Crypto 'Gatekeeper' BitGo Rings the Bell at NYSE

- Core View: Cryptocurrency custodian BitGo has successfully listed on the NYSE. Its IPO not only signifies traditional capital market recognition for crypto infrastructure companies but also highlights the value of its 'selling picks and shovels' business model, built on compliant custody and demonstrating resilience across market cycles.

- Key Elements:

- BitGo IPO'd at $18 per share, opened up approximately 25%, with a valuation around $2 billion, kicking off the wave of crypto company listings expected in 2026.

- The company's core value lies in its 'institutional flywheel' model: locking in assets through compliant custody and deriving value-added services like staking and clearing, resulting in resilient operations.

- Its valuation is underpinned by high-margin subscription and service businesses. Core economic revenue for fiscal year 2025 is projected to be approximately $196 million, implying a valuation multiple of around 10x.

- BitGo adopted a 'crypto-native' approach to its listing by partnering with Ondo Finance to tokenize its shares simultaneously on multiple chains including Ethereum and Solana.

- Its listing reflects the 'infrastructuralization' trend within the crypto industry's IPO wave, with more infrastructure companies like Kraken and Consensys expected to follow.

Original author: Bootly, Bitpush News

Cryptocurrency custodian BitGo ($BTGO) officially rang the opening bell at the New York Stock Exchange on January 22, Eastern Time.

The company, regarded as the "infrastructure lifeline" for crypto assets, completed its IPO at $18 per share. It surged to $22.43 at the opening, jumping approximately 25% on its first day, firing the starting shot for the wave of crypto company listings in 2026.

Based on the IPO price, BitGo's valuation is approximately $2 billion. Although this figure is far below the nearly $7 billion valuation of stablecoin issuer Circle ($CRCL) which listed last year, as one of the first major crypto companies to go public this year, BitGo's performance can be considered steady.

A Decade in the Making: From Multi-Sig Pioneer to Institutional Gatekeeper

BitGo is the latest native crypto company attempting to enter the public market, following the successful listings of several crypto firms in 2025.

Its story begins in 2013, when the crypto world was still in its "wild west" era, with frequent hacker attacks and private key management being a nightmare. Founders Mike Belshe and Ben Davenport keenly realized that if institutional investors were to enter, what they needed was not flashy trading software, but a sense of "security."

BitGo founder Mike Belshe

Standing on the bell podium at the NYSE, Mike Belshe might recall that afternoon over a decade ago.

As one of the first ten employees of the Google Chrome founding team and a key contributor to the modern web acceleration protocol HTTP/2, Mike was initially not interested in cryptocurrency and even suspected it was a scam. But he used the most "programmer" way to disprove it: "I tried to hack Bitcoin, and I failed."

This failure instantly turned him from a skeptic into a hardcore believer. To find a safer place for the old laptop full of Bitcoin under his sofa, he decided to personally dig a set of "trenches" for this wild market.

BitGo's early office resembled a laboratory more than anything else. While contemporaries like Coinbase were busy acquiring customers and boosting retail trading volume, Mike's team was researching the commercial potential of multi-signature (Multi-sig) technology. Despite his close personal ties with Netscape's founding figures and a16z's leader Ben Horowitz, he did not choose the fast track of "VC promotion," but rather the slowest and most stable path.

In 2013, BitGo pioneered the launch of multi-signature (Multi-sig) wallet technology, which later became an industry standard. However, BitGo did not stop at selling software; it made a crucial strategic choice: to transform into a "licensed financial institution."

By obtaining trust charters in South Dakota and New York, BitGo successfully became a "qualified custodian." This status played a pivotal role during the crypto ETF wave in 2024 and 2025. When asset management giants like BlackRock launched Bitcoin and Ethereum spot ETFs, it was underlying service providers like BitGo that were responsible for safeguarding assets and handling settlement processes.

Unlike trading platforms such as Coinbase, BitGo built a robust "institutional flywheel": first locking in assets (AUM) with extremely compliant custody, then deriving staking, clearing, and prime brokerage services around these deposited assets.

This "infrastructure-first" logic has allowed BitGo to demonstrate remarkable resilience amidst market volatility. After all, regardless of bull or bear markets, as long as assets remain in the "vault," BitGo's business continues.

10x Price-to-Sales Ratio: What's the Basis?

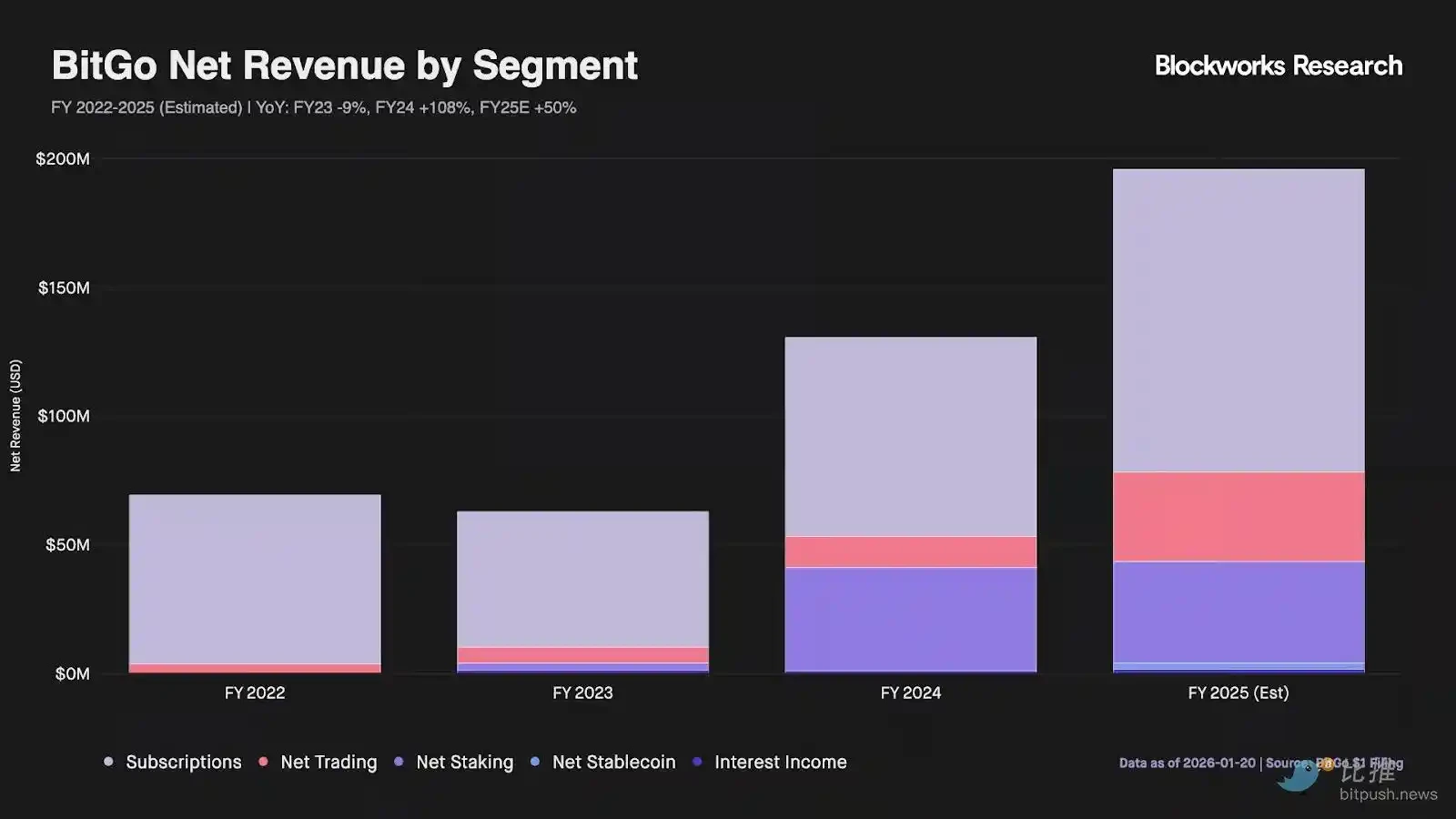

Looking at the financial data disclosed in BitGo's prospectus, its numbers appear quite "impressive."

Due to U.S. GAAP (Generally Accepted Accounting Principles) requirements, BitGo must record the full principal of transactions as revenue. This led to its "Digital Asset Sales" gross revenue reaching a staggering $10 billion in the first three quarters of 2025. However, in the eyes of seasoned investors, these figures are merely "pass-through money" and do not reflect true profitability.

What truly supports its $2 billion valuation is the "Subscription & Services" business segment.

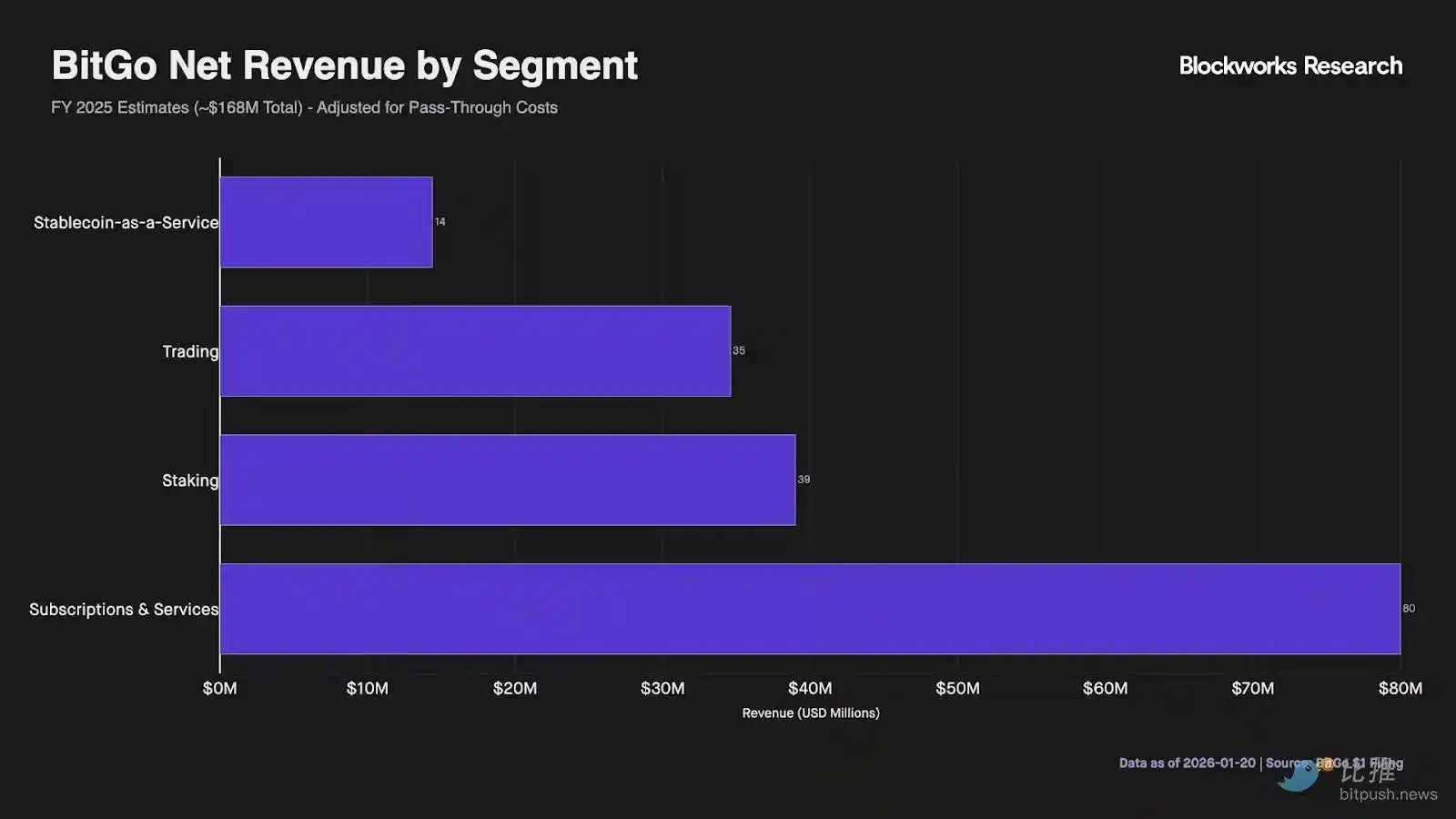

According to chart data from Blockworks Research, BitGo's core economic revenue (excluding pass-through fees and costs) is estimated to be approximately $195.9 million for the 2025 fiscal year. The subscription business contributes the majority of high-margin recurring revenue, accounting for nearly 48% of total net revenue with $80 million. This revenue primarily comes from recurring fees charged to over 4,900 institutional clients.

Furthermore, the staking business has become an unexpected growth driver. Staking revenue reached $39 million, ranking second. This reflects that BitGo is no longer just a simple "vault"; by providing value-added yield on top of custodial assets, it has significantly improved capital efficiency.

Looking at the trading and stablecoin business, although trading volume accounts for the highest proportion of total revenue, it only contributes $35 million to adjusted net revenue.

The newly launched "Stablecoin-as-a-Service" contributed $14 million. Although it's still in its early stages, it has already demonstrated some market penetration.

To assess BitGo's true valuation, its paper financial metrics need adjustment. If calculated solely based on its approximately $16 billion GAAP revenue, its valuation appears extremely low (P/S ratio ~0.1x). However, after excluding non-core items like pass-through trading costs, staking revenue sharing, and payments from stablecoin issuers, the moat of its core business is deep:

- 2025 Fiscal Year Core Economic Revenue (Estimate): ~$195.9 million

- Implied Valuation Multiple: Enterprise Value / Core Revenue ≈ 10x

This 10x valuation multiple places it above wallet-focused peers with retail-centric businesses. The premium reflects its regulatory moat as a "qualified custodian." Simply put, at a $1.96 billion valuation level, the market is willing to pay a premium for the subscription business, while the low-margin trading and staking businesses are just the icing on the cake.

Matthew Sigel, Head of Research at VanEck, believes that compared to the vast majority of crypto tokens with market caps exceeding $2 billion that have never generated net profit, BitGo's equity is a more tangible asset. The essence of this business is "selling shovels." Regardless of market cycles, as long as institutions are trading, ETFs are operating, and assets need storage, it can continuously earn fees. This model may not be as flashy as some altcoins in a bull market, but in volatile and bear markets, it's an "iron rice bowl."

More symbolic is its listing method itself. Unlike other crypto company IPOs, BitGo adopted a more "crypto-native" approach: by partnering with Ondo Finance, its shares were simultaneously made available on-chain on the listing day.

The tokenized BTGO shares will circulate on Ethereum, Solana, and BNB Chain, allowing global investors near-instantaneous access to this newly listed custodian. Tokenized BTGO stock may in the future serve as collateral, directly participating in DeFi lending protocols, bridging TradFi (Traditional Finance) and DeFi.

Summary

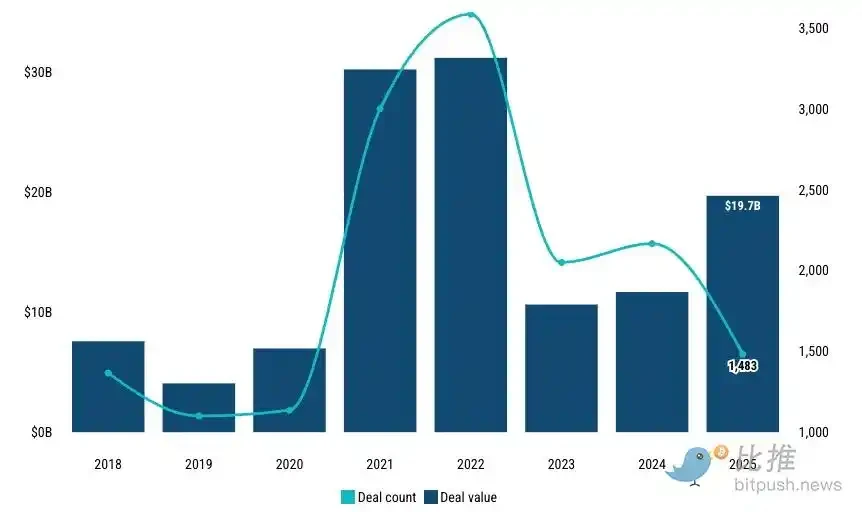

Source: PitchBook

Looking back at 2025, crypto venture capital (VC) deal value surged to $19.7 billion. As PwC IPO expert Mike Bellin stated, 2025 completed the "professionalization transformation" of cryptocurrency, and 2026 will be the year of full liquidity explosion.

Following pioneers like Bullish, Circle, and Gemini successfully going public in 2025, crypto company listings are now exhibiting dual characteristics of "infrastructuralization" and "giantization." Currently, Kraken has confidentially filed with the SEC, potentially aiming for the year's largest crypto exchange IPO; Consensys is closely collaborating with JPMorgan Chase, seeking capital influence within the Ethereum ecosystem; and Ledger, amidst the wave of self-custody demand explosion, has also set its sights on the New York Stock Exchange.

Of course, the market has never been free from macro fluctuations, and memories of some companies' stocks falling below their IPO price in 2025 remain fresh. But this precisely indicates the industry is maturing. Capital is no longer paying for every good story but is starting to scrutinize financial health, compliance frameworks, and sustainable business models.