRICE_KEYS_DENOMINATOR 為264000 ,NUMBER_UNIT_PER_ONE_ETHER 為10 。比起TOMO,價格增加得更加緩慢。

2. 網絡風險

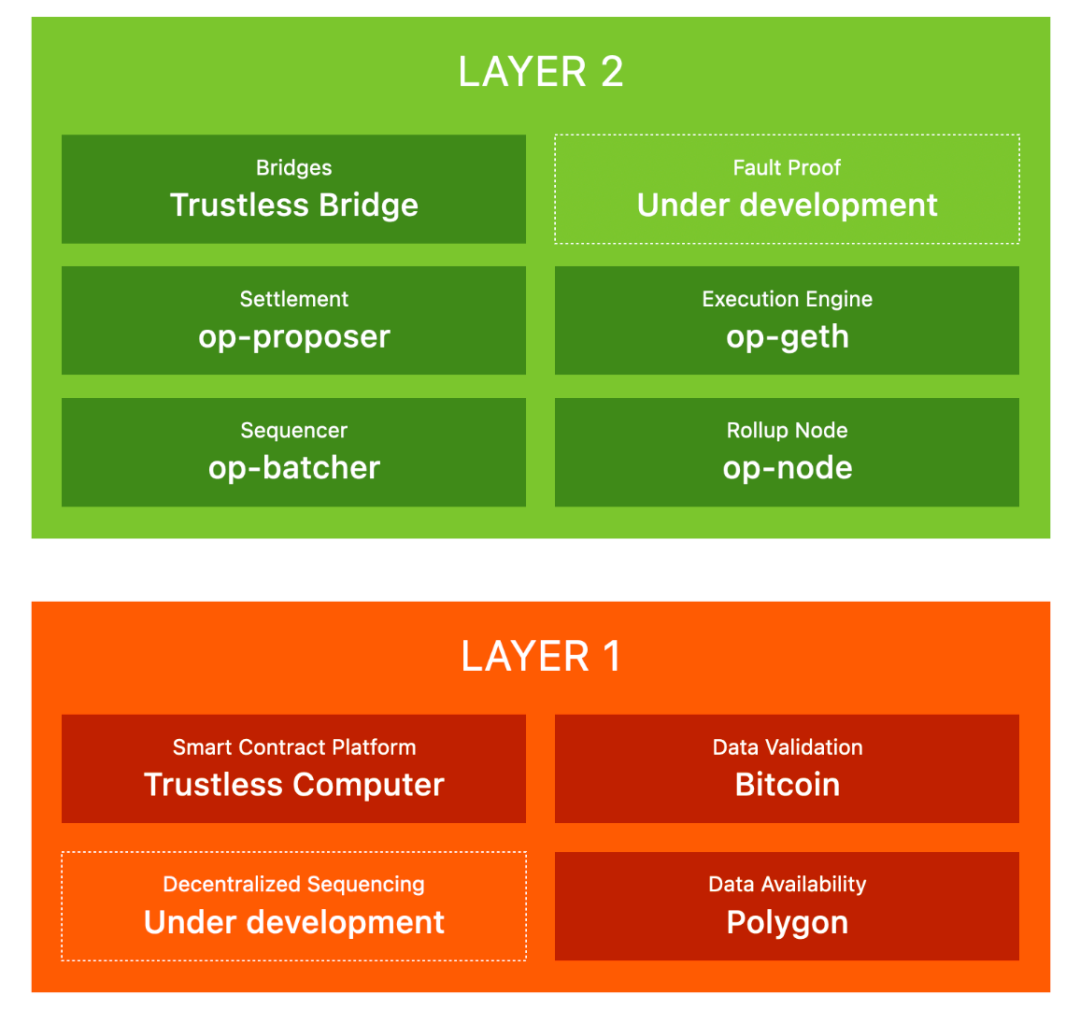

除了和TOMO 部分存在相同的中心化風險外,根據New Bitcoin City 團隊描述,NOS 使用Trustless Computer Layer 2 技術以運行其合約。而Trustless Computer 也是由New Bitcoin City 團隊開發的,在執行層基於OP Stack 開發相容以太坊,在比特幣網絡完成資料驗證。

source: https://docs.trustless.computer/blockchain-architecture/rollups-on-bitcoin

目前該網絡上只有New Bitcoin City 的社群應用程式活躍,網路的穩定性和安全性未經檢驗。

3. 私鑰管理

New Bitcoin City 與Friend.tech 類似,用戶在第一次用推特授權給應用程式後產生一個EOA 錢包。但生成錢包是在New Bitcoin City 後台完成的,其私鑰生成和保管流程依然是未知的。

總結

Friend.tech 競賽在Friend.tech 的基礎上進行了改良和創新。核心的定價模型基本上不變,在用戶互動方面進行了改進,但未能很好地解決用戶錢包私鑰的儲存問題。合約的中心化風險明顯,用戶在互動時需做好專案調查。