Seller Exhausted, Buyer Absent: The Quiet Moment in the Bitcoin Market

- Core View: The Bitcoin market remains in a structural consolidation phase characterized by low participation and supply surplus. The recent rebound stems from a temporary easing of selling pressure, not from strong active buying momentum. Price faces sustained selling pressure near key cost levels, limiting upside potential.

- Key Elements:

- On-chain structure is fragile; price is encountering resistance below the Short-Term Holder cost basis (approximately $98,000) and the $100,000 psychological barrier, with dense "overhead" supply above.

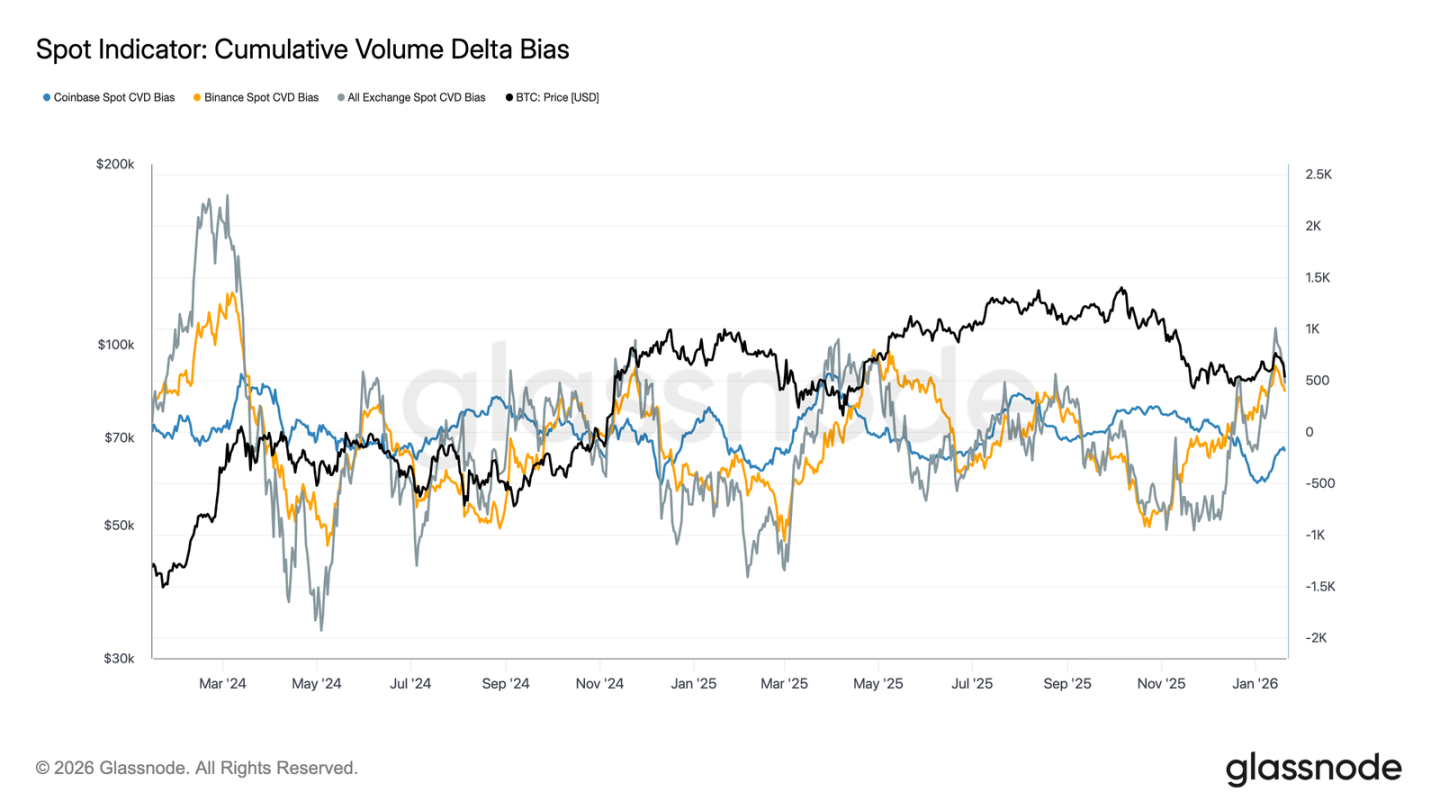

- Positive signals emerged in the spot market, with the cumulative volume delta (CVD) on major exchanges turning to net buying. However, the buying is selective and has not yet formed a trend-driven expansion.

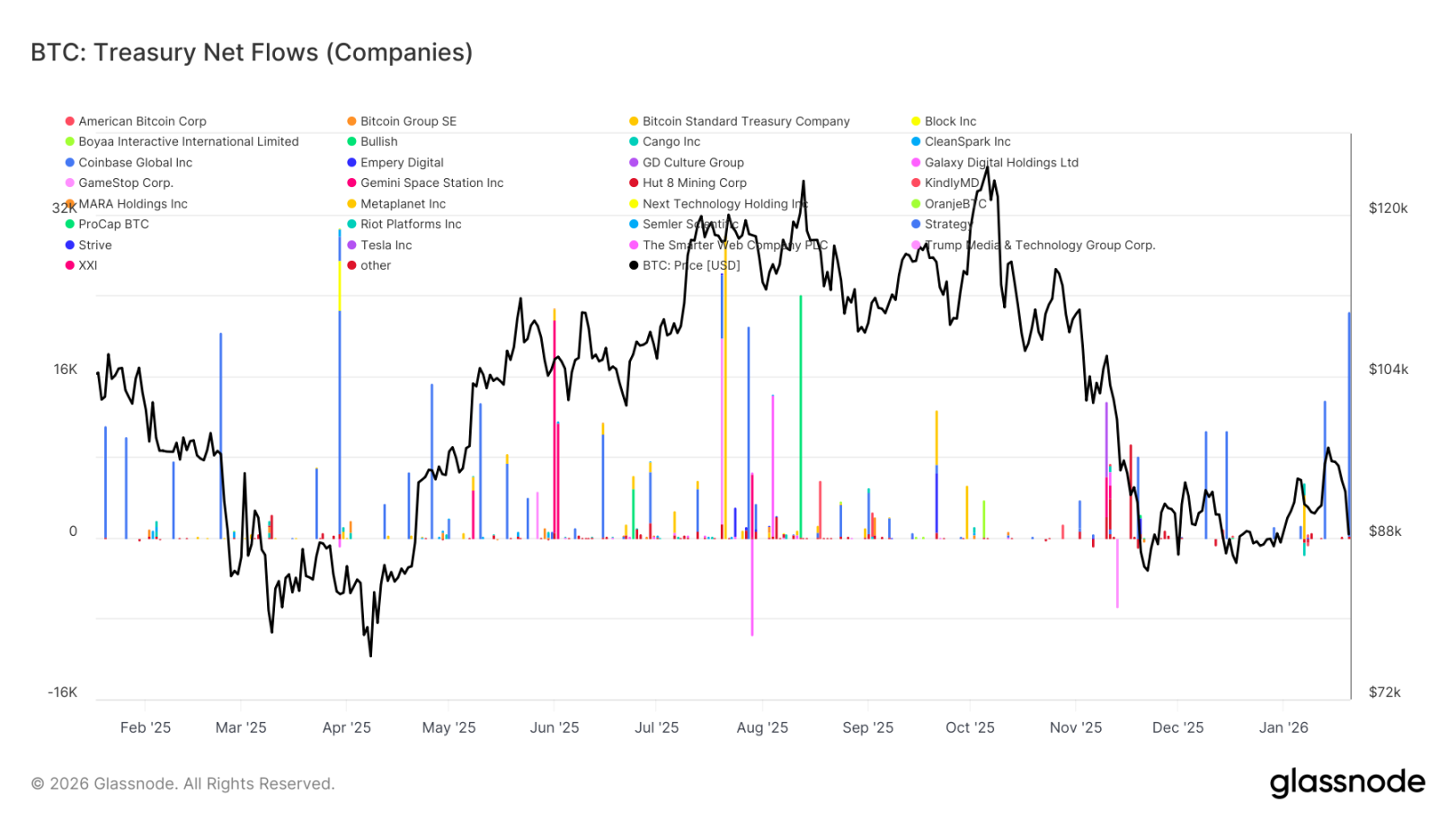

- Corporate treasury inflows are sporadic and event-driven, lacking systematic accumulation, thus having a limited impact on overall demand.

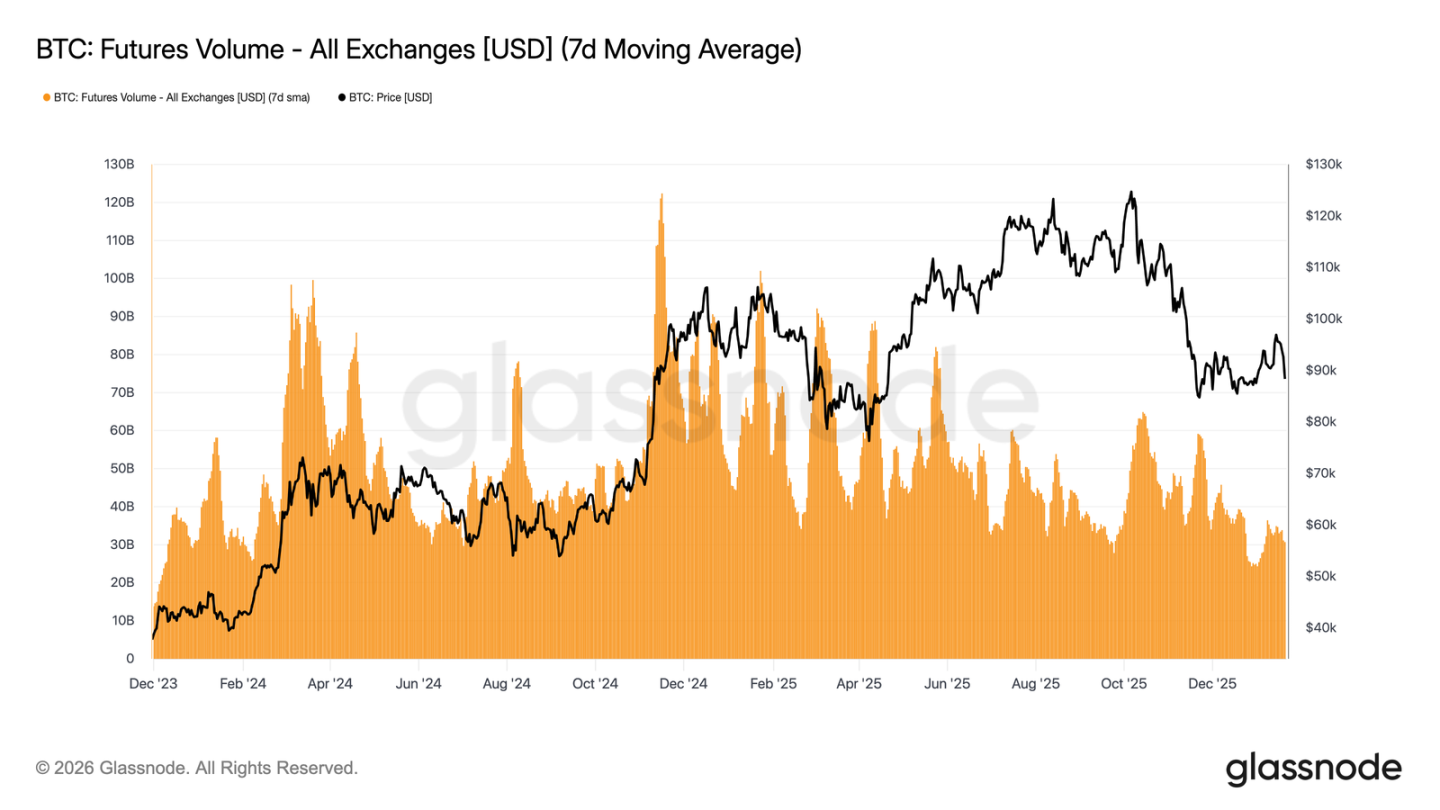

- Derivatives market participation is low, with futures trading volume shrinking, cautious leverage usage, and sparse market liquidity.

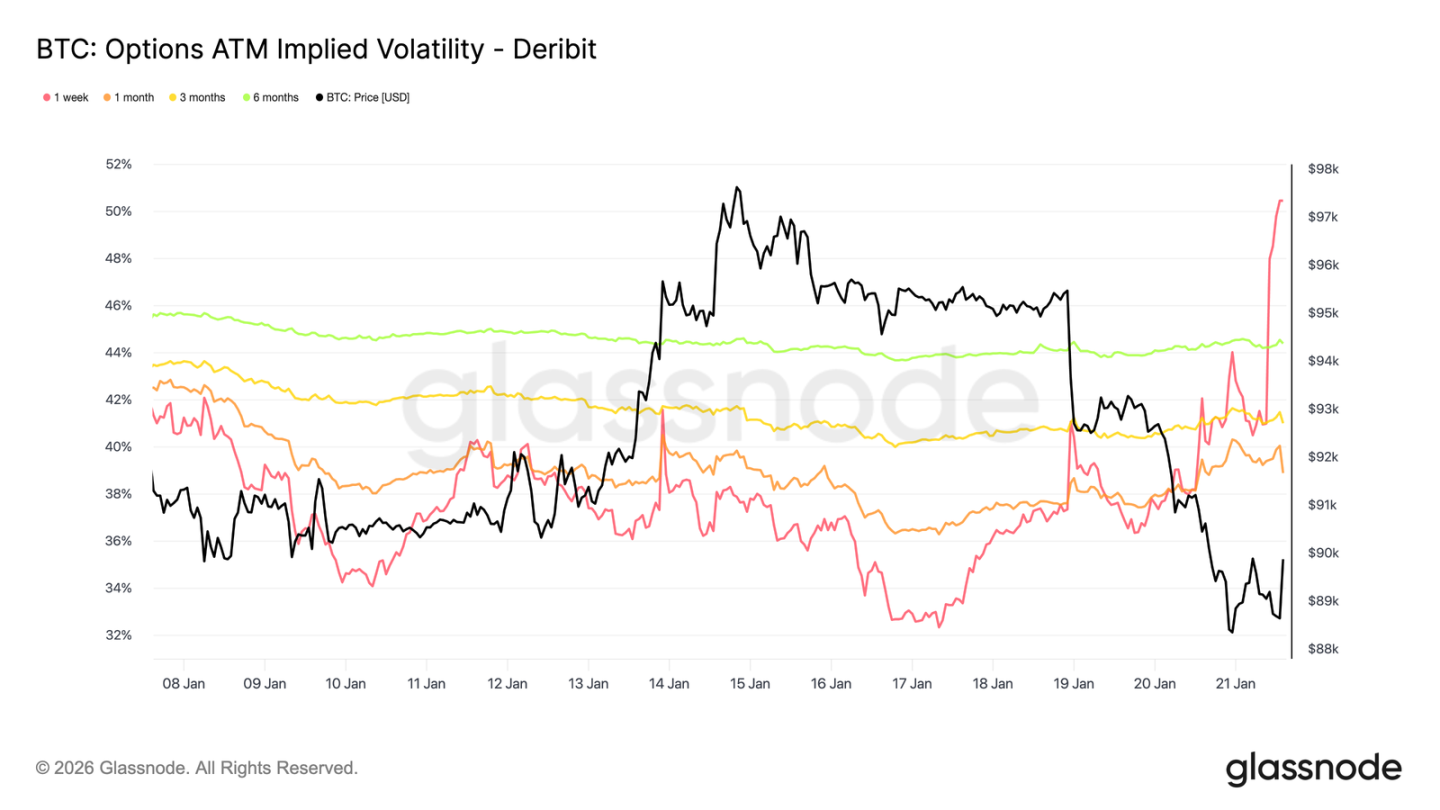

- The options market indicates risk aversion is tactical; short-term implied volatility spiked and then quickly retreated, while volatility risk premium remains high, suppressing overall volatility.

- Dealer gamma positioning turned net short below $90,000, weakening stability during price declines and increasing the market's sensitivity to liquidity shocks.

Original Author: Glassnode

Original Compilation: AididiaoJP, Foresight News

Entering early January 2026, the market is showing signs of seller exhaustion, creating an opportunity for a price rebound towards the upper boundary of the current trading range. However, this rebound comes with elevated risk as the price approaches the ~$98k zone, where recent buyers have formed active "breakeven" selling pressure around their cost basis.

Core Insights

- On-chain structure remains fragile: Price hovers near key cost basis levels, lacking sustained confirmation from the firm conviction of long-term holders.

- Supply overhang persists: Recent buyers face overhead resistance, limiting the sustainability of rallies and making any rebound vulnerable to selling.

- Spot flows turn positive: Selling pressure from major exchanges has eased, but buying remains selective rather than broad-based.

- Treasury inflows are sporadic: Treasury activity is characterized by isolated, event-driven actions, not yet forming a coordinated accumulation trend, limiting its impact on overall demand.

- Derivatives participation is low: Futures volume is contracting, leverage is used cautiously, and the market is in a state of low engagement.

- Options market sees only short-term pressure: Short-term implied volatility reacted to risk events, while medium-to-long-term volatility remains stable.

- Hedging demand spikes then normalizes: The surge in the Put/Call Volume Ratio has subsided, indicating risk aversion was tactical.

- Dealer gamma positioning is net short: This weakens mechanical support for price stability and increases market sensitivity to liquidity shocks.

On-Chain Deep Dive

Over the past two weeks, the anticipated technical rebound has largely materialized, with price stalling below the Short-Term Holder cost basis after hitting resistance, reaffirming the presence of substantial overhead supply. This report will focus on analyzing the structure and behavior of this "overhang" supply, revealing emerging seller dynamics.

Technical Rebound Meets Resistance

A clear narrative has formed: the market has been in a mild bearish phase. Its lower bound is supported by the ~$81.1k Realized Price, while the upper bound is capped by the average cost of Short-Term Holders. This range creates a fragile equilibrium where downside pressure is absorbed, but upward attempts are repeatedly met with selling from investors who bought between Q1 and Q3 2025.

Entering early January 2026, waning seller momentum opened a window for price to rebound towards the range's upper bound. However, this rebound is at risk as price approaches the ~$98k zone, where recent buyers show increased willingness to sell near their cost basis.

The recent rejection near ~$98.4k (the Short-Term Holder cost basis) mirrors the market structure seen in Q1 2022. Back then, the market repeatedly failed to decisively break above the cost zone of recent buyers, leading to an extended consolidation period. This similarity highlights the fragile nature of the current recovery attempt.

Overhead Supply Pressure Remains

Building on the observation of price rejection at key cost levels, a closer look at on-chain supply distribution provides a clearer explanation for why upward momentum has repeatedly faltered.

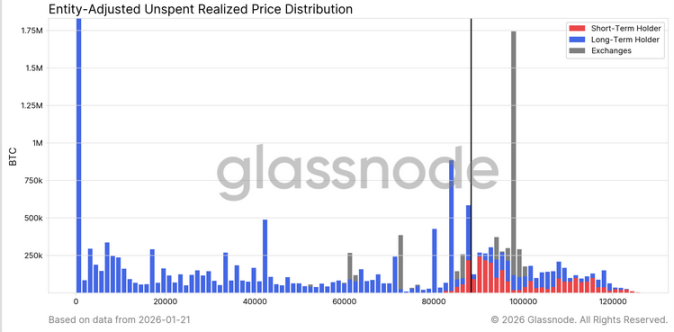

The URPD (Unrealized Profit/Loss Distribution) chart clearly illustrates why the supply overhang above $98k remains the primary force suppressing medium-term rallies. The recent rebound partially filled the "vacuum" between ~$93k and $98k, primarily through early buyers distributing to new entrants, forming a new cluster of Short-Term Holder supply.

However, the supply distribution above $100k reveals a broad and dense band of supply, with these coins gradually aging into Long-Term Holder status. This undigested "overhang" supply is a persistent source of selling pressure, likely capping price below the $98.4k (STH cost basis) and $100k psychological levels. Therefore, a decisive breakout requires a significant and sustained acceleration in demand momentum.

Long-Term Holders Also Pose Resistance

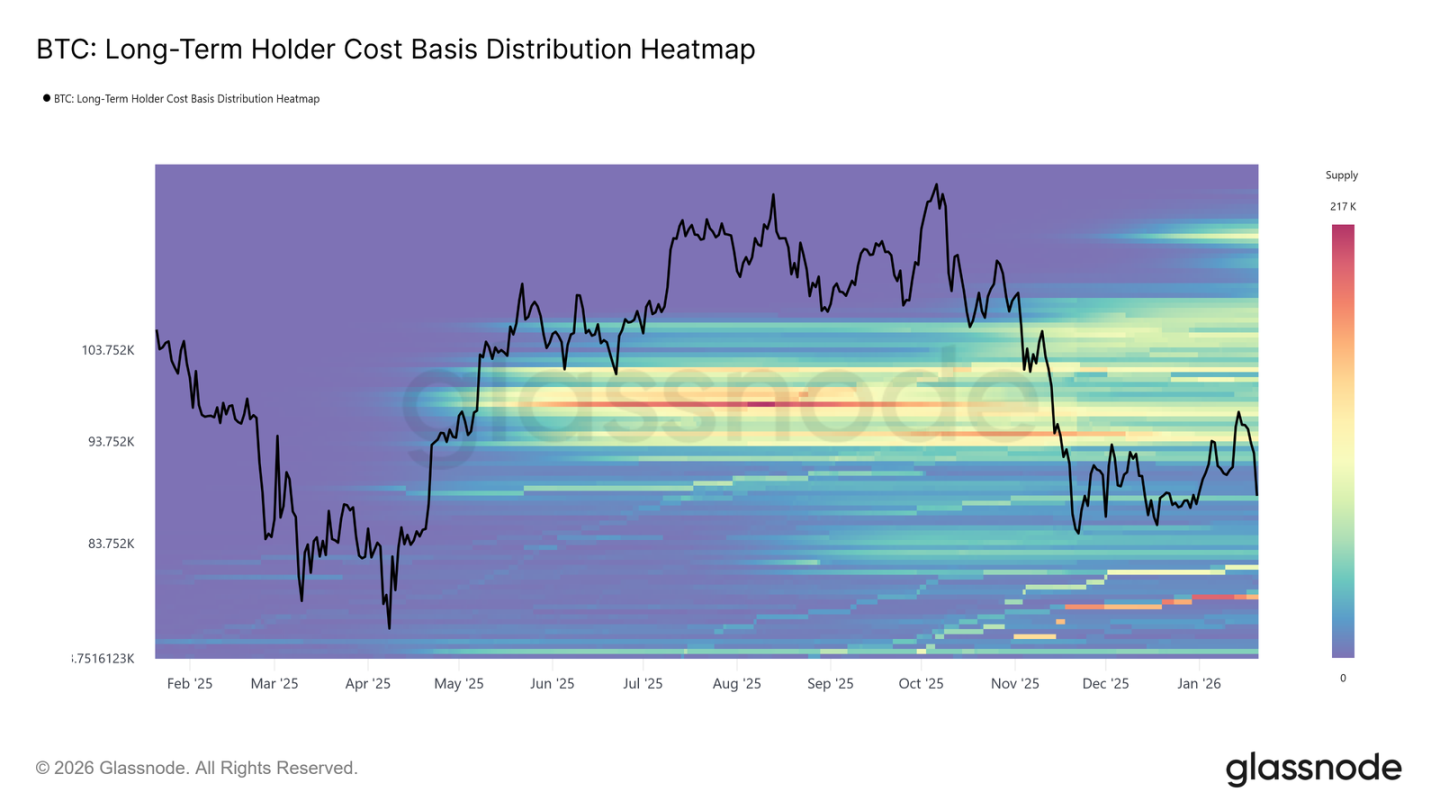

Expanding the view from Short-Term Holders to long-term holdings reveals the same structural constraints persist.

The Long-Term Holder cost basis distribution heatmap shows a dense cluster of long-term coin acquisition costs above the current spot price. This zone represents a significant pool of potential seller liquidity when price rallies towards these historical purchase levels.

Until new, sufficiently strong demand emerges to absorb this overhead supply, Long-Term Holders will remain a potential source of resistance. Thus, unless this "overhang" supply is fully digested, upside may remain limited, with any rally vulnerable to renewed selling.

Rebound Meets Profit-Taking and Stop-Loss Selling

Going further, we can identify which investor cohorts were actively realizing (profits or losses) during the recent rally towards ~$98k, thus capping the price.

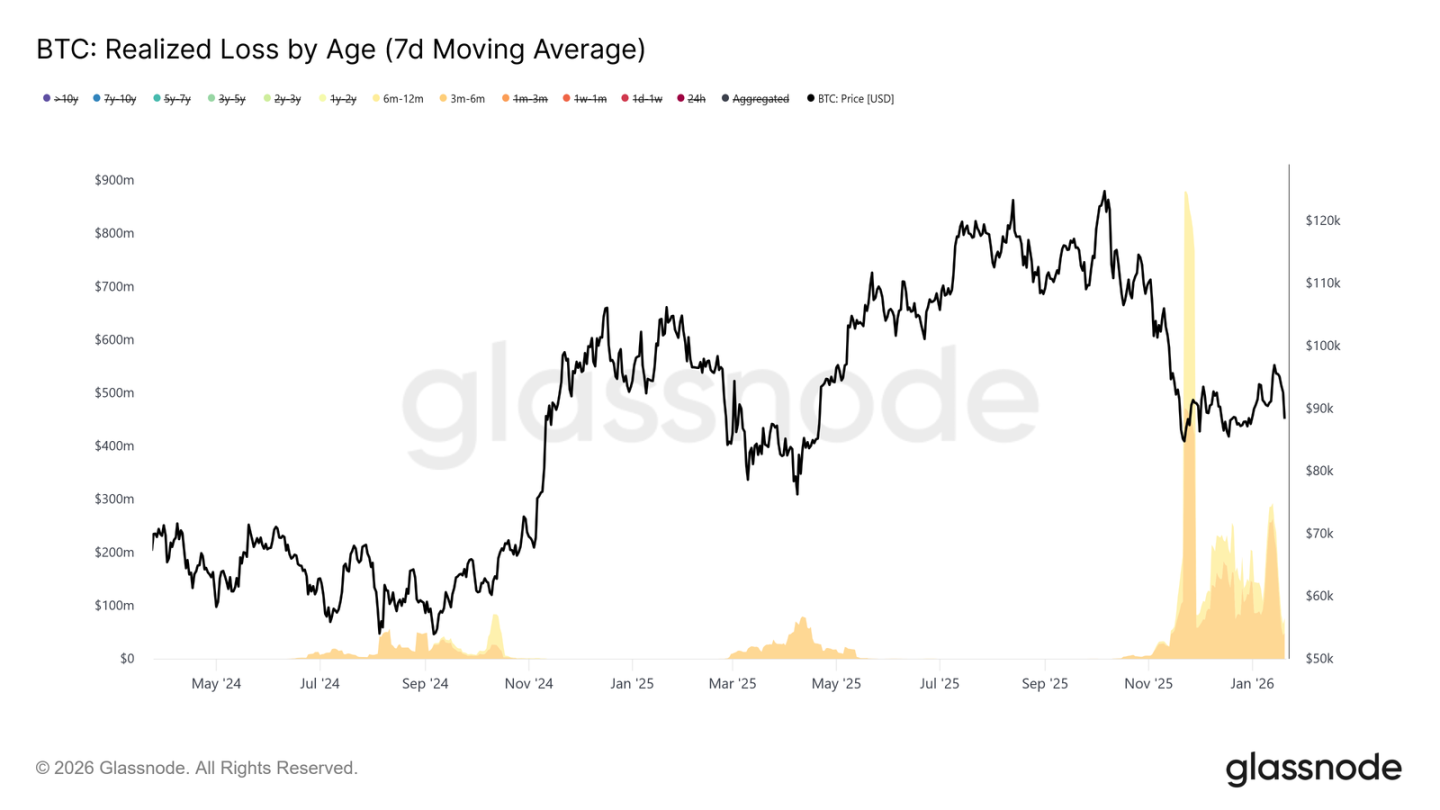

Realized Loss data segmented by coin age shows loss-taking was dominated by the 3-6 month cohort, followed by the 6-12 month holders. This pattern is characteristic of "capitulatory selling," particularly from investors who bought above ~$110k and are now exiting as price approaches their cost basis. This behavior reinforces seller pressure near key recovery levels.

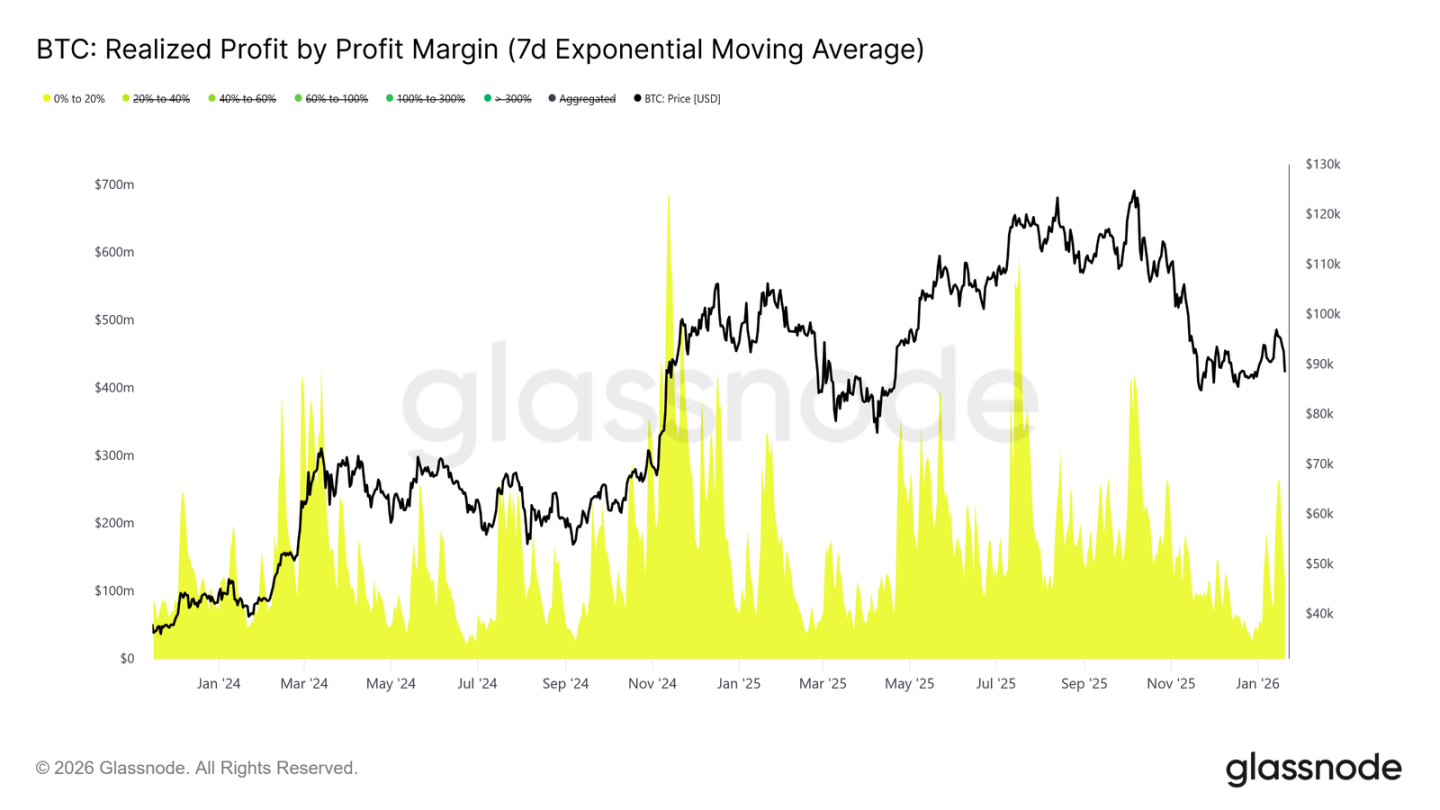

Meanwhile, Realized Profit data segmented by profit margin shows a notable increase in profit-taking within the 0% to 20% profit margin band. This highlights the influence of "breakeven sellers" and short-term swing traders who prefer to exit with small gains rather than wait for trend continuation.

This behavior is common during market transitions where investor conviction is fragile, prioritizing capital preservation and tactical profits. This increase in low-margin selling continuously undermines upward momentum as supply is released near cost.

Off-Chain Market Observations

Spot Flows Turn Positive

Spot market behavior has improved following the recent decline. The Binance and Exchange Aggregate CVD (Cumulative Volume Delta) metrics have flipped back to net buying. This indicates spot participants are beginning to re-accumulate rather than sell into strength, contrasting with the persistent selling pressure seen during the prior consolidation.

Coinbase, which had been a consistent source of sell pressure during the range-bound phase, has also seen a significant slowdown in its net selling pace. Reduced selling pressure from Coinbase helps diminish overhead supply, stabilizing price action and supporting the recent bounce.

While spot participation hasn't yet shown the sustained, aggressive buying typical of trending expansion phases, the shift back to net buying on major platforms marks a positive improvement in the underlying spot market structure.

Digital Asset Treasury Inflows Remain Sporadic

Recent net flows for digital asset treasuries remain sporadic and uneven, with activity driven by isolated events rather than broad-based trending accumulation. While there have been notable buying spikes from individual companies in recent weeks, overall corporate demand has not entered a sustained accumulation mode.

Overall, digital asset treasury flows are oscillating narrowly around the zero line, suggesting most corporate treasuries are currently in a wait-and-see or opportunistic mode rather than systematically accumulating. This contrasts sharply with earlier phases where multiple corporations bought in concert, driving trend acceleration.

In summary, the latest data shows corporate treasuries are only a marginal, selective source of demand, with an intermittent impact that is not yet decisive for overall price dynamics.

Derivatives Market Quiet

The 7-day moving average trading volume for Bitcoin futures continues to contract, remaining well below levels typically associated with trending markets. Recent price volatility has not been accompanied by a meaningful expansion in volume, highlighting low participation and lack of conviction in the derivatives market.

The current market structure suggests recent price action is driven more by sparse liquidity than aggressive positioning. Adjustments in Open Interest are also not accompanied by concurrent volume growth, reflecting more the adjustment and risk rebalancing of existing positions than the deployment of new leverage.

In short, the derivatives market is currently in a low-participation "quiet" state with subdued speculative interest. This "ghost market" characteristic means the market could be very sensitive to any resurgence in volume, but its influence on price discovery is currently limited.

Implied Volatility Spikes Only Short-Term

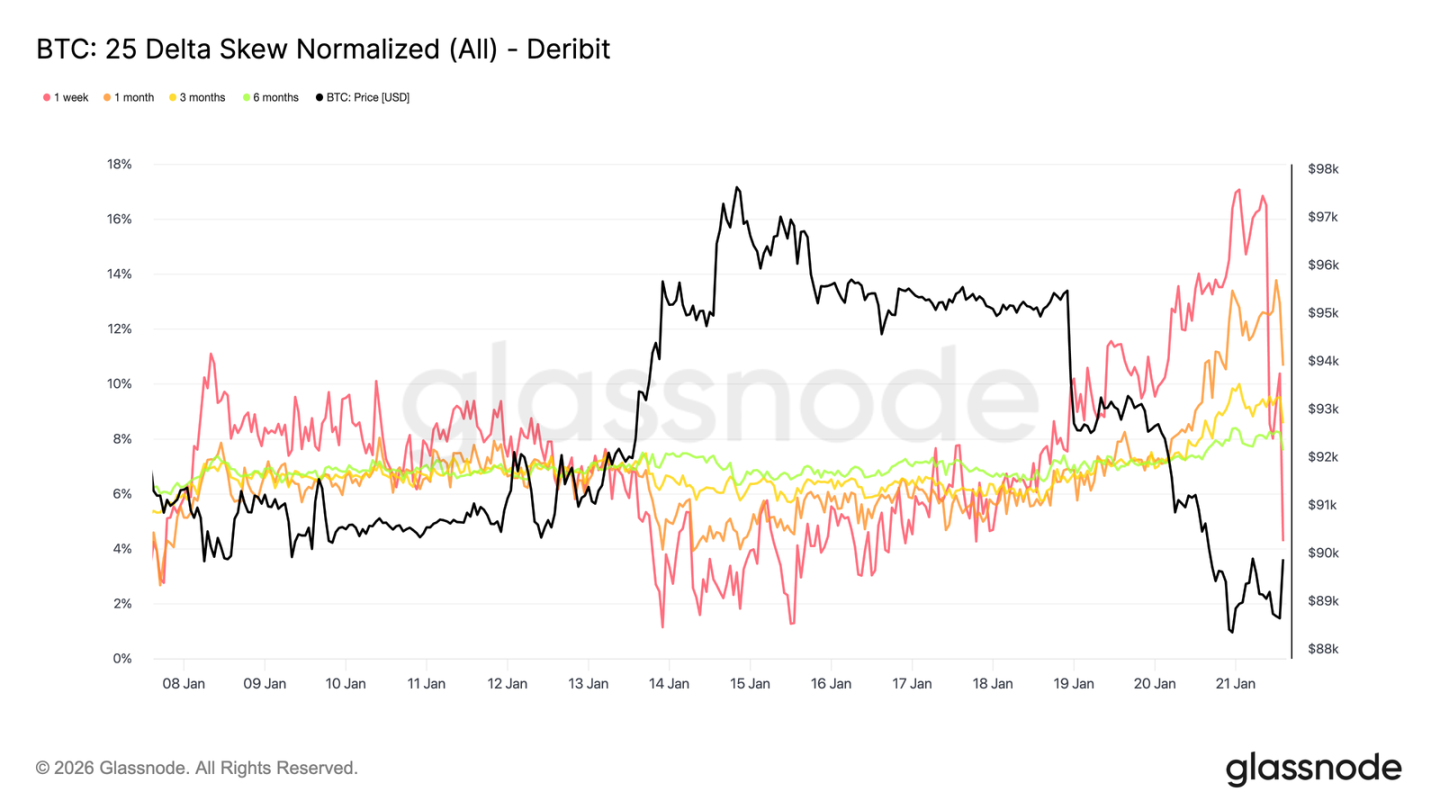

The spot sell-off triggered by macro and geopolitical news only stimulated a rise in short-term volatility. Since Sunday's decline, 1-week implied volatility has risen by over 13 volatility points, while 3-month implied volatility rose only ~2 points, and 6-month implied volatility barely moved.

This sharp steepening at the very front of the volatility curve indicates traders are engaging tactically, not reassessing the medium-term risk structure. Only short-term volatility adjusted, reflecting event-driven uncertainty, not a shift across the entire volatility regime.

The market is pricing transient risk, not persistent turmoil.

Short-Term Option Skew Experiences Sharp Volatility

Similar to at-the-money volatility, short-term skew dominated this adjustment. The 1-week 25-delta skew, which was near equilibrium a week ago, has sharply shifted to a "puts more expensive" state.

Since last week, this skew measure has moved ~16 volatility points towards puts, reaching a put premium of nearly 17%. The 1-month skew also reacted, while longer-dated skews, already in put territory, only deepened slightly.

Such a dramatic skew tilt often accompanies localized extremes where the market is positioned against trend continuation. Following the digestion of Davos-related commentary, the downside premium has been partially taken profit on, and the skew has begun to retrace rapidly.

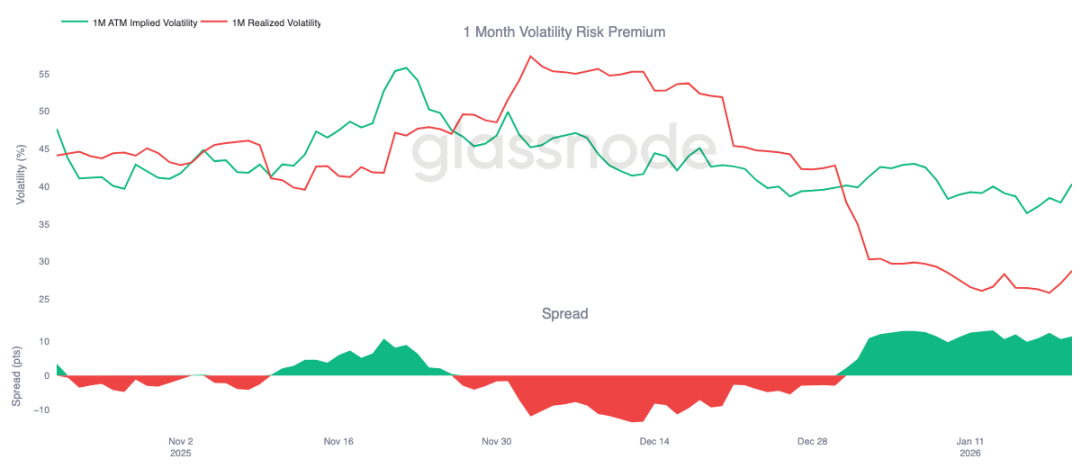

Volatility Risk Premium Remains Elevated

The 1-month Volatility Risk Premium has remained positive since the start of the year. Despite implied volatility being at historically absolute lows, its pricing consistently remains above realized volatility. In other words, options remain "expensive" relative to the actual price volatility occurring.

The Volatility Risk Premium captures the difference between implied and realized volatility. A positive premium means option sellers are compensated for bearing volatility risk. This creates a favorable environment for "short volatility" strategies—holding short gamma positions can generate returns as long as realized volatility stays contained.

This dynamic is self-reinforcing, suppressing volatility. As long as selling volatility is profitable, more participants join, keeping implied volatility suppressed. As of January 20th, the 1-month volatility spread is ~11.5 volatility points in favor of sellers, illustrating that the environment remains conducive to selling volatility.

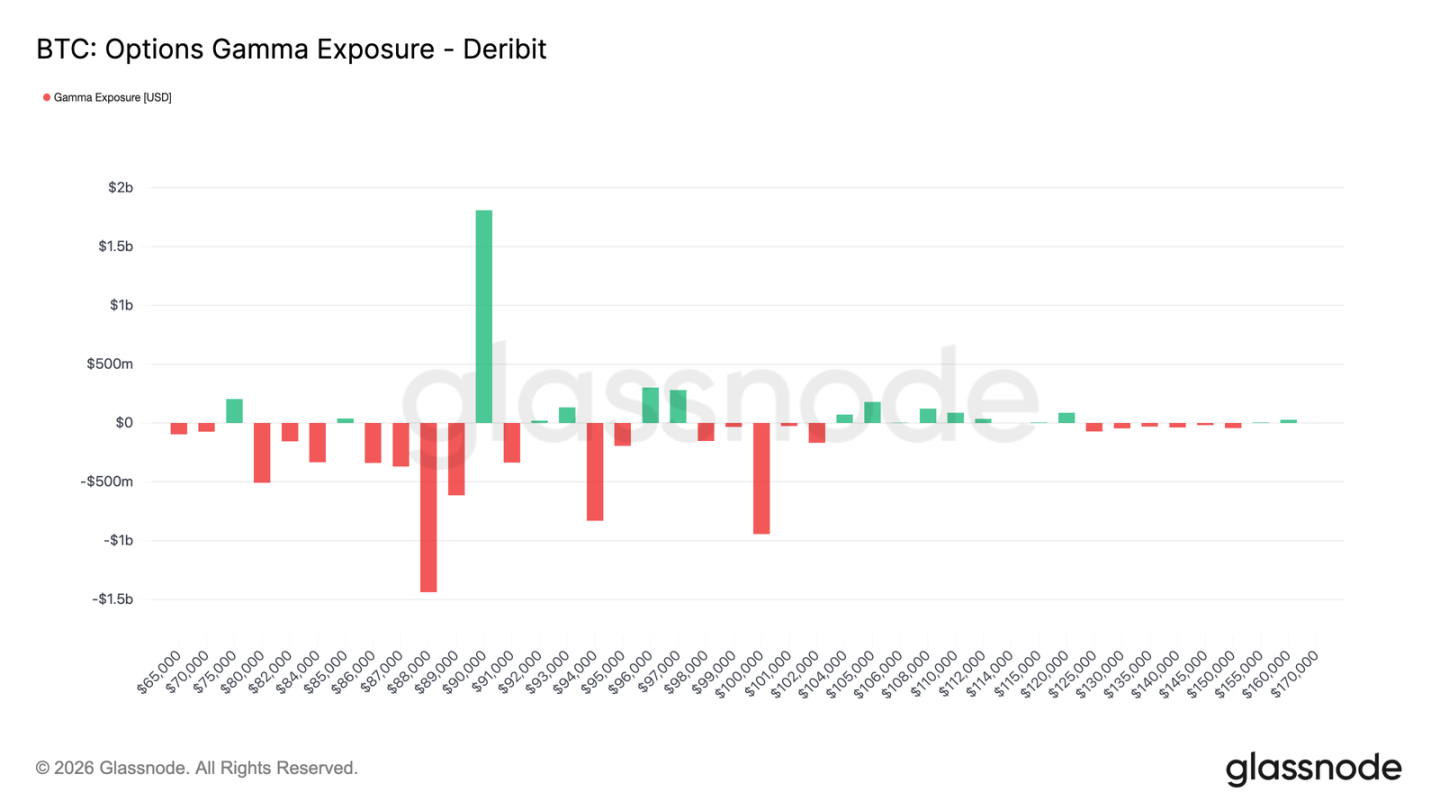

Dealer Positioning Turns Net Short

Dealer gamma positioning is a key structural force influencing short-term price behavior. Recent flows show investors actively bought downside protection, leaving dealers short gamma below $90k. Simultaneously, some investors financed this by selling upside calls, leaving dealers long gamma above $90k.

This creates an asymmetric setup: Below $90k, dealers are short gamma, meaning price declines could be self-accelerating due to their hedging operations (selling futures or spot). Above $90k, dealers' long gamma acts as a stabilizer, as rallies trigger their hedging buys, dampening the move.

Therefore, price action below $90k may remain fragile, while $90k itself becomes a key friction point. A decisive and sustained break above this level would require sufficient market momentum and confidence to digest dealer hedging flows and push their gamma exposure to higher strikes.

Summary

The Bitcoin market remains in a state of low participation, with current price action stemming more from "reduced selling pressure" than "aggressive buying." On-chain data continues to reveal issues of supply overhang and fragile structural support. While spot flows have improved, they have not yet translated into a sustained buying trend.

Institutional demand remains cautious, with treasury flows stabilizing around the zero line and activity dominated by sporadic trades. The derivatives market is quiet, with contracting futures volume and constrained leverage use, collectively creating a low-liquidity environment where prices are hypersensitive to minor positioning shifts.

The options market reflects this restraint. Volatility repricing is confined to the short term, hedging demand has normalized, and elevated volatility risk premiums continue to anchor overall volatility levels.

Overall, the market appears to be quietly building a base. The current consolidation stems not from overheated participation but from a temporary pause in investor conviction, as they await the next catalyst capable of inspiring broad-based engagement.