from DappRadar, original author: Pedro Herrera

Odaily Translator |

Odaily Translator |

Industry overview

The cryptocurrency market seems to have come out of the "gloom of May". In the past July, the decentralized application industry once again showed exciting and rapid development. The success of the "play-to-earn" game model, the rise of high-value non-fungible token (NFT) collectibles, and the multi-chain paradigm that continues to heat up the centralized finance (DeFi) race - this Everything is driving the entire encryption industry forward.

secondary title

Industry overview

The blockchain industry appears to be recovering from the downturn since the cryptocurrency market crash in May. Since July, the prices of Bitcoin and Ethereum have risen by 18% and 17% respectively. At the same time, the average daily unique users of dApps in July also exceeded 1.4 million, an increase of 23.72% from June.

The "play-to-earn" game has shocked the entire crypto industry and is quickly becoming a cross-circle trend. With low transaction fees and high scalability, emerging blockchains such as Ronin, WAX, and BSC are the first choice for dApps around the world. In addition, NFT games like Axie Infinity have also achieved great success, with the cumulative transaction volume breaking through $1 billion in early August, setting a record high.

NFT collectibles, on the other hand, will not be forgotten. Series of NFTs such as CryptoPunks and Bored Ape Yacht Club (BAYC) have become the industry's "established reference". Additionally, the added utility some of these NFTs confer on collectibles engages the community like never before.

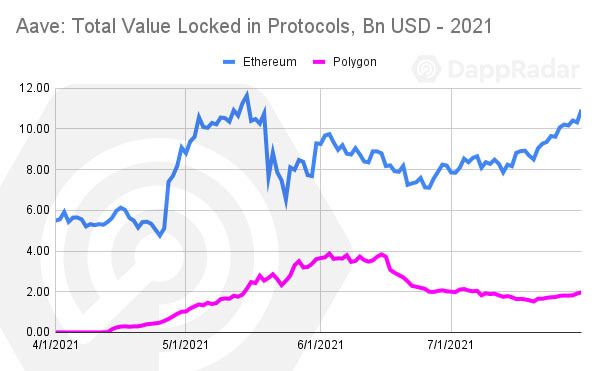

Finally, the DeFi space became more consolidated in July. Competition across multiple protocols continues to heat up, with the multi-chain paradigm in full swing, with players like Aave and Sushi extending functionality beyond Ethereum. With the rapid adoption of new decentralized exchange projects like QuickSwap on the Polygon blockchain, it would not be surprising to see organic growth in this space.

secondary title

10 Important Data

1. In July, the average daily unique users of the dApp industry exceeded 1.4 million, an increase of 23.72% from June.

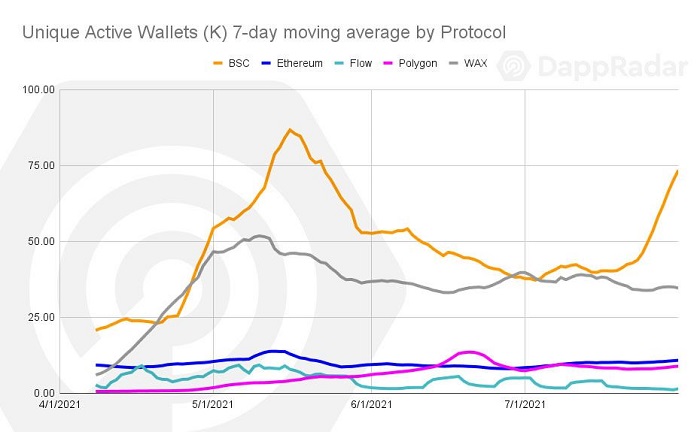

2. Binance Blockchain (BSC) is the most used blockchain, with more than 658,000 unique users in July; WAX ranked second with 336,000 unique users; Ethereum ranked third with 105,000 unique users .

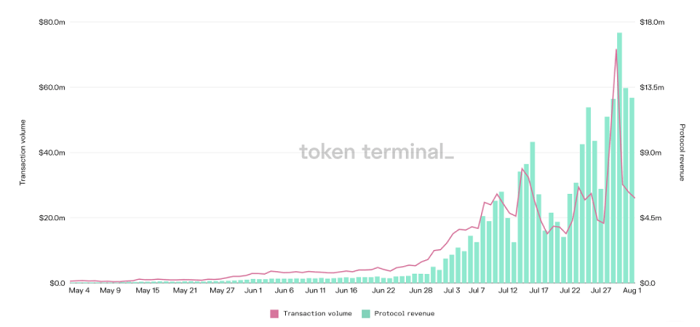

3. Axie Infinity has become the most valuable NFT collectible ever, with a transaction volume of $600 million in July.

4. "Play-to-earn" games have sprung up on the Binance Smart Chain, and Cryptoblades has gained more than 316,000 unique users while generating more than $4.3 million in transaction volume.

5. The top Ethereum NFT collectibles (CryptoPunks, Meebits, VeeFriends, and Bored Apes) are still increasing in value, with a total increase of about 250%.

6. Virtual lands between different metaverses increase their value; a Sandbox land sold for $863,000, while several Axie lands also traded for over $500,000.

8. In July, the locked-up volume of DeFi protocols on Ethereum exceeded 80 billion US dollars, an increase of 23% from the previous month.

9. PancakeSwap is still the most used dapp among all protocols. In July, the number of users exceeded 2 million, the transaction volume reached 22 billion US dollars, and the number of Twitter fans exceeded 1 million.

10. The decentralized exchange QuickSwap became the most used dApp on the Polygon chain, attracting 135,000 unique users while generating more than $5 billion in transaction volume.

secondary title

"Play-to-earn" games bring about a disruptive revolution

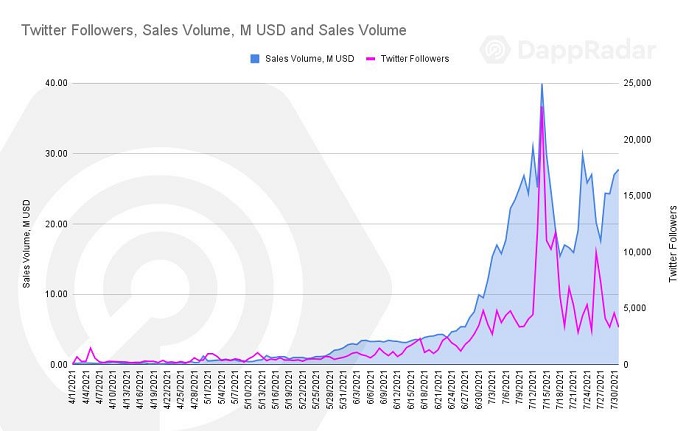

On the other hand, Axie Infinity's growth in social media channels is also very rapid. The game has more than 700,000 followers on Twitter and Discord, and the trend of "following" continues. In addition, according to Token Terminal data, as the price of AXS governance tokens soared, Axie Infinity’s revenue in July exceeded that of the entire Ethereum, Bitcoin, and Binance Smart Chain.

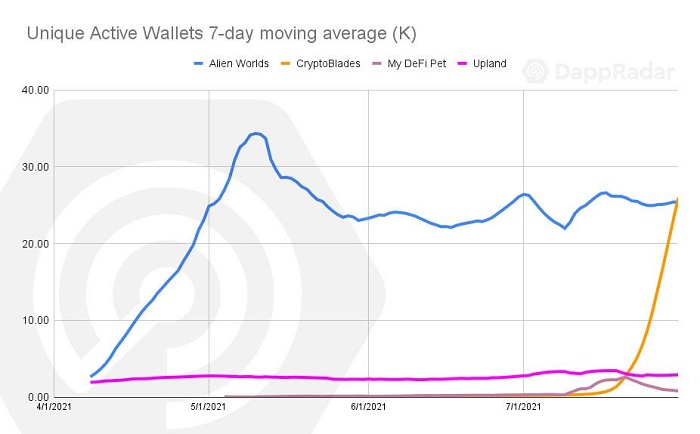

Axie Infinity is certainly the poster child for the “play and earn” genre, but the development of other crypto games cannot be ignored. For example, the usage of Alien Worlds and Upland players is also increasing. The number of Alien Worlds game wallets based on the WAX blockchain exceeds 900,000, an increase of 32.06%; the number of EOS game independent wallets in Upland exceeds 150,000, an increase from June 17%.

Games that give players higher rewards are becoming mainstream, and this trend is changing the way we understand games. In the past, players had to pay in-game fees to unlock certain special abilities, but now, players can earn daily rewards simply based on their in-game behavior. As blockchain continues to evolve in search of a better user experience, play-to-earn games are expected to see mass adoption.

secondary title

In the past year, Binance Smart Chain has become one of the top blockchains in the industry and the most commonly used protocol in the industry. In July, the number of unique users of Binance Smart Chain exceeded 750,000. In part, Binance Smart Chain’s previous success was fueled by a surge in demand for DeFi dApps and NFTs, but recently the trend has started to shift — to games.

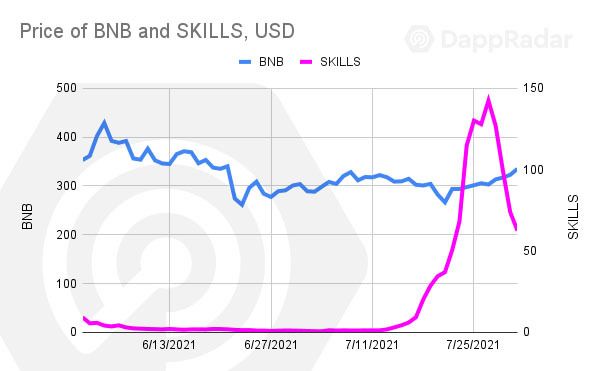

For example, the "earn while you play" game CryptoBlades has become the second most used dApp after PancakeSwap, attracting 580,000 unique users on its first day of launch, generating more than $92 million in more than 50 million transactions Revenue; MyDeFiPet, another virtual pet game, saw average daily unique users grow 660% month-on-month, attracting 172,000 unique users and generating more than $54 million in transaction volume in the past thirty days.

Taking advantage of low fees and high scalability, Binance Smart Chain hopes to replicate the success of DeFi in the gaming space.

secondary title

NFT continues to "clash and rush"

About a few months ago, some media and practitioners believed that the NFT market was about to face a downturn, but this negative trend did not appear. On the contrary, the NFT phenomenon has reached unimaginable heights a few months ago.

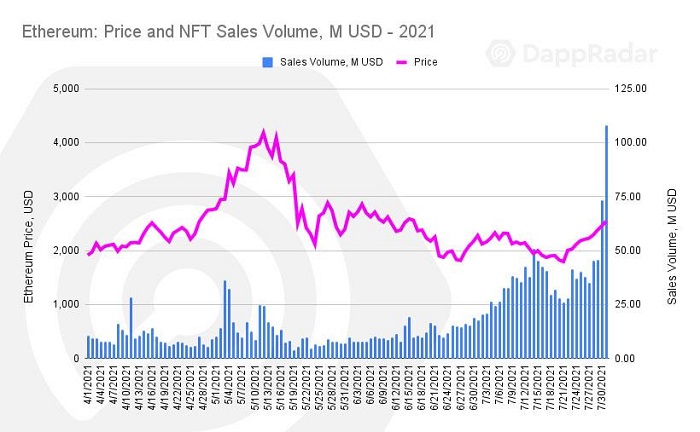

Overall, sales in the NFT space surpassed $1.2 billion in July alone. Except for Axie Infinity, about 80% comes from Ethereum's primary and secondary markets. While NBA Top Shot on the FLOW blockchain and Alien Worlds on the WAX blockchain are the two most traded projects, the vast majority of NFT transactions still take place on Ethereum.

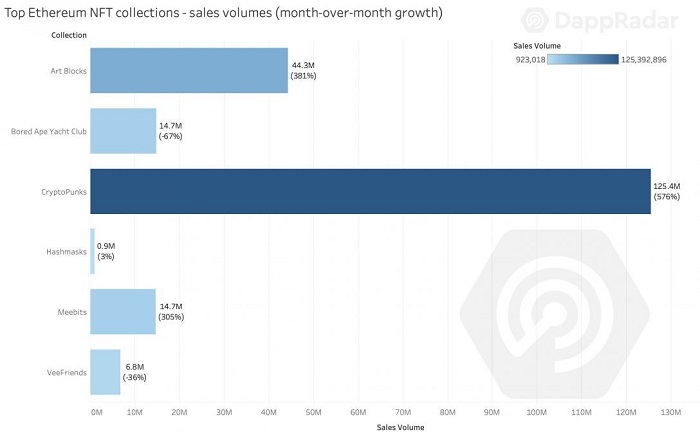

Mature NFT projects such as CryptoPunks, Meebits, and BAYC continue to bring high returns to holders, and due to scarcity, the market demand for NFT has increased significantly. Both CryptoPunks and Meebits have grown in impressive fashion this past July:

2. The transaction volume of Meebits reached 14.7 million US dollars, an increase of 305% compared with June.

It is worth mentioning that institutional investors have also begun to enter the NFT market. For example, Three Arrows Capital (Three Arrows Capital) purchased thousands of ETH of Punks and Art Blocks collections. In addition, Ethereum-based NFT projects such as Royal Society of Players and Stoner Cats have also attracted huge attention, and the collectibles launched sold out within minutes.

At this stage, with dozens of NFT collections launching every month, it is important to learn as much as possible about these projects before purchasing. Like the art itself, teams, communities, and additional features are often what make a project long-term successful.

secondary title

In recent months, NFT has slowly become one of the main drivers of the encryption industry, and two of the "bright spots" are worthy of attention:

1. In July alone, the sales of OpenSea, an Ethereum-based NFT marketplace, reached $167.5 million, a 101% increase from previous months. With the demand for NFTs increasing significantly, OpenSea's latest market valuation seems to be in line with this trend. Two weeks ago, OpenSea raised $100 million at a $1.5 billion valuation. With the integration of other blockchains such as Polygon and Binance, OpenSea's market valuation may rise further.

2. As one of the most well-known brands in the world, Coca-Cola has announced the launch of its first NFT series. The NFT of this "red brand" has begun to be auctioned on OpenSea and raised 217 ETH (approximately $543,750). Also included in the collection of NFTs are various Coca-Cola-inspired collectibles, such as a unique custom wearable that can be worn within Decentraland (pictured below).

secondary title

In-depth analysis of DeFi market competition

It is undeniable that in July, the entire industry was mainly driven by the NFT and gaming space, however let’s not overlook the impressive performance that Decentralized Finance has brought.

In general, some important projects in the field of decentralized finance have achieved rapid growth this month. Despite the problems of high gas fees and low scalability, dapps and their underlying protocols are looking for solutions to provide users with better products and improve their experience. These efforts finally paid off, and we saw higher usage rates, as well as better numerical metrics.

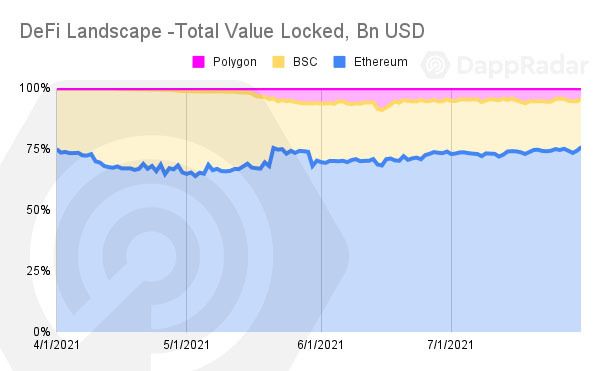

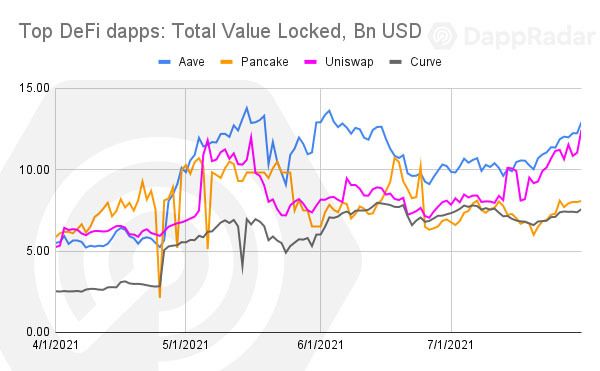

Ethereum is currently still the leading protocol in terms of locked volume, as Uniswap, Aave, Compound, and Curve account for 44.16% of locked volume. At present, the total amount locked in Ethereum is 83.6 billion US dollars, which exceeds 70% of the entire industry indicator. Compared with the previous month, the on-chain index increased by 23%; compared with the price of Ethereum, the total locked position on Ethereum also increased. Ether is on an upward trend in July, gaining 17%. Therefore, we can deduce that the total locked volume on this chain has increased by about 6%.

Secondly, Binance Smart Chain is the network with the second highest total lock-up volume, and its current total lock-up volume has exceeded $21 billion, an increase of 7.63% from the previous month. It is worth mentioning that it is mainly driven by the PancakeSwap DEX. PancakeSwap has always maintained its leading position as the most used dApp among all protocols. In July alone, there were more than 2 million unique users, and the total locked volume reached 8.08 billion US dollars, an increase of 16.28% from the previous month. In addition, according to statistics from LunarCrash, the number of PancakeSwap users on Twitter has exceeded 1 million, and the total number of social users has exceeded 4 million.

In fact, the dominance of PancakeSwap’s lock-up volume has declined slightly from the previous period, and now accounts for about 38% of the total lock-up volume on the Binance blockchain. On the other hand, Venus and Alpaca Finance have grown rapidly in terms of locked positions. At present, the locked volume of Venus accounts for 15% of the total locked volume of Binance, exceeding USD 3.15 billion, an increase of 25% month-on-month. Alpaca Finance now accounts for 7.25% of Binance's total lock-up volume with a lock-up volume of US$1.58 billion.

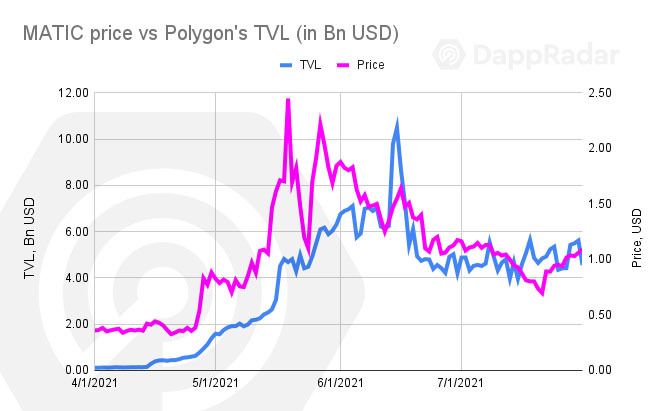

The most interesting thing for Polygon is that the price of Matic has dropped by 9% compared to the previous month. Since June, users on the chain have grown by 24%, giving the network a 17% growth.

In fact, the decentralized finance industry is undergoing an important transformation. The structure of Ethereum somewhat limits its potential for scalability. As blockchains such as Tezos and Terra enter the DeFi world, more users and a better experience will drive the healthy development of the entire industry.

In addition, DeFi is still looking for a way to connect with traditional finance. Those accredited financial institutions are entering the decentralized finance space through ETFs (Exchange Traded Funds). While regulations are still a big hurdle holding back the development of the decentralized finance industry, the decentralized finance industry is still poised to take off in a big way.

secondary title

Multi-chain industry analysis

Another dApp that benefits from trading on multiple chains is Curve. As an automated market maker (AMM), Curve's total lock-up volume on the Ethereum and Polygon blockchains has exceeded $7.57 billion. Similar to Aave's situation, Curve's lock-up volume increased by nearly 11% month-on-month. While 93% of the lockup in the Curve protocol is locked in the Ethereum blockchain, the current lockup in Polygon is up 21.39%

Summarize

The multi-chain paradigm appears to be gaining momentum. In the beginning, some dApps hosted on the Ethereum blockchain just extended their services to Polygon or Binance Smart Chain, but recently DeFi native dApps such as Apeswap and Paraswap have also decided to expand to other blockchains, decentralized finance The ecosystem is expected to be further enhanced in the coming months.

secondary title