การอภิปรายเชิงลึกเกี่ยวกับ Blur และโอกาสในการลงทุนที่อาจเกิดขึ้น

ผู้แต่ง: Jessica Shen ผู้จัดการฝ่ายการลงทุน Mint Ventures

บทความนี้กล่าวถึงโอกาสและความท้าทายในปัจจุบันของ Blur ก่อน จากนั้นจะกล่าวถึงสิ่งที่เราสามารถเรียนรู้จาก Blur จากมุมมองของการเป็นผู้ประกอบการและการลงทุนของ Web3.0 เจาะลึกรายละเอียดของโครงการ และสุดท้ายจะกล่าวถึงโอกาสการลงทุนที่เป็นไปได้เกี่ยวกับ Blur

ความท้าทายและโอกาสของ Blur

ท้าทาย

ท้าทาย

1. ขาดนวัตกรรมทางเทคโนโลยีพื้นฐานในการปรับปรุงสภาพคล่อง

ในระดับหนึ่ง Blur ใช้โมเดลโทเค็นเพื่อกระตุ้นสภาพคล่อง แต่ขาดนวัตกรรมที่ก่อกวนของเทคโนโลยีพื้นฐาน และมีความเป็นไปได้ในระยะยาวที่จะถูกลอกเลียนแบบหรือถูกคู่แข่งแซงหน้า ปัจจุบัน ข้อได้เปรียบของ Blur อยู่ที่ข้อมูลเชิงลึกของผลิตภัณฑ์เกี่ยวกับความต้องการที่แท้จริงของผู้ใช้และได้เปิดตัวผลิตภัณฑ์ที่สะดวก ใช้งานง่าย และใช้งานง่ายสำหรับผู้ใช้ แต่ปัญหาสภาพคล่องของ NFT ยังไม่ได้รับการแก้ไขในระยะยาว หากคู่แข่งเปิดตัวโมเดลด้วยสิ่งจูงใจโทเค็นที่สูงขึ้นตาม Blur ด้วยความเร็วที่เร็วขึ้น UI ที่ใช้งานง่ายขึ้น และผลิตภัณฑ์ระดับมืออาชีพมากขึ้น เราอาจเห็นการแข่งขันระหว่าง SushiSwap และ Uniswap ในตอนนั้น

เมื่อเร็ว ๆ นี้ Gem V2 ยังอยู่ในขั้นตอนการทดสอบภายใน หลังจากได้สัมผัสกับผลิตภัณฑ์แล้ว ผู้เขียนรู้สึกว่ารายละเอียดของผลิตภัณฑ์ได้รับการปรับให้เหมาะสมตาม Blur แม้ว่าจะไม่มีความแน่นอนว่า Gem จะออกเหรียญในอนาคตหรือไม่จากมุมมองของผลิตภัณฑ์ การอัปเดตของ Gem V2 สามารถแข่งขันกับ Blur ได้แล้วในแง่ของความเร็วในการรีเฟรชข้อมูล, การแสดงผลที่ใช้งานง่ายและฟังก์ชั่นข้อเสนอ ราคาขอ "เวลาจำกัด" ฟังก์ชั่นขอราคาสำหรับคุณสมบัติบางอย่าง ความต้องการฟีเจอร์การขอราคาฟังก์ชั่นนั้นแน่นอนมาก ๆ ผู้ใช้หลายคนที่ต้องการซื้อ Otherdeed กับ Koda ได้ร้องขอฟังก์ชั่นที่คล้ายกันซ้ำ ๆ สำหรับ Blur และ Gem V2 ได้เปิดตัวล่วงหน้าแล้ว

คูเมืองของผลิตภัณฑ์ Web3.0 เป็นคำถามที่นักลงทุนและโครงการจำนวนมากกำลังคิดอยู่ คูเมืองปัจจุบันของ Blur ไม่สามารถกล่าวได้ว่าเป็นผลิตภัณฑ์หรือรูปแบบโทเค็น ความเหนียวแน่นของผู้ใช้ Web3.0 เป็นความท้าทายที่ยิ่งใหญ่สำหรับผลิตภัณฑ์หลาย ๆ ตัว ในสภาพแวดล้อมแบบ open source code การโจมตีของแวมไพร์เป็นสนามที่วางทุ่นระเบิดที่อาจระเบิดได้ทุกเมื่อ ในทางกลับกัน โปรโตคอล Web3.0 บางตัวที่สามารถข้ามระหว่างขาขึ้นและขาลงได้ เช่น Curve, Uniswap, Aave, Compound เป็นต้น นอกเหนือจากผลิตภัณฑ์ที่ตอบสนองความต้องการของตลาดแล้ว ยังมีโมเดลโทเค็นที่เสถียร ทีมงานที่ก้าวหน้า ระบบนิเวศน์ที่ขยายตัวอย่างต่อเนื่อง และความไว้วางใจที่ปลอดภัยต่อโปรโตคอลของผู้ใช้มีบทบาทสำคัญในการรักษาโปรโตคอลเหล่านี้ในตลาดในระยะยาว การที่ Blur จะสามารถรวมเอาปัจจัยแห่งความสำเร็จที่กล่าวมาข้างต้นในทุกด้านได้หรือไม่นั้นยังคงต้องผ่านการทดสอบของเวลา เฉพาะการปรับปรุง UI และโมเดลโทเค็นเท่านั้นและเป็นการยากที่จะกำจัด Blur ของรุ่นเครื่องพิมพ์เงิน นอกจากนี้ ยังจำเป็นต้องแตะนวัตกรรมด้านเทคโนโลยีหรือเลเยอร์โปรโตคอลเพิ่มเติมเพื่อสร้างคูน้ำพื้นฐานเพื่อรักษา ตำแหน่งที่โดดเด่นในระยะยาว

2. มีความเสี่ยงที่จะสูญเสียผู้ใช้และปริมาณการซื้อขายในการปรับพารามิเตอร์ในอนาคต

ค่าธรรมเนียมการทำธุรกรรมปัจจุบันคือ 0% ค่าลิขสิทธิ์ขั้นต่ำคือ 0.5% และค่าลิขสิทธิ์จะถูกบังคับใช้สำหรับ NFT บางตัวเท่านั้น กฎนี้เป็นกลยุทธ์ Go-To-Market ในระยะสั้น ในระยะยาว เป็นไปไม่ได้ที่โปรโตคอลจะคงค่าธรรมเนียมการทำธุรกรรมไว้ที่ 0% ในอนาคต หาก Blur ต้องการสนับสนุนผู้สร้าง NFT และชุมชนต่างๆ มากขึ้น ค่าลิขสิทธิ์ที่ยืดหยุ่นได้ นโยบายอาจมีการปรับเปลี่ยนในอนาคต การปรับเปลี่ยนเหล่านี้โดยพื้นฐานจะเพิ่มต้นทุนของเทรดเดอร์และเพิ่มแรงเสียดทานของตลาด NFT เมื่อต้นทุนเพิ่มขึ้นและสิ่งจูงใจโทเค็นของ Blur หายไป ผู้ใช้จะยังคงโหวตด้วยเท้าของพวกเขาเองเพื่อเลือกตลาดการซื้อขายที่มีต้นทุนต่ำกว่า Blur ไม่ว่าจะเป็นความได้เปรียบด้านต้นทุนในขณะนั้น เวลาที่ยังคงมีอยู่มีความสำคัญอย่างยิ่งต่อตำแหน่งการแข่งขัน

3. การเปลี่ยนแปลงในแนวการแข่งขันหลังจากการให้เงินสนับสนุนโทเค็นสิ้นสุดลง

โครงการ Web3.0 จำนวนมากต้องเผชิญกับการออกโทเค็นอย่างจำกัดและวันที่จะมีการแจกจ่ายเงินอุดหนุนในที่สุดหากรูปแบบเครื่องพิมพ์เงินยังคงดำเนินต่อไปจะทำให้เกิดแรงขายจำนวนมากต่อโทเค็น Blur จะมีจุดสิ้นสุดของการกระจาย airdrop หากการออกแบบโปรโตคอลและรูปแบบโทเค็นรักษาสถานะที่เป็นอยู่ก็คาดว่าสภาพคล่องจะลดลงอย่างมากในเวลานั้นและตลาดจะตั้งคำถามว่า Blur สามารถแข่งขันกับ OpenSea ได้หรือไม่ ซึ่งจะส่งผลลบต่อความคาดหวังและการประเมินมูลค่า ผลกระทบลดลง ความยั่งยืนของรูปแบบการอุดหนุนโทเค็นจะเป็นหนึ่งในจุดเสี่ยงที่อาจเกิดขึ้นกับ Blur

4. ความคาดหวังของ Airdrop สำหรับไตรมาสที่สองนั้นสูงเกินไป

การลดลงของโทเค็นในไตรมาสแรกทำให้ผู้เล่น NFT จำนวนมากได้รับผลตอบแทนที่สูงมาก ความเชื่อมั่นของตลาดที่สูงเอื้อต่อความเชื่อมั่นของตลาดในโครงการ ซึ่งจะสะท้อนโดยตรงในราคาโทเค็น อย่างไรก็ตาม เราพบว่าการจัดสรรโทเค็น airdrops ทั้งหมดในไตรมาสที่สองมีเพียง 10% ซึ่งน้อยกว่า 12% ในไตรมาสแรก และคาดว่าจะมีผู้ใช้จำนวนมากขึ้นที่จะเข้าร่วมในกิจกรรม "airdrop" รวมถึงทองคำระดับมืออาชีพจำนวนมาก การสร้างสตูดิโอ ตามเอกสาร Token economics อย่างเป็นทางการ สรุปได้ว่า การปลดล็อคโทเค็น airdrop (10% ของจำนวนทั้งหมด) ในไตรมาสที่สองจะเสร็จสิ้นในไตรมาสที่สี่ของปี 2023 (ข้อมูลการปลดล็อคและ airdrop ที่เฉพาะเจาะจงคือ ตามประกาศของทางราชการ)

. ในกรณีที่มีพระสงฆ์มากเกินไปและโจ๊กน้อยเกินไป ผู้ใช้อาจรู้สึกถึงช่องว่างระหว่างความเป็นจริงกับความคาดหวังเมื่อมีการปล่อยหยดอากาศในไตรมาสที่สอง ในขณะเดียวกัน หากราคาโทเค็นแสดงแนวโน้มขาลงภายใต้การคาดการณ์ของ airdrops จำนวนมาก อาจนำมาซึ่งความรู้สึก FUD ของตลาดที่มากขึ้น เพิ่มความรู้สึกของช่องว่างทางอารมณ์ และทำให้ผู้ใช้และผู้ถือโทเค็นสั่นคลอนความเชื่อมั่นใน โครงการ.

5. ความสามารถในการจับค่าโทเค็นอ่อนแอ

แผนที่เส้นทางแผนที่เส้นทางโอกาส

โอกาส

1. การปรับปรุงตลาดมหภาคและตลาด NFT

มูลค่าตลาดและปริมาณการซื้อขายของ NFT นั้นมุ่งเน้นไปที่ Ethereum ซึ่งมีความสัมพันธ์อย่างมากกับสถานการณ์ของตลาด Ethereum และแนวโน้มโดยรวมของตลาดสกุลเงินดิจิทัล ในขณะที่ตลาด cryptocurrency ปรับปรุงอย่างต่อเนื่อง ตลาด NFT คาดว่าจะดีขึ้น แม้ว่าตลาดจะยังคงผันผวนและถึงจุดต่ำสุดก่อนที่ตลาดกระทิงรอบถัดไปจะมาถึง แต่ตลาด NFT ก็ประสบกับการลดลงอย่างรวดเร็วหลายครั้งในปี 2022 พลังของโครงการ blue-chip NFT นั้นแข็งแกร่งขึ้นหลังจากวิกฤตต่างๆ Yuga Labs และอื่น ๆ ปาร์ตี้โครงการ blue-chip กิจกรรมใหม่ ๆ และความคาดหวังใหม่ ๆ ที่นำมาสู่ชุมชนก็คาดว่าจะนำเรื่องเล่าใหม่ ๆ มาสู่อุตสาหกรรมต่อไป

NFTGo เข้ามาแล้ว《NFT Annual Report 2023 》ตามที่กล่าวไว้ในปี 2022 จำนวนผู้ค้า NFT ทั้งหมดบน Ethereum ตลอดทั้งปีคือ 1.87 ล้าน ในขณะที่ข้อมูล Dune@sixdegree แสดงให้เห็นว่าจำนวนที่อยู่ที่ใช้งานบน Ethereum จะสูงถึง 48.16 ล้านในปี 2022 ซึ่งมากกว่า 25 เท่าของจำนวน ของเทรดเดอร์ NFT ในช่วงตลาดหมี การลดลงของ Blur และการออกเหรียญทำให้ผู้ใช้จำนวนมากที่อยู่นอกแวดวง NFT เต็มใจที่จะเข้าร่วมในการซื้อขายและโฆษณาของ NFT Blur ยังได้รับความสนใจอย่างมากในช่วงแรกของโครงการ หาก Blur รักษาตำแหน่งผู้นำในอุตสาหกรรมด้วยการมาถึงของตลาดกระทิง จุดสูงสุดในตลาดการซื้อขาย NFT จะทำให้การประเมินมูลค่าเพิ่มขึ้น อาจนำมาซึ่งการเพิ่มราคาของ $BLUR ช่องว่างสำหรับการปรับปรุงเพิ่มเติม

2. ความได้เปรียบทางการแข่งขันของเส้นทางเอื้อต่อการขยายธุรกิจในแนวราบ

ตั้งแต่ Blur เปิดตัวเมื่อปลายเดือนตุลาคมที่ผ่านมาปริมาณการซื้อขายสะสมมีอยู่

มีอยู่แผนภาพเบลอในบทความ ผู้เขียนตีความความคิดของ Blur เกี่ยวกับธุรกรรมภาคสนาม ERC 1155 การเปิดสวิตช์ค่าธรรมเนียม (F-Switch) และการขยายโครงการสภาพคล่อง (Liquidity Project) แผนงานที่ "คลุมเครือ" ดูเหมือนจะบ่งบอกเป็นนัยว่า Blur จะขยายต่อไป ในอนาคต การขยายตัวในแนวนอนของธุรกิจในระบบนิเวศ NFT ทำให้เห็นความทะเยอทะยานของ Blur ที่จะกลายเป็นโครงสร้างพื้นฐาน NFT แบบครบวงจร (เฉพาะการตีความแผนงานของ Blur เท่านั้นที่ไม่ได้แสดงถึงแนวคิดอย่างเป็นทางการของโครงการ) นอกจากนี้ยังมีแบบฟอร์มใบสมัครสำหรับ NFT API บนเว็บไซต์อย่างเป็นทางการ โปรโตคอลและผลิตภัณฑ์ NFT จำนวนมากกำลังรอให้ Blur เปิดพอร์ต API เพื่อให้ใบเสนอราคา NFT แม่นยำยิ่งขึ้นและสภาพคล่องของธุรกรรมและการหักบัญชีดีขึ้น

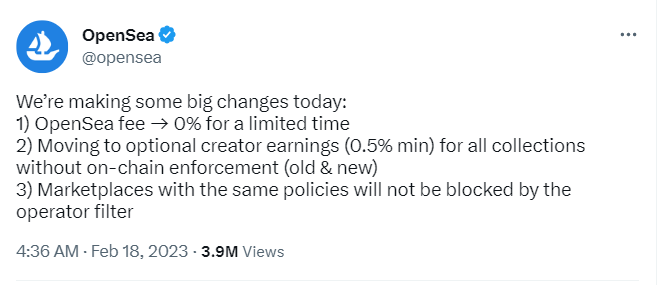

เมื่อเร็วๆ นี้ OpenSea ได้ลดค่าธรรมเนียมการทำธุรกรรมและเปลี่ยนกฎสำหรับค่าสิทธิที่ยืดหยุ่น ทำให้ตลาดมีความเชื่อมั่นมากขึ้นเกี่ยวกับภัยคุกคาม Blur ที่มีต่อ OpenSea จากการเปรียบเทียบในแนวนอนระหว่างทั้งสอง OpenSea คล้ายกับ "ซูเปอร์มาร์เก็ตขนาดใหญ่ NFT แบบหลายเครือข่าย" โดยเน้นที่การออก NFT ระดับแรกและการแสดง NFT ประเภทต่างๆ เหมาะสำหรับเป็นจุดแรก สำหรับมือใหม่ NFT Xiaobai เพื่อเข้าสู่ระบบ NFT ในขณะที่ Blur อยู่ในตำแหน่ง "NFT Professional Trading Tools" ที่เน้นการซื้อขายระดับมืออาชีพและเหมาะสำหรับตลาดของผู้เล่นมืออาชีพ เช่น ทหารผ่านศึก NFT, ปลาวาฬยักษ์ และผู้ดูแลสภาพคล่อง การวางตำแหน่งของทั้งสองแตกต่างกัน ซึ่งนำไปสู่ความจริงที่ว่า OpenSea ยังคงมีผู้ค้าจำนวนมากที่สุด แต่สัดส่วนโดยรวมของปริมาณการซื้อขายรองของ NFT นั้นสูงกว่า หลังจากการออกอากาศของ Blur ในไตรมาสที่สองสิ้นสุดลง ปริมาณการซื้อขายและจำนวนผู้ค้าของทั้งสองบริษัทยังคงต้องได้รับการติดตามอย่างต่อเนื่อง ซึ่งจะเป็นตัวบ่งชี้ที่สำคัญของแนวการแข่งขัน

3. มีการเติบโตทางธุรกิจที่หลากหลายและความเป็นไปได้ในการเพิ่มมูลค่าของโทเค็นในรูปแบบเศรษฐศาสตร์ของโทเค็น

โดยพื้นฐานแล้ว ข้อแตกต่างที่ใหญ่ที่สุดระหว่าง Blur และ OpenSea คือ Blur เป็นตลาดซื้อขาย NFT ที่มีระบบเศรษฐกิจโทเค็นในตัว Chris Dixon (หุ้นส่วน a16z) และ Fred Ehrsam (ผู้ก่อตั้ง Paradigm) กล่าวในการให้สัมภาษณ์ในปี 2560 ว่าโทเค็นเป็นทางออกทั่วไปสำหรับปัญหาการขยายตัวของ (บริษัทแพลตฟอร์มอินเทอร์เน็ต) เมื่อแพลตฟอร์มเครือข่ายใหม่ไม่เพียงพอเมื่อมีจำนวนมาก มูลค่าเครือข่าย ใช้สิ่งจูงใจทางการเงินเพื่อดึงดูดผู้ใช้เริ่มต้น จากนั้นมูลค่าของคุณสมบัตินี้จะค่อยๆ แคบลงเนื่องจากมูลค่าเครือข่ายเพิ่มขึ้นทีละน้อย นี่คือเหตุผลที่ Blur สามารถแซงโค้งได้ในเวลาอันสั้นและเทียบเท่ากับ OpenSea ตลาดการซื้อขาย NFT ที่มีโมเดลโทเค็นในตัวช่วยให้ผู้เข้าร่วมแต่ละราย (ทีมผู้ก่อตั้ง ชุมชน NFT ผู้ใช้ ผู้สร้างตลาด ฯลฯ) สามารถรับสิ่งจูงใจได้โดยตรงบนแพลตฟอร์มนี้ และแบ่งปันเงินปันผลจากผลกระทบเครือข่ายที่เกิดขึ้นหลังจากสร้างผลิตภัณฑ์ร่วมกัน ในอนาคต แรงจูงใจในการปล่อยโทเค็นทิ้งและชุมชนจะยังคงดำเนินต่อไปอีกระยะหนึ่ง การสะสมข้อมูลผู้ใช้และเอฟเฟกต์เครือข่ายอย่างค่อยเป็นค่อยไปของ Blur จะเพิ่มความเชื่อมั่นของชุมชนในผลิตภัณฑ์และพฤติกรรมของผู้ใช้ ดังนั้นจึงสร้างวงจรเชิงบวกต่อไป

จากมุมมองในระดับจุลภาค เอกสารโทเค็นเศรษฐศาสตร์อย่างง่ายที่เผยแพร่โดย $BLUR ทำให้มีตัวเลือกที่เปิดกว้างมากมายสำหรับการกำกับดูแลแบบกระจายอำนาจของชุมชน NFT ในบรรดากลไกการกำกับดูแล Blur เป็นผู้กำหนดสามคณะกรรมการผู้สร้าง

ผู้สร้าง@PacmanBlurในการสัมภาษณ์ ฉันได้พูดถึงการคิดเกี่ยวกับการจับมูลค่าของโทเค็น การอภิปรายเกิดขึ้นในตลาดเกี่ยวกับโปรโตคอล Blur ที่ใช้โมเดล Voting Escrow เพื่อการเก็บมูลค่าที่มากขึ้น นอกจากนี้ เรายังได้เรียนรู้ว่า Blur ตั้งใจที่จะพัฒนาไปสู่โมเดล veToken (แต่เฉพาะเจาะจง ไม่ทราบความคืบหน้า) ในอนาคต หากมูลค่าของโทเค็นเป็นรายได้ของข้อตกลง และข้อตกลงยังคงรักษาตำแหน่งผู้นำในตลาดการซื้อขาย ดังนั้นการประเมินมูลค่าของโทเค็นจะมีพื้นที่และโมเมนตัมสำหรับการเติบโตมากขึ้น

ชื่อเรื่องรอง

Web3.0 ผู้ประกอบการ

รายละเอียดมากมายของการออกแบบผลิตภัณฑ์สะท้อนให้เห็นถึงความเข้าใจอย่างลึกซึ้งของทีมงานเกี่ยวกับปัญหาของตลาด NFT และความเข้าใจที่ชัดเจนเกี่ยวกับความต้องการของผู้ใช้ การออกแบบผลิตภัณฑ์ที่รอบคอบของ Blur ได้ดึงดูดผู้ค้า NFT และผู้ใช้ปลาวาฬยักษ์เป็นจำนวนมาก รูปแบบสิ่งจูงใจทางการตลาดที่ถูกต้องและความคาดหวังของ airdrop สำหรับสภาพคล่องของ NFT ได้เน้นความสนใจของผู้ใช้ Crypto จำนวนมากในฟิลด์ที่ไม่ใช่ NFT ความคาดหวังของ airdrop อย่างต่อเนื่องและ การอัปเดตการทำงาน แสดงให้เห็นถึงความทะเยอทะยานของ Blur อย่างต่อเนื่องที่จะ "เปลี่ยนพฤติกรรมของผู้ใช้" และล้มล้างแพลตฟอร์มแบบรวมศูนย์ของ OpenSea

1. เข้าใจความต้องการของตลาดอย่างชัดเจนและสร้างผลิตภัณฑ์ที่แก้ปัญหาความเจ็บปวดของตลาดได้อย่างแท้จริง

Blur เปิดตัวอย่างเป็นทางการเมื่อวันที่ 19 ตุลาคม 2022 และได้รับคำวิจารณ์อย่างล้นหลามตั้งแต่นั้นมา นอกเหนือจากตลาดการค้าอื่นๆ แล้ว ผู้รวบรวมยังมีการคาดการณ์แบบ airdrop กลไกการขุด และอื่นๆ คุณลักษณะหลักของผลิตภัณฑ์ Blur คือความเร็ว ค่าธรรมเนียมการทำธุรกรรม 0% (ซึ่งอาจเพิ่มขึ้นในภายหลัง) และฟังก์ชันการประมูลแบบสะสม (Collection Bidding)รายละเอียดการทำงานที่เรียบง่ายอย่างยิ่งได้ยกระดับประสิทธิภาพของตลาดการซื้อขาย NFT ไปสู่ระดับที่สูงขึ้นในระดับผลิตภัณฑ์ การผสมผสานระหว่างรายละเอียดผลิตภัณฑ์ที่หลากหลายของ Blur และกลยุทธ์การดำเนินงานแบบ Go-To-Market ในช่วงแรกทำให้ดูเหมือนว่าฝ่ายตรงข้ามไม่เคยเข้าใจผู้ใช้และตลาดอย่างแท้จริง

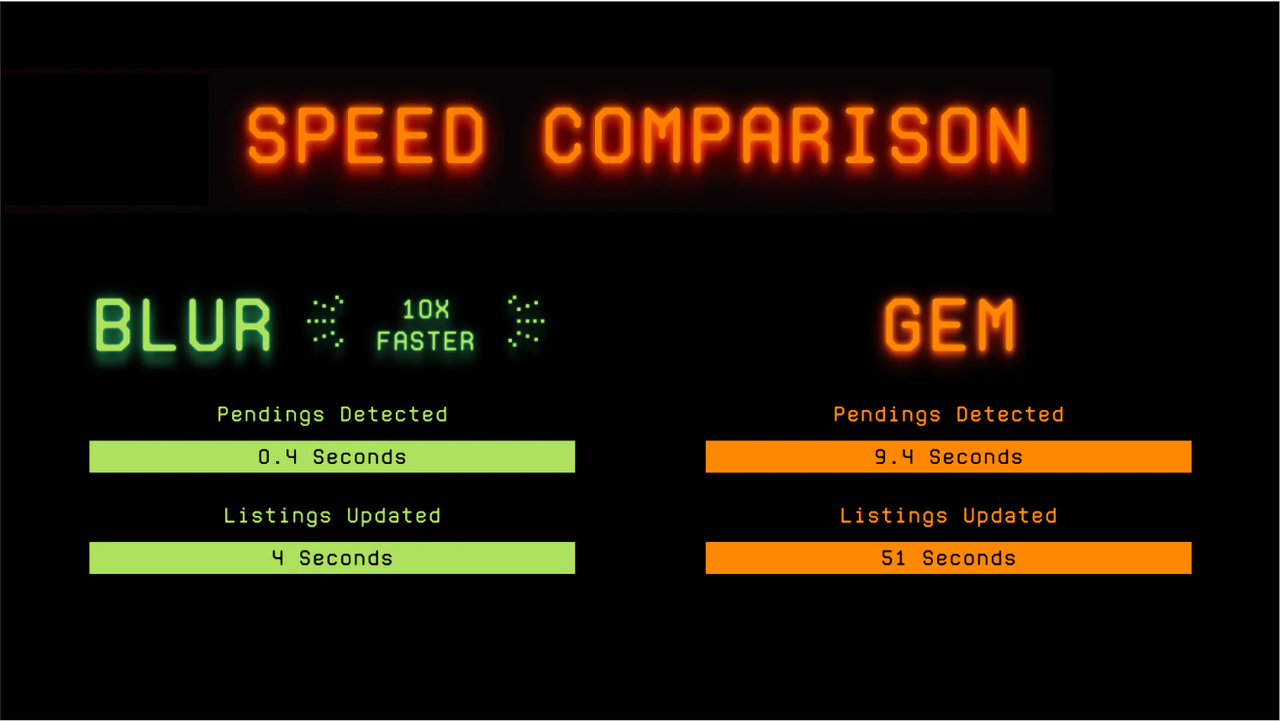

ความเร็วคำอธิบายภาพ

ที่มาของภาพ:Blur Mirror

ฟังก์ชันที่ดูเหมือนธรรมดานี้มีความสำคัญอย่างยิ่งสำหรับเทรดเดอร์มืออาชีพและเทรดเดอร์เป็นประจำ และยังเป็นกุญแจสำคัญที่ทำให้ผู้ใช้ Blur ชนะ ในตลาดการซื้อขายโทเค็น FT อัตราการรีเฟรชราคาไม่ใช่จุดที่ละเอียดอ่อนสำหรับผู้ใช้อีกต่อไป เนื่องจากเราตั้งค่าเริ่มต้นให้ความเร็วในการอัปเดตข้อมูลของแต่ละการแลกเปลี่ยนนั้นใกล้เคียงกัน ซึ่งจะไม่ทำให้เกิดความแตกต่างของการเก็งกำไรมากนัก แต่ในตลาดการซื้อขาย NFT ตลาดต้องยอมรับข้อมูลใบเสนอราคาที่ช้าของแพลตฟอร์มการซื้อขายดั้งเดิมหลายแห่ง

ค่าใช้จ่าย

ค่าใช้จ่าย

Blur ยังพยายามจัดหาสภาพแวดล้อมที่มีค่าใช้จ่ายในการทำธุรกรรมต่ำที่สุดให้กับผู้ใช้ การลดต้นทุนเป็นหนึ่งในการแก้ปัญหาสภาพคล่องที่ตรงจุดที่สุด ค่าธรรมเนียมการทำธุรกรรม ค่าลิขสิทธิ์ ค่าธรรมเนียมน้ำมัน และราคาของ NFT นั้นเป็นต้นทุนหลักสำหรับเทรดเดอร์ นอกจากสภาพคล่องแล้วผู้ใช้ยังอ่อนไหวอย่างมากต่อต้นทุนการทำธุรกรรมอีกด้วย ตลาดจะลงมติ และเลือกแพลตฟอร์มที่มีต้นทุนต่ำที่สุด บทความนี้กล่าวถึงค่าธรรมเนียมการทำธุรกรรมและค่าลิขสิทธิ์

ค่าธรรมเนียมการทำธุรกรรม (ปัจจุบัน 0%)

นับตั้งแต่เปิดตัว Blur ได้มุ่งเน้นไปที่ค่าธรรมเนียมการทำธุรกรรม 0% ซึ่งเป็นผลกระทบอย่างมากต่อค่าธรรมเนียมการทำธุรกรรมของ OpenSea 2.5%, X2Y2 0.5%, LookRare 2% และ SudoSwap 0.5% สำหรับผู้ขาย เป็นเรื่องจริงที่สามารถส่งต่อค่าธรรมเนียมการจัดการไปยังผู้ซื้อผ่านราคาของ NFT เอง แต่การลดค่าธรรมเนียมการจัดการธุรกรรมนั้นมีบทบาทในการอำนวยความสะดวกในการทำธุรกรรมในตลาด ทำให้ระยะห่างระหว่างคำสั่งซื้อและขายสั้นลง ในอนาคต Blur อาจเพิ่มค่าธรรมเนียมการทำธุรกรรมภายใต้มติของชุมชน แต่จะยังคงรักษาระดับนี้ในระยะสั้น

ค่าลิขสิทธิ์ (เริ่มต้นขั้นต่ำ 0% ปรับเป็นขั้นต่ำ 0.5%)

เมื่อ Blur เปิดตัวสู่สาธารณะในเดือนตุลาคม 2022 จะไม่มีการบังคับใช้ค่าสิทธิของครีเอเตอร์ ผู้ขายสามารถตั้งค่าลิขสิทธิ์ขั้นต่ำเป็น 0% หรือทำตามแผนค่าสิทธิของผู้สร้างเดิมได้ แต่สำหรับผู้ค้าที่จ่ายค่าลิขสิทธิ์ 0.5% Blur จะให้ airdrops มากขึ้นอย่างชัดเจน ส่งเสริมพฤติกรรมนี้ ความหมายก็คือ Blur สนับสนุนผู้สร้าง แต่ก็รู้ว่าค่าสิทธิที่ต่ำกว่าก็เป็นกุญแจสำคัญในการอำนวยความสะดวกในข้อตกลง ในช่วงเวลาต่อมา Blur ได้ปรับกฎค่าลิขสิทธิ์เป็นการตั้งค่าขั้นต่ำที่ 0.5% แม้ว่าเส้นมาตรฐานจะสูงขึ้นแต่ก็ไม่ได้ก่อให้เกิดการโต้เถียงครั้งใหญ่ในชุมชนเมื่อ X2Y2 เปลี่ยนกฎค่าลิขสิทธิ์ซ้ำๆ

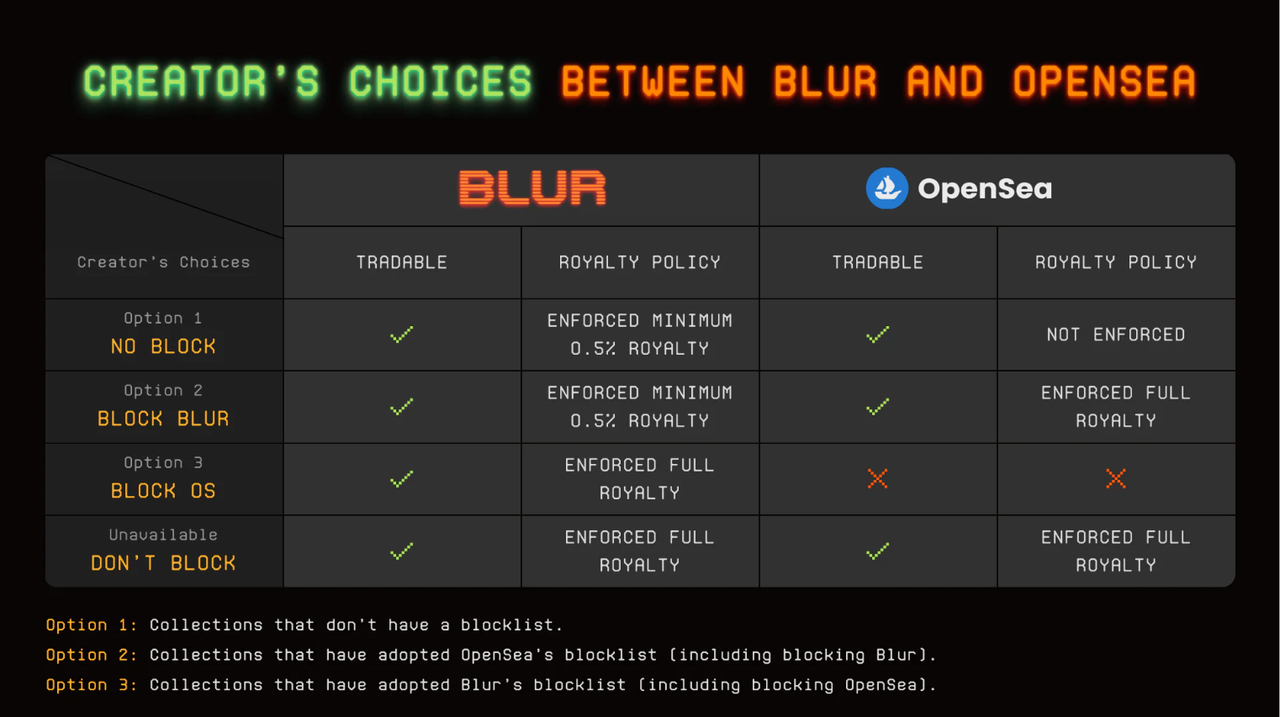

หลังจากออกโทเค็น Blur ได้ประกาศกฎค่าสิทธิใหม่อย่างรวดเร็ว จากมุมมองของการดึงดูดผู้สร้าง ตอบโต้ชุดของนโยบาย "คว่ำบาตร" ที่ OpenSea นำมาใช้กับ Blur

สรุป:

พฤศจิกายน 2565OpenSea เปิดตัวเครื่องมือบัญชีดำ (Blocklist) ของตลาดซื้อขาย(ตลาดซื้อขายหลายแห่งที่ไม่บังคับค่าลิขสิทธิ์ รวมถึง Blur) ผู้สร้าง NFT สามารถเลือกใช้เครื่องมือนี้เพื่อบล็อกธุรกรรมบนแพลตฟอร์มที่ไม่บังคับค่าลิขสิทธิ์ แต่ข้อดีคือ OpenSea จะบังคับให้เก็บค่าลิขสิทธิ์ คอลเลกชัน NFT นั้น ไม่ใช้บัญชีดำนี้สามารถซื้อขายในตลาดการค้าหลายแห่ง แต่ OpenSea จะไม่บังคับค่าลิขสิทธิ์กับผู้ซื้อ การย้ายครั้งนี้ทำให้ผู้สร้างจำนวนมากอยู่ในภาวะที่กลืนไม่เข้าคายไม่ออก หากพวกเขาเลือกบัญชีดำของ OpenSea อัตราส่วนรายได้ค่าลิขสิทธิ์จะได้รับการรับรอง แต่จะสูญเสียโอกาสด้านสภาพคล่องของ NFT ในตลาดซื้อขาย เช่น Blur และ X2Y2 หากพวกเขาเลือกสภาพคล่องของหลายแพลตฟอร์ม ก็ต้องยอมเสียสละ ส่วนหนึ่งของรายได้ค่าภาคหลวง

ในเดือนมกราคม 2023 Blur ใช้โปรโตคอล Seaport ของ OpenSea เพื่อข้ามผ่านนโยบายของเครื่องมือบัญชีดำที่กล่าวถึงข้างต้นอย่างชาญฉลาด ซึ่งหมายความว่า NFT ที่ออกใหม่สามารถซื้อขายบน Blur ได้ในขณะที่ใช้เครื่องมือบัญชีดำของ OpenSea ด้วยวิธีนี้ ผู้สร้าง NFT สามารถเก็บค่าสิทธิได้เต็มจำนวนบน OpenSea และยังสามารถซื้อขายบน Blur ได้ในเวลาเดียวกัน

นโยบายค่าลิขสิทธิ์ล่าสุดของ Blur ให้ผู้สร้าง NFT มี 3 ตัวเลือก:

(1) ตัวเลือกที่ 1: คอลเลกชัน NFT ใหม่ที่ไม่ใช้เครื่องมือบัญชีดำของ OpenSea และ Blur บังคับใช้การคุ้มครองสิทธิขั้นต่ำ 0.5% สำหรับ NFT ใหม่ดังกล่าว

(2) ตัวเลือกที่ 2: การรวบรวม NFT ใหม่โดยใช้เครื่องมือบัญชีดำของ OpenSea นอกจากนี้ Blur ยังใช้การคุ้มครองสิทธิ์ขั้นต่ำ 0.5% สำหรับ NFT ใหม่ดังกล่าว (เนื่องจากปัจจุบัน Blur ข้ามบัญชีดำของ OpenSea ผ่านโปรโตคอล SeaPort)

(3) ทางเลือกที่สาม: หากคอลเลกชัน NFT ถูกห้ามไม่ให้ทำการซื้อขายบน OpenSea โดยสมบูรณ์ Blur จะบังคับใช้ค่าลิขสิทธิ์ของผู้สร้างทั้งหมด (ค่าลิขสิทธิ์เต็มจำนวน)

นอกจากนี้ Blur ยังแดกดันให้ "ทางเลือกที่สี่" ที่ยังไม่สามารถดำเนินการได้: หาก OpenSea หยุดเครื่องมือบัญชีดำ Blur จะใช้นโยบายลิขสิทธิ์ผู้สร้างที่สมบูรณ์พร้อมกับ OpenSea ซึ่งสามารถเห็นได้ว่า Blur เรียกร้องให้ OpenSea ยกเลิกนโยบาย Blacklist

ที่มาของภาพ:

ที่มาของภาพ:Blur Mirror

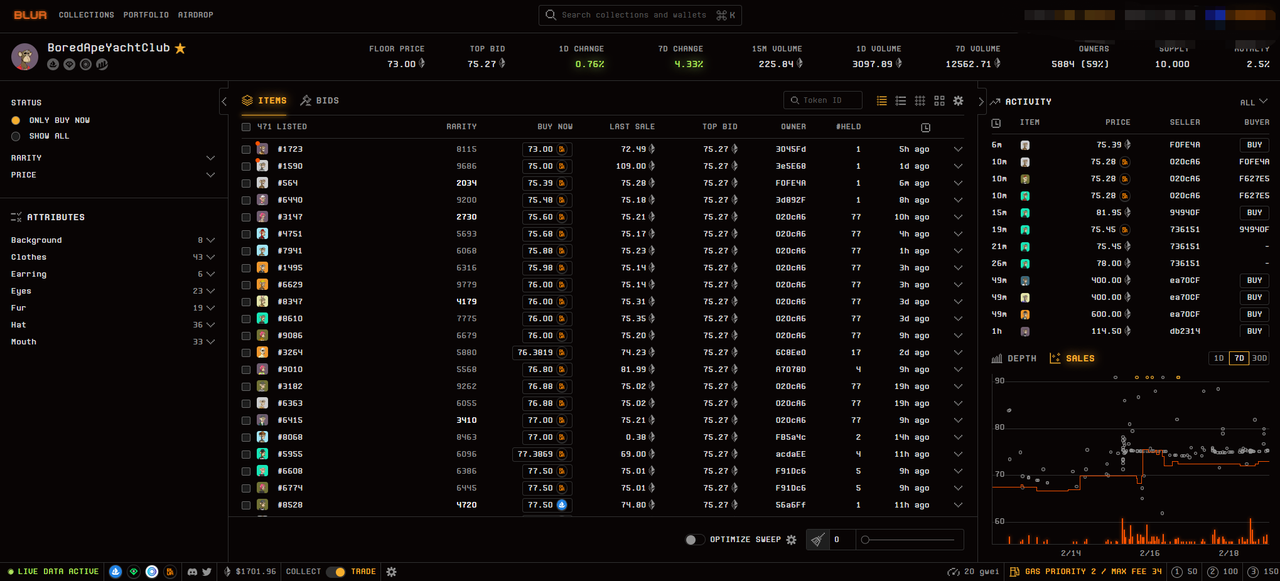

การแสดงผล UI:Blur ให้ข้อมูลธุรกรรมที่ครอบคลุมมากขึ้นแก่ผู้ใช้ NFT ลดค่าใช้จ่ายด้านเวลาสำหรับผู้ใช้ในการสลับไปมาระหว่างแพลตฟอร์มต่างๆ และปรับปรุงประสบการณ์ผู้ใช้ให้ดียิ่งขึ้น การเพิ่มประสิทธิภาพอย่างละเอียดของแดชบอร์ดข้อมูลช่วยให้การตัดสินใจของผู้ค้า NFT ดีขึ้น ซึ่งเอื้อต่อ การปรับปรุงความถี่ในการทำธุรกรรม ส่งเสริม

NFTGo ในการเปิดตัวล่าสุด《NFT Annual Report 2023 》สรุปได้ว่ารูปแบบนิสัยของเทรดเดอร์มืออาชีพ NFT เปลี่ยนไป จากเดิมที่ค้นพบโครงการบนโซเชียลมีเดีย แล้วเปิด OpenSea เพื่อทำธุรกรรมให้เสร็จสมบูรณ์ พัฒนาเป็น ค้นพบโครงการ แล้วดำเนินการตรวจสอบผ่านแพลตฟอร์มการวิเคราะห์ข้อมูล และผู้รวบรวมการค้า

อินเทอร์เฟซ UI ของ Blur คล้ายกับ Bloomberg ซึ่งให้ข้อมูลธุรกรรมหลายมิติแก่เทรดเดอร์ NFT รวมถึงแนวโน้มธุรกรรมในอดีต ความลึกของธุรกรรม ข้อมูลคำสั่งซื้อที่รอดำเนินการ ราคาเสนอขาย และข้อมูลพื้นฐานเกี่ยวกับการเก็บรวบรวม NFT รวมถึงการออกทั้งหมด อัตราส่วนค่าลิขสิทธิ์ การถือครอง สัดส่วน เป็นต้น อินเทอร์เฟซ UI ที่ไม่มีสิ่งกีดขวางทำให้ผู้ค้าไม่จำเป็นต้องเปรียบเทียบข้อมูลของตลาดการซื้อขายอื่น ๆ และกระดานวิเคราะห์ข้อมูลหลายครั้งอีกต่อไป และไม่จำเป็นต้องข้ามไปยังหลาย ๆ หน้าเพื่อรับข้อมูลที่จำเป็นในการตัดสินธุรกรรม ในแง่ของการออกแบบ การนำเสนออย่างมืออาชีพของ Blur สะท้อนถึงความเข้าใจอันดีของทีมงานเกี่ยวกับเทรดเดอร์ NFT

จากการเปรียบเทียบในแนวนอน Gem ซึ่งอยู่ในกลุ่มของแทร็ก Aggregator และ Genie ซึ่งรวมเข้ากับ Uniswap นั้นล้าหลังกว่ามากในแง่ของการออกแบบผลิตภัณฑ์ ผู้ค้ายังคงต้องข้ามไปยังหลายอินเทอร์เฟซเพื่อรับข้อมูลและข้อมูล จริง ๆ แล้วการแสดงข้อมูลที่ครอบคลุมมากกว่านั้นมีความซ้ำซ้อนของข้อมูลสูง เวลาให้ผู้ใช้เลือกและรอจะเพิ่มแรงเสียดทานในการทำธุรกรรมและลดความถี่ในการทำธุรกรรม อินเทอร์เฟซการแสดงผลของ Gem รวมการแสดงข้อมูลของ Dune Analytics และฟังก์ชันแผนที่ของที่อยู่ผู้ถือของ Bubblemaps โดยตรง ความครอบคลุมของข้อมูลนั้นดีแต่ความหยั่งรู้นั้นไม่ดีและความถูกต้องของข้อมูลนั้นขึ้นอยู่กับทั้งหมด เกี่ยวกับบุคคลที่สามในทางตรงกันข้าม Blur ให้ข้อมูลและข้อมูลที่จำกัดเท่านั้น แต่เน้นที่ข้อมูลสำคัญของธุรกรรม NFT และข้อมูลนั้นใช้งานง่ายและอ่านง่ายกว่า ความเข้าใจของทีม Blur เกี่ยวกับนิสัยการซื้อขายของผู้ใช้ NFT และจุดบอดของอุตสาหกรรม NFT นั้นสะท้อนให้เห็นในการออกแบบผลิตภัณฑ์ที่เป็นมืออาชีพและรอบคอบ

ความทะเยอทะยานของ Blur ที่จะเปลี่ยนกระบวนทัศน์การทำธุรกรรมของอุตสาหกรรม NFT ต่อไปสามารถเห็นได้จากการปรับ UI ล่าสุดให้เหมาะสมการออกแบบ UI ในปัจจุบันทำให้ขั้นตอนการทำธุรกรรมของผู้ใช้ง่ายขึ้น แต่รูปแบบธุรกิจในปัจจุบันครอบคลุมเฉพาะตลาดการซื้อขายเท่านั้น และโฟกัสไปที่ธุรกรรมรองของ NFT มากกว่า ผู้ใช้ NFT เริ่มต้นจะยังคงใช้ OpenSea เป็นที่แรกในการเข้าสู่โลก NFT เนื่องจาก OpenSea มีข้อดีของการเป็นมิตรกับ NFT Xiaobai มากกว่า มีหลายเชน และหลากหลาย เมื่อวันที่ 17 กุมภาพันธ์ 2023 Blur ได้อัปเดตเพื่อเพิ่มฟังก์ชัน Kanban "Trending" (เทรนด์ที่กำลังมาแรง) ผู้ใช้สามารถดูโปรเจ็กต์ NFT ยอดนิยมล่าสุดได้โดยตรงบน Blur และสัญญาณการซื้อขายขั้นสูงและก่อนหน้าของตลาด NFT ก็รวมอยู่ใน ขอบเขตการแสดง

ที่มาของภาพ:

ที่มาของภาพ:เว็บไซต์อย่างเป็นทางการของ Blur BAYC Collection

ฟังก์ชันการเสนอราคาแบบคอลเลคชัน (การเสนอราคาแบบคอลเลคชัน):นอกจากจะมีฟังก์ชันเดียวกันกับผลิตภัณฑ์คู่แข่งอื่นๆ เช่น Sweeping และ Bulk Listing แล้ว ฟังก์ชันการเสนอราคาของ Blur สำหรับคอลเลกชัน NFT ยังได้รับความชื่นชอบจากเทรดเดอร์มืออาชีพ NFT จำนวนมาก

ฟังก์ชันการเสนอราคาบนแพลตฟอร์มการซื้อขายอื่น ๆ สามารถมุ่งเป้าไปที่ NFT เดียวเท่านั้นหรือไม่มีฟังก์ชันนี้เลย การเทียบเคียงนามธรรมกับธุรกรรม FT หมายความว่าเฉพาะข้อมูลคำสั่งขายในตลาดเท่านั้นที่โปร่งใสและชัดเจน คำสั่งซื้อสำหรับคอลเลกชัน NFT บางรายการ ไม่มีช่องทางที่ชัดเจนในการทำความเข้าใจสถานการณ์ ฟังก์ชันการเสนอราคาแบบรวมของ Blur ช่วยเติมเต็มข้อมูลการตลาดที่สำคัญนี้ ช่องว่างการทำงาน เมื่อออกแบบฟังก์ชันนี้ Blur ยังได้เปิดฟังก์ชันการป้องกัน NFT ที่ถูกขโมย (Stolen NFT Protection) เพื่อหลีกเลี่ยงสถานการณ์ที่ NFT ที่ถูกขโมยถูกซื้อโดยการประมูล

ฟังก์ชัน Bid ช่วยให้ผู้ใช้สามารถเสนอราคาโดยตรงกับกองทุน ETH โดยไม่จำเป็นต้องแปลง ETH เป็น WETH ในบางแพลตฟอร์ม จากนั้นทำธุรกรรม ซึ่งช่วยประหยัดเวลาในการทำธุรกรรมของผู้ใช้

2. การวางตำแหน่งผลิตภัณฑ์ในตลาดเฉพาะ แต่เข้าใจผู้ใช้หลักของตลาด

เนื่องจากอินเทอร์เฟซ UI คล้ายกับ Bloomberg และมีสไตล์โค้ด คุณลักษณะ Pro-Trader-Friendly (เป็นมิตรกับผู้ค้ามืออาชีพ) ของ Blur จึงโดดเด่นมาก แต่ก็อยู่ในตำแหน่งตลาดเฉพาะที่ให้บริการผู้ค้ามืออาชีพ NFT และ NFT Flippers ด้วยผลิตภัณฑ์เริ่มต้น ( ตลาดเฉพาะ). ในอุตสาหกรรม NFT รูปแบบของสินทรัพย์ PFP ชิปสีน้ำเงินบน Ethereum เสริมด้วยสินทรัพย์ NFT จำนวนมากที่เอวและหางได้ก่อตัวขึ้น และกลุ่มนักเก็งกำไร NFT ที่มีประสบการณ์ ผู้ค้ามืออาชีพ และผู้ดูแลสภาพคล่องได้ค่อยๆ ก่อตัวขึ้น กลุ่มผู้ใช้ แม้ว่าคนกลุ่มนี้จะไม่ใช่กลุ่มแรกในการส่งเสริม NFT "Mass Adoption" แต่พวกเขาก็มีสินทรัพย์บลูชิปจำนวนมาก มีประสบการณ์ระดับมืออาชีพใน NFT hype/Flip และเป็นแหล่งสภาพคล่องหลักของอุตสาหกรรม . ส่วนนี้ของตลาดเฉพาะยังเป็นผู้เล่นที่มีความเคลื่อนไหวมากที่สุดในตลาด NFT การควบคุมผู้ใช้ในส่วนนี้ให้เชี่ยวชาญยังหมายถึงการควบคุมกลุ่มผู้ใช้หลักใน NFT ตลาดผู้ใช้ NFT นั้นยากที่จะปรับตัว Blur ไม่ได้เลือกการออกแบบ UI ที่เรียบง่ายและน่ารักซึ่งเป็นมิตรกับผู้ใช้มือใหม่และผู้ใช้ใหม่ ๆ แต่เลือกคัมบังอินเทอร์เฟซแบบรหัสเพื่อเจาะตลาดมืออาชีพ ผู้ใช้การซื้อขายที่มีมูลค่าสูง ด้วยแรงจูงใจด้านสภาพคล่องที่แข็งแกร่งขึ้น ด้วยการเติบโตของผู้ใช้ในระยะหลัง ผู้ใช้รายใหม่ก็คาดว่าจะค่อย ๆ เปลี่ยนเป็นผู้เล่นระดับสูง

สำหรับวาฬ NFT, ผู้ค้าความถี่สูง, NFT Flippers, ผู้ค้ามืออาชีพ, กองทุน NFT และผู้สร้างตลาด NFT ในอดีตที่ผ่านมายังขาดเครื่องมือและผลิตภัณฑ์ครบวงจร Blur ได้แก้ปัญหานี้สำหรับผู้เล่นมืออาชีพ ความเจ็บปวดอย่างหนึ่ง การออกแบบรายละเอียดระดับมืออาชีพนำมาซึ่งประสบการณ์ผู้ใช้ใหม่ล่าสุด และได้รับชื่อเสียงที่ยอดเยี่ยมในชุมชน และได้รับการยกย่องจากผู้ใช้แบบปากต่อปาก

มีอยู่

ผู้สร้าง@PacmanBlurมีอยู่เปิดสัมภาษณ์ตามที่กล่าวไว้ในบทความ Blur ให้ความสำคัญกับการเติบโตของผู้ใช้ในช่วงแรกและการสร้างผลิตภัณฑ์ที่ให้คุณค่าที่แท้จริงแก่ผู้ใช้มากกว่ารายรับที่ไม่มีข้อตกลงในระยะสั้น ผลิตภัณฑ์ที่ดีจะไม่ต้องกังวลเกี่ยวกับการสร้างรายได้ในระยะยาว ความเร็วและผลิตภัณฑ์ที่ใช้งานง่าย แข่งขันกันเพื่อผู้ใช้

ที่มาของภาพ:

ที่มาของภาพ:OpenSea Twitter

4. ในแง่ของทักษะการปฏิบัติงาน ความคาดหวังในการปล่อยทิ้งอย่างต่อเนื่องนั้นเข้ากันได้อย่างสมบูรณ์แบบกับจังหวะของคุณสมบัติผลิตภัณฑ์ใหม่ และล็อคความสนใจของผู้ใช้และตลาดไว้อย่างแน่นหนา

กลยุทธ์การดำเนินงานของ Blur ก่อนออกเหรียญก็คุ้มค่าที่จะเรียนรู้สำหรับทีมผู้ประกอบการทุกคน "วัฒนธรรม airdrop" ในฟิลด์ cryptocurrency สามารถดึงดูดปริมาณการใช้งานและความสนใจได้มากขึ้นเสมอ แต่ Blur เป็นกรณีที่ค่อนข้างประสบความสำเร็จที่สามารถใช้ airdrops โทเค็นเป็นเครื่องมือและเพิ่มมูลค่าสูงสุด

ความมั่นใจ:Airdrop ในช่วงไตรมาสแรกก่อนการออกเหรียญของ Blur แบ่งออกเป็นสามรอบ และผู้ใช้ได้รับการ "ฝึกฝน" เพื่อใช้แพลตฟอร์ม Blur เป็นระยะ Airdrop 1 มอบให้กับผู้ใช้บางคนที่เข้าร่วมการทดสอบภายใน ส่วน Airdrop 2 มอบให้กับผู้ใช้ ที่สั่งซื้อและมอบ Airdrop 3 ให้กับผู้ใช้ที่สอบถามราคา ยกเว้นว่ามีการประกาศ airdrops รอบแรกหลังจากปิดเบต้า ทั้ง Airdrop 2 และ Airdrop 3 ประกาศกฎก่อน airdrops ของกิจกรรม สำหรับผู้ใช้ที่มักจะหลับตาและส่ง airdrops สุ่มสี่สุ่มห้าความแน่นอนจะสูงกว่าและทิศทางจะสูงกว่า มันจะแข็งแกร่งขึ้นด้วย ไม่เพียง แต่สามารถรับรู้ถึงฟังก์ชั่นที่ Blur ต้องการให้ผู้ใช้สัมผัส (คำสั่งที่รอดำเนินการและฟังก์ชั่นราคาคอลเลกชัน) ปลูกฝังนิสัยการใช้งานของผู้ใช้ แต่ยังช่วยให้ผู้ใช้ "สร้างรายได้จากงานของพวกเขา"

ความก้าวหน้า:แอร์ดรอปสามรอบในฤดูกาลแรกแต่ละรอบมีขนาดใหญ่กว่ารอบที่แล้ว (รอบที่สองคือ 1-2 เท่าของแอร์ดรอปรอบแรก และรอบที่สามคือ 10 เท่าของรอบที่สอง) ทำให้มีสิ่งจูงใจมากขึ้นสำหรับผู้ใช้ที่ เข้าสู่ตลาดในภายหลัง นอกจากนี้ เมื่อ Blur ประกาศ airdrops รอบที่สาม ก็เปิดตัวฟังก์ชันพิเศษ "Collection Bid" พร้อมกัน และยังให้ผู้ใช้ฟังก์ชันนี้ได้รับรางวัล airdrops มากที่สุด และใช้สิ่งจูงใจ airdrop เพื่อโปรโมตคุณสมบัติผลิตภัณฑ์ใหม่และผู้ใช้ การเสริมนิสัย. "ราคาที่ขอสำหรับคอลเลกชัน" ได้เติมเต็มช่องว่างในตลาดแล้ว และความชาญฉลาดของการดำเนินงานของทีมทำให้การส่งเสริมฟังก์ชันเป็นเรื่องง่าย

ไม่ได้หมายความว่า "แอร์ดรอป" นั้นมีประสิทธิภาพและเป็นประโยชน์ทั้งหมด หรือการคัดลอกโมเดลแอร์ดรอปของ Blur จะประสบความสำเร็จอีกครั้งอย่างแน่นอน ความสำเร็จในการดำเนินงานของ Blur อยู่ที่ความเข้าใจอย่างลึกซึ้งของทีมงานเกี่ยวกับความคาดหวังของผู้ใช้ที่มีต่อแอร์ดรอป และการใช้ความคาดหวังในการออกแบบฟังก์ชั่นใหม่ที่เข้ากับจังหวะที่ดีสำหรับการประชาสัมพันธ์ ซึ่งสั่งสมเป็นความสัมพันธ์ที่ผูกพันกับชุมชนในระยะยาว

5. Token Economics แสดงให้เห็นถึงความมุ่งมั่นในระยะยาวของทีมในการสร้างผลิตภัณฑ์และวิสัยทัศน์ของการกำกับดูแล DAO

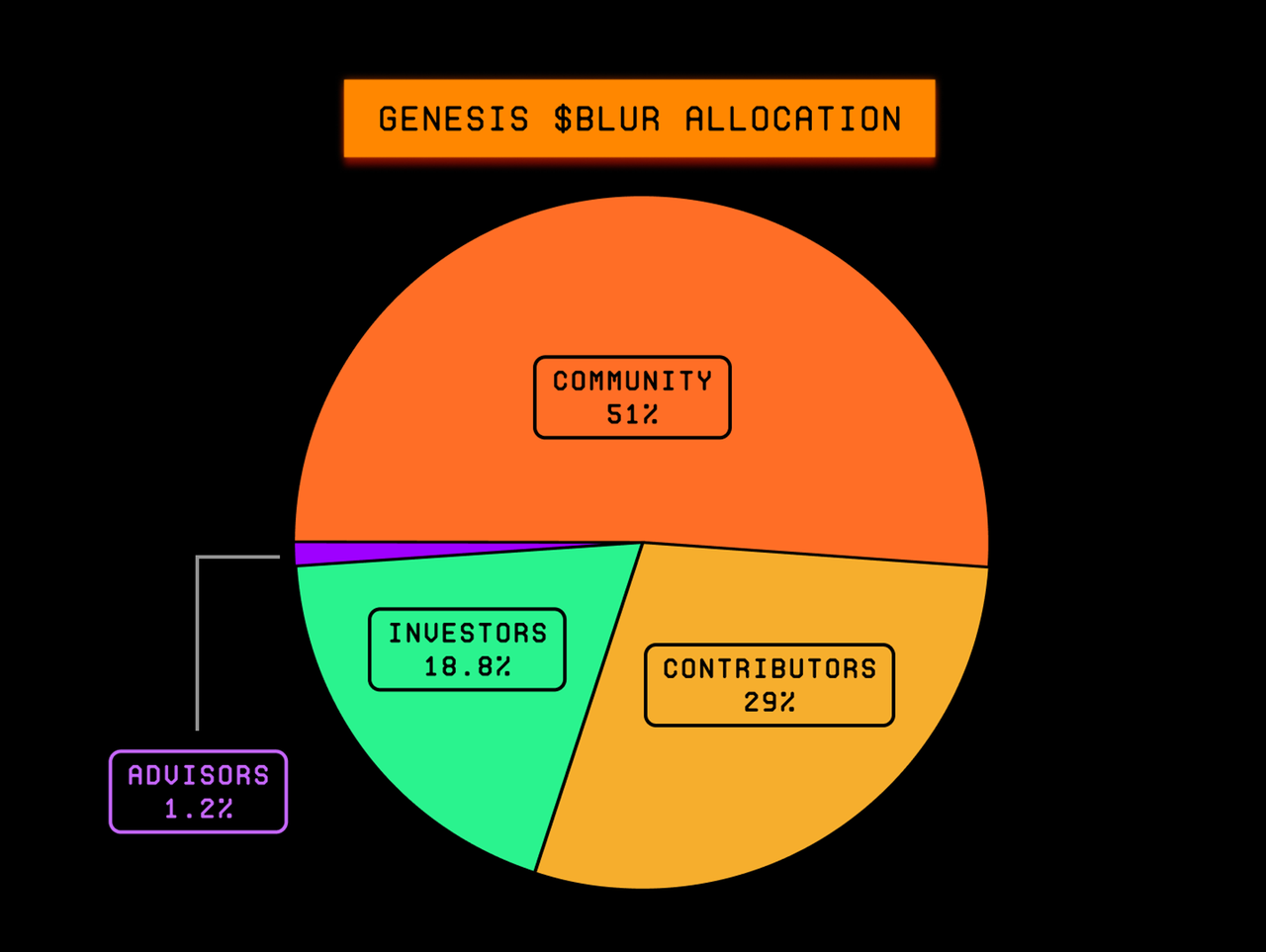

เศรษฐศาสตร์โทเค็นของ $BLUR รวบรวมเป้าหมายโครงการก่อสร้างระยะยาวของทีมและวิสัยทัศน์ของการกำกับดูแลแบบกระจายอำนาจ ผู้สร้าง@PacmanBlurมีการกล่าวถึงหลายครั้งใน Twitter Space ว่าการออกแบบโทเค็นเศรษฐศาสตร์ของ Blur นั้นได้รับการออกแบบร่วมกันโดยทีมงานและนักลงทุน Paradigm โดยใช้โมเดลเศรษฐศาสตร์โทเค็นของโครงการ DeFi อื่นๆ อีกมากมาย (รวมถึง Uniswap, GMX, dYdX เป็นต้น) เห็นได้จากเอกสารเศรษฐศาสตร์โทเค็นว่าทีมงานทราบดีว่าโทเค็นเป็นสะพานเชื่อมชุมชน และในที่สุดโทเค็นส่วนใหญ่ (51%) จะถูกแจกจ่ายให้กับผู้เข้าร่วมในชุมชนดังที่แสดงด้านล่าง

🎉 สมาชิกชุมชน Blur 51% = 12% Airdrop ซีซั่นที่ 1 + 10% Airdrop ซีซั่นที่ 2 + 29% ผู้สนับสนุนอื่นๆ ทุน/โครงการชุมชน/สิ่งจูงใจ ฯลฯ

ที่มาของภาพ:

ที่มาของภาพ:เบลอเอกสารอย่างเป็นทางการ

การลงทุน Web3.0

1. สิ่งที่ต้องการการยอมรับจำนวนมากอย่างเร่งด่วนใน Web3.0 ไม่ใช่ผู้ใช้ แต่เป็นผู้ประกอบการและนักพัฒนาที่ยอดเยี่ยม

NFT กำเนิดขึ้นในปี 2017 เสนอโดย Dieter Shirley ผู้ก่อตั้ง CryptoKitties เพื่อให้ตลาดแยกแยะความแตกต่างระหว่าง CryptoKitties และ ERC 20 แนวคิดของโทเค็น NFT ที่ไม่เป็นเนื้อเดียวกันได้รับการแนะนำสู่ตลาด OpenSea ก่อตั้งขึ้นในปี 2018, Gem ก่อตั้งขึ้นเมื่อสิ้นปี 2021, X2Y2 และ LooksRare ถือกำเนิดขึ้นในปี 2022 และมูลค่าตลาดของ NFT สูงถึงปี 2022ระดับสูงสุดที่ 34.6 พันล้านดอลลาร์ (พฤษภาคม 2565)อย่างไรก็ตาม Blur ยังไม่เปิดตัวการแสดงข้อมูลรวมศูนย์ขั้นพื้นฐานที่สุดของคำสั่งซื้อในแพลตฟอร์มการซื้อขาย NFT สู่ตลาดจนกว่าจะถึงไตรมาสที่สี่ของปี 2022 ซึ่งทำให้ฉันรู้อีกครั้งว่ามีผู้ประกอบการที่โดดเด่นในอุตสาหกรรมนี้น้อยเกินไป มันคือ ไม่ใช่ผู้ใช้ที่ต้องการการยอมรับจำนวนมากอย่างเร่งด่วน แต่เป็นผู้ประกอบการและนักพัฒนาที่โดดเด่น

ผู้ก่อตั้ง Blur เพิ่งยกสถานะ "ไม่เปิดเผยตัวตน" เพื่อเปิดเผยประสบการณ์ในอดีตต่อสาธารณะ จากการสัมภาษณ์และข้อมูลสาธารณะต่าง ๆ ทำให้เราทราบได้ว่า@PacmanBlurด้วยพื้นฐานการศึกษาด้านวิศวกร การลงทุนครั้งแรกของเขาในปี 2559 จึงกลายเป็นหนึ่งในโครงการกลุ่มฤดูหนาวปี 2559 ของ Y Combinator หลังจากนั้น เขาได้พบกับผู้ร่วมก่อตั้ง Blur เมื่อเขาไปเรียนที่ MIT เพื่อศึกษาคณิตศาสตร์และวิทยาการคอมพิวเตอร์ ในปี 2018 ตอนที่พวกเขายังเรียนอยู่ที่ MIT ทั้งสองเริ่มต้นธุรกิจร่วมกันและประสบความสำเร็จในการขายบริษัทในปี 2021 หลังจากจบช่วงสุดท้ายของการเป็นผู้ประกอบการ ไม่นานทั้งสองก็เริ่มโครงการ Blur เพราะ@PacmanBlurฉันรู้สึกทึ่งกับการทำธุรกรรม NFT ในปี 2021 แต่ในฐานะผู้ใช้ เขารู้สึกว่าตลาดขาดตลาดการซื้อขายและโครงสร้างพื้นฐาน NFT ที่คิดและออกแบบจากมุมมองของผู้ค้า ดังนั้นเขาจึงเกิดแนวคิดเรื่อง Blur ทีมงาน 10 คนของ Blur เต็มไปด้วยความสามารถ รวมถึงวิศวกร 7 คนจากทีม Citadel, Five Rings และ Twitch และนักออกแบบ 1 คนจาก Square และ Brex โดยทั่วไปแล้ว ทีม Blur มีประสบการณ์ในการพัฒนาบริษัทการค้าในอุตสาหกรรมการเงินแบบดั้งเดิม แพลตฟอร์มสื่อสตรีมมิ่งขนาดใหญ่ และประสบการณ์ด้านการออกแบบในบริษัทที่มีชื่อเสียง ซึ่งเป็นพื้นฐานที่ดีสำหรับ Blur ในการเปิดตัวผลิตภัณฑ์ที่ได้รับความนิยมจาก ผู้ใช้ ประสบการณ์ความร่วมมือยังปูทางไปสู่ความร่วมมือ ทีมผู้บริหาร และการเงินเพิ่มเติม

2. ผลิตภัณฑ์ที่แก้ปัญหา Pain point ที่แท้จริงของอุตสาหกรรม ไม่กลัวการแข่งขันในทะเลแดง

ทีมงาน Blur ก่อตั้งขึ้นในเดือนมกราคม 2022 การทดสอบผลิตภัณฑ์ภายในเริ่มขึ้นในเดือนพฤษภาคม และการทดสอบผลิตภัณฑ์ต่อสาธารณะเริ่มขึ้นในเดือนตุลาคม โครงการจะออกเหรียญประมาณหนึ่งปีหลังจากก่อตั้ง ขั้นตอนของโครงการไม่เร็วมากในแวดวง cryptocurrency แต่จะเห็นได้ว่าทีมงานมีแนวคิดเกี่ยวกับผลิตภัณฑ์ที่ชัดเจนตั้งแต่เริ่มต้น และรักษาจังหวะในการพัฒนาผลิตภัณฑ์และเปิดตัวฟังก์ชันใหม่ในสภาพแวดล้อมตลาดหมีอยู่เสมอ แม้ว่าตลาดซื้อขาย NFT หลายแห่งจะเป็นผู้นำในการยึดตลาดก่อนที่ Blur จะเข้าสู่ตลาดออนไลน์ แต่จุดบอดในอุตสาหกรรมนี้ยังคงมีอยู่และไม่ได้ถูกแก้ไขโดยคู่แข่งรายเดิมสำหรับทีมผู้ประกอบการ การติดตามการแข่งขันเป็นแง่มุมที่ต้องพิจารณา แต่ตามหลักการข้อแรก ควรเน้นที่ "การแก้ปัญหาความเจ็บปวดของอุตสาหกรรม" หากผลิตภัณฑ์ดีพอ มันสามารถเปลี่ยนรูปแบบการแข่งขันเดิมๆ ของสนามแข่ง สะสมความรู้มากมาย และแม้กระทั่งเป็นผู้นำเทรนด์และการพัฒนาของอุตสาหกรรม

ว่ากันว่า "เวลา สถานที่ และผู้คน" เป็นสิ่งที่จำเป็นในการทำให้สิ่งต่างๆ เกิดขึ้น Blur ไม่ได้เลือกที่จะเปิดตัวผลิตภัณฑ์ในช่วงเวลาที่เหมาะสมที่สุด (ตลาดกระทิง) และไม่ได้รอให้ตลาดกระทิงเกิดขึ้นด้วยซ้ำ แต่เมื่อพิจารณาจากผลลัพธ์แล้ว Blur ได้รับชัยชนะแบบค่อยเป็นค่อยไป และยังกลายเป็นโครงการที่สร้างเรื่องเล่าอย่างอิสระในช่วงตลาดหมีไม่ว่าผลิตภัณฑ์จะเปิดตัวหรือเวลาของการออกเหรียญจะอยู่ในตลาดหมีหรือตลาดกระทิง จะไม่มีความแตกต่างกันมากสำหรับผลิตภัณฑ์และทีมที่ดีเพียงพอ แต่อาจมีความแตกต่างกันอย่างมากสำหรับโครงการทั่วไป นี่คือความมั่นใจที่ผู้เขียนสังเกตเห็นในทีมผู้ประกอบการที่ประสบความสำเร็จทั้งหมด

3. การรับรู้ของทีมจะกำหนดขีดจำกัดสูงสุดของผลิตภัณฑ์

ฟังก์ชันการเสนอราคาสำหรับคอลเลกชัน (Collection Bidding) ช่วยเติมเต็มช่องว่างในข้อมูลตลาดฟังก์ชันราคาขอแบบรวมของ Blur เป็นฟีเจอร์หลักที่ช่วยเสริมสภาพคล่อง เติมเต็มช่องว่างข้อมูลขนาดใหญ่ในตลาด NFT หนึ่งในปัญหาที่เทรดเดอร์ NFT เผชิญก่อนหน้านี้คืออุปทานชัดเจนแต่อุปสงค์ไม่ชัดเจน นั่นคือผู้ใช้สามารถเข้าใจสถานะของคำสั่งซื้อขายที่รอดำเนินการในตลาดซื้อขาย/ผู้รวบรวมในอดีตได้อย่างชัดเจนเท่านั้น แต่พวกเขาไม่สามารถเข้าใจ การสอบถามราคาและความต้องการของ NFT เช่นในหนังสือสั่งซื้อ ผู้ค้าออนไลน์สามารถดูข้อมูลการขายหนึ่งรายการขึ้นไปเท่านั้น ฟังก์ชันราคาคอลเลกชันของ Blur นั้นธรรมดา แต่ช่วยให้ผู้ใช้ได้รับสถานการณ์ราคาการสั่งซื้อที่ชัดเจนและใช้งานง่าย เมื่อช่องว่างข้อมูลถูกเติมเต็ม ความปรารถนาของผู้ใช้ในการซื้อขายจะดีขึ้นโดยพื้นฐาน ฟังก์ชันนี้ยังอำนวยความสะดวกอย่างมากในการซื้อต่ำและขายธุรกรรมสูงของผู้ใช้ (วาฬยักษ์ เทรดเดอร์ขาประจำ เทรดเดอร์มืออาชีพ ผู้ดูแลสภาพคล่อง) ที่มีเงินร้อน NFT จำนวนมาก

โทเค็นกระตุ้น "สภาพคล่อง" ไม่ใช่ "ปริมาณการซื้อขาย"ในหลาย ๆ@PacmanBlurเขากล่าวถึงใน Twitter Space และบทสัมภาษณ์ที่เขาเข้าร่วมว่าความแตกต่างระหว่าง Blur กับโมเดลเศรษฐกิจโทเค็นอื่นๆ ในตลาดซื้อขายคือมันกระตุ้น "สภาพคล่อง" มากกว่า "ปริมาณการซื้อขาย" และอย่างหลังมักจะตกอยู่ที่ปริมาณการซื้อขาย ( Wash Trade) เพิ่มปริมาณการซื้อขาย ในฐานะตลาดซื้อขาย NFT คำจำกัดความของ "สภาพคล่องที่ดี" คือผู้ขายสามารถขายได้อย่างรวดเร็วด้วยคำสั่งซื้อที่รอดำเนินการ และผู้ซื้อสามารถซื้อได้อย่างรวดเร็วในราคาที่ขอ วิธีแก้ปัญหาที่ Blur มอบให้คือการจูงใจโทเค็นไปยังคำสั่งซื้อที่รอดำเนินการและขอราคาที่ใกล้เคียงกับราคาพื้น นั่นคือผู้ใช้ที่ช่วย "จับคู่ธุรกรรม" ในตลาด สามารถเข้าใจได้โดยการเปรียบเทียบว่าผู้ใช้จำนวนมากขึ้นได้รับการสนับสนุนให้รวมเงินทุนเพื่อ "ซื้อ" และ "ขาย" เมื่อราคาผันผวนการทำธุรกรรมจะเกิดขึ้นตามธรรมชาติและสิ่งจูงใจด้านสภาพคล่องจะถูกส่งไปยังปริมาณการทำธุรกรรมในที่สุด แต่เห็นได้ชัดว่าเป็น "สิ่งจูงใจ" มากกว่าการให้สิ่งจูงใจแก่ผู้ค้าโดยตรง อินทรีย์"

ในช่วงแรก การเติบโตคือจุดสนใจ และการรับรู้เงินสดไม่ใช่ปัญหาใหญ่สำหรับผลิตภัณฑ์ที่ดีสำหรับค่าธรรมเนียมการทำธุรกรรม 0% ส่งผลให้รายได้เป็นศูนย์สำหรับข้อตกลงในระยะสั้น@PacmanBlurคำตอบคือ ในช่วงเริ่มต้นของโครงการควรให้ความสนใจมากขึ้นกับการเติบโตของผู้ใช้และการขัดเกลาผลิตภัณฑ์ คล้ายๆ กับแนวทางเชิงกลยุทธ์ในช่วงแรกๆ ของ Alibaba การคิดเกี่ยวกับวิธีการสร้างรายได้จะง่ายกว่าหลังจากที่โครงการก้าวขึ้นสู่ตำแหน่งที่โดดเด่นอย่างแท้จริง กลยุทธ์ "เติบโตก่อน แล้วค่อยจ่ายเงิน" ของผู้ก่อตั้งอาจใช้ไม่ได้กับโครงการและทีมของผู้ประกอบการทั้งหมด แต่มันแสดงให้เห็นถึงความอดทนและความมั่นใจในโครงการก่อสร้างระยะยาว

4. การลงทุนเป็นกระบวนการของการเลือกร่วมกันและการเติบโตร่วมกัน

สาเหตุหนึ่งที่หลายคนมอง Blur ในแง่ดีก็คือมีกระบวนทัศน์ที่โดดเด่นอยู่เบื้องหลังการจัดการ แต่ผู้เขียนคิดว่าการผสมผสานนี้เป็น "การเลือกร่วมกัน" และ "การเติบโตไปด้วยกัน" วิสัยทัศน์ของทีมในการเติบโตก่อนแล้วจึงมีรายได้สอดคล้องกับรูปแบบการลงทุนระยะยาวของ Paradigm เหมือนกับการผสมผสานของ "ระยะยาว" สองอย่างเข้าด้วยกัน ในแง่ของการออกแบบโทเค็นโมเดลทางเศรษฐกิจ Blur ยังร่วมมือกับ Paradigm อีกด้วย เชื่อว่าในกระบวนการนี้ทีมวิจัยของ Paradigm จำนวนมากเคยมีประสบการณ์ในการออกแบบโทเค็นในโครงการอื่นๆ เช่น Uniswap กระบวนการของสองทีมที่ยอดเยี่ยมที่เล่นอย่างเต็มที่เพื่อประโยชน์ของตน ช่วยเหลือซึ่งกันและกัน เติบโต สร้างประโยชน์ร่วมกัน และนำคุณค่าให้กันและกัน เป็นสิ่งที่ควรค่าแก่การอ้างอิงและเรียนรู้โดยผู้ปฏิบัติงาน

ภาพสะท้อนในการศึกษาโครงการระดับแรกของ Web3.0 มักจะได้ยินเรื่องราวสุดโต่งสองเรื่อง: (1) บางโครงการ A: กองทุน cryptocurrency ที่รู้จักกันดีต่างแข่งขันกันเพื่อแบ่งปัน (2) บางโครงการ B: ไม่มีใครสนใจ เกี่ยวกับเรื่องนี้ การเงินล้มเหลวเป็นเวลา N เดือน ในขั้นตอนของการเลือกร่วมกัน เรื่องราวการไล่ตามและการถูกไล่ล่ามีอยู่มากมาย แต่ไม่มีทางเลือกใดที่ "ถูกต้องที่สุด" มีเพียงตัวเลือกที่ "เหมาะสมที่สุด" เท่านั้นในขณะนี้ ในตลาดที่มีข้อมูลไม่สมมาตรและไม่เพียงพอ ทั้งนักลงทุนและฝ่ายโครงการจำเป็นต้องชั่งน้ำหนักคุณค่าและความต้องการของตนเอง สำหรับนักลงทุน เพื่อกำหนดเส้นทางและทิศทางการลงทุนของตนเอง และในขณะเดียวกันก็ปรับปรุงมูลค่าเพิ่มที่พวกเขาสามารถสร้างให้กับโครงการและอุตสาหกรรมได้ สามารถจับคู่กับโครงการเป้าหมายได้แม่นยำยิ่งขึ้น สำหรับทีมผู้ประกอบการ เลเวอเรจที่มาจากทุกเปอร์เซ็นต์ของการจัดหาเงินทุน ผลที่ได้ก็แตกต่างกันเช่นกัน การเลือก นักลงทุนที่มีแนวคิดเดียวกันสามารถหลีกเลี่ยงข้อโต้แย้งที่ไม่จำเป็นมากมายบนเส้นทางที่ยาวไกลในการเป็นผู้ประกอบการ

สะท้อนการติดตามโครงการหลังการลงทุนยังมีสิ่งที่ทำได้ดีขึ้น ผู้ปฏิบัติงานในอุตสาหกรรม cryptocurrency โดยทั่วไปยังอายุน้อย และเป็นเรื่องยากสำหรับผู้ประกอบการและนักลงทุนที่จะพูดว่าใครมีประสบการณ์และความรู้มากกว่ากัน แต่ไม่ว่าคุณจะเป็นใคร คุณต้องมีความเชื่อและความอดทนในระยะยาวในอุตสาหกรรมนี้ จัดการกับเสียงรบกวนในตลาดอย่างใจเย็น มีวิจารณญาณที่เป็นอิสระ ขัดเกลาความเข้าใจของคุณเกี่ยวกับเส้นทางและอุตสาหกรรมอย่างต่อเนื่อง และนำการสร้างคุณค่ามาสู่ผู้ใช้และ อุตสาหกรรมที่อยู่ในความสามารถของคุณ ผมเชื่อว่า ตลาดนี้จะไม่ทำให้ทุกคนที่ทำงานหนักมาถูกทาง

ชื่อเรื่องรอง

1. การลงทุนโทเค็น

มูลค่าตลาดมูลค่าตลาดชื่อเรื่องรอง

2. การลงทุน NFT

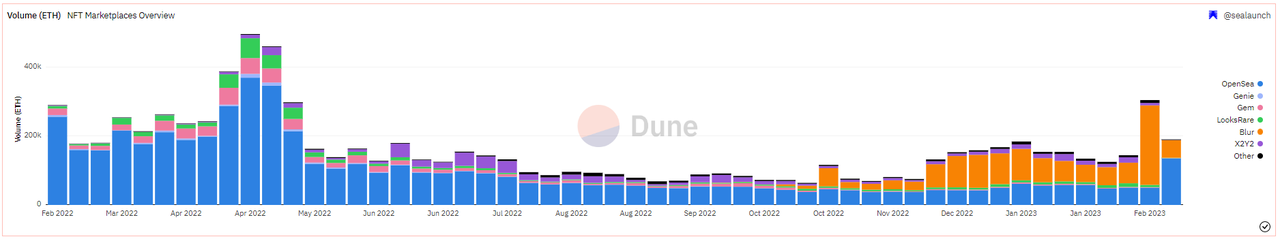

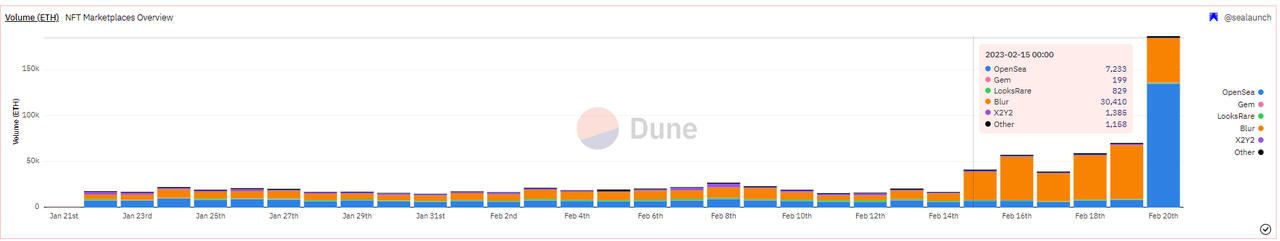

ที่มาของภาพ:

ที่มาของภาพ:NFT Marketplaces Dune Analytics – SeaLaunch

ที่มาของภาพ:NFT Marketplaces Dune Analytics – SeaLaunch

ธุรกรรม NFT ขั้นสูงสามารถใช้กับเครื่องมือ NFT-Fi เพื่อเลเวอเรจและการป้องกันความเสี่ยง ผลิตภัณฑ์ฟิวเจอร์สของ NFT ได้แก่ NFTPerp, NFEX, Tribe 3 เป็นต้น เพื่อให้ได้รับ airdrops มากขึ้น ผู้ค้า NFT บางรายมักจะวางคำสั่งซื้อจำนวนมากหรือการเสนอราคาสะสมใกล้กับราคาพื้น ข้อตกลง Futures สามารถช่วยป้องกันความเสี่ยงที่เกิดจากการขึ้นและลงของราคา NFT หลังจากสรุปธุรกรรม และยังสามารถเปิดใช้งานนักเก็งกำไร NFT เมื่อตลาด NFT มีสภาพคล่องมากขึ้น ให้เพิ่มเลเวอเรจให้กับกลยุทธ์การซื้อขาย

ชื่อเรื่องรอง

3. ความร่วมมือทางระบบนิเวศของ Blur และ Paradigm

จุดแข็งของโครงการ Blur เองยังมีศักยภาพในการฟีดแบ็คพันธมิตรและ Paradigm เพื่อลงทุนในเป้าหมายอื่นๆ โครงการทดลองทางสังคมระหว่าง Paradigm และ Justin Roiland เมื่อ Blur เปิดตัวครั้งแรกในปลายเดือนตุลาคม 2022Art Gobblersเมื่อกิจกรรมโรงกษาปณ์ฟรีเริ่มต้นขึ้น ราคาพื้นครั้งหนึ่งเคยพุ่งสูงถึง 14 ETH นักลงทุนใน Blur และ KOL ที่ช่วยโปรโมต Blur สามารถเข้าร่วม Free Mint ได้โดยตรงและได้รับประโยชน์จากมัน จากเหตุการณ์นี้ จะเห็นได้ว่า Paradigm และ Blur มีความสัมพันธ์ที่แน่นแฟ้น และไม่มีการตัดออกว่าจะมีกลยุทธ์การดำเนินงานในการสร้างโมเมนตัมและเอื้อต่อการรับส่งข้อมูลซึ่งกันและกันในอนาคต Paradigm ยังได้ลงทุนใน DeFi, NFT, เครือข่ายสาธารณะ, โครงการ MEV หลายโครงการโครงการและผลิตภัณฑ์ของบริษัทสรุป

สรุป

Blur มีทีมที่ตั้งใจที่จะแก้ไขจุดบกพร่องของอุตสาหกรรมและการก่อสร้างในระยะยาวอย่างแท้จริง ด้วยการสนับสนุนของวิสัยทัศน์ระยะยาวของ Paradigm และความรู้ระดับมืออาชีพเกี่ยวกับโมเดลเศรษฐศาสตร์โทเค็น ฉันมองเห็นอนาคตของ Blur ที่จะเปลี่ยนแปลง NFT ต่อไป กระบวนทัศน์การทำธุรกรรมและการล้มล้างโครงสร้างตลาด NFT

แหล่งข้อมูล

Blur Escalates Royalty Battle With OpenSea, Recommends Blocking Platform – CoinDesk

OpenSea Launches First Royalty Enforcement Tool Amid NFT Marketplace Drama – CoinDesk

Blur – the NFT marketplace for pro traders | Interview with Pacman | Token Terminal

ขอบคุณ

รายงานการวิจัยนี้แยกไม่ออกจาก@xuxiaopengmint@fanyayunคำแนะนำและบทวิจารณ์ ปลื้มปีติ@MasterXDaiการอภิปรายและคำแนะนำเกี่ยวกับคูเมืองผลิตภัณฑ์ เส้นทางตลาดซื้อขาย NFT แบบจำลองเศรษฐศาสตร์โทเค็น ฯลฯ นอกจากนี้ ขอขอบคุณ @BTCdayu สำหรับการแก้ไขรายงานอย่างทันท่วงที!