This article comes fromThe Block, original author: Yogita Khatri

Odaily Translator | Nian Yin Si Tang

Summary:

This article comes from

, original author: Yogita Khatri

Odaily Translator | Nian Yin Si Tang

secondary title

- Binance.US has completed its first round of financing, with a financing amount of more than US$200 million and a pre-money valuation of US$4.5 billion.According to reports- The exchange plans to offer new products and services through organic or strategic mergers and acquisitions.Binance.US, the U.S. subsidiary of global cryptocurrency exchange Binance, has announced that it has completed its Series A funding round.。

The company has raised more than $200 million in seed funding at a pre-money valuation of $4.5 billion. Investors include RRE Ventures, Foundation Capital, Original Capital, VanEck, Circle Ventures, Gaingels and Gold House. There was no lead investor in the round.

Seven months ago, Binance CEO Changpeng Zhao said in August 2021 that Binance.US was close to completing financing and had the support of "reputable investors."

According to reports

, after a $100 million fundraising effort failed, Binance.US then-CEO Brian Brooks quit the exchange three months after joining the exchange.

leave sadly

Now with new funding in hand, Binance.US aims to offer new products and services. A Binance.US spokesperson declined to comment on specific products, but said the exchange is exploring a range of new services organically or through strategic acquisitions. The company hopes to bring some of these services to market in the near future.

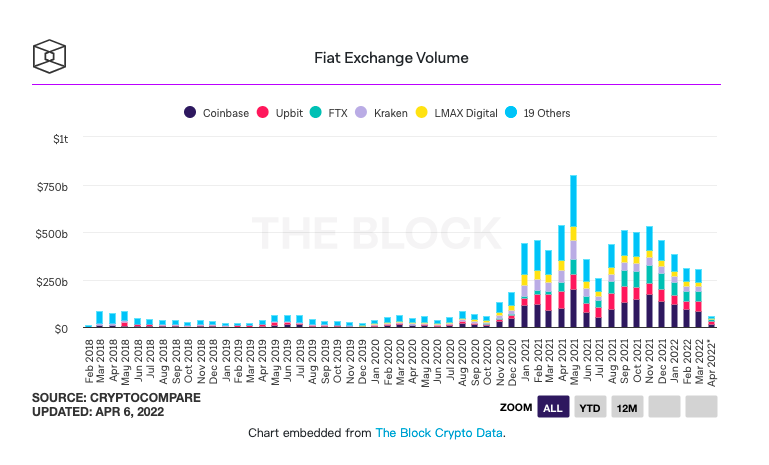

Binance.US currently offers crypto spot trading services for retail and institutional clients. Launched in 2019, the exchange currently provides services in 45 US states and 8 territories. Its follow-up plans to provide services in all states and territories of the United States.As for trading volume, Binance.US lags far behind rival Coinbase. According to The Block's data dashboard, the exchange traded more than $9 billion last month, compared with Coinbase's more than $81 billion.In March of this year, the trading volumes of other leading US exchanges - FTX.US and Gemini exceeded US$5 billion and nearly US$4 billion, respectively.Following Brooks' departure, Binance.US president and board member Brian Shroder was promoted to CEO last October. The exchange said it has doubled its headcount since then. The spokesperson said that Binance.US currently has more than 350 employees and is expected to continue to recruit talents for various positions, including marketing, compliance and risk, customer support, product and technology.To this end, Binance.US also plans to raise more funds in the coming months. The exchange also plans to go public “in the next two to three years,” the spokesperson said.

Get $400 millionto report, with a valuation of $7.1 billion; FTX.US also

$400 million raised

, valued at $8 billion.