揭秘「牛市赢家」LD CAPITAL:野蛮生长背后的秘密

“你看,《BIG TIME》的这个画质多漂亮!”

坐在对面的投资人一边展示测试视频,一边用湖南腔的普通话介绍着,显得格外欣喜,他所在的机构仅在《BIG TIME》一个链游项目上便可斩获上百倍股权回报。

这位投资人是易理华,LD CAPITAL 创始人。

随着 LD CAPITAL 在这个牛市周期中捕获众多 Alpha 项目,易理华也重新成为大家口中的“易老板”。

“不可思议”,一位与易理华有过接触的上海传统投资人这样评价他的经历,“几年前,易理华还在“拉皮条”,那时他只是篮球场上的小弟,没想摇身一变成了“币圈大佬”,之后听说他们在币圈熊市中不行了,没想到居然能东山再起。”

从湖南农村的穷小子到如今的“VC大佬”,易理华的人生轨迹生动诠释了何为时代机遇下的区块链革命,与他一同起飞的还有他亲手创立的 LD CAPITAL 。

从五十万美元起步,没有外部融资,四年内 LD CAPITAL 投资了数百个项目,迅速将资产规模增至超十亿美元,却又饱受质疑与争议。

深潮 TechFlow 与LD CAPITAL 创始人以及多位投资经理交流,尝试还原 LD CAPITAL 成长轨迹以及野蛮生长背后的秘密。

萌芽与挫折

“我的人生完全没有水分,你不知道以前有多艰难,我拿了一手烂牌走到今天,心里有一个大写的不服。”

2018年9月,易理华回到湖南娄底,在母校新化一中捐款成立 “助教助学金”时,如此说道。

“我是农村孩子,一无所有,从小渴望摆脱那个世界,来到上海读大学,在大学开始创业,从一路失败被骗,到创业赚到第一桶金,再到古典投资,那些都不是我想要的世界,直到区块链给了我一把武器,这种渴望支撑了我。”

这就是易理华前半生的人生掠影。

三次机缘,改变一生。

2013年,某地市政府正在招商引资,易理华得到消息后,把在上海认识的所有企业老板都找了一遍,从400人中筛选出60人,然后帮他们填写长达40多页的申报材料,涵盖技术、团队到商业模式的各个方面。最终,有20人申报成功,易理华赚到人生中第一个500万。

2015年,初识比特币。易理华将资产的三分之一投入BitSE进行挖矿,彼时一枚比特币仅为 1000 元。

2016年底,“爱思欧”热潮。易理华投入 10 万元,参与量子链天使轮融资,拿下 10 万枚 Qtum ,5 月份 Qtum 上线交易,价格很快飙升至 100 元,最高一度达600元,为易理华赚得百倍收益。此后,他又连续参加Vechain,EOS等众多项目的融资,斩获颇丰。

通过“爱思欧”,易理华获得了真正意义上的“第一桶金”。2018年1月,作为个人投资的延续,易理华正式创建了 Crypto Fund 了得资本(LD CAPITAL)。

从成立的第一天起,了得资本极具话题与争议。

一方面,易理华与加密OG的网络争吵吸睛无数;另一方面,了得资本的投资过于激进和高调。

在成立之初的十个月,了得资本就投资了超过80个项目。

GRE、Bitget、Bitgogo、Citex、Lbank、MEXC、BHEX、GGBTC、Coinsuper、BiLaxy......了得的投资组合中包含了大量交易所。

据悉,易理华还曾获得参与Binance最早期投资的机会,结果因为朋友的几句劝诫,没有亲自DD(尽职调查),最终主动错过。

或是错过Binance的悔恨,又或是对该赛道长期看好,导致易理华一直有交易所情节。

此外,了得资本延续了易理华在“爱思欧”热潮时期的投资风格,快速投资了大量“国产项目”。

2018年在接受链捕手专访时,易理华曾谈及投资逻辑——“不给任何项目下定义,只看进化速度”。同时,他还介绍了了得资本的投资决策流程,直言“投资决策时间很短,大家认为哪个项目好,讨论没问题就立马投,一天就可以做决策。”

彼时,无论是了得资本还是易理华本人,在行业中异常高调。

一个典型的场景是,2018年的某一天,易理华在某媒体大咖群发布了一则“了得资本战略投资海链”的消息,微信红包炸群后,沉寂已久的区块链媒体记者和相关从业者纷纷“送上祝福”。

快速决策,大量投资,加上高调的行事风格,了得资本存在感十足。

然而,短暂的虚假繁荣很快被熊市击垮,当“爱思欧”泡沫破灭,大量项目上线即跌破发行价,甚至频频出现项目方跑路的情况。

愤怒的投资者开始调查各类“土狗项目方”背景,在投资机构中频繁发现熟悉的身影,“怎么到处都有了得资本,钱都被他们割走了”。

对于外界的质疑,易理华表示可以理解却又很无辜。

一方面,了得资本被认为是收割市场的“镰刀”,另一方面,易理华在朋友圈表示了得资本 2018 年亏了 6 亿人民币。

“市场的看法我非常理解,一是他们大部分不认识项目方,但是对几个投资机构非常熟悉,项目失败肯定有部分人将责任归咎到投资机构;二是当年认知不足,又不够国际化,投资能力一般,却又异常高调,必然招人不喜欢。”

名利双失,加上惨淡的市场环境,了得资本一度濒临破产,痛定思痛,易理华和团队进行了深刻反思,并做了四方面的调整:

一,聚焦投资,砍掉一切跟投资无关的业务。

二,尽力低调,努力提升对行业和赛道认知。

三,全方位提高投后服务能力,获得优质项目的认可和支持。

四,虽然经历了熊市惨烈的投资失败,依然要坚信区块链的未来。

此后,了得资本逐渐淡出舆论视野,亟待新生。

牛市赢家

进入2021年,“了得资本”消失了,取而代之的是 LD CAPITAL 开始频繁出现在各类项目的融资新闻中。

投资风格依然激进,但这次稍微有所不同。

不再只投交易所和“国产土狗”,Flow、Mina、Assembly、Flare、Immutable X、CoinList……众多国际一线项目出现在了 LD CAPITAL 的 Portfolio中。

在NFT和GameFi领域,LD的投资组合更是Alpha云集:区块链3A游戏大作Illuvium和Bigtime、分布式渲染网络Render Network、Solana 生态的明星链游Star Atlas、首发 BINANCE IEO的Alien Worlds (TLM)……

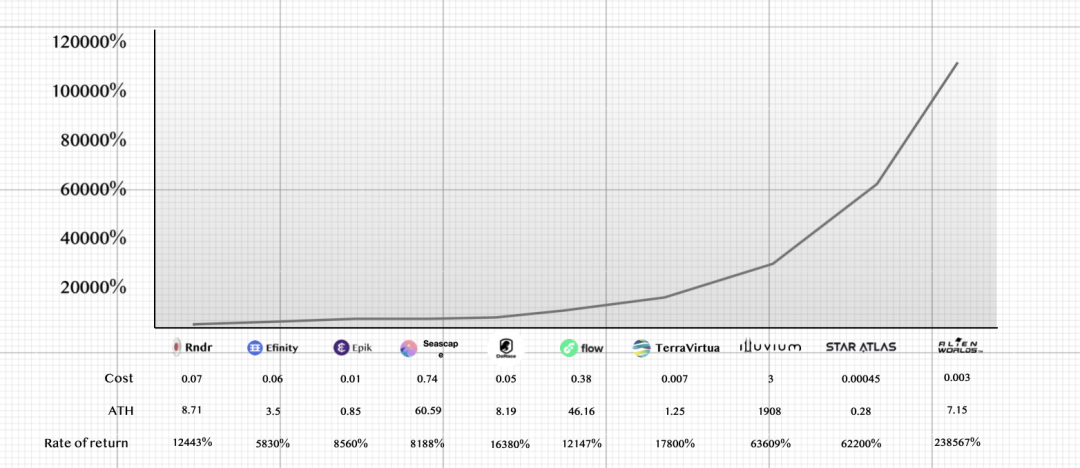

受益于 GameFi 热潮,LD 获得了一个极度夸张的投资收益比。

Illuvium 最高63609%账面回报;Star Atlas 最高 62200%账面回报;Alien Worlds 最高238567% 账面回报……

LD 在GameFi领域部分高回报投资

LD CAPITAL 何以蜕变,在竞争激烈的一级市场获得高Alpha项目的投资机会?

来自多位 LD CAPITAL 投资经理的观点,或许可以一窥问题的答案。

1.敢投。

LD CAPITAL 一如既往坚持了敢于下注的风格,幸运的是,这一次投在了牛市前夕。

2020年3月12日,经历了历史性的大崩盘,一、二级市场都降至冰点,大部分创业者和投资人纷纷选择离场或者观望,而 LD CAPITAL 靠着对区块链的信仰和一股冲劲,选择 “ALL IN ”,并加快在一级市场的布局。

用投资经理的话来说,312之后的短暂空档,其实是一级市场的黄金真空期:竞争小,相对容易投进;估值低,很多优质项目估值仅在千万美元左右;在行业低谷选择继续前行的创业者更值得信任和投资……

更重要的是,LD 敢于做项目的第一个投资者,不在意其他VC是否已经参与了投资。

“我们是很多项目的第一个投资者,不仅是给钱,更给予了创始人信心,这当然是一种冒险,但我们认为值得”,易理华如此表示。

2.全方位投后。

LD CAPITAL 将投后服务作为自己“拿下”项目的重要筹码,号称全员上阵做好投后服务,包括但不仅限于战略咨询、经济模型设计、资本和平台关系、市场品牌增长、生态合作、技术开发和人才招聘等。

比如,投资某交易聚合协议后,LD 不仅协助项目方获得海外顶尖VC投资;还协助其对接IDO平台和大型交易所、寻找海外知名KOL和社区进行合作、对接其他DeFi 项目进行合作,持续参与到项目的发展建设中,未退出一个Token。

3.人才与激励。

人是一切投资的核心,如何吸引到更优秀的投资经理?如何激发投资经理的积极性?

由于是自有资金,LD CAPITAL 有更加灵活的激励机制:与投资经理共享投资额度,最高可参投30%,并且这一比例还会不断提高,最终投资负责人的参投比例可超过50%。

因此,有人曾调侃称,在LD是给自己做投资,顺便带着老板投一投。

此外,合伙人在顶尖项目的投资中能够发挥重要的作用,每个合伙人都有自己的资源网络和核心能力圈,Illuvium、Bigtime等顶尖项目的Pitch与投资,很大程度上是依靠合伙人的个人能力。

相较于其他不少 VC 开始佛系躺平,LD 称得上是行业中最努力的那一批,合伙人 Lee XI 表示,自己已经两年没睡过好觉了。

目前,LD 有接近40人,仍在积极扩张中。

4.另起炉灶。

为什么 LD CAPITAL 抓住了 NFT和 GameFi 的投资机会?

因祸得福。

2020年,经历 DeFi Summer 之后,DeFi 赛道异常火热。然而,优质项目主要集中在欧美,作为亚洲机构很难参与头部项目的投资,说得直白一点,LD 想投顶尖 DeFi 项目却投不进去。

所以,LD 不得不转向研究新的赛道和机会。早在两年前,LD 的一位合伙人便开始研究 NFT和GameFi,经过讨论,LD 决心押注。判断逻辑在于,这是出圈的赛道,DeFi能捕获大量TVL,但集中在少数人,而NFT和GameFi可以带来海量的用户,任何机会都存在于巨大的增量市场。过去的 Web2.0 时代已经证明了这一点,拥有用户才拥有未来。

5.出海&线下

LD CAPITAL 很早便意识到一件事,“加密世界,西升东降”,大量优质项目在美国或者欧洲,“出海”成为了一个必选项。

因此,LD 开始在美国、新加坡开展招聘,积极参加各类线下会议和活动,拓展项目。

疫情阻隔了世界,大量的沟通在线上进行,但线下更容易建立人与人之间的信任与连接,Pitch项目更简单直接。

通过积极的线下跑动,LD CAPITAL 在美国投资了大量早期项目,其中很多还未曝光。

LD 在美国的人员

6.FOF与资源网络

2021年9月,LD Capital 宣布成立5000 万美元区块链母基金,用于投资全球优秀区块链基金。

官网显示,目前 LD 已投资1kx Capital、Kraken Ventures、Republic 基金、Shima Capital、BigTime 生态基金、DHVC等Fund。

易理华表示,FOF 投资主要是两个目的,一是全球交朋友,结识更多合作伙伴,发现更多好项目投资机会;二是为项目储备更多资源,做好投后服务,很多机构拥有不同的优势,希望能组合起来帮助投资的项目,投后服务是核心。

一方面,Shima、Republic等VC成为了LD的Deal Sourcing,另一方面 LD 也在搭建与顶尖项目之间连接网络。

比如 LD 投资 DAOMaker 后,获得了大量的Deal。

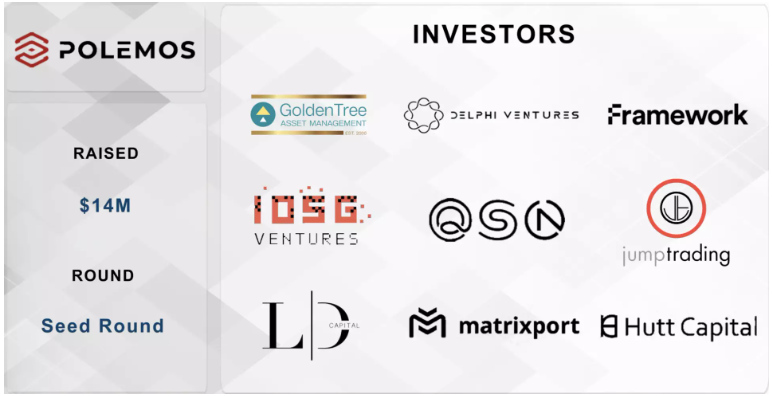

LD 投资的某顶尖 AAA GameFi 项目,为 LD 引荐了其他顶尖项目,比如 P2E 游戏公会 Polemos,最近宣布完成 1400 万美元种子轮融资,由 Framework Ventures 和 Delphi Digital 领投,LD Capital 参投。

如果还要说最后一点,那就是坚持与执着,为了投中一个项目,LD 愿意“放低姿态,N顾茅庐”。

一个项目方曾表示,LD Capital 多次沟通承诺,最终在“软磨硬泡”、“诚意与坚持”下,最终让LD Capital 参与投资。

争夺议价权

就财务回报而言,LD Capital 称得上这轮牛市周期中的大赢家,但是离一线 Crypto Fund 依然有不小差距。

关于VC的评价标准,某 Crypto VC 从业人员表示:“外行人评价的VC的标准是看赚了多少倍,但是行业内看VC是看资金规模、生态卡位、话语权。”

与真正的一线VC相比,LD仍然缺少“议价权”。

时至今日,在加密世界的无数VC中,真正拥有议价权的仍然只有 a16z、Paradigm、Binance Labs、Multicoin Capital 等少数投资机构。

议价权来自于品牌和投后服务(Value-added)。

一个客观存在的现象是,在品牌端,LD Capital 仍被“历史记忆”所拖累,导致仍有一些项目和FUND会拒绝 LD Capital 的投资,甚至出现过谈好Deal,快要打款的时候,项目方临时反悔,因为参与投资的其他 VC中有人认为 LD Capital 是 Pump & Dump Capital 。

通常而言,行业中有两种VC。一种是 Pump & Dump ,一切只为更大的财务回报,没有Value-added ,甚至会上线即抛售所有Token,伤害到项目方。

另一种是 DiamondHand,不仅一直持有,还能持续提供Value-added,比如今年一月Coinbase Ventures 表示从未出售过投资的代币。

易理华认为 LD 介于两者中间,因为都是自有资金,所以策略是退出一部分项目以支持新项目。不过,在选择退出的时,LD 会和项目方进行充分的沟通,做到尊重项目方的诉求,对持续努力迭代成长的项目长期投资,相信价值增长复利。

“LD 严重反对解锁即砸盘,也强烈反对这类投资人,在极致盈利和市场尊重之间,LD 选择后者”。

此外,此前流传的“LobsterDAO 加密 VC 榜单”也给 LD 的投资造成了严重困扰,榜单中 LD Capital 被列为黑名单,尽管后来 LobsterDAO 辟谣该榜单和他们无关,但是该榜单已经在各大社区和社交媒体上被广泛传播。

对于外界的种种看法,易理华表示已不再关心,“专注于做好自己的事情,时代已经变了,除了投资,LD 接下来会把精力放在海外品牌和打造更优质的投后服务上,目前新招聘的人才大部分都是为投后服务做准备。”

据 LD 投资经理表示,被拒绝接受投资的情况也已经大为减少,“因为投资本身存在正循环,投中一个好项目就更容易投中其他好项目,LD 已经用 Portfolio 证明了自己,特别是在 GameFi 领域。更何况,LD会给项目方做全方位的投后服务。”

那么,LD 还会延续之前的海投风格吗?

“也许是我们团队强烈看好区块链的未来,会忍不住支持那些展现出创新和理想的团队,敢于做项目的第一个投资者”,易理华如此解释,但变化也正在发生。

“我们也在复盘,持续提升,要把子弹留给最佳团队,把服务和资源用来支持顶级项目,所以最近已经开始行动和改变,最近2个月的投资基本是对顶级项目下重注,相信以后市场会看到全新的LD Capital。”

关于未来看好的方向,LD 投资经理表示还在寻找各类能够广泛出圈的WEB3应用,游戏仍然是其中重要的板块,比如,Bigtime和Cradles此类区块链游戏。

Bigtime是由Decentraland联合创始人Ari Meilich推出AAA 级链游大作,团队成员来自于Epic Games、暴雪、EA、Riot 等一线游戏公司。

Cradles是一个史前文明背景的RPG游戏,创造性地引入时间与熵系统,首次将现实世界的时间和空间规则融入游戏。

Cradles团队为此专门开发了一种新的NFT标准,EIP-3664 ,为静态的NFT增加了可操作性的模块,将它们变成一个“灵活的”、“有生命的”NFT,比如NFT具有了属性衰减的特征来模拟真实世界的物品老化。

模块化公链,是 LD 看好的另一方向。

一条公链通常可以被分解成共识层、数据可用层和执行层,而现阶段大多数的公链属于单片链。随着链上节点越来越多,区块也越来越大,交易拥堵不可避免。因此,模块化成为趋势,我们常听到的Layer2中的Rollup,也是区块链模块化的产物,负责执行交易。

在这个赛道,LD 押注了 IOTA 团队开发的智能合约链 Assembly,Assembly允许开发者根据需求自由创建自己的智能合约链,有点类似于类似 Cosmos 或波卡的多链网络。不同之处在于,Cosmos目前仍是松散的各链自制,没有共享安全,而 Assembly 链则依靠 IOTA 2.0 的L1共识安全层,解决了共享安全问题。

总体上看,LD 的成长经历了三个阶段。

2018年,了得资本更像是有一个暴发户心态的“投机VC”;2021年,LD Capital 开始国际化,并逐步形成了自己的投资方法论;如今,LD Capital,正迈向 3.0 版本:

(1)更加聚焦,针对顶级项目下重注。

(2)打造更高质量的全方位投后服务体系,为项目深度赋能。

(3)全面出海,提升全球品牌影响力。

(4)敢于做项目方的第一家投资机构。

总体而言,无论是 LD Capital 还是其创始人,都充满故事性和争议,试图定义 LD Capital 是困难的,它受益于对区块链的信念与坚持,甚至有一点好运气,在WEB3席卷全球的时代浪潮中,踏浪前行,成为了一个典型的华人 Crypto VC 样本。

未来,WEB3必然是全球化的竞争,一级市场将更加残酷与“阶级固化”, LD Capital 能否完全走出“品牌阴影”,在更加西方的加密叙事语境中找到自己的生存堡垒,获得更多话语权?

我不知道,但奔腾中的河流只能冲向大海,无法回头。