Written by: Delphi Labs

Introduction

Introduction

Delphi has invested a lot of time in analyzing and designing token issuance mechanisms. Overall, the token issuance mechanism has come a long way since ICO fixed price sales, but we still think it has a lot of room for improvement.

We recently incubated two projects, Mars and Astroport, but when planning their token issuance mechanisms, we found that none of the existing structures adequately met all of our design goals. In order to achieve the purpose of "tailor-made" for the design goal, we re-modified the token issuance mechanism from the first principles. The result of the modification is the Lockdrop + Liquidity Bootstrap Auction, which will be piloted on Astroport in December and later on Mars.

first level title

secondary title

Current Token Issuance Mechanism

Broadly speaking, the goal of a token issuance mechanism is to distribute tokens to the protocol's users and community. Various current projects mainly adopt the following two token issuance mechanisms:

(1) Distribution of tokens to users - users earn tokens through past actions or ongoing actions. This mechanism includes airdrops as well as all forms of ongoing incentives (staking rewards, liquidity mining rewards, trading competitions, etc.).

(2) Public sale of tokens - users receive tokens in exchange for invested money. Such mechanisms include fixed price sales, auctions, LBPs, Pylon-style yield commissions, and more.

secondary title

Distribute tokens to users

The protocol for distributing tokens to users mainly adopts two methods, namelyairdrop。

airdropDesigned to distribute tokens based on past behavior of users, either because they have used the protocol before or because they are high-value users of other protocols. This might seem like a good idea, but airdrops reward past behavior, not future promises, so it's not guaranteed to be good for the future development of the protocol. In fact, our research shows that most airdrops are simply abandoned later.

Continuous Liquidity IncentivesDesigned to reward continued participation in the protocol, it has become the preferred distribution method for most projects. However, protocols that rely solely on this approach have some drawbacks. First, continuous incentives can only be used to reward those uses that can be manifested through on-chain behavior, such as providing liquidity, collateral, or completing transactions. This favors whales with more capital to get a higher share of rewards, but also excludes other stakeholders of all kinds who add value to the protocol, such as community members, third-party integrators, and even those built on top of the protocol. Items are also excluded. For these stakeholders, acquiring tokens on the open market may be the only way to achieve incentive alignment.

secondary title

Public sale of tokens

In order to prevent the above-mentioned problems from happening, some projects choose the method of public sale to promote price discovery (price discovery), but the public sale itself also has disadvantages. First and foremost, all public sale-type mechanisms expose projects to higher regulatory risks. Agreements involving significant "capital investment" and early stages are most likely to be identified as "essential entrepreneurial efforts" that rely on small groups in the "Howey Test". This factor, among others, makes public token sales more likely to be considered unregistered securities sales than other distribution methods.

Second, while a public sale solves the problem of price discovery, it does not necessarily solve the problem of low initial liquidity. While projects can increase initial liquidity on their own, doing so requires significant amounts of capital and exposes them to regulatory risk, since public sales essentially establish markets that set prices for tokens themselves. As a result, many tokens exhibit high volatility in the days and weeks after launch—crucially, this high volatility tends to hurt early adopters who are enthusiastic about the project, as they may not necessarily be skilled in trading. Sophisticated enough.

first level title

Summary: Design Goals and Limitations

In summary, we hope to propose a token distribution mechanism that achieves the following goals:

distribution:We want to ensure that tokens are distributed fairly to a wide range of stakeholders. Most importantly, this means that the activation mechanism should not be exploited by bots or whales. Ideally, we would like to give holders of smaller shares an opportunity to earn more tokens by showing commitment to the protocol.

Price Discovery:We want to make sure that there is a fair, decentralized, bottom-up mechanism for establishing the price of tokens, establishing a price for tokens before they are traded.

Sufficient circulation:fluidity:

fluidity:Decentralization:

Decentralization:The joint venture involved in creating Mars and Astroport does not want to set prices, conduct public sales, launch AMM/LBP, accept"venture capital"Invest, or otherwise make yourself a seller, authority, market maker, broker.

Lock + Liquidity Guided Auction

Lock + Liquidity Guided Auction

We believe the Lockdrop + Liquidity Bootstrap Auction can achieve all of these goals. It is at the highest level a two-stage process that works as follows:

Phase 1 (Lock):distribution stage. This phase provides a window of time in which anyone can pre-commit to become a user of the protocol for a certain period of time (see "Phase 1: Lockdown" below for details).

At the end of the time window, they receive a proportional share of the total tokens being distributed, based on the size of the pledge and how long it lasted. These tokens are locked until the end of the second phase.

Phase 2 (Liquidity Guided Auction):price discovery stage. This stage provides a time window. If participants in the lock-up stage want to provide liquidity, they can commit to deposit part or all of their ASTRO in one side of the stablecoin pair liquidity pool (ie ASTRO-UST). Other users can then join in and deposit their own UST into this liquidity pool, effectively buying ASTRO from lock-up phase participants. At the end of this phase the following happens:

1. Native tokens + stablecoins are deposited into the liquidity pool. The ratio of native tokens to stablecoins determines the final price of native tokens.

2. Auction participants receive LP shares in proportion to their deposits, and LP shares are locked and vested linearly within 3 months. Assuming there is sufficient participation in the second phase, this move will ensure instant, deep liquidity in the market price.

3. All tokens issued in the first phase, if not used in the pledged liquidity auction in the second phase, will be unlocked and can be used for free trading.

Note: Airdrops can also be used to distribute tokens to users during the first phase (either as an alternative or in addition to locking).

secondary title

Phase 1: Lockdown

The first phase is the distribution phase, whose goal is to get tokens into the hands of Astroport users. Ideally, users should receive tokens proportional to the "value" they bring to the protocol. Values are measured in different ways, and different distribution mechanisms correspond to different value forms. For example, the airdrop mechanism is to identify the value brought by the historical users of the target protocol or the historical users of the collaborative protocol that are very likely to use the target protocol. A lock-in can be thought of as similar to an airdrop, but instead of rewarding users for previous actions, it rewards users for a forward-looking commitment to use the protocol in the future - it's similar to signing up for a full year at a time with service providers like cellphones, broadband, etc. benefits received from the contract.

As far as Astroport is concerned, the clients of these long-term agreements are liquidity providers and can play a role in guiding liquidity in key trading pairs. During the lockup period, users can commit to deposit liquidity into Astroport in the form of Terraswap LP shares for pre-selected trading pairs. The key is that users can further demonstrate their commitment to Astroport by setting a long-term lock-up in liquidity. The longer the lock-up period, the higher the reward, and the lock-up period can be up to one year. 7.5% of ASTRO's total supply will be allocated to users who locked liquidity in the first phase, hence the name "lockdrop".

In general, an individual user's resulting "locked" share will be calculated based on two factors:

1. The total number of ASTROs allocated to trading pairs that users contribute liquidity to (will be announced before the start of the first phase).

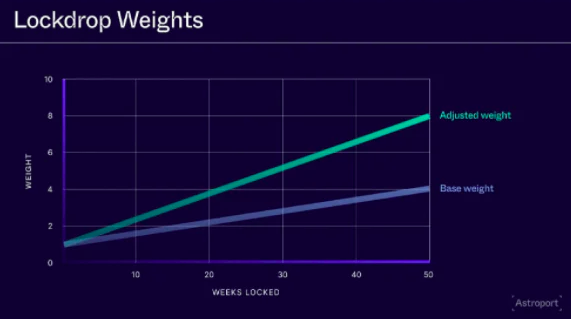

2. The user's weight in a pool adjusts the liquidity share. Rather than just being measured as user liquidity or total user liquidity, there is a weight adjuster based on how long users have locked their LP tokens. This means that the numerator is the user's weight-adjusted liquidity, and the denominator is the total weight-adjusted liquidity provided by all users in the pair.

The ASTRO share a user gets for his LP contribution to a trading pair is calculated as follows:

The ASTRO share a user gets for his LP contribution to a trading pair is calculated as follows:

A = Ap * (wLu/wLp)

A = ASTRO received by the user

Ap = total ASTRO allocated to the trading pair selected by the user

wLu = weight-adjusted liquidity provided by users

wLp = weight-adjusted total liquidity in the pool

B = boost value based on selected lockout length

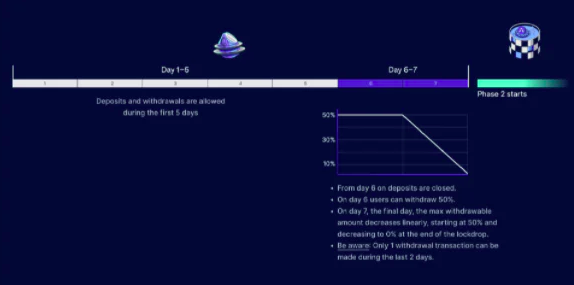

As per the schedule, users are free to deposit and withdraw for the first 5 days, encouraging anyone to participate and invest all their liquidity they are willing to invest. Users can only withdraw in the last 2 days, and the system allows them to withdraw part of the liquidity if they feel that the amount of ASTRO they have obtained in the lockup is less than the opportunity cost of that liquidity.

At the end of Phase 1, liquidity will be migrated from Terraswap to Astroport — users’ Terraswap LP shares will be burned in exchange for locked Astroport LP shares.

Importantly, in addition to the one-time lockup reward, LPs will also receive transaction fees + issuance fees for their pools (as do other liquidity providers).

secondary title

Phase 2: Liquidity Guided Auction

The second stage is the price discovery stage, its goal is to establish a price for the token and establish a deep liquidity based on this price. To those familiar with trading, a liquidity-guided auction can be seen as similar to the recent Mango Markets auction, with several key differences:

1. Users are selling tokens, not agreements;

2. Auction participants get locked LP shares, not unlocked tokens;

3. In the last two days, withdrawals will be gradually restricted to prevent whales from manipulating transactions (more details will be given below).

In the second phase, users participating in the lock-up or users who obtained tokens in the airdrop can choose to deposit some or all of their locked ASTRO tokens into the ASTRO-UST liquidity pool. Any user can then join and deposit UST on the other side, effectively buying ASTRO from locked participants.

The price of ASTRO is determined by the amount of UST and ASTRO that users add to the pool, especially the final ratio of UST and ASTRO. If 100 ASTRO and 100 UST are deposited, the implied ASTRO price is $1, and if another 100 UST is deposited, the implied price jumps to $2. The point is that this price makes sense because participants commit to initializing and locking their tokens in the liquidity pool at this price for 3 months (i.e. they actually buy ASTRO for an amount below that price, and at 3 Sell at an amount higher than this price within a month) - this is a typical risk faced by providing liquidity in an AMM, that is, it cannot exit spontaneously according to market conditions.

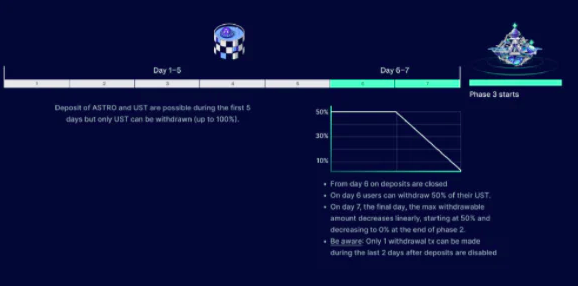

According to the schedule, in the first 5 days of the second phase, users can deposit as much ASTRO and UST as they want, while they can only withdraw UST. This encourages users to participate and bid the maximum amount they are willing to invest. Users can only withdraw UST in the last 2 days. As UST is removed, the implied ASTRO price will drop. This enables price discovery as users will keep withdrawing UST until they see the ASTRO:UST ratio reflecting an acceptable market price for ASTRO to them.

What happened in the last 2 days is worth looking into, as other similar designs are at risk of manipulation at this stage. Once the 6th day is reached, the withdrawal limit will be limited to 50% of the deposit amount. Once the 7th day is reached, the withdrawal limit will drop linearly from 50% to 0 within one day. This limit is necessary, without it whales will overcommit (i.e. put in far more money than they plan to keep in the pool) in an effort to drive prices far higher than they actually want The price to be paid to deter others from participating. Then when the time is over, they draw all the excess funds and lock in a lower price. This phenomenon of manipulation has happened before in the mango market, and it has severely disrupted token offerings and price discovery. Withdrawal caps limit the efficacy of manipulation, and gradual declines create more and more stability around price discovery, leading to closures.

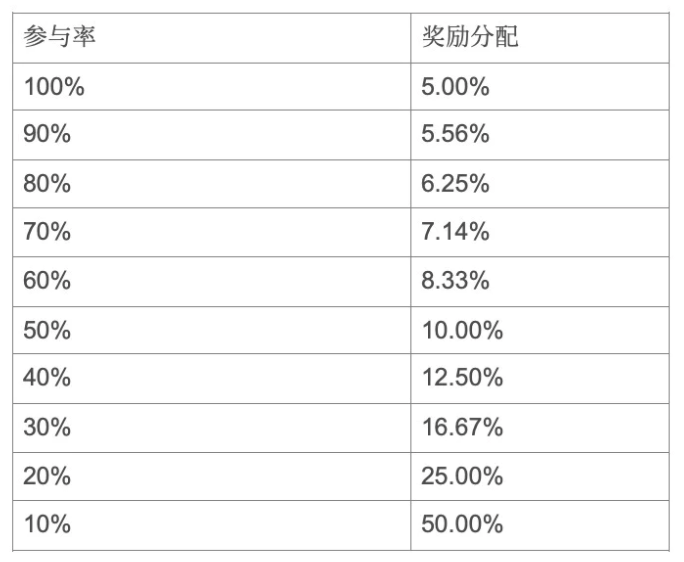

Speaking of which, the mechanics of the final days of Phase 2 should be fairly clear, and we need to move on to what keeps users participating in Phase 2 in general. Whether they prefer to sell their rewards or use them for LPs, they can do both without participating in Phase 2 while retaining the option. The reason why it is called the option right is that when users participate in the second phase, their LP shares will be locked for 3 months. In response, we will reward Phase 2 participants in the form of an additional 1% of the ASTRO supply (10 million ASTRO). This 1% is distributed between ASTRO depositors and UST depositors, which is actually a premium for sellers and a discount for buyers. The fixed 1% reward means that if the participation in the second stage is low, the bonus will increase relatively. This helps create secondary market liquidity and ensures the level of participation we believe is necessary. We present in the table below a scenario for the distribution of rewards given to Phase 2 depositors based on the overall participation rate:

While we enumerate all participation in the table, we certainly do not expect a participation rate anywhere near 100%. We provide an example below with integers to illustrate the application of this table.

Example: 25% of Phase 1 token holders decide to participate in Phase 2 (25,000,000 ASTRO tokens), 25,000,000 UST is also deposited. This would result in a price of $1 per ASTRO. These participants will receive an additional 10,000,000 ASTRO (5 meters per square) in proportion to their deposit.

Assuming you hold ASTRO representing 1% of your deposit, you are entitled to 1% of the 5% ASTRO reward. This means that your 250,000 ASTRO deposit is now LP tokens representing 125,000 ASTRO and 125,000 UST, and you can get an additional 50,000 ASTRO, which is a bonus of up to 20%.

After the end of the second stage, auction participants will obtain LP shares in proportion to their contributed liquidity shares, and LP shares will be locked and vested linearly within 3 months.

advantage

advantage

Now that we've looked at the new mechanism in detail, let's explore how it achieves the goals outlined in the Design Considerations section.

distribution:ASTRO is allocated to users who pre-commit to use the protocol. Small investors can increase their ASTRO stake by voluntarily locking up a longer commitment to use it, and non-users can also acquire tokens in a way that is not exploited by whales and bots, and allows users to have some control over the price they pay.

Price Discovery:The second stage implements a bottom-up price discovery auction mechanism through LP shares, allowing buyers (users who pledge UST to LP) and sellers (Astroport users who pledge ASTRO to LP) to determine the fair price of ASTRO together.

enough floats:fluidity:

fluidity:Decentralization:

Decentralization:in conclusion

in conclusion

We believe both Lockdrops and Liquidity Bootstrapped Auctions (LBAs) represent new fundamentals for token offerings, and we'd love to see how the wider cryptocurrency community chooses to adapt and build upon them. While we chose to use the two together this time around, they are separate mechanics that are equally suitable for use on their own.

"Staking" can be seen as a new method of distributing tokens to users, rewarding future commitments rather than past or ongoing actions. It can be used for any protocol that "uses" and commits capital that can be tokenized and locked. The "Liquidity Bootstrap Auction" we propose in this article does not exactly fall into the category of token distribution or public sale, it can be said to represent a new type of token distribution:peer-to-peer auction. That said, for those relatively tolerant of regulatory risk, a Liquidity-Guided Auction can serve purely as a superior price discovery and liquidity mechanism, one with project-sourced funding pools rather than users The mechanics of the token.

We have released the code for Lockdrop and Liquidity Bootstrap Auction (LBA). We've talked to a number of projects looking to take advantage of these mechanics and will work closely with them to help them design for their goals. If you are interested in using these mechanisms for your own projects, please feel free to contact our team and we will be happy to help you think about how to implement your ideas.