การปลดล็อกโทเค็นส่งผลต่อราคาอย่างไร การวิเคราะห์ข้อมูลขนาดใหญ่จาก 5,000 รายการ

การรวบรวมข้อความต้นฉบับ: Deep Tide TechFlow

การรวบรวมข้อความต้นฉบับ: Deep Tide TechFlow

ชื่อเรื่องรอง

TL;DR

ในฐานะวิศวกรโทเค็น เป้าหมายของเราคือการทำความเข้าใจว่าองค์ประกอบต่างๆ ของการออกแบบการปลดล็อกโทเค็น ได้แก่ ขนาด ความถี่ ระยะเวลา และการกระจายของการปลดล็อกส่งผลต่อเสถียรภาพและสถานะในระยะยาวของราคาโทเค็นอย่างไร

เรารวบรวมและวิเคราะห์ข้อมูลจากเหตุการณ์การปลดล็อคต่างๆ มากกว่า 5,000 รายการ และได้ข้อสรุปดังต่อไปนี้:

เหตุการณ์การปลดล็อกเล็กๆ น้อยๆ (เช่น การเพิ่มอุปทานหมุนเวียนจาก 0% เป็น 1%) ไม่มีความสัมพันธ์ที่เป็นสาระสำคัญกับราคา

เหตุการณ์การปลดล็อคที่ใหญ่ขึ้น (เช่น การเพิ่มอุปทานหมุนเวียนมากกว่า 1%) มีความสัมพันธ์เชิงลบที่ชัดเจน: เมื่อขนาดการปลดล็อคเพิ่มขึ้น ราคาก็จะลดลง

โทเค็นที่ปลดล็อกอุปทานส่วนใหญ่ (มากกว่า 70%) มีความผันผวนต่ำกว่าอย่างมากและราคาสัมพัทธ์ที่สูงกว่า ในขณะที่โทเค็นในช่วงต้นของช่วงเวลาการปลดล็อกจะมีราคาที่ค่อนข้างต่ำกว่า

โปรโตคอลที่มีการจัดสรรมากขึ้นสำหรับตำแหน่งส่วนตัว (เช่น ทีม นักลงทุน) ทำงานได้ดีกว่าตำแหน่งสาธารณะ (เช่น ระบบนิเวศ ชุมชน) เล็กน้อย อย่างไรก็ตาม ในความเห็นของเรา ผลลัพธ์นี้ไม่สูงพอที่จะเป็นข้อพิจารณาสูงสุดสำหรับวิศวกรโทเค็น

จากข้อสรุปเหล่านี้ เราเสนอสามประเด็นที่ผู้ก่อตั้งจำเป็นต้องพิจารณาในแง่ของเศรษฐศาสตร์โทเค็น โดยสรุปโดยย่อดังนี้:

พิจารณาจำกัดขนาดของการปลดล็อคไม่เกิน 1% ของอุปทานหมุนเวียน ชอบการปลดล็อกรายวันหรือรายสัปดาห์มากกว่าการปลดล็อกรายไตรมาสหรือรายปี

พิจารณาการรวมกิจกรรมการปลดล็อกขนาดใหญ่อีกครั้ง เหตุการณ์เหล่านี้สามารถสร้างแรงกดดันด้านราคาที่สำคัญและไม่จำเป็น

ชื่อระดับแรก

เป้า

แม้ว่าผลกระทบของการปลดล็อกโทเค็นจำนวนมากจะมีอยู่ในเกือบทุกโครงการที่ระดมทุน แต่การออกแบบโทเค็นยังขาดการศึกษา การปลดล็อกเหล่านี้สามารถสร้างความผันผวนได้อย่างมาก ทำให้เกิดความสับสนแก่ชุมชน นักออกแบบโทเค็น และผู้ค้า

อย่างไรก็ตาม เมื่อทำอย่างถูกต้อง การปลดล็อกโทเค็นจะช่วยสร้างแรงจูงใจให้กับผู้มีส่วนได้ส่วนเสีย ดังนั้นวิธีที่ดีที่สุดคืออะไร? เราเจาะลึกข้อมูลเพื่อทำความเข้าใจว่าการปลดล็อกโทเค็นส่งผลต่อการเคลื่อนไหวของราคาในอดีตและความสำเร็จของโปรโตคอลโดยรวมอย่างไร เราสามารถรวบรวมหลักการทั่วไปจากข้อมูลได้หรือไม่? ผู้ก่อตั้งจะดำเนินการกับข้อมูลเชิงลึกเหล่านี้ได้อย่างไร

เป้าหมายของเราคือการได้รับข้อมูลเชิงลึกทั่วไปว่าองค์ประกอบการออกแบบการปลดล็อกที่แตกต่างกันอย่างไร (ขนาด ความถี่ ช่วงเวลา และการกระจาย) ส่งผลต่อเสถียรภาพของราคาโทเค็นอย่างไร

ชุดข้อมูล

ชุดข้อมูล

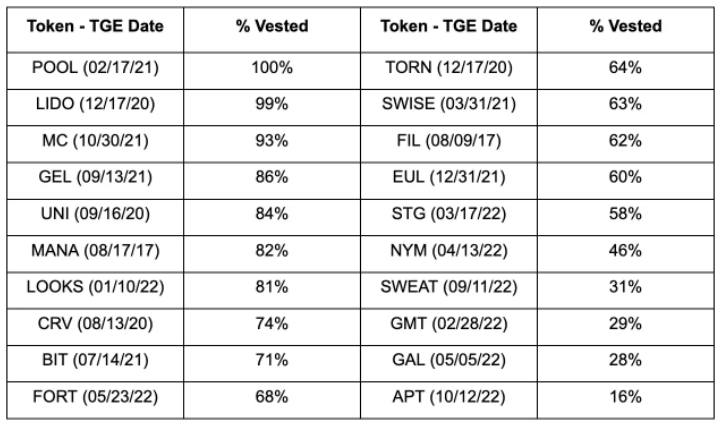

เรารวบรวมและตรวจสอบข้อมูลจาก 20 โปรโตคอล รวมถึง Uniswap (UNI), Galxe (GAL) และ BitDAO (BIT) ส่งผลให้มีเหตุการณ์การปลดล็อกที่แตกต่างกันกว่า 5,000 รายการสำหรับการวิเคราะห์ การตรวจสอบข้อมูลรวมถึงการดูข้อมูลออนไลน์และ/หรือการยืนยันแผนการปลดล็อกโทเค็นและทีมหลักของโปรโตคอล

เปอร์เซ็นต์การถือครอง ณ เดือนเมษายน 2566:

วิเคราะห์

วิเคราะห์

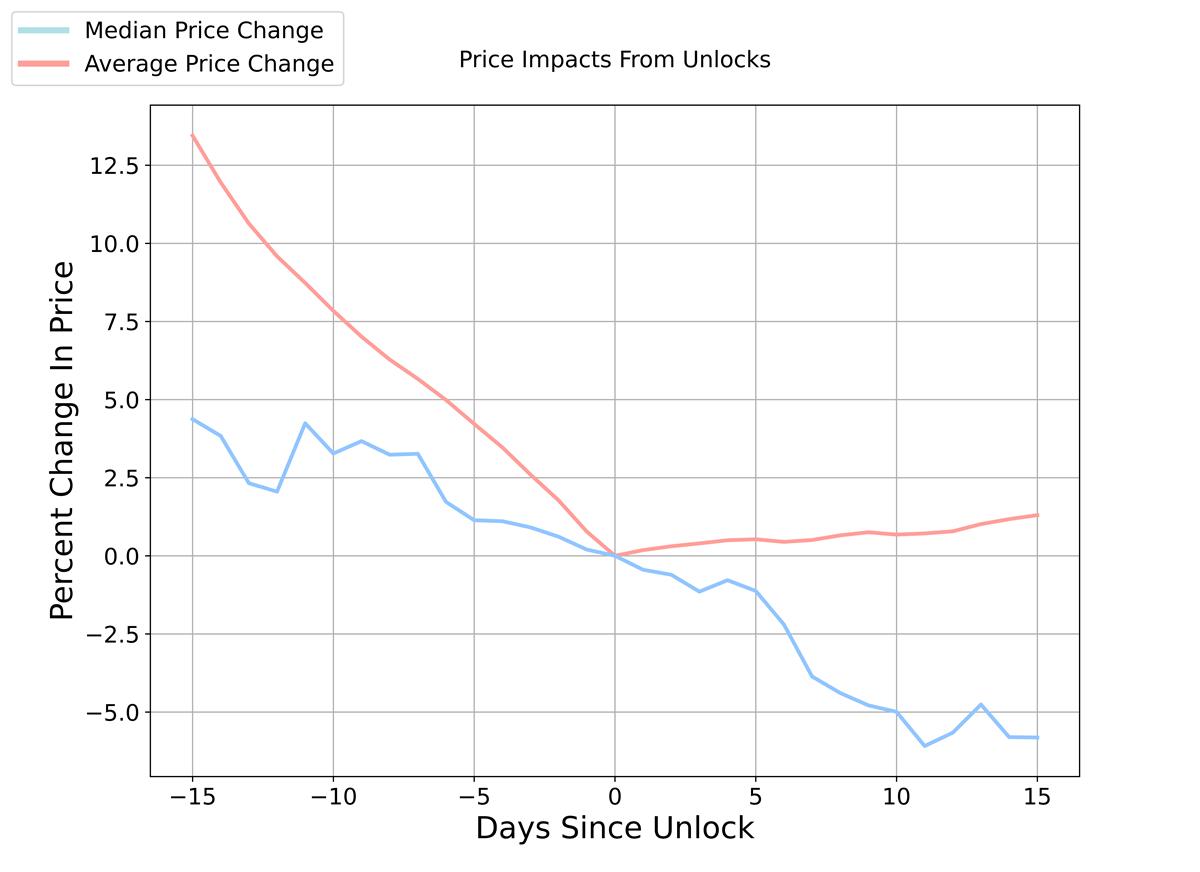

ในขั้นต้น เราจะตรวจสอบความสัมพันธ์โดยตรงระหว่างขนาดการปลดล็อกโทเค็นและการเปลี่ยนแปลงราคาในอดีต เพื่อให้ได้บริบทแนวโน้มทั่วไปสำหรับข้อมูล เราได้รวบรวมข้อมูลราคาปกติสำหรับการปลดล็อกแต่ละครั้งและวางแผนเส้นค่าเฉลี่ยและค่ามัธยฐานในแผนภูมิเดียว เราดูข้อมูลราคาหนึ่งเดือน ปลดล็อกกรอบเวลา 15 วันก่อนและหลังเหตุการณ์

โดยเฉลี่ยแล้ว ราคาโทเค็นจะสูงขึ้นประมาณ 13% ในช่วง 15 วันแรกของการปลดล็อค และเพิ่มขึ้นในระดับปานกลางหลังจากนั้น เส้นมัธยฐานแสดงแนวโน้มขาลงที่แข็งแกร่งขึ้น โดยลดลงอีก 5% หลังจากปลดล็อก เราระบุความเบี่ยงเบนระหว่างค่ามัธยฐานและค่าเฉลี่ยจากความผิดปกติบางอย่างในเหตุการณ์ตลาดที่รุนแรง ดังนั้นเราจึงเชื่อว่าค่ามัธยฐานเป็นตัวแทนที่ดีกว่าสำหรับการปลดล็อกส่วนเพิ่ม

ผลลัพธ์เหล่านี้สอดคล้องกับสัญชาตญาณทางเศรษฐกิจขั้นพื้นฐาน: หากอุปทานเพิ่มขึ้นอย่างรวดเร็วโดยที่อุปสงค์ไม่เปลี่ยนแปลง ราคาควรจะลดลง อย่างไรก็ตาม สถานการณ์มีความซับซ้อนมากขึ้นอย่างชัดเจน กำหนดการปลดล็อกมักจะเปิดเผยต่อสาธารณะ ซึ่งเปิดโอกาสให้มีการสร้างเรื่องราวและแลกเปลี่ยนกิจกรรม เมื่อเร็ว ๆ นี้ เนื่องจากการบีบสั้น ๆ * การปลดล็อคโทเค็นบางส่วนจึงกลายเป็นเรื่องเล่าที่รั้น กิจกรรมที่คาดหวังนี้ทำให้สถานการณ์ซับซ้อนยิ่งขึ้น มีวิธีบรรเทาไหมครับ? มันคุ้มค่าที่จะบรรเทา?

(คำอธิบายประกอบ Shen Chao: Short Squeeze หนึ่งในคำศัพท์ในตลาดหุ้น เมื่อผู้ขายชอร์ตถูกบังคับให้ปิดตำแหน่ง (ตำแหน่งว่าง) และดำเนินการซื้อหุ้นอ้างอิงต่อไป ความต้องการหุ้นในตลาดมีมากเกินกว่าตลาด สภาพคล่องเนื่องจากอุปทานไม่เพียงพอส่งผลให้ราคาเพิ่มขึ้นอย่างรวดเร็ว)

ชื่อระดับแรก

ชื่อเรื่องรอง

การวิเคราะห์ของวัน

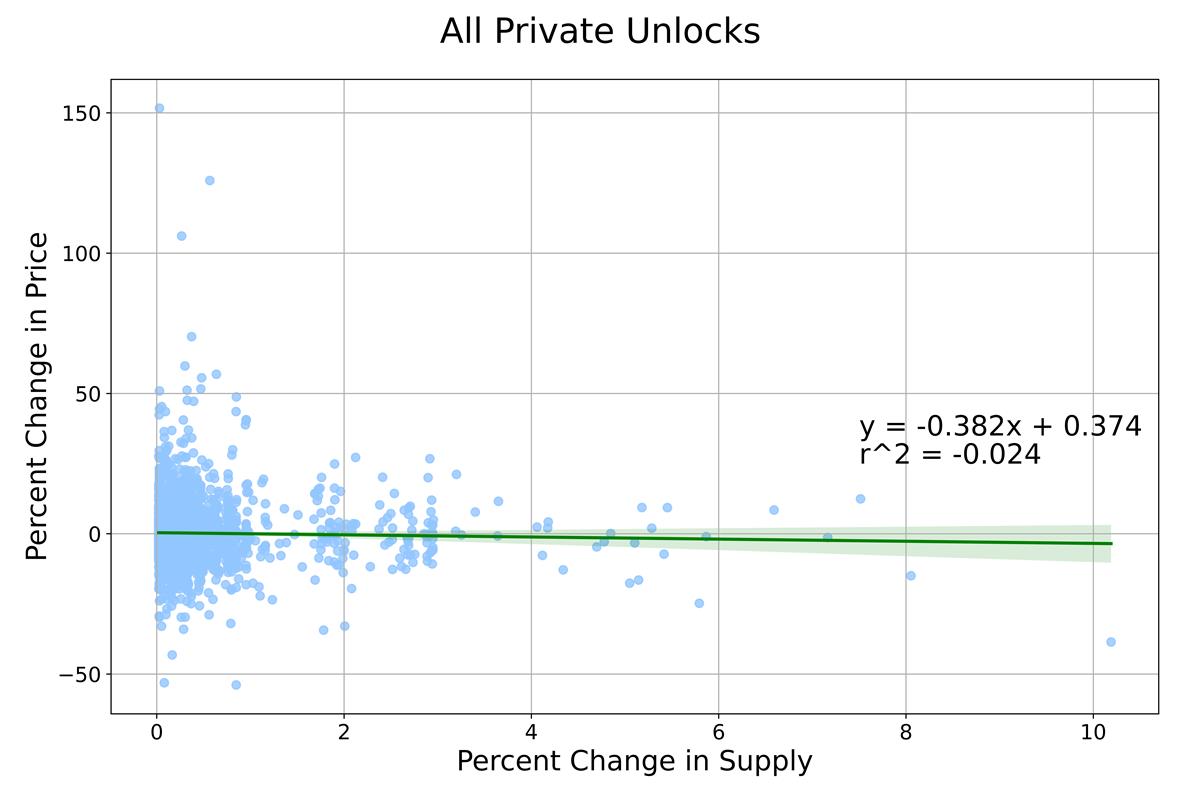

ขั้นแรก เราจะประเมินการตอบสนองของตลาดต่อการปลดล็อกโดยการวิเคราะห์การเปลี่ยนแปลงราคาในวันเดียว ด้านล่างเราจะแสดงเปอร์เซ็นต์การเปลี่ยนแปลงของราคา (เทียบกับวันก่อนหน้า) เทียบกับเปอร์เซ็นต์การเปลี่ยนแปลงของอุปทานหมุนเวียน โดยพื้นฐานแล้วสิ่งนี้จะพยายามวัดความสัมพันธ์ระหว่างขนาดการปลดล็อกและผลกระทบต่อราคา หากความสัมพันธ์ของเราแสดงความสัมพันธ์เชิงลบ หมายความว่าการปลดล็อกที่มากขึ้นเกี่ยวข้องกับราคาที่ลดลงมากขึ้น

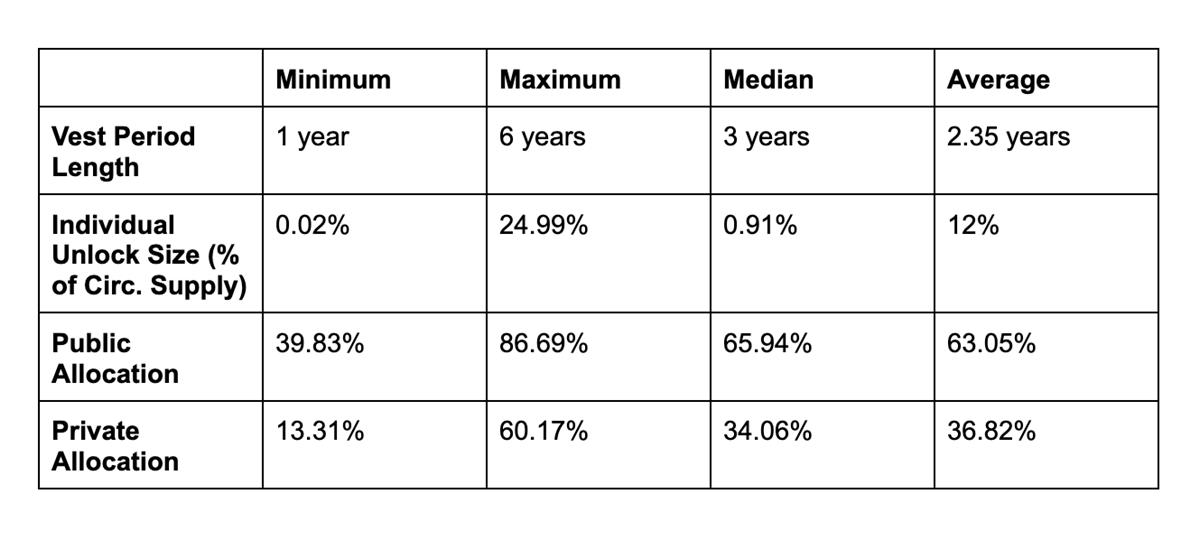

เราแบ่งประเภทการปลดล็อคออกเป็นสองประเภท: การปลดล็อคข้อเสนอส่วนตัวและการปลดล็อคข้อเสนอสาธารณะ การปลดล็อกหุ้นส่วนตัวประกอบด้วยทีม ผู้ทำงานร่วมกัน นักลงทุน และที่ปรึกษา ในขณะที่การปลดล็อกทุนสาธารณะ ได้แก่ คลังสมบัติ กองทุนระบบนิเวศ การกระจายชุมชน และแอร์ดรอป โดยรวมแล้ว เรารวบรวมเหตุการณ์ปลดล็อคการขายสาธารณะ 2187 รายการและกิจกรรมปลดล็อคการขายส่วนตัว 4546 รายการ

เมื่อเปรียบเทียบการปลดล็อคแบบส่วนตัวและแบบสาธารณะ เราพบว่าการปลดล็อคแบบสาธารณะนั้นมีขนาดเล็ก—โดยทั่วไปแล้วจะน้อยกว่า 2% ของอุปทานทั้งหมด—ในขณะที่การปลดล็อคแบบส่วนตัวมีขนาดและผลกระทบต่อราคาในเชิงลบที่ใหญ่กว่าและสัมพันธ์กัน สิ่งนี้สมเหตุสมผล เนื่องจากการปลดล็อกให้กับคนวงในมักมีเหตุการณ์สำคัญๆ เช่น Cliff และ/หรือการปลดล็อกรายไตรมาส ซึ่งบางรายการอาจขายเมื่อได้รับโทเค็น

การแยกการปลดล็อกตำแหน่งส่วนตัวออกจากกันนำไปสู่ข้อสรุปต่อไปนี้:

ลักษณะเด่นคือกลุ่มของจุดระหว่าง 0% ถึง 1% ของอุปทานที่ปลดล็อก ซึ่งบ่งชี้ว่าอาจมีความสัมพันธ์ที่แตกต่างกันในช่วงขนาดการปลดล็อกที่ต่างกัน ในการตรวจสอบเรื่องนี้ เราพิจารณาการปลดล็อกระหว่าง 0% ถึง 1% และมากกว่า 1%

สำหรับคลัสเตอร์แรก (ปลดล็อค 0%-1%) เราไม่พบความสัมพันธ์เชิงเส้น สิ่งนี้สอดคล้องกับการตัดสินว่าการปลดล็อคขนาดเล็กมีผลกระทบต่อราคาน้อยกว่า แต่ก็ยังคาดว่าผลกระทบด้านราคาจะเพิ่มขึ้นเมื่อขนาดการปลดล็อคเพิ่มขึ้น แต่ดูเหมือนว่าขนาดการปลดล็อกใดๆ ในช่วงนี้โดยทั่วไปจะมีผลกระทบที่คล้ายคลึงกัน

สำหรับคลัสเตอร์ที่สอง (ปริมาณการปลดล็อคมากกว่า 1%) เราเห็นความสัมพันธ์เชิงลบที่แข็งแกร่งขึ้น ซึ่งบ่งชี้ว่าเมื่อขนาดการปลดล็อคเพิ่มขึ้น ราคาจะลดลง สิ่งนี้สอดคล้องกับสมมติฐานของเราที่ว่าการปลดล็อกที่มากขึ้นนำไปสู่การลดราคาที่มากขึ้น เนื่องจากมีตัวแปรภายนอกหลายอย่างในราคาโทเค็น เรารู้ว่าเราจะไม่คาดหวังความสัมพันธ์ที่สูง แต่คิดว่า 16% จะมีความหมายสำหรับข้อมูลราคาโทเค็น

ชื่อเรื่องรอง

หน้าต่างเวลาที่นานขึ้น

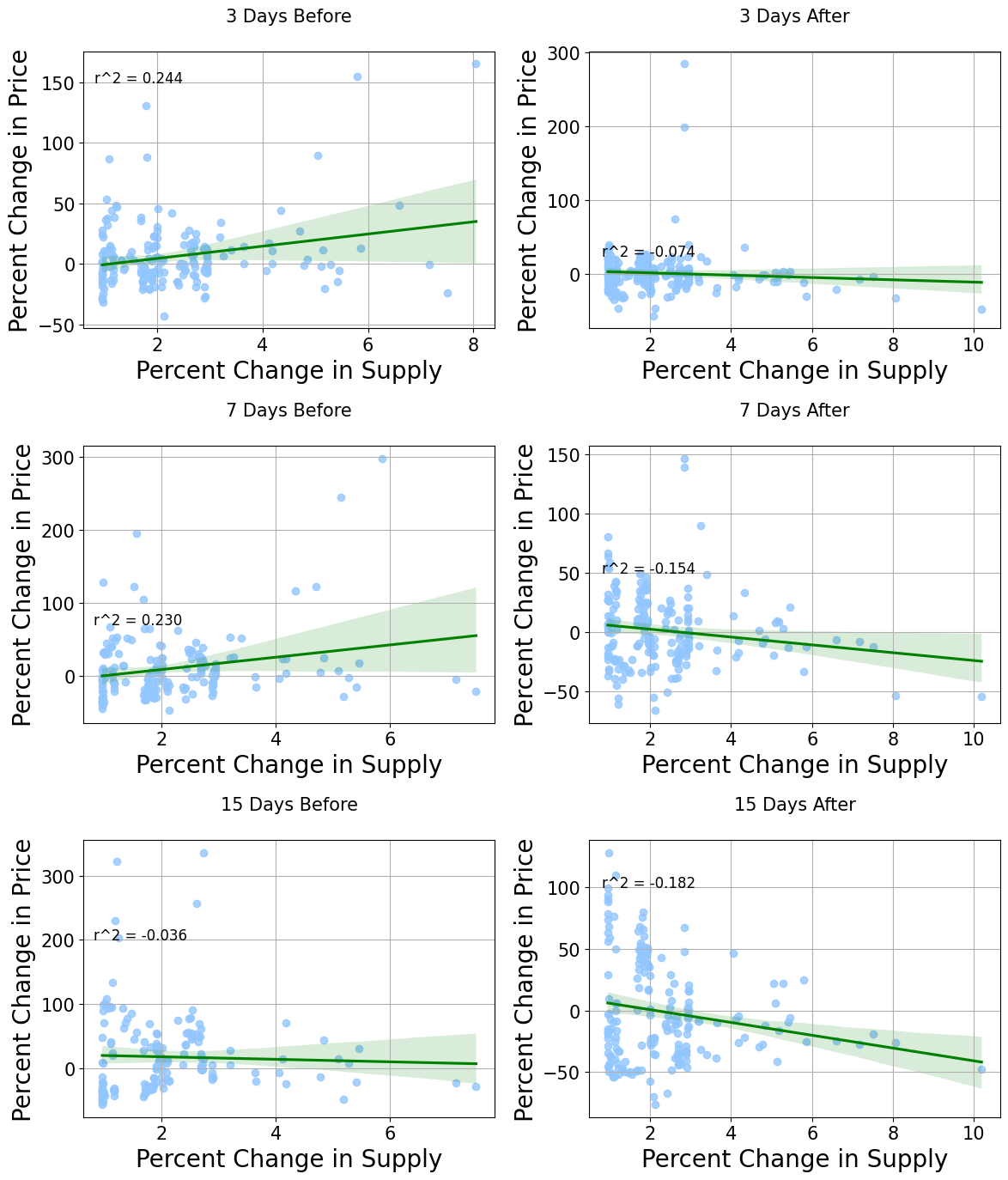

ข้อเสียที่ชัดเจนของการวิเคราะห์ในวันเดียวคือการขาดข้อมูลราคาก่อนและหลังการปลดล็อก เราถือว่ามีผลทั้งแบบไปข้างหน้าและแบบโต้ตอบเมื่อมีการปลดล็อกโทเค็น ซึ่งอาจใช้เวลาหลายวันหรือหลายสัปดาห์ในการแสดง ตัวอย่างเช่น ผู้ขายชอร์ตอาจเริ่มต้นตำแหน่งหนึ่งสัปดาห์ก่อนเหตุการณ์ปลดล็อคครั้งใหญ่ หรืออาจใช้เวลาหลายวันกว่าที่บุคคลภายในจะออกจากตำแหน่งเนื่องจากสภาพคล่องต่ำ ในการตรวจสอบสิ่งนี้ เราได้ทำการวิเคราะห์ความสัมพันธ์ที่คล้ายกันสำหรับกรอบเวลาที่ยาวขึ้น ซึ่งรวมถึง 3 วัน 1 สัปดาห์ และ 15 วันก่อนและหลังการปลดล็อก

สำหรับวันแรกของการปลดล็อก เราคำนวณการเปลี่ยนแปลงของราคาระหว่างวันที่ปลดล็อกและวันแรกของช่วงเวลาหน้าต่าง ดังนั้น ความหมายเชิงสัญลักษณ์ของความสัมพันธ์จึงกลับกัน ความสัมพันธ์เชิงบวกหมายถึงราคาที่สูงขึ้นก่อนที่จะปลดล็อก ความสัมพันธ์เชิงลบหมายถึงราคาที่ต่ำกว่า หากเราเชื่อว่าสัญชาตญาณของเราถูกต้อง เราก็คาดว่าจะเห็นความสัมพันธ์เชิงบวกในวันที่นำไปสู่การปลดล็อก เนื่องจากแรงขายที่คาดไว้จะนำไปสู่การลดราคาที่นำไปสู่การปลดล็อก อีกครั้ง เราควรเห็นความสัมพันธ์เชิงลบภายในสองสามวันหลังจากปลดล็อคเนื่องจากราคายังคงลดลง

ในทำนองเดียวกัน เราพบความสัมพันธ์เพียงเล็กน้อยระหว่างการปลดล็อก 0% และ 1% เส้นที่เหมาะสมที่สุดโดยทั่วไปจะแบนทั้งก่อนและหลังการปลดล็อค ซึ่งบ่งชี้ว่าสำหรับการปลดล็อคขนาดนี้ การวิเคราะห์ประเภทใดไม่แสดงผลกระทบต่อราคาอย่างต่อเนื่อง

และสำหรับการปลดล็อคที่มีมากกว่า 1% ของอุปทานหมุนเวียน เราได้รับความสัมพันธ์ดังต่อไปนี้:

มีข้อแม้เบื้องต้น เราขอย้ำว่าสาเหตุไม่สามารถพิสูจน์ได้โดยเด็ดขาด แต่ให้ใช้ผลลัพธ์เหล่านี้เป็นหลักฐานที่เป็นไปได้ของความสัมพันธ์สำหรับการพิจารณาและการศึกษาเพิ่มเติม นอกจากนี้ เราจำกัดการวิเคราะห์ความสัมพันธ์ไว้ที่กรอบเวลาสองสัปดาห์ เนื่องจากการวัดระยะยาวจะรวมปัจจัยที่ไม่รู้จักหรือวัดไม่ได้มากขึ้นเรื่อยๆ สุดท้ายนี้ อาจมีบางโทเค็นปลดล็อคทับซ้อนกันเมื่อหน้าต่างเวลาเพิ่มขึ้น แต่เราเชื่อว่าผลกระทบเหล่านี้จะน้อยที่สุด เมื่อคำนึงถึงคำเตือนเหล่านี้ ผลลัพธ์ของเราควรทำหน้าที่เป็นข้อบ่งชี้ที่เป็นประโยชน์และอิงตามหลักฐานว่าราคาโดยทั่วไปมีแนวโน้มที่จะปลดล็อกราคาไม่ทางใดก็ทางหนึ่ง

เมื่อมองแวบแรก ผลลัพธ์เหล่านี้ดูเหมือนจะสนับสนุนสมมติฐานของเรา โดยปกติแล้วความสัมพันธ์เชิงบวกจะเกิดขึ้นก่อนการปลดล็อก ซึ่งบ่งชี้ถึงราคาที่สูงขึ้นก่อนการปลดล็อก หลังจากการปลดล็อกเกิดขึ้น เราจะเห็นความสัมพันธ์เชิงลบซึ่งบ่งชี้ว่าราคาลดลง

ในกรอบเวลา 3 วันและ 7 วันก่อนการปลดล็อกจะเกิดขึ้น เราเห็นความสัมพันธ์ที่ค่อนข้างชัดเจนระหว่างราคาและขนาดการปลดล็อก (24% และ 23%) นอกจากนี้ ความสัมพันธ์คือ -7% และ -15% ในช่วงระยะเวลา 3 วันและ 7 วันหลังการปลดล็อก สิ่งนี้บ่งชี้ว่าแรงกดดันด้านราคาจะรุนแรงขึ้นจนถึงหนึ่งสัปดาห์ก่อนที่จะมีการปลดล็อก ซึ่งน่าจะเกิดจากการคาดหมายของเหตุการณ์การปลดล็อกที่ทราบกันทั่วไป ในทางกลับกัน ข้อมูลของเราเข้าใกล้เส้นถดถอยมากขึ้นภายในสองสามวันหลังจากปลดล็อก ซึ่งบ่งชี้ถึงความเชื่อมั่นในผลลัพธ์นี้มากขึ้น

ชื่อเรื่องรอง

การวิเคราะห์แบบจำลอง

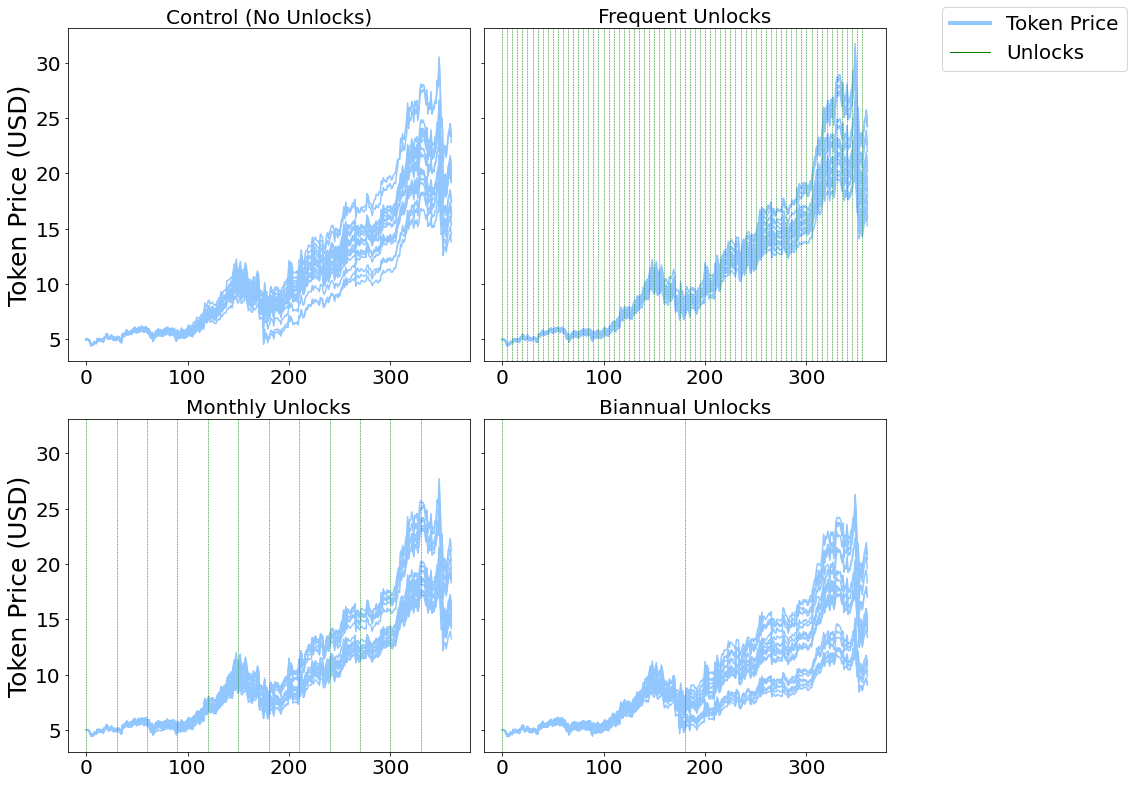

เราไม่สามารถอาศัยข้อมูลเชิงประจักษ์ในการวิเคราะห์ระยะยาวได้ เนื่องจากมีปัจจัยภายนอกมากมายในช่วงเวลาที่นานเกินไป อย่างไรก็ตาม เราสามารถใช้ Agent Based Models* ซึ่งเป็นระบบปิดที่มีตัวแปรแยกกัน เพื่อทำความเข้าใจผลกระทบระยะยาว

(หมายเหตุประกอบ Deep Chao: วิธีที่ใช้ในการจำลองการกระทำและการโต้ตอบของตัวแทนอิสระ (บุคคลอิสระหรือกลุ่มทั่วไป เช่น องค์กรและทีม)แบบจำลองการคำนวณ, ประเมินบทบาทของตัวแทนในระบบโดยรวมด้วยการแสดงภาพ)

เราจำลองสถานการณ์ที่แตกต่างกันสามสถานการณ์และกลุ่มควบคุม ในกลุ่มควบคุมไม่มีการแจกจ่ายโทเค็นให้กับนักลงทุนสถาบัน จากนั้น เราแนะนำสถาบันที่ถือครองโทเค็น 8% สำหรับการทดลองของเรา: โทเค็นจะปลดล็อกวันเว้นวัน ทุกเดือน และทุก 6 เดือน

โดยรวมแล้ว เราพบผลลัพธ์ที่คล้ายกันกับผลลัพธ์เชิงประจักษ์ ซึ่งบ่งชี้ว่าการปลดล็อกที่ใหญ่ขึ้นทำให้ราคาโทเค็นลดลงมากขึ้นและยาวนานขึ้น ในกรอบเวลาที่ยาวขึ้น เราเห็นความแปรปรวนและความผันแปรที่มากขึ้นเมื่อขนาดการปลดล็อกเพิ่มขึ้น

สรุปความสัมพันธ์

ชื่อระดับแรก

ช่วงปลดล็อค

สมมติฐานอื่นที่เรามีคือผู้รับโทเค็นบางรายอาจขายหลังจากได้รับโทเค็น ซึ่งหมายความว่าโทเค็นที่ปลดล็อคก่อนกำหนดอาจมีอัตราสภาพคล่องต่ำกว่าโทเค็นส่วนใหญ่ที่ได้รับหรือปลดล็อคอย่างสมบูรณ์ มีแรงกดดันในการขายที่มากขึ้นและต่อเนื่องใน สภาพแวดล้อมทางเพศ

ในการประเมินสิ่งนี้ เราแบ่งชุดข้อมูลออกเป็นสองส่วน: ส่วนใหญ่ปลดล็อค (>= 70% ปลดล็อค) และส่วนใหญ่ล็อค (<70% ปลดล็อค) มี 9 โทเค็นที่ส่วนใหญ่ถูกปลดล็อกและ 11 โทเค็นที่ส่วนใหญ่ถูกล็อก

ควรสังเกตว่าเหรียญเหล่านี้จัดอยู่ในหมวดหมู่เหล่านี้ ณ เวลาที่ตีพิมพ์ ดังนั้นเราจึงตรวจสอบช่วงเวลาล่าสุดเพื่อประเมินว่าเหรียญเหล่านี้มีการดำเนินการอย่างไรในแง่ของเปอร์เซ็นต์สถานะที่ได้รับสิทธิในปัจจุบัน เราดูรอบ 4 เดือนตั้งแต่วันที่ 15 มกราคมถึง 15 เมษายนของปีนี้ ในการวัดประสิทธิภาพ เรามุ่งเน้นไปที่สองเมตริก

หมายถึงความแปรปรวน แทนที่จะใช้ค่าความแปรปรวนหรือส่วนเบี่ยงเบนมาตรฐาน เราใช้ค่าสัมประสิทธิ์ของการแปรผัน ซึ่งเป็นการวัดค่าส่วนเบี่ยงเบนมาตรฐานหารด้วยค่าเฉลี่ย ซึ่งช่วยให้สามารถเปรียบเทียบความผันผวนระหว่างสินทรัพย์ต่างๆ ได้โดยตรง โดยไม่ถูกบิดเบือนจากการเปลี่ยนแปลงของราคาโทเค็น โดยพื้นฐานแล้ว เราจะวัดความแตกต่างและความผันผวนที่เกิดขึ้นในราคาของโทเค็นในช่วงเวลาหนึ่ง

การเปลี่ยนแปลงราคาเฉลี่ย เปอร์เซ็นต์การเปลี่ยนแปลงของราคาตั้งแต่ต้นจนจบช่วงเวลา เราใช้เมตริกนี้เพื่อทำความเข้าใจว่าโทเค็นทำงานอย่างไรเมื่อเทียบกับตลาด

หลังจากใช้ตัวชี้วัดเดียวกันบน Bitcoin และ Ethereum เราก็ได้ผลลัพธ์ดังต่อไปนี้:

ชื่อระดับแรก

การกระจายโทเค็น

จากสถิติรวมของเราแสดงให้เห็นว่าการกระจายโทเค็นโดยเฉลี่ยอยู่ที่ 63% ของสาธารณะและ 37% ของเอกชน อีกครั้ง เราแบ่ง 20 โทเค็นออกเป็นสองส่วน: "การจัดสรรสาธารณะมากขึ้น" (8 โทเค็น) และ "การจัดสรรส่วนตัวมากขึ้น" (12 โทเค็น) และวิเคราะห์ด้วยวิธีที่คล้ายกับข้างต้น

สมมติฐานของเราคือโทเค็นที่มีการจัดสรรการขายแบบส่วนตัวมากขึ้นจะประสบกับความผันผวนที่มากขึ้น เนื่องจากสามารถสร้างเรื่องเล่าเกี่ยวกับการปลดล็อกการขายแบบส่วนตัวจำนวนมาก โดยเฉพาะอย่างยิ่งการเทขายจาก "คนวงใน" หลังจากทำการวิเคราะห์แบบเดียวกัน เราได้ข้อสรุปดังต่อไปนี้:

15 มกราคม - 15 เมษายน 2566

1 ตุลาคม 2565 ถึง 1 มกราคม 2566

สรุป

สรุป

โดยรวมแล้ว ผลการศึกษาแบบจำลองของเราแสดงข้อสรุปที่คล้ายคลึงกันกับข้อสรุปเชิงประจักษ์ จำนวนที่ปลดล็อคมากกว่า 1% ของอุปทานหมุนเวียนจะส่งผลให้เกิดความสัมพันธ์เชิงลบระหว่างขนาดที่ปลดล็อคและราคา ที่น่าสนใจคือ สำหรับการปลดล็อกที่มีขนาดเล็กลง ผลกระทบแทบจะไม่มีเลย นอกจากนี้ เรายังพบว่าโปรโตคอลที่มีโทเค็นส่วนใหญ่ที่ปลดล็อกแล้วนั้นใกล้เคียงกับตลาดมากขึ้นและมีประสิทธิภาพดีกว่าโทเค็นที่อยู่ในรอบการปลดล็อกก่อนหน้านี้ สุดท้าย โทเค็นที่มีสัดส่วนการจัดสรรในวงจำกัดที่สูงกว่าจะมีความผันผวนต่ำกว่าเล็กน้อยและประสิทธิภาพด้านราคาที่ดีกว่า

ผลลัพธ์เหล่านี้ให้ข้อสรุปบางประการสำหรับผู้ก่อตั้งโครงการ

กฎ 1%:ผู้ก่อตั้งที่ต้องการลดความผันผวนของราคาโทเค็นควรปลดล็อกโทเค็นน้อยลงเมื่อเทียบกับอุปทานหมุนเวียน ข้อมูลของเราชี้ให้เห็นว่าการปลดล็อกน้อยกว่า 1% ของอุปทานไม่เกี่ยวข้องกับผลกระทบด้านราคา หมายความว่าการปลดล็อกเป็นบล็อก กำหนดการรายวันหรือรายสัปดาห์อาจเป็นที่นิยมมากกว่ากิจกรรมการปลดล็อกรายไตรมาสและประจำปี ข้อได้เปรียบที่สำคัญอีกประการหนึ่งของการปลดล็อกที่มีขนาดเล็กและบ่อยกว่าคือแรงขายพื้นฐานจะกระจายอย่างเท่าเทียมกันมากกว่าที่จะกระจุกตัวที่เหตุการณ์ขนาดใหญ่

พิจารณาการจัดสรรใหม่:เราสังเกตว่าการลดลงของราคานั้นเด่นชัดที่สุดก่อนการกระจายโทเค็นขนาดใหญ่ ในบางกรณี ส่งผลให้ราคาลดลง 20% ซึ่งต้องใช้เวลาถึง 2 เดือนในการกู้คืน การลดการกระจายของกิจกรรมขนาดใหญ่ช่วยขจัดการเสริมแรงของเรื่องราวเชิงลบและแนวทางการซื้อขายที่ใช้เลเวอเรจที่ไม่ดีต่อสุขภาพ ผู้ก่อตั้งควรพิจารณาความเป็นไปได้ในการปลดล็อกโทเค็นมูลค่าหนึ่งปี แทนที่จะทำให้การกระจายขนาดใหญ่เป็นการออกแบบโทเค็นเริ่มต้น ทีมงานในสหรัฐอเมริกาอาจต้องเลื่อนการปลดล็อกออกไป 1 ปีเพื่อรักษาการปฏิบัติตามกฎระเบียบที่มีอยู่ เพื่อให้บรรลุเป้าหมายนี้ ทีมสามารถเริ่มปลดล็อกโทเค็นหลังจากหนึ่งปี แทนที่จะปลดล็อกโทเค็นมูลค่าหนึ่งปีในเหตุการณ์เดียว

ลิงค์ต้นฉบับ