Hướng dẫn tránh hố DeFi: Năm bước giúp bạn tìm các dự án DeFi đáng để đầu tư

Ngày: tháng 10 năm 2021

Ngày: tháng 10 năm 2021

Nguồn dữ liệu: Cách khám phá các dự án có giá trị (https://footprint.cool/valuableprojects)

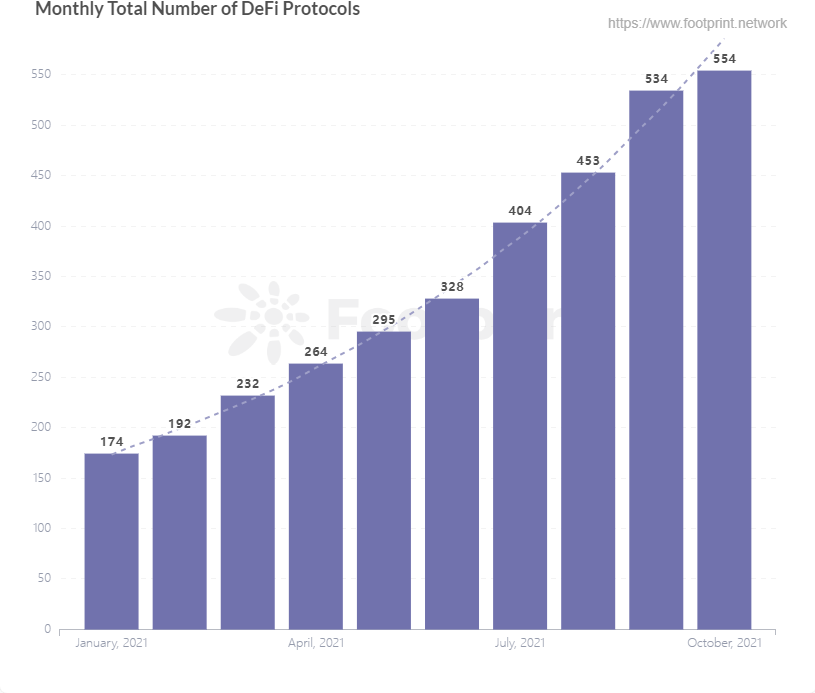

Với sự phát triển và phổ biến của thị trường mã hóa, ngày càng có nhiều dự án DeFi được thu hút và một số lượng lớn các nhà đầu tư cũng bị thu hút. Sự phát triển của DeFi vào năm 2021 có thể được mô tả là nhanh chóng. TVL (tính đến thời điểm báo chí) đã tăng 860,42% so với mức 21,4 tỷ USD vào đầu năm; số lượng dự án DeFi trên chuỗi cũng tăng từ 174 tại đầu năm lên 554, với tốc độ tăng trưởng 218,39%. Sự thịnh vượng của thị trường DeFi không chỉ cho phép các nhà đầu tư thu được lợi nhuận cao hơn so với các khoản đầu tư tài chính truyền thống mà còn nâng cao niềm tin.

Mô tả hình ảnh

Thay đổi về số lượng dự án DeFi mỗi tháng vào năm 2021, nguồn dữ liệu: Footprint Analytics

Mô tả hình ảnh

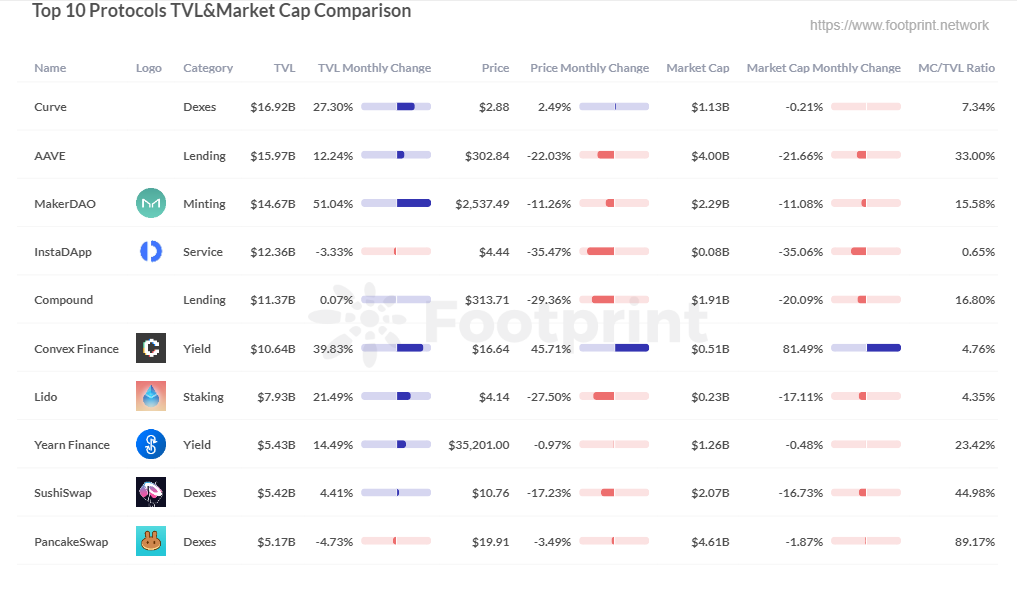

So sánh các chỉ số khác nhau của 10 nền tảng TVL hàng đầu (khối lượng khóa, giá, giá trị thị trường), nguồn dữ liệu: Footprint Analytics

1. Tổng khối lượng bị khóa (TVL)

Đối với những người tham gia đầu tư DeFi, TVL không còn xa lạ với chỉ số này và dữ liệu TVL cần thiết của nền tảng DeFi có thể được lấy trên các nền tảng dữ liệu lớn (chẳng hạn như DeFi Llama, CoinGecko và CionMarketCap). TVL đề cập đến tổng số lượng tài sản được người dùng ký gửi và bị khóa trong thỏa thuận. Giá trị càng lớn thì dự án tích lũy được càng nhiều tài sản. Người dùng có mức độ tin tưởng cao đối với dự án và sẵn sàng ký gửi tài sản vào nền tảng hơn cho các hoạt động kinh tế khác nhau (chẳng hạn như cung cấp thanh khoản, cung cấp tài sản thế chấp, v.v.), càng thu hút được nhiều người dùng thì mức độ phổ biến càng cao.

Có thể thấy từ hình trên, mười nền tảng hàng đầu về TVL, ngoài khối lượng lớn (hơn 5 tỷ đô la Mỹ), TVL về cơ bản đã duy trì xu hướng tăng trưởng hàng tháng, điều này chứng tỏ rằng các dự án tiếp tục duy trì sức sống và sức mạnh của họ.

2. Giới hạn thị trường

Giá trị thị trường phản ánh giá trị thị trường của một dự án trong ngành DeFi. Chỉ số này được tính toán theo cách tương tự như thị trường chứng khoán truyền thống và chủ yếu bị ảnh hưởng bởi giá tiền tệ và số lượng mã thông báo đã được lưu hành và có sẵn để giao dịch .

Như thể hiện trong hình trên, do số lượng mã thông báo bị ảnh hưởng bởi lưu thông và cung và cầu, giá của tiền tệ thay đổi bất cứ lúc nào, điều này ảnh hưởng đến sự thay đổi của giá trị thị trường. giá trị duy trì trong phạm vi hợp lý khoảng 20% và không có hiện tượng tăng vọt rồi lao dốc như vách đá. .

Sau khi nắm rõ các chỉ số cơ bản, chúng ta hãy xem cách sử dụng các chỉ số cơ bản để đánh giá dự án và khám phá các dự án có tiềm năng và đáng để đầu tư.

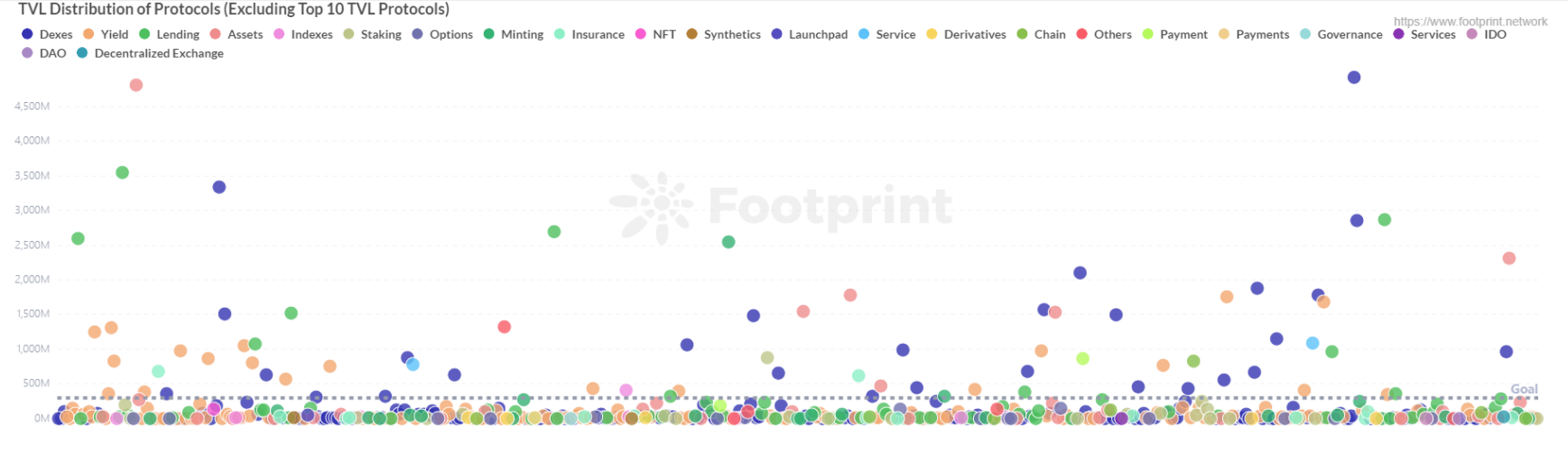

Mô tả hình ảnh

Phân phối nền tảng TVL, nguồn dữ liệu: Footprint Analytics

Như thể hiện trong sơ đồ phân tán ở trên, hiện có hơn 500 dự án DeFi, trong số đó có nhiều dự án mới nổi và có TVL nhỏ (các nền tảng có TVL dưới 5 triệu đô la Mỹ chiếm tới 33%). Làm thế nào để chọn đầu tư phù hợp từ nhiều dự án của dự án? Để đảm bảo an toàn, tránh rủi ro cạn vốn đối với các dự án quy mô quá nhỏ, nhà đầu tư cá nhân nên cố gắng lựa chọn các dự án từ mức TVL trung bình trở lên (khoảng 20 triệu USD) khi xác định mục tiêu đầu tư. .

Đối với các dự án DeFi, các dự án có giá trị từ 1 triệu đô la Mỹ đến 10 triệu đô la Mỹ phù hợp để các tổ chức đầu tư tiến hành đầu tư vòng hạt giống, nhưng không phù hợp với các nhà đầu tư cá nhân, vì định hướng phát triển và định hướng chiến lược trong tương lai của loại dự án này không rõ ràng.

Mặc dù TVL đã tìm ra chiến lược phát triển phù hợp cho các dự án từ 1.000 đến 20 triệu USD và các nhà đầu tư có thể lấy dữ liệu của phần này của dự án, nhưng xét về tính ổn định, sự tăng trưởng của các dự án đó sẽ bị cản trở. không đủ, Có nhiều nguy cơ tăng trưởng yếu hoặc suy giảm.

TVL đã tìm ra cơ chế sản phẩm và điểm tăng trưởng rõ ràng, phù hợp cho các dự án có quy mô từ 20 triệu đô la Mỹ đến 50 triệu đô la Mỹ, cộng đồng và hỗ trợ kỹ thuật đang dần hoàn thiện, nếu bạn muốn thu nhập cao hơn nền tảng hàng đầu, chẳng hạn Nền tảng là một lựa chọn tốt.

Nếu mức độ chấp nhận rủi ro thấp và nhu cầu về thu nhập không quá cao, bạn có thể chọn các dự án từ các nền tảng hàng đầu để đầu tư dựa trên danh mục dự án DeFi yêu thích của mình (chẳng hạn như DEX cung cấp thanh khoản, cho vay Lending, v.v.).

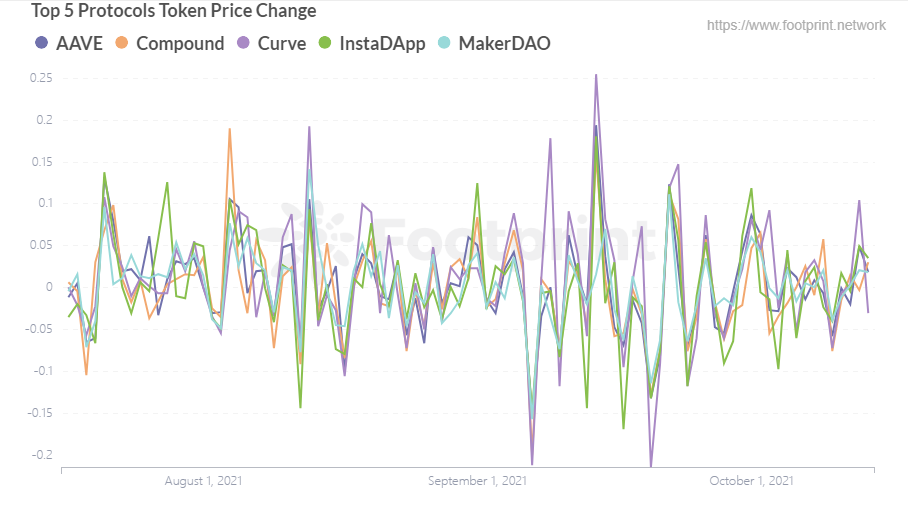

Mô tả hình ảnh

Thay đổi giá mã thông báo trên 5 nền tảng TVL hàng đầu, nguồn dữ liệu: Footprint Analytics

Sau khi chọn một dự án ứng cử viên phù hợp thông qua chỉ báo TVL, cần sàng lọc thêm thông qua tình hình của mã dự án, theo quy luật thay đổi giá của mã thông báo nền tảng hàng đầu (như trong hình trên), nó chủ yếu được đánh giá từ hai khía cạnh:

Đầu tiên, liệu giá mã thông báo có duy trì xu hướng tăng giảm tương đối ổn định hay không (mức tăng hoặc giảm không được vượt quá 20%). Nếu giá của mã thông báo vẫn tương đối ổn định, thì việc lưu thông mã thông báo danh nghĩa sẽ tương đối ổn định và khả năng thiệt hại cho dự án do một số lượng lớn bán mã thông báo của một nhà đầu tư sẽ trở nên nhỏ hơn.

Thứ hai, liệu cơ chế phát hành mã thông báo có hợp lý hay không. Ví dụ: tỷ lệ nắm giữ tiền tệ của nhóm/tổ chức có quá cao hay không, nếu quá cao, mục đích "xoay vòng tiền" của dự án sẽ tăng lên; liệu tốc độ phát hành mã thông báo có quá nhanh hay không, giá tiền tệ sẽ bị pha loãng nghiêm trọng nếu việc phát hành quá nhanh và mã thông báo Khả năng tiền tệ được bán tăng lên, điều này không có lợi cho sự phát triển bền vững của giá tiền tệ.

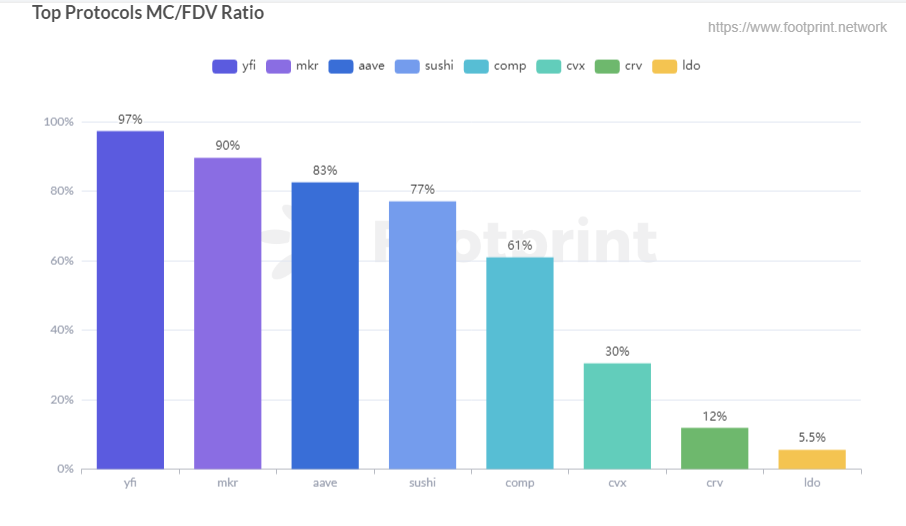

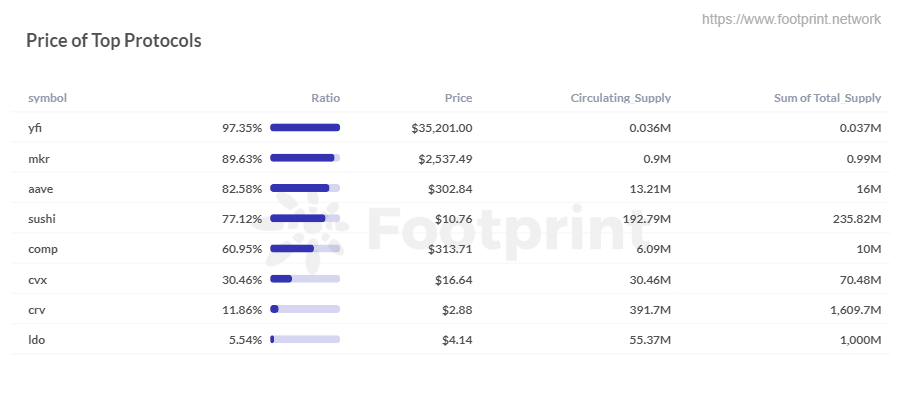

Mô tả hình ảnh

Mô tả hình ảnh

So sánh giá trị thị trường/tỷ lệ định giá pha loãng hoàn toàn, giá, lưu thông mã thông báo và tổng nguồn cung cấp mã thông báo của các nền tảng hàng đầu, nguồn dữ liệu: Footprint Analytics

Định giá pha loãng hoàn toàn đề cập đến sản phẩm của giá tiền tệ và nguồn cung cấp mã thông báo tối đa. Khi tất cả các mã thông báo được phát hành, giá trị thị trường bằng với giá trị pha loãng hoàn toàn. Nếu tỷ lệ "MC/FDV" của mã thông báo dự án (tức là tỷ lệ giá trị thị trường so với định giá được pha loãng hoàn toàn) quá nhỏ, điều đó có nghĩa là một số lượng lớn mã thông báo vẫn chưa được phát hành. Tại thời điểm này, các nhà đầu tư cần phải xem xét cẩn thận và tập trung vào thời lượng trực tuyến của dự án, lịch trình cung cấp mã thông báo và liệu tốc độ tăng giá tiền tệ có quá nóng hay không.

Đối với các nhà đầu tư cá nhân có nhu cầu đầu tư dài hạn, cần đánh giá tỷ lệ “MC/FDV” của dự án Khi các token mới được phát hành và dần dần chảy vào thị trường, khi nguồn cung token cao hơn nhu cầu thực tế , việc định giá Nó sẽ trở nên không hợp lý. Với sự điều chỉnh của thị trường, giá của các mã thông báo sẽ giảm xuống và những người nắm giữ lâu dài sẽ phải đối mặt với áp lực bán lớn hơn. Lúc này, các mã thông báo dự án được nắm giữ sẽ trở nên vô giá trị.

Lấy các dự án được xếp hạng hàng đầu làm ví dụ, đối với các nền tảng có tỷ lệ "MC/FDV" cao hơn 60%, các mã thông báo nền tảng đó phù hợp hơn để nắm giữ lâu dài và tính bảo mật được đảm bảo, nhưng nhược điểm nằm ở mức cao. giá khởi điểm; Các nền tảng thấp, chẳng hạn như Curve (CRV), mặc dù tỷ lệ không cao nhưng giá tiền tệ nằm trong phạm vi hợp lý hơn, đó là một nền tảng có thể được xem xét; so sánh, tỷ lệ "MC/FDV" của Lido thấp hơn Curve6,32%, tuy nhiên, giá của mã thông báo cao hơn 43,75% so với Curve và định giá thị trường quá cao, hiện tại không phù hợp để nắm giữ lâu dài. Với sự tự điều chỉnh của thị trường , giá của mã thông báo có thể giảm xuống.

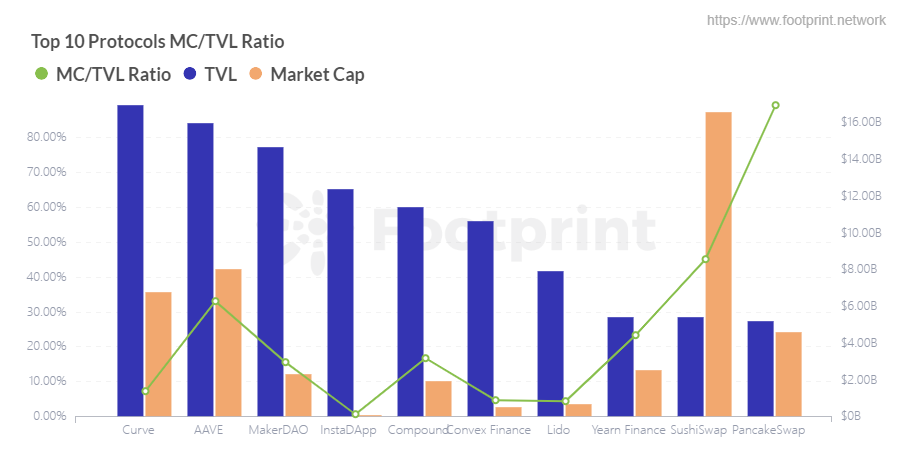

Mô tả hình ảnh

Vốn hóa thị trường/tỷ lệ khối lượng cố định của 10 nền tảng hàng đầu, nguồn dữ liệu: Footprint Analytics

Theo dữ liệu do Footprint cung cấp, tỷ lệ "MC/TVL" (tức là tỷ lệ giá trị thị trường so với khối lượng bị khóa) của mười dự án TVL hàng đầu về cơ bản là nhỏ hơn 1, điều đó có nghĩa là định giá dự án bị đánh giá thấp và rất đáng để đầu tư, đặc biệt là tỷ lệ InstaDapp chỉ 0,65%. Từ góc độ kinh tế, TVL của dự án càng cao thì MC càng cao, bởi vì các dự án có tên TVL cao là lạc quan và có thể mang lại lợi ích kinh tế lớn hơn cho dự án, và giá trị thị trường cũng sẽ tăng theo, đạt như nhau giá trị như thể tích TVL.

tóm tắt

tóm tắt

Bạn đọc có thể sử dụng các chỉ số đánh giá trong bài viết này để đánh giá dự án đầu tư, được tóm tắt như sau:

● Xếp hạng TVL ở vị trí trung bình trở lên, khoảng 20 triệu đô la Mỹ trở lên

● Giá token tương đối ổn định: mức tăng giảm hàng tháng không quá 20%

● Cơ chế phân phối mã thông báo có hợp lý: liệu việc nắm giữ mã thông báo của nhóm và tốc độ phát hành mã thông báo có hợp lý hay không

● Với tỷ lệ MC/FDV dưới 5%, token dự án không phù hợp để nắm giữ lâu dài

● Nếu tỷ lệ MC/TVL nhỏ hơn 1 thì dự án phù hợp để đầu tư

Về các chỉ số liên quan đến tính toán nêu trên, độc giả có thể lấy trực tiếp từ Footprint Dashboard (nhấp vào liên kết), mà không cần tính toán bổ sung.

Sau khi phân tích một số chỉ số trên, sẽ thấy rằng DeFi, với tư cách là một loại thị trường đầu tư mới, đã tạo ra nhiều khả năng đầu tư hơn so với tài chính truyền thống do tính "mới" và tính toàn diện của nó, đồng thời các phong cách ngày càng trở nên phong phú. nhiều dự án đáng đầu tư Được biết và hiểu rằng còn rất nhiều dự án tiềm năng chưa được khai phá.

Footprint Analytics là một nền tảng phân tích dữ liệu chuỗi khối trực quan một cửa. Footprint đã hỗ trợ giải quyết vấn đề làm sạch và tích hợp dữ liệu trên chuỗi, cho phép người dùng tận hưởng trải nghiệm phân tích dữ liệu chuỗi khối không ngưỡng miễn phí. Cung cấp hơn một nghìn mẫu lập bảng và trải nghiệm vẽ kéo và thả, bất kỳ ai cũng có thể tạo biểu đồ dữ liệu được cá nhân hóa của riêng mình trong vòng 10 giây, dễ dàng hiểu rõ hơn về dữ liệu trên chuỗi và hiểu câu chuyện đằng sau dữ liệu.

Trang web chính thức của Footprint Analytics: https://www.footprint.network/

Cộng đồng bất hòa: https://discord.gg/3HYaR6USM7

Tài khoản công cộng WeChat: Phân tích chuỗi khối Footprint (FootprintDeFi)

Giới thiệu về Phân tích Dấu chân:

Footprint Analytics là một nền tảng phân tích dữ liệu chuỗi khối trực quan một cửa. Footprint đã hỗ trợ giải quyết vấn đề làm sạch và tích hợp dữ liệu trên chuỗi, cho phép người dùng tận hưởng trải nghiệm phân tích dữ liệu chuỗi khối không ngưỡng miễn phí. Cung cấp hơn một nghìn mẫu lập bảng và trải nghiệm vẽ kéo và thả, bất kỳ ai cũng có thể tạo biểu đồ dữ liệu được cá nhân hóa của riêng mình trong vòng 10 giây, dễ dàng hiểu rõ hơn về dữ liệu trên chuỗi và hiểu câu chuyện đằng sau dữ liệu.