Rollup经济学2.0:解析成熟Rollup生态的多层经济关系

原文作者:davidecrapis.eth

原文编译:深潮 TechFlow

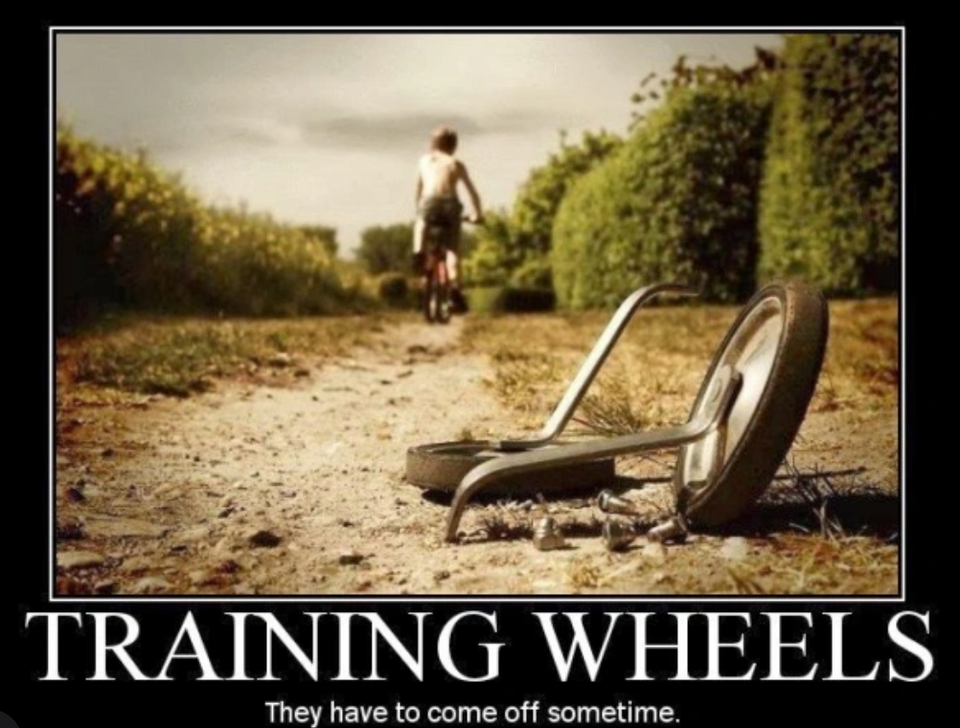

在 2022 年 2 月,Barnabé提出了一个关于资源定价和价值流动的 Rollup 经济学框架,用于思考 L1 依赖型经济中的 MEV、L1 和 L2 费用的相互作用、运营商收入和成本等关键概念。这是一个简单的框架,适用于一个简单的世界:在独立运行的辅助轮上的中心化 Rollup。在过去的 18 个月里发生了很多变化:共享排序、去中心化、证明/数据聚合、Rollup 联盟、治理。

我们提出了一个新的框架,将有助于理解 Rollup 准备扩展的新世界。目前仍在进行大量的实验,但已经出现了几种模式。我们将分析关键模式,并希望提供一个工具,帮助理解事物可能发展的方向,并解答当前的开放性问题。

回归基础:重温 Rollup 经济学 1.0

最初的 Rollup 经济学框架包括三个实体:用户、Rollup 运营商和基础层。它也有一个类似的简化视图,涉及价值流动:L2 费用和 MEV、运营商成本以及数据发布成本。这是一个简单的框架,但从这里开始并以此为基础很有用,因为事情很快就会变得更加有趣和复杂。

从这些基本流程中,我们可以衡量 Rollup 协议盈余并推理相关概念,MEV 的提取和分配、L2 发行、L2 拥堵费用分配,以及 Rollup 维持预算平衡或实现预算盈余的时间范围(L2 生态系统是不断增长的经济体,可能会发现运行盈余对于社区的公共物品资金、发展和增长是有用的)。

Rollup 协议盈余 = L2 fees - 运营成本- 数据成本

Rollup 协议对其 L2 费用(包括拥堵定价和 MEV)以及运营成本(包括发行和运营商奖励)具有控制权。无论协议决定追求平衡还是盈余目标,L2 操作都需要协调技术,以便

(1)最优地设置 L2 拥堵费用,

(2)提取和重新分配 MEV,

(3)通过优化和战略发布降低数据成本。

这些是不同 L2 生态系统目前正在尝试的主要经济设计选择。未来,协议可能希望通过使用区块空间衍生品来减少数据成本的不确定性。

在过去的 18 个月里,有一件重大的事情发生了变化。类似于 L1 的区块构建,我们看到 Rollup 运营商被分解为更专业的角色。随着经济的增长,自然会出现专业化,这是一件好事,因为关注点的分离会导致更具弹性的系统,如果我们能够在设计中解决这个问题。但是,现在的设计空间更大了,所以我们需要一张新地图来指导我们的过程。

Rollup 正在成熟

随着 Rollup 的成熟,Rollup 的复杂性都在增加,我们称之为“Rollup 联盟”。相同类型的 Rollup 之间共享的 Rollup 架构被设计用于增加安全性(通过共享治理和社区协调)、效率(通过共享功能和规模经济)和用户体验(通过更好的互操作性和减少碎片化)。与此同时,独立的提供商正在开发基础设施,为任何决定选择他们的服务的 Rollup 提供上述一项或多项好处。我们将在下面详细介绍这些模型。

独立 Rollup

单个 Rollup 正在摆脱辅助轮,增加安全性和去中心化。从运营/经济的角度来看,主要的成本领域包括:

排序:这会带来运营成本和激励成本以激励排序者。

数据可用性(DA):Rollup 必须在基础层上发布数据,因此会产生数据成本,这是原始框架中讨论的主要成本项目。

状态验证(SV):这通过证明成本直接增加了 zkRollup 的运营成本。

在所有这些成本领域中,单一的 Rollup 面临着安全性和效率之间的重要权衡。例如,他们可能选择使用成本较低的较不安全的数据可用性层。数据发布成本(我们简称为数据成本,尽管其中包括与发布相关的一些 L1 计算成本)在历史上一直是最高的项目。在以太坊上很快实施 EIP-4844 并在后续实施完整的 Danksharding 后,这将显著降低,从而为 Rollup 提供所需的成本效益,以实现规模化并支持新的用例。从长远来看,数据成本和相关服务的效率可能会通过离链创新的聚合来实现,以释放规模经济效益。

聚合的具体示例包括:共享排序服务;对于 Optimistic Rollup,一个有趣的想法是共享批量发布,可以更快地实现批量压缩收益,尤其是对于较小的参与者,通过更快的数据发布提供了更低的成本和更高的安全性;对于 zk Rollup,共享证明者是最令人兴奋的 Rollup 解决方案之一,特别是因为它们可以递归地进行这些聚合,从而在 L1 数据市场的高效利用方面获得巨大收益,但代价是更多的链下计算。一个明显的事实是,Rollup 迟早会选择采用共享服务,无论是作为 Rollup 联盟的一部分还是作为经济联盟的一部分。

Rollup 生态系统可能采取的一个方向是拥有更多与 L1 紧密对齐的独立 Rollup。尽管我们还没有看到很多实现,但至少有两种有趣的架构。一种是将其区块排序委托给 L1 的 Rollup,从而利用 L1 交易供应网络进行 MEV 提取,但保留设置 L2 拥堵费用的权力。更极端的一种是 Rollup 被确立在以太坊本身中。当我们讨论 Rollup 的 MEV 弹性和去中心化时,我们将更深入地探讨这些模型的经济学。

Rollup 合作社

两个 Rollup 之间的第一种集成类型是纯经济合作,例如经济合作社。

“合作社是一群共享或共同努力实现共同目标(如经济利益或节约)的实体。” — 维基百科

在其最简单的形式中,Rollup 之间有一个某种服务的联合采购协议。想象一下,有一个共享的批量发布服务,Rollup 可以订阅并获得更低的数据发布成本。还可以进行更深入的经济整合,例如共享排序服务既提供成本效益,也使得 Rollup 之间的交易更容易以原子方式结算,从而降低了它们之间的贸易壁垒。这种思维模式类似于欧洲经济共同体或其他类似的共同市场协会。

我们可以通过引入中间服务提供商来增强独立 Rollup 经济学的简单模型。在这种情况下,对 Rollup 生态系统产生了两个新的经济效应。

Rollup 成本结构:Rollup 运营商的成本现在包括运营成本、服务成本和数据发布成本。

共享服务经济学:新实体需要实现预算平衡。

这类服务的例子包括 Espresso 排序器,它是一个用于排序和发布的共享服务,仅限于共享批量发布,或者共享证明。在所有这些情况下,共享服务存在两个重要的经济问题。

L2 的服务成本共享:需要以经济和公平的方式将总服务成本分摊给采用共享服务的 Rollup。

共享服务的去中心化:实现一定程度的去中心化,具体取决于服务类型,在性能和稳健性之间取得适当的平衡。这个标准低于基础层,但它包括管理激励和 MEV。

Rollup 联盟

Rollup 联盟与经济合作社不同,因为它们既具有经济一体化,又具有某种形式的政治一体化。这种思维模式类似于一个联邦国家。

从技术上讲,政治一体化是通过共享跨链桥实现的,但它还需要一个共享治理系统。在这里,我们将很大程度上抛开政治和治理考虑,我们将假设共享跨链桥的存在,并关注它所暗示的经济关系。这种 Rollup 联邦架构正在所有主要的 Rollup 系统上出现,它们正在成为部署互操作的对等 Rollup 的平台。

例如,Optimism Superchain、Polygon 2.0、StarkWare SHARP、zkSync Hyperchains 等其他相关项目在其架构中共享类似的模式。我们在下图中概括了这一点。注意为了效果,我们做出了现实的假设,即 Rollup 联盟自动选择共享服务,并且不会产生直接的数据发布成本。

共享跨链桥的存在引入了额外的经济变量。特别是原生的 L2 代币,如 Optimism 生态系统中的 OP 代币,通过治理提供了重要的决策权,用于在生态系统内分配资源、角色和经济流动(例如,OP 治理是一种基于混合代币身份的治理的实验)。一旦 Rollups 技术栈成熟并解决了一级安全问题,下一个关注点是稳健性,这可能涉及到某种程度的去中心化。

当 Rollups 考虑建立去中心化服务(用于排序、证明或验证)时,它们将需要运行共识协议。这是规模足够的生态系统看到将其原生代币“升级”为生产资产的机会的时候(这正是 Polygon 2.0 计划用 POL 实现的)。这并不是去中心化 L2 服务的唯一方式,因为以太坊 L1 也可以利用其更好的安全性质来实现。然而,对于希望保留更多内部控制/治理以及相关奖励/激励机制的较大生态系统来说,使用原生代币可能是一个吸引人的方向。

原生代币是帮助引导 L2 生态系统/经济的重要经济工具。发行量可以用于奖励服务运营商、资助生态系统支持项目或公共物品。然而,当原生代币用于通过某种原生权益证明协议支持去中心化时,随着更多的稀释,安全性可能会降低。即使原生代币仅用于治理,过度稀释也可能导致更多预算受限的持有者出售,从而可能导致所有权集中。因此,似乎很重要的是拥有与需求增长相匹配的代币发行计划。最后,另一个重要的考虑因素是使 L2 经济对原生代币(而不是 ETH)更加依赖,这也使其对某些故障模式的稳健性降低,因为转移到 L1 可能不是一个选择。在极限情况下,L2 仍然由以太坊提供安全性,但失去了以太坊作为外部货币提供的安全性。

更多的层

另一个活跃发展的领域是针对特定应用或定制执行环境的开发,这些环境最终会在基础层上进行结算,即使不是直接进行。这些通常针对需要低执行成本和简单部署的应用程序,并愿意在安全性上做出权衡的应用。例如游戏、社交媒体、不需要启动自己的服务经济体或吸引/保障大量流动性的 NFT 产品。

这些包括 L3、Validium 和作为服务的 Rollup(RaaS)平台等不同类型。例如,Arbitrum Orbit 是一个平台,支持在 Arbitrum L2(One 或 Nova)上部署 L3 链,并具有一些可配置性,例如选择 Arbitrum 授权的数据可用性委员会(DAC)或以太坊 L1 作为数据可用性层。StarkNet 和其他 zk rollups 项目也一直在尝试实现 L3。在部署简易性方面的一个极端例子是 AltLayer 或 Caldera,它们提供了无代码解决方案来部署“可定制”的 Rollup,并赋予用户权力来进行安全性和效率的权衡。

我们专注于 L3 系统。这实质上是在 L2 之上添加的一层。从 L2 Rollup 的角度来看,这是 L2 费用的另一个来源。而对于 Rollup 生态系统来说,L3 是一个新的实体,具有自己的预算平衡约束:

L3 的收入可能来自费用、订阅(例如游戏)或其他机制,如收入分享(例如 NFT)。

L3 的成本包括系统的运营成本以及计算/数据的 L2 费用。这些费用可以由 L3 直接承担,或者在托管服务的情况下由 RaaS 平台支付。这是另一个需要进行预算平衡的服务提供商。

这是 Rollup 生态系统中经济专业化的另一个例子。