一文盤點引領NFT投資熱潮的7大風投公司

原文來源:老雅痞

原文來源:老雅痞

原文來源:老雅痞

原文來源:老雅痞

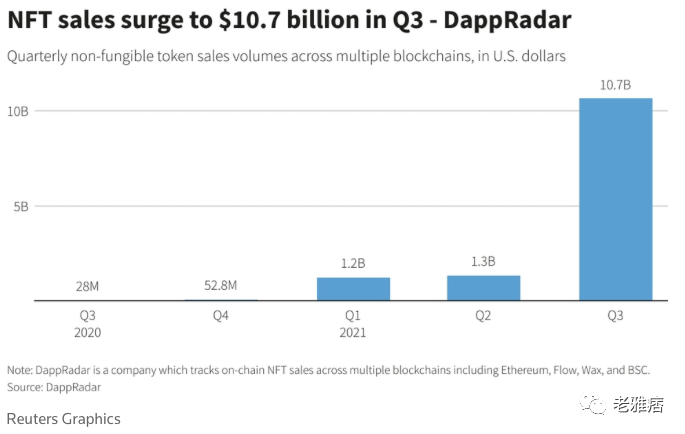

根據路透社的報告,2021年第三季度,NFT的銷售額猛增超過100億美元。另外,Brandessence市場研究顯示,在2021年上半年和第三季度內,NFT交易量增長了328%。這表明,NFT行業正在快速增長,並吸引更多的專業和機構參與者進入該行業。

就在最近,加密貨幣億萬富翁、銀河數字控股公司的首席執行官邁克-諾沃格拉茨宣布推出他的NFT慈善項目。

誰是在這個行業中行動和投資的主要參與者是非常重要的。這裡可以說是NFT行業中領先的風險投資公司和投資者,每個人都可以看到他們為什麼在這個名單上。如果你有一個項目,你的項目有可能成為這些人投資的下一個項目。如果你是一個NFT收藏家,關注這些名字對你分析這個行業是很有幫助的,可以為你的收藏品找到下一個寶石。

1、Andreessen Horowitz (a16z)

二級標題

二級標題

二級標題

A16z是NFT市場上最大的初創企業風險投資商之一。它是一家位於矽谷的風險投資公司,支持大膽的創業者用技術改造世界。

在PitchBook 2021年11月的一篇文章中,按價值計算,A16z參與了NFT公司所有VC交易的39.27%。 A16z只參與市場上價值最大的交易。

a16z在NFT市場上的一些值得注意的投資包括在C輪融資中對遊戲平台Mythical Games的1.5億美元投資,該平台的價值為12.5億美元。此外,如果我不提及對Axie Infinity的B輪融資,以30億美元的估值籌集1.52億美元,這是一家支持區塊鏈的玩到賺的視頻遊戲公司,那就是我的疏忽。

2021年11月,a16z在A輪融資過程中向基於NFT的音樂版權創業公司Royal投資了高達5500萬美元,而基於NFT 的音樂初創公司sound.xyzan 宣布已在由a16z 牽頭的種子輪融資中籌集了500 萬美元.

2、Coatue

二級標題

二級標題

二級標題

Coatue還在為NFT市場Opensea籌集超過1.25億美元的資金方面發揮了作用。

3、Benchmark

二級標題

二級標題

2021年9月,Benchmark也是Sorare的B系列融資6.8億美元的回報投資者。

4、Moonrock Capital

二級標題

二級標題"CoinBase for NFTs "二級標題

Moonrock Capital是一家位於英國和德國的領先的NFT融資風險投資公司。

2020年5月,Moonrock Capital共同領導了CoinBurp的初始種子輪融資,該公司是一個位於倫敦的加密貨幣平台,建立了一個

應用生態系統。

二級標題

二級標題

5、Animoca品牌

二級標題

5、Animoca品牌

2021年10月,Animoca Brands參與了Genopets的種子輪融資830萬美元,Genopets是一個NFT移動賺錢遊戲平台,玩家通過他們在現實生活中的步驟獲得獎勵。

6、Divergence Ventures

二級標題

二級標題

二級標題

Divergence ventures是一家位於加州舊金山的風險投資公司。

2021年1月,Divergence ventures為Fractional、藝術和娛樂NFT公司融資680萬美元。

2021年5月,Divergence Ventures參與了為增強現實NFT平台Anima籌集50萬美元的預種子輪基金。

7、Coinbase Ventures

一級標題

二級標題

二級標題

總結

總結