Affected by the macroeconomic situation and the influx of traditional institutions, the fundamentals of Bitcoin are stable and positive. The DeFi sector has also developed rapidly in the past year of continuous innovation and defoaming, driving the new husband chain, expansion and interoperability solutions, basic components on the chain and other fields to climb together.

Among the many potential targets, who has the most room for growth and development potential? We think the answer will be Polkadot.

secondary title

Polkadot's ecological development

image description

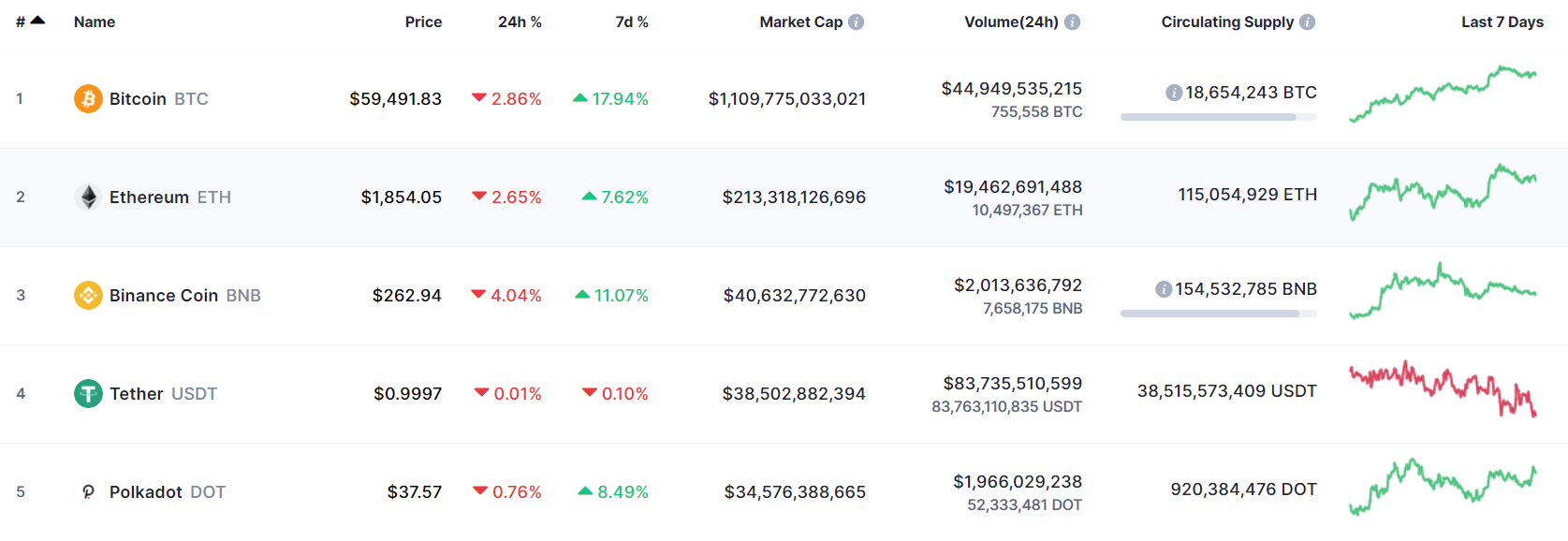

Picture from CMC, data as of 13:50 on March 15, 2021

From an ecological point of view, the number of projects built around Polkadot is not small.Polka Project project repositoryIt shows that there are as many as 369 projects in the Polkadot ecosystem today, covering a wide range.

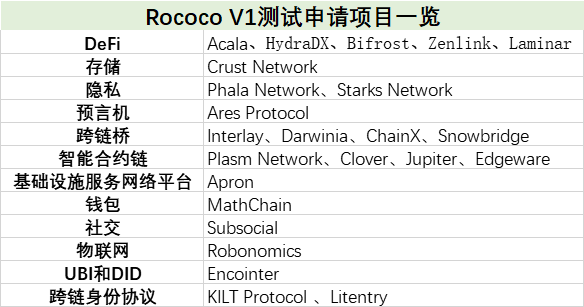

until now,27 projects submitted Rococo V1 testing applications, which means that the development of these projects has basically matured.

It can be seen from the fields of these projects that Polkadot is trying to become an infrastructure covering a wide range of application ecology.

There are three main reasons why Polkadot is surrounded by developers: the industry influence of the founder Gavin Wood, the support of the Polkadot Foundation to the developer community, and Polkadot's own technical superiority.

Gavin Wood is one of the core developers of Ethereum and the first CTO of Ethereum. Due to the relatively early underlying design of Ethereum, there are many problems and deficiencies, such as expansion. Gavin Wood is doing Polkadot because he hopes to create a better blockchain from the bottom up. Gavin Wood began to focus on the development of Polkadot in 2016. After 5 years of continuous development, the Polkadot mainnet will finally go live in 2020.

The Web3 Foundation provides substantial financial and technical support to the developer community.

secondary title

Polkadot's technical advantages and value

The technical characteristics of Polkadot that are often mentioned include: the double-layer structure of the relay chain and the parallel chain provides stronger expansion capabilities for the system; Polkadot can connect to Bitcoin and Ethereum to realize the ecological migration of assets, and has strong compatibility ; Polkadot's substrate can greatly reduce the cost and difficulty of public chain development and so on.

Thinking about it carefully, the new generation of public chains can be said to lead to the same goal by different routes. Although the technical solutions are different, the general direction is pointing to scalability, interoperability, cost reduction and efficiency increase. Therefore, this article will not repeat them.

text

text

Recently, the Ethereum EIP-1559 proposal has sparked heated discussions.mining poolmining poolBetweenantagonistic attitudeand the upcoming "Peace Martial Arts"text

text

text

text

text

text

text

text

text

"In the future, various projects connected to the parachain can freely experiment and innovate. The innovations that are verified to be effective will be promoted to the main chain by Polkadot, and the invalid innovations will be left on the parachain." Delin Capital Founder Li Kunyun told Odaily, "Over time, Polkadot has become a master. While improving the quality, it also provides a development platform for other projects, which is very inclusive."text

secondary title

Subsequent important time nodes and market forecasts

In December last year, Gavin Wood announced the order of major Polkadot events, roughly as follows:

1. Launch Rococo v1 and wait for its stable operation;

2. Launch Kusama's system (public interest nature) parachain;

3. Open the auction on Kusama;

4. Launch the successful parachain on Kusama;

5. After the audit is completed, Polkadot’s public interest parachain will be launched;

6. Open the auction on Polkadot;

7. Launch the parachain that was successfully auctioned on Polkadot.

Gavin Wood said in a recent interview that the Rococo parachain testnet has been launched two months ago and is slowly joining the parachain team. The Kusama and Polkadot auctions are likely to happen within the next month or two, with a tentative goal of completing them by the end of this quarter.

There will be an initial version of XCMP once work on the slot auction is complete. XCMP is a cross-chain messaging protocol that enables parallel chains to send information to each other. It plans to make the first delivery at the end of the first quarter, and in the first half of this year, it will more or less optimize an off-chain version of XCMP. On February 18, Acala successfully completed the cross-chain with Plasm's native asset PLM through XCMP (Polkadot cross-chain messaging function), which marks the era of Polkadot blockchain cross-chain interoperability has arrived.

Gavin Wood also mentioned a technology called SPREE. He believes that SPREE stands for Secure Protected Runtime Execution Enclaves, which can run in parallel chains like small programs and handle things like token balances. SPREE takes into account the advantages of two aspects: homogeneous sharding and heterogeneous sharding, and it is expected to be released in the third quarter.

Gavin Wood on Element, March 11Respond to community membersRegarding the question of "Kusama parachain launch time": "We will increase the number of validators on Rococo to hundreds of levels to confirm that the network layer is running well. If it goes well, after that we will integrate the code into Kusama and Deployment. After the parachain function is launched on Kusama, it will wait for several parachains to run relatively stably before making further optimizations (such as controlling the block generation time to 6 seconds, execution context, etc.), and making some improvements to the network , and then deploy more chains.”

According to this roadmap, we divide the development of Polkadot in 2021 into four main stages:

The first stage: Polkadot ushered in a boom in card slot auctions. From the end of March to April, Polkadot began to auction slots, marking the maturity of Polkadot technology. At the same time, the pledge demand of DOT will increase, thereby pushing up the price of DOT. The demand for DOT comes from project parties bidding for limited card slots, as well as retail investors running towards the attractive economic incentives of ecological projects.(Note: Many project parties in the Polkadot ecosystem have not yet issued coins.)

The second stage: DeFi+Layer2 will introduce a large amount of funds and users to Polkadot. At present, the amount of DeFi locked positions on many emerging public chains has risen sharply, which has played a major role in promoting the tokens of the public chains. This is mainly due to the fact that it provides a wealth of application scenarios for public chain tokens, such as serving as Gas fees, providing liquidity mining, etc. Therefore, this article believes that it is expected that Polkadot will still have a lot of room to rise after the short-term realization of the benefits in May and June.

"Tesla's high-profile entry, how high will Bitcoin rise in 2021? ""Tesla's high-profile entry, how high will Bitcoin rise in 2021? "It has been mentioned: In this round of bull market, the main driving forces for the long-term rise of BTC include: the new crown epidemic, the central bank’s massive release of water (mainly in the United States), grayscale holdings increase, DeFi lock-up, and Bitcoin halving effect. With the changes in the external environment and the development of blockchain technology itself, the current round of Bitcoin bull market will have a double-top market. The price of BTC is expected to reach a high point in April, peaking for the first time when the major inflection point of the epidemic appeared in June and July; however, driven by the value of DeFi and more blockchain applications, the encryption market will rise again, and Bitcoin is expected to There is a second peak in autumn and winter.

The fourth stage: The development of Polkadot technology drives the return of value, thus ushering in a new round of rise. In terms of technology, Polkadot still has many technologies to be completed in addition to the slot auction, such as the SPREE technology mentioned above, which is expected to be released in the third quarter.

secondary title

Polkadot risks and opportunities

technical aspect,"Why does Polkadot never mention cross-chain delay? "The article believes that Polkadot has the problem of transaction delay between the side chain and the main chain.

It is pointed out in the article: In the Polkadot original white paper (polkadot.network/PolkaDotPaper.pdf) specifically mentioned that it takes an hour for Polkadot to cross back to Ethereum, in order to allow enough time for reporting. Although the white paper does not clearly state the cross-chain delay between the core chain and the side chain, it can be inferred that this period of time should also be on the order of ten minutes to hours. This means that a cross-chain message sent by a Polkadot side chain needs to wait for dozens of minutes before it can be received and processed by the message receiver. If Polkadot is a solution for connecting different blockchains, it is acceptable to spend tens of minutes to transfer assets from Ethereum to other chains. However, in today's Polkadot ecosystem, each DeFi application and infrastructure has become a sidechain, and the interaction between contracts on Ethereum has become a tens of minutes of cross-chain here.

It should be pointed out that the assumption of this article is that 100 parachains go online at the same time. However, Polkadot currently plans to only launch 10 parachains in the initial stage, and the current verifiers can completely perform detection and verification to ensure network security. In the later stage, according to the needs, the number of verifiers can be further increased. The delay problem mentioned above has little impact.

Based on the fork-free upgrade we introduced above, Polkadot has the ability to quickly iteratively upgrade after discovering a better solution. Therefore, although Polkadot is in a latecomer position, it can catch up with other competing public chains due to time-consuming upgrades and other issues.

Criticisms about "in today's Polkadot ecosystem, every DeFi application and infrastructure has become a sidechain, and the interaction between contracts on Ethereum has become a tens of minutes of cross-chain in Polkadot" , we believe that this is mainly due to the fact that the blockchain industry itself is still in its early stages of development, and the application scenarios of the industry itself are limited. The projects or public chains on the Polkadot ecology, although some overlap, have different business logics. In the Polkadot heterogeneous sharding large design model, competition is carried out, and the survival of the fittest leaves behind high-quality public chains. It has more advantages than the disorderly competition of other homogeneous public chains. With the development of the blockchain industry, more application-oriented public chains focusing on specific fields are born, and Polkadot's ecological public chains will gradually become more diversified.

From the perspective of capital, Institutions began to pay attention to Polkadot, showing signs of increasing holdings.

Grayscale among newly registered trust productsIncludeIncludeDOT, although the increase in holdings has not been confirmed yet, from the perspective of market value, DOT is still in line with the institutional holdings increase standard. At present, it is mainly necessary to observe the performance of Polkadot after it goes online. In addition, according to Bloomberg terminal data, on February 4, Goldman Sachs, ICAP, JPMorgan and UBS purchased the first exchange-traded product (ETP) to provide customers with access to Polkadot. The opportunity of DOT cryptocurrency, but the share is relatively limited. According to Laurent Kssis, director of 21Shares ETP, Polkadot ETP currently manages more than $15 million in assets. The firm also manages a "Basket of Cryptocurrency Index ETP," which tracks the performance of five major cryptocurrencies. Polkadot is currently the index’s second-largest constituent, Kssis said. On February 25, Finance Magnates reported that FD7 Ventures, a cryptocurrency investment fund that manages $1 billion in bitcoin, plans to sell $750 million worth of bitcoin within 30 days to buy Cardano (ADA) and Polkadot (DOT).

In the encryption circle, the three major exchanges have launched Polkadot investment support funds, focusing on the Polkadot ecology, and there are more well-known projects in the Polkadot ecology.

secondary title

When Will the Next Trillion Crypto Assets Appear?

Will Polkadot be the next trillion crypto assets? We believe that the new generation of public chains represented by Polkadot have potential.

From the perspective of adoption rate, comparing the development of the Internet and the blockchain industry, it can be seen that the current development of the blockchain industry is very similar to that of the Internet in 1997, but the development speed is faster.

The figure below shows the evolution process of the top ten companies by market capitalization in the world. In 1990, no Internet giant appeared, but by 2019, the Internet giant has already dominated the list.

It can be seen from the figure that in the short 30 years, the growth rate of Internet leaders in the first 20 years seems to be very slow, but in 2010-2019, the number of Internet giants increased from 2 to 7, which shows that once Internet technology has entered the stage of application, and its development speed is astonishing.

It has been 12 years since Bitcoin was born, and its underlying blockchain technology has been in continuous development. Blockchain 2.0 represented by Ethereum has spawned a powerful DeFi ecological application, which already has the potential to challenge the traditional financial system. ability. In addition, this epidemic has further promoted this digitalization process. For example, the health code used in China uses blockchain technology. Blockchain technology has entered the application stage. Although it is still relatively early, those public chains with application value will surely become the darling of capital.

grayscale in"The Great Transfer of Wealth Promotes BTC to Become a Mainstream Investment Target"The report pointed out that: the digital age has arrived, and in the next 25 years, 68 trillion US dollars of wealth will be transferred to the younger generation who are inclined to digital currency investment. This is a huge opportunity for the entire crypto world. Bitcoin has established its status as digital gold, but the dominance of Ethereum is not yet stable. Let us look forward to the arrival of the next trillion encrypted assets.