Original title: "Kazakhstan's "Encryption Dream"", author Pan Zhenglin

Energy consumption is always the sword of Damocles hanging over the cryptocurrency world. As of May 10, 2021, the energy consumption of the global mining industry is 149.37 TWh (1 TWh equals 100 million kWh). China has been restricting the development of virtual currencies within its territory, but for a long time in the past, China has been the main gathering place for the mining industry of cryptocurrencies such as Bitcoin. According to data from the University of Cambridge in the United Kingdom, China once occupied 65.08% of the computing power of the Bitcoin network.

But recently, Chinese regulatory authorities have begun to intensively introduce policies to restrict domestic encrypted digital currency trading activities and completely prohibit the operation of encrypted digital currency mines.

secondary title

1. Why has it become one of the first choices for mining circles to go to sea?

The reason why Kazakhstan can attract a large number of computing power and become the main choice for many mine owners in mainland China to go to sea is related to its unique natural resources and climatic conditions, and it is inseparable from the support of the local government.

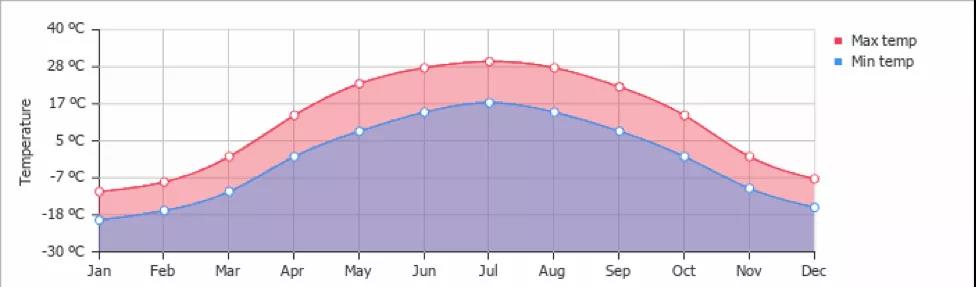

(1) Weather conditions

image description

Source: Weather & Climate

(2) Policy preference

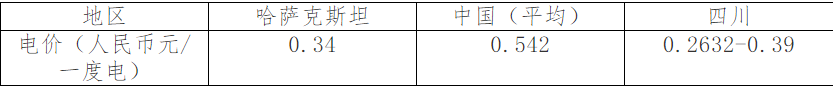

image description

Kazakhstan's policies on cryptocurrencies

Astana International Financial Center (AIFC, a financial center established in Kazakhstan) has specially established an IT park, and the mines settled here do not need to pay any taxes except for the "use fee" of 1% of the annual turnover. However, as more and more mining farms choose to settle in Kazakhstan, the country intends to amend its tax law, and plans to collect a digital mining tax at the price of 1 tenge ($0.00232) per kWh from 2022.

In addition, the Ministry of Digital Development of Kazakhstan is working with the AIFC and the Blockchain Association to draft regulations on the cryptocurrency industry and blockchain technology to standardize the country's blockchain regulations.

Kazakhstan's unswerving support for cryptocurrencies, and the active construction of relevant policy standardization and the introduction of favorable policies for cryptocurrencies have led to the transfer of a large number of mining machines to Kazakhstan.

(3) Energy resources

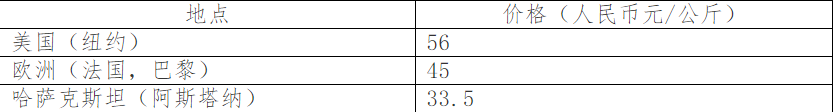

image description

Average electricity price cost by region

Electricity price has always been one of the most important flow costs in the cryptocurrency mining industry, which directly affects the actual revenue of the mine. Previously, a large number of miners would "migrate" on a large scale during the wet season and the dry season, and move frequently in various regions, with the purpose of chasing lower-priced electricity. The cost of electricity prices in Kazakhstan is even comparable to that of Sichuan, which may be one of the main reasons why many mines have moved to Kazakhstan.

Although expensive as the world's ninth largest oil exporter, Kazakhstan has long been active in developing renewable energy. Kazakhstan passed the "Law on Supporting the Utilization of Renewable Energy" in 2009, establishing a green economic transformation model based on renewable resources. Although traditional energy is the main source of power generation today, Kazakhstan has set a goal of generating 6% of its electricity from renewable sources by 2025, 10% of its electricity by 2030, and at least 50% of its electricity by 2050 from renewable energy sources.

At the same time, the government of Kazakhstan is also emphasizing the importance of economic diversification, and the energy transition is also continuously increasing. As of 2020, there are 97 renewable energy power facilities in Kazakhstan, more than half of which are solar power. Because there is no need for electricity transportation and storage, local companies have launched a new business, that is, building mines near power facilities. Experienced contractors can help miners build mines within 3-4 weeks.

(4) Transfer costs

In addition to low energy prices, relatively low transportation costs and labor costs are also the reasons for attracting a large number of mines. Due to the epidemic, the sea freight from China to the United States has soared, and it is still "difficult to find a container". In addition, the relatively low local labor costs have also made Kazakhstan one of the first choices for overseas travel.

image description

The price list of China's air freight by country, from the price query of Jincheng Logistics Network

The price of air freight is mainly determined by the long distance. The more miles you fly, the higher the shipping cost per kilo. The United States is relatively far away, so the shipping cost is higher. Kazakhstan is a neighboring country of China, and the flight distance is relatively short, so the air freight is the lowest.

The price of sea freight to the United States has soared 469% in the past two years due to the epidemic! In 2018, the average shipping cost of a container from China to the United States was about US$1,500; in May 2021, the price was US$7,000 per container. The price of a container shipped to Europe has also increased by 485% in the past two years to $10,174.

Because Kazakhstan borders China, there are China-Europe trains as transportation channels, so sea transportation is not feasible. According to the website of China Railway Express, the shipping fee for a container from Shenzhen to Almaty (a city in Kazakhstan) is US$5,100. In contrast, shipping mining machines to Kazakhstan has become a relatively good choice. In addition, the cabinets shipped to Europe and the United States are now "hard to find"; while the waiting time for China-Europe trains is relatively short. Based on the above, among many options, Kazakhstan's freight and time costs are the lowest.

secondary title

2. The challenge of the mine going to sea in Kazakhstan

Although it has become a major trend for mining machines to go to Kazakhstan, placing mines in Kazakhstan still faces some challenges.

In addition to the need to transport the mining machines to Kazakhstan, the cleaning machines and shelves for the mining machines also need to be imported from China to Kazakhstan. This virtually increases the cost of the mine. At present, 70% of the world's mining machines are produced in China, and logistics and tariffs will be an inevitable proposition for mines going to sea in the future.

Even though there are specialized service providers in the market today that provide services for transferring mining machines abroad, for small and medium-sized mining farms, the cumbersome procedures and costs may be unaffordable.

In addition, there are differences in regulatory policies and market conditions in each country, and it takes a long time for mines to adapt. For example, issues such as mining machine maintenance and adapting to the working hours of overseas staff have challenged the progress of Chinese mines going to sea.

Relatively high local maintenance hardware costs and downtime losses, intermittent power supply, and frequent failures of the power grid, all these problems will eventually lead to increased costs and loss of efficiency.

secondary title

3. In addition to mining, Kazakhstan also likes these things~

In addition to becoming the world's first choice for mining, Kazakhstan's government and companies are also actively promoting cryptocurrency-related industries. These include the launch of central bank digital currency and the launch of space exchange projects.

(1) Actively pilot central bank digital currency

The central bank of Kazakhstan is designing a central bank digital currency that will allow businesses and consumers to pay in fiat currencies on the blockchain. The Central Bank of Kazakhstan said in a statement that its focus in developing a central bank digital currency is to ensure consistency with overall monetary policy goals.

The AIFC is working on the project to help the country develop a legal framework for a new central bank digital currency. The AIFC agreement will include legal definitions of many terms, such as digital currency classification, smart contracts and digital wallets, among others.

In fact, in addition to Kazakhstan, China, Japan, Canada and EU countries are stepping up testing of central bank digital currencies on the basis of pilot projects. Russia is also studying related issues. The digitization of currency has become a development project in many countries, among which Kazakhstan is one of the most active countries.

At present, the central bank of Kazakhstan is analyzing various technical infrastructure and regulatory methods, and formulating a scenario report on the introduction of digital currency in Kazakhstan, which is planned to be officially announced in the second half of 2021. In the future, based on the results of discussions with relevant government departments, international financial organizations, market participants and experts, pilot projects will be implemented in advance, and then central bank digital currency will be introduced in stages.

For Kazakhstan, the opportunity to leverage digital currencies is huge. Low local energy costs can attract many block reward mining companies to the country. With the continuous improvement of the country's legal framework for the digital currency industry, Kazakhstan will surely become an ideal destination for investors in the block reward mining business. The launch of a central bank digital currency may accelerate this process.

(2) Cryptocurrency out of the earth

Kazakhstan-based investment firm Eurasian Space Ventures (ESV) has launched two projects, Biteeu and Divine, in partnership with the SpaceChain satellite network. Biteeu plans to be the world's first space-based cryptocurrency exchange, using licensed and compliant digital asset exchange programs from the EU and Australia. The Divine project uses space technology to broadcast free satellite content of the Qur'an to Muslim believers and people interested in the Qur'an around the world.

Biteeu's competitive advantage is the promise to keep all operation and maintenance and customer transaction data in low earth orbit. The project is expected to process multisig bitcoin transactions from space when it activates this fall. Unlike standard methods with a single signature, multi-signature technology requires multiple private keys to authorize a Bitcoin transaction from a cryptocurrency wallet address, making transactions more secure than standard single-signature methods.

Locating data and transactions in space will enhance the security of data and transactions. Various security mechanisms possessed by Biteeu space nodes, including a communication delay of up to 12 hours between ground stations and satellites, can prevent cyber fraud and theft, because hackers cannot quickly transfer digital assets or data out.

secondary title

4. What can cryptocurrency bring to Kazakhstan?

Why is the Kazakh government actively embracing blockchain and cryptocurrencies?

(1) Diversification of government revenue

In July 2021, President Tokayev of Kazakhstan signed a new law amending the Central Asian country’s legislation on “payment of taxes and other budgetary obligations,” imposing additional levies on the energy used by crypto miners operating in the country. taxes and fees. The new law will come into force in January 2022. Cryptocurrency miners pay an additional fee of about $0.0023 per kilowatt of electricity used.

As China closes a large number of mines in its territory and a large number of mines move to Kazakhstan, the number of mines in Kazakhstan is bound to increase rapidly. These mines run day and night, perform complex calculations, and consume large amounts of electricity. These consumed electricity will bring additional and considerable income to the Kazakh government when the new policy takes effect.

(2) Become one of the pioneers in cryptocurrency regulation

Kazakhstan is the second country in the world after Japan to recognize the need to develop a cryptocurrency market system at the government level. Kazakh authorities have recognized that the legal framework related to blockchain and cryptocurrencies is relatively backward.

Nurlan Kussainov, CEO of the AIFC Authority, said in an interview: Despite experiencing rapid growth in the past few years, cryptoeconomics lacks a regulatory mechanism. There is an urgent need to create the necessary conditions for a legal framework for blockchain projects and cryptocurrencies. Currently, no other jurisdiction fully meets all the requirements of cryptoeconomics. There is a good opportunity for AIFC to be one step ahead and capture this niche market in the global market.

AIFC has set up a working group specifically with the goal of formulating legislation to regulate cryptocurrency transactions; and establishing an ecosystem using blockchain technology, encrypted assets, and blockchain-based projects; creating a favorable environment for innovative development in Kazakhstan, promoting Dialogue between business, citizens and government to improve Kazakhstan's investment climate to develop and support innovative technologies.

It’s not hard to see how Kazakhstan wants to be a legal pioneer in the blockchain and cryptocurrency industry. Although blockchain and cryptocurrencies have developed rapidly in the past decade, legal frameworks are still relatively lacking. Kazakhstan is optimistic that the blockchain will become an innovative technology in the future, and also optimistic about the long-term development of the cryptocurrency industry. Therefore, it wants to take the lead in establishing a relevant regulatory framework and become a reference for other latecomers in this field.

(3) Oversupply of energy consumption

Kazakhstan has a vast territory, low population density, and power generation capacity is mainly concentrated in the north of the country. This means that the long-distance transmission of the generated energy will cause energy loss. According to the International Energy Agency (IEA), in 2018 Kazakhstan generated a total of energy (equivalent to the energy generated by burning 178 million tons of oil) to meet twice the country's energy needs. There are many energy sources that cannot be effectively used.

Cryptocurrency mining farms can help Kazakhstan effectively absorb excess energy. Many mining farms are set up near power facilities, which can absorb excess electricity on the spot. For Kazakhstan, discarded energy ultimately cannot generate value or make a substantial contribution to the country, but mining farms can make these energy generate additional value. This is one of the reasons why Kazakhstan is vigorously promoting the mine.

(4) Increase employment opportunities

Every introduction of a mine is an increase in employment opportunities for Kazakhstan. The increase in jobs such as mine operations, mining machine maintenance, and mining machine maintenance will further reduce the unemployment rate in Kazakhstan. For example, the Ekibastuz mining facility in Kazakhstan, which has the potential to generate 4% of Bitcoin's global hash rate, would require 160 workers to maintain operations and host as many as 50,000 mining machines.

According to data from Micro Trends, the unemployment rate in Kazakhstan has historically remained within 4%-5%. However, under the ravages of the new crown epidemic in 2020, the unemployment rate in Kazakhstan soared to 6.05%. Solving the unemployment rate has become a thorny problem that the country needs to face. After the cryptocurrency shines in 2020 and 2021, the government of the country has also set its sights on the cryptocurrency field, hoping to solve the employment problem of a part of the population.