มูลค่าตลาดของ UST เหรียญ Stablecoin แบบกระจายอำนาจนั้นแซงหน้า DAI แล้ว

การแข่งขันในตลาด Stablecoin นั้นมีมานานแล้วตั้งแต่สนามแบบรวมศูนย์ไปจนถึงสนามแบบกระจายศูนย์ และสถานการณ์การต่อสู้ก็เปลี่ยนไปอีกครั้ง

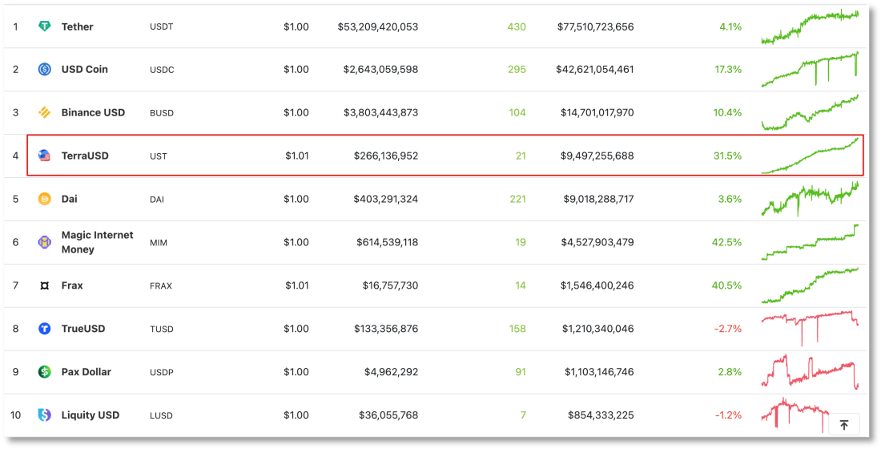

เมื่อวันที่ 23 ธันวาคม ข้อมูลของ Coingecko แสดงให้เห็นว่ามูลค่าตลาดของเหรียญ Stablecoin แบบกระจายอำนาจสูงถึง 9.479 พันล้านเหรียญสหรัฐ ซึ่งแซงหน้ามูลค่าตลาดของ DAI ที่มีมูลค่าตลาด 9.035 พันล้านเหรียญสหรัฐในแนวทางเดียวกัน UST สร้างขึ้นบนเครือข่ายบล็อกเชน Terra และ DAI เป็นเหรียญ Stablecoin แบบกระจายอำนาจที่ใหญ่ที่สุดบนเครือข่าย Ethereum

การเพิ่มขึ้นของมูลค่าตลาดของ UST ทำให้มันอยู่ในอันดับที่สี่ในรายการของมูลค่าตลาดของ Stablecoin และ “สามอันดับแรก” ยังคงถูกครอบครองโดย Centralized Stablecoin ได้แก่ USDT ของ Tether, USDC ของ Circle และ BUSD ของ Binance Ecosystem

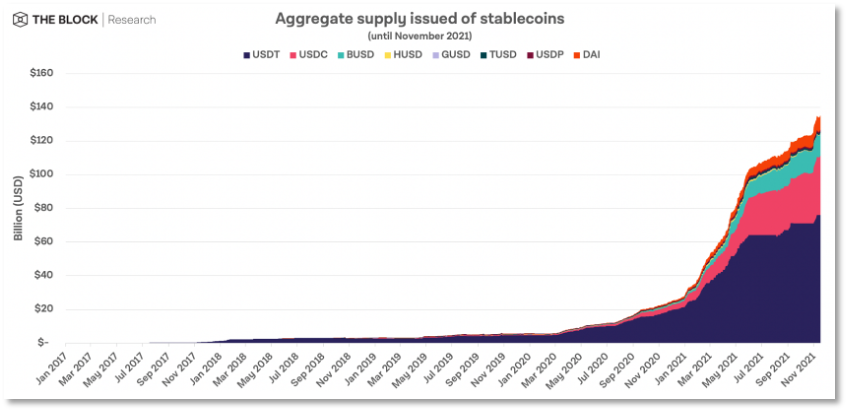

รายงานล่าสุดจาก The Block Research แสดงให้เห็นว่าอุปทานทั้งหมดของ Stablecoins เพิ่มขึ้นจาก 29 พันล้านดอลลาร์ในช่วงต้นปี 2021 เป็นมากกว่า 140 พันล้านดอลลาร์ ซึ่งเป็นอัตราการเติบโต 388% ในระหว่างปี UST ไม่รวมอยู่ในสถิติที่รายงาน ซึ่งหมายความว่าขนาดตลาดปัจจุบันของ Stablecoins อาจใหญ่กว่าสถิติ มีมุมมองว่า DeFi และอนุพันธ์เป็นสาเหตุสำคัญที่ทำให้ความต้องการ Stablecoins เพิ่มขึ้น

ชื่อระดับแรก

มูลค่าตลาด UST เพิ่มขึ้น เชน Terra TVL แซงหน้าเชน BSC

ปัจจุบัน พื้นที่ของ Stablecoin ถูกครอบงำโดย USDT และ USDC ทั้งคู่ออกโดยบริษัทที่รวมศูนย์และได้รับการสนับสนุนโดยตราสารทางการเงินแบบดั้งเดิม เช่น พันธบัตรรัฐบาลสหรัฐฯ เงินสด และหุ้นกู้เพื่อยึดมูลค่าของเงินดอลลาร์สหรัฐฯ

ตามข้อมูลจาก CoinGecko USDT ของ Tether คิดเป็นมากกว่า 60% ของจำนวน Stablecoins ทั้งหมดที่ออกในตลาดสินทรัพย์เข้ารหัสทั้งหมด ซึ่งครองตำแหน่งสูงสุดในรายการมูลค่าตลาดของ Stablecoin ด้วยมูลค่าตลาด 77.4 พันล้านเหรียญสหรัฐ มูลค่าตลาดของ เหรียญ Stablecoin ที่เป็นไปตามมาตรฐาน USDC ที่ออกโดย Circle อยู่ในอันดับที่สองด้วยมูลค่าประมาณ 42.6 พันล้านเหรียญสหรัฐ BUSD เหรียญ Stablecoin ที่เป็นไปตามมาตรฐานอื่นที่ออกโดย Binance ซึ่งอยู่ในอันดับที่สามด้วยมูลค่าตลาด 14.7 พันล้านเหรียญสหรัฐ

คำอธิบายภาพ

มูลค่าตลาดของ UST สูงกว่า DAI

คุณรู้ไหมว่า DAI เป็น Stablecoin แบบกระจายอำนาจที่ยาวที่สุดในตลาด มันถูกสร้างขึ้นตามโปรโตคอล MakerDao บนเครือข่าย Ethereum ไม่ว่าจะเป็นอุปทานหรือมูลค่าตลาด มันเป็นราชาแห่งตลาด Stablecoin แบบกระจายอำนาจเสมอมา วันนี้ "มงกุฎ" ได้เปลี่ยนมือแล้ว มูลค่าตลาดของ UST ปัจจุบันอยู่ที่ประมาณ 9.4 พันล้านดอลลาร์สหรัฐ และมูลค่าตลาดของ DAI อยู่ที่ประมาณ 9 พันล้านดอลลาร์สหรัฐ

Stablecoin ที่ออกโดยส่วนกลางนั้นง่ายกว่าที่จะรักษาสมอ 1:1 ด้วยเงินดอลลาร์สหรัฐเนื่องจากสินทรัพย์ทางการเงินแบบดั้งเดิมเป็นทุนสำรอง ในการเปรียบเทียบ UST และ DAI เป็น Stablecoin แบบกระจายอำนาจซึ่งสนับสนุนโดยการจำนองสินทรัพย์ที่เข้ารหัส สกุลเงินดิจิทัลที่มีความผันผวนสูงเป็นสินทรัพย์อ้างอิง เมื่อ Stablecoins แบบกระจายศูนย์ปรากฏขึ้นในสภาวะตลาดที่รุนแรง

เมื่อพิจารณาจากมูลค่าตลาดและความต้องการของตลาดสำหรับสัญญาอัจฉริยะบนเครือข่ายแล้ว เหรียญ Stablecoin แบบกระจายศูนย์กำลังเติบโตขึ้นทุกวัน และโครงสร้างพื้นฐานที่สอดคล้องกันบนเครือข่ายก็เพิ่มขึ้นตามกระแส สิ่งอำนวยความสะดวกพื้นฐานของ UST คือ Terra chain เป็นกรณีตัวอย่าง มีเพียง 13 แอปพลิเคชันบนห่วงโซ่เท่านั้นที่สามารถล็อคสินทรัพย์ที่เข้ารหัสได้มากกว่า 18 พันล้านดอลลาร์ และ TVL (มูลค่ารวมของสินทรัพย์ที่เข้ารหัสที่ถูกล็อคบนเชน) เมื่อแซงหน้ายูนิคอร์นเชนสาธารณะแล้ว วท.บ.

เมื่อวันที่ 21 ธันวาคม เครื่องมือวิเคราะห์ข้อมูล DeFi Llama แสดงให้เห็นว่า TVL ของเชน Terra มีมูลค่าเกิน 18.2 พันล้านดอลลาร์สหรัฐ และ TVL เฉลี่ยของแต่ละแอปพลิเคชันบนเชนนั้นเกิน 1.4 พันล้านดอลลาร์สหรัฐ ส่วน TVL เฉลี่ยของโปรโตคอลเชน BSC คือ 73 ล้านดอลลาร์สหรัฐ ซึ่ง 165 พันล้านดอลลาร์ในสินทรัพย์ crypto ถูกล็อคใน 225 โปรโตคอล

การเพิ่มขึ้นของ TVL บนเชนของ Terra นั้นสอดคล้องกับการเพิ่มขึ้นของราคาของโทเค็นการกำกับดูแล LUNA ตามข้อมูลจาก CoinGecko นั้น LUNA เพิ่มขึ้น 48.5% ภายใน 7 วัน และทำสถิติสูงสุดเป็นประวัติการณ์ที่ 97.9 ดอลลาร์ในวันที่ 22 ธันวาคม ซึ่งผลักดันให้มูลค่าตลาดรวมของ LUNA ขึ้นสู่สิบอันดับแรก (อันดับที่ 9) ในรายการมูลค่าตลาดสินทรัพย์เข้ารหัส ไม่รวม Stablecoins LUNA อยู่ในอันดับที่ 7 ในแง่ของมูลค่าหลักทรัพย์ตามราคาตลาด

บางคนระบุว่ามูลค่าตลาดที่เพิ่มขึ้นของ LUNA มาจากกลไกโทเค็นและการใช้งานในแอปพลิเคชัน DeFi ขณะที่ Adrian Krion ซีอีโอของบริษัทเกม Web 3 Spielworks กล่าวว่าความต้องการของตลาดสำหรับ LUNA นั้นเกิดจากความต้องการ UST เป็นหลัก โดยการคัดเลือก UST จำเป็นต้องเผา LUNA บนโซ่ Terra

ชื่อระดับแรก

DeFi และอนุพันธ์ช่วยเพิ่มอุปทาน Stablecoin ได้ถึง 388%

The Block Research ชี้ให้เห็นในรายงานล่าสุด "2022 Digital Asset Outlook" ว่าอุปทานรวมของ Stablecoins เพิ่มขึ้นจาก 29 พันล้านดอลลาร์ในช่วงต้นปี 2021 เป็นมากกว่า 140 พันล้านดอลลาร์ ซึ่งเป็นอัตราการเติบโต 388% ในระหว่างปี

คำอธิบายภาพ

การวิจัยที่ถูกบล็อก: การเปลี่ยนแปลงการจัดหา Stablecoins ในช่วงหลายปีที่ผ่านมา

มีหลายปัจจัยที่อยู่เบื้องหลังการเพิ่มขึ้นของอุปทาน Stablecoin สำหรับบริษัทซื้อขายสินทรัพย์ crypto แล้ว stablecoins เป็นวิธีการลดความผันผวนของการซื้อขาย cryptocurrencies ต่างๆ

ในปี 2021 ผู้ค้ารายย่อยจำนวนมากจะนำ Stablecoins เข้าสู่โปรโตคอลการเงินแบบกระจายอำนาจ (DeFi) บนเครือข่ายต่างๆ ทำให้เกิดความต้องการใหม่สำหรับ Stablecoins ผู้ค้าสามารถแลกเปลี่ยนสินทรัพย์ใหม่ในแอปพลิเคชันการซื้อขายแบบกระจายศูนย์ DEX หรือใช้ Stablecoins เป็นคำมั่นสัญญาในการยืมสินทรัพย์อื่นเพื่อการเก็งกำไร หรือจับคู่ Stablecoins กับสินทรัพย์อื่นเพื่อรับรางวัลสินทรัพย์ใหม่ในแหล่งรวมสภาพคล่องเพื่อทำกำไร

DeFi นำเสนอสถานการณ์ตลาดใหม่สำหรับ Stablecoins และยังส่งเสริมการเปลี่ยนแปลงของเอาต์พุต Stablecoin จากวิธีการรวมศูนย์เป็นวิธีการกระจายอำนาจ อัลกอริทึม Stablecoin UST เป็นผลิตภัณฑ์ของแนวโน้มนี้

นอกจาก DeFi แล้ว ตลาดอนุพันธ์ยังเป็นแรงผลักดันสำคัญสำหรับการเติบโตของ Stablecoin

Paolo Ardoino จาก Tether ชี้ให้เห็นว่าอนุพันธ์ส่วนใหญ่ของสินทรัพย์เข้ารหัส (สัญญาฟิวเจอร์ส สัญญาออปชั่น ฯลฯ) ชำระด้วยเหรียญ Stablecoins Jeremy Allaire ซีอีโอของ Circle คาดการณ์ว่าปี 2022 คาดว่าจะเป็นปีแห่งวิวัฒนาการของ Stablecoins เนื่องจากสถาบันและบุคคลต้องการถือครอง Stablecoins มากขึ้นเรื่อยๆ ความต้องการของพวกเขาจะเพิ่มขึ้นอย่างต่อเนื่อง รวมถึงการชำระเงิน การใช้งาน

อย่างไรก็ตาม The Block Research ยังชี้ให้เห็นว่าตลาดกำลังเผชิญกับการตรวจสอบข้อเท็จจริงมากขึ้นในปี 2564 ในแง่ของกฎระเบียบและการตรวจสอบข้อเท็จจริง สหรัฐอเมริกาได้ระมัดระวังเป็นพิเศษกับเหรียญ Stablecoins โดยหน่วยงานกำกับดูแลได้ย้ำถึงภัยคุกคามที่อาจเกิดขึ้นต่อระบบการเงินของสหรัฐอเมริกาครั้งแล้วครั้งเล่า

วุฒิสมาชิกเอลิซาเบธ วอร์เรน ได้กล่าวหลายครั้งว่า Stablecoin นั้นไม่เสถียรเสมอไป "ในช่วงเวลาที่เศรษฐกิจตกต่ำ ผู้คนมักจะถอนเงินจากผลิตภัณฑ์ทางการเงินที่มีความเสี่ยงสูงและเปลี่ยนไปใช้ดอลลาร์จริง เสถียรภาพของ Stablecoin จะลดลงอย่างมากเมื่อต้องการความเสถียร และความคิดแบบนี้อาจจบลงด้วยการทำลายเศรษฐกิจทั้งหมดของเรา”

คณะกรรมการกำกับดูแลเสถียรภาพทางการเงิน ซึ่งเป็นหน่วยงานหลักของกระทรวงการคลังสหรัฐฯ ที่ตรวจสอบระบบการเงิน เตือนว่าเหรียญ Stablecoins เหล่านี้มักถูกวางตลาดว่า "ได้รับการสนับสนุนจากสินทรัพย์ทางการเงินแบบดั้งเดิม" โดยอ้างว่าสินทรัพย์มีมูลค่าที่มั่นคง แต่เมื่อนักลงทุนสงสัยในความน่าเชื่อถือของพวกเขา เหรียญ Stablecoin อาจถูก “ไถ่ถอนและการชำระสินทรัพย์อย่างกว้างขวาง ซึ่งอาจก่อให้เกิดปัญหาด้านสภาพคล่องคล้ายกับการฝากเงินในธนาคาร ซึ่งอาจเป็นอันตรายต่อผู้ใช้และระบบการเงินที่กว้างขึ้น”