NYSE's Entry: The Endgame for Stock Tokenization or the Dawn of Crypto-Friendly Brokerages?

- Core Viewpoint: The New York Stock Exchange (NYSE) launching an on-chain stock trading platform signifies that stock tokenization is transitioning from an exploration phase dominated by private projects to a standardized phase supported by official infrastructure and regulatory frameworks. This will reshape the industry landscape and is a long-term positive for infrastructure connecting the traditional and on-chain worlds, such as crypto-native brokerages.

- Key Elements:

- Official Solutions Address Core Pain Points: Official platforms like the NYSE can directly interface with mature clearing and custody systems like DTCC, natively supporting complex corporate actions such as dividends, voting, and stock splits. These are the technical and compliance bottlenecks that private issuance solutions have long struggled to perfect.

- Liquidity Concentrates Towards Official Systems: Official endorsement will attract clearing houses, market makers, and large institutions, creating a gravitational pull for liquidity. This may lead to privately issued stock tokens facing issues of insufficient liquidity and high trust costs.

- Industry Focus Shifts: The opportunity shifts from "issuing more tokens" to building user gateways, trading experiences, and settlement infrastructure around official stock tokens, such as crypto-friendly brokerages.

- Stablecoins Become a Key Gateway: The penetration of stablecoins will lower the barriers and friction for global users to participate in stock trading, serving as a crucial foundation for the reshaping of next-generation brokerages.

- Historical Patterns Foreshadow Ecosystem Reshaping: Looking back at the history of stock trading, every major shift in trading paradigms (e.g., electronic, internet-based) has given rise to entirely new forms of brokerages. On-chain integration will be the next window for such restructuring.

Author: Founder of Stablestock Zixi.bnb

Recently, the NYSE announced plans to build a 24/7 on-chain stock trading platform. Simply put: in the future, U.S. stocks can be traded on-chain around the clock.

New York Stock Exchange to Launch Tokenized Stock Trading Platform

Many people's first reaction was: "Great! Stocks are finally going fully on-chain!" "Can anyone issue stock tokens now?"

But if you really break this down, you'll find a counterintuitive conclusion: NYSE's entry does not mean stock tokenization becomes freer; instead, it means the era of private companies haphazardly issuing stock tokens may be coming to an end.

1. In Plain Terms: What is "Stock Tokenization"?

Without jargon, let's use the most straightforward analogy.

- Stock: You hold a "share" of a company through a broker.

- Tokenization: Through the broker's infrastructure, users/institutions mint this "share" into a token on the blockchain.

Sounds great, right? That's what Stablestock thought mid-year: Could Stablestock, following the stablecoin model, tokenize stocks using a broker as the underlying layer and enable free on-chain trading? The problem lies right here. It involves numerous compliance and technical challenges.

Let me give some examples: On compliance, if you don't have your own broker, you lack user asset custody rights, meaning users cannot transfer shares into a broker. This implies users can only buy from scratch. Technically, take stock splits/reverse splits as an example. After tokens are issued for stock tokenization, once the underlying stock undergoes complex operations like splits/reverse splits (which happen frequently), smart contracts struggle to handle such split/merge operations. If the oracle operates incorrectly, it can trigger user liquidations in perp/lending and other trading products.

During our months exploring stock tokenization, besides the above issues, we encountered many technical challenges that made us realize the foundation of stock tokenization is DTCC, or rather Nasdaq/NYSE, not the token-issuing company. If NYSE/Nasdaq/DTCC don't solve the underlying problems, stock tokenization will be a sector that collapses midway.

2. Why Can Private Companies Issue Stablecoins but Not Stock Tokens?

Unlike stablecoins, stock tokens are not something private companies can issue arbitrarily. The reason stablecoins can be issued by private companies is that "the US dollar itself is freely circulating"; stock tokens cannot because "stocks are not truly held by brokers or companies."

Stablecoins are pegged to the US dollar. The dollar itself is a freely circulating asset; as long as you have a bank account, you can receive, pay, and transfer money. Issuing stablecoins is essentially about "redemption": a user gives you $1, and you give them 1 stablecoin on-chain; they can exchange the stablecoin for $1 at any time. As long as reserves are real and redemption is reliable, this logic holds. The dollar doesn't involve dividends, voting, or "ownership registration" issues, making the technical and legal structure relatively simple.

Stocks are completely different. Stocks don't reside at a specific broker; their ultimate registration and custody are centralized in systems like DTCC. The stock you buy represents shareholder status in a company, not an asset that can be freely transferred. Transferring stocks in and out requires clearing, reconciliation, and registration updates—far more complex than a simple transfer.

More importantly, stocks continuously undergo events during holding, such as dividends, voting, splits, and additional issuances. Each change must be legally valid and accurately reflected in the shareholder register. This means issuing stock tokens isn't "done after issuance"; it requires responsibility for the entire stock lifecycle.

Let's take transfers in/out and stock splits/reverse splits as examples.

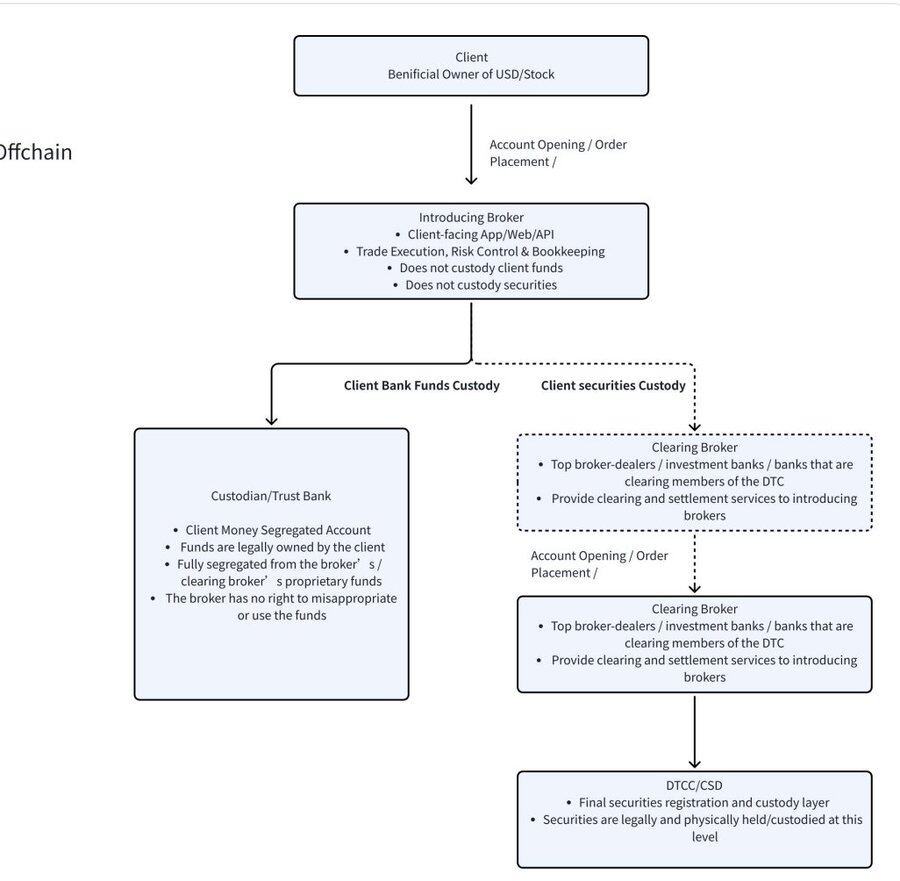

From a transfer perspective, having a bank account suffices for dollars because dollar inflows/outflows already use the banking system; transfers don't require notifying anyone or updating an "ownership registry." But stocks aren't "money"; they have a complete set of legal relationships and ownership systems. Stocks aren't actually stored at brokers. Many think when they buy stock in a broker's app, the stock is with that broker. Actually, no. The final registration and custody of stocks are centralized at DTCC (see stock/fund flow chart below). The company's shareholder list, splits/reverse splits, and voting are all based on DTCC records. Unlike money, stock transfer means ownership changes, the shareholder list must be updated, and dividend/voting rights follow. This isn't as simple as a bank transfer; it requires reconciliation between different brokers, confirmation by clearing systems, and registration by the central depository. Therefore, stocks have never been an asset that can flow freely. The business logic is completely different from stablecoins.

Broker Asset Flow and Custody

Asset behavior is also entirely different. Dollars just sit there. But stocks pay dividends, have voting, splits/reverse splits, mergers, and additional issuances. Let's take a real example: a stock split. Netflix announced a 1-for-10 split on Nov 17. Assume a stock token issuer has 1000 NFLX shares in broker inventory (registered at DTCC), with 1000 NFLX tokens circulating on-chain pre-split. When the 1-for-10 split occurs, at the broker, shares automatically change from 1000 to 10000 without any action, all handled by clearing and custody systems. But what about on-chain? It seems simple: if the chain forces the issuance of 9000 more NFLX tokens, so each existing token holder gets 10 tokens per 1 held. But who executes this? Who ensures every address is processed correctly? What if users put tokens in DeFi, lending, or AMMs? How to split tokens locked in smart contracts? Who guarantees the price oracle will process it timely (if relying entirely on off-chain prices, off-chain might quote $10 while on-chain price remains $100)? If tokens aren't split, only the exchange ratio changes (1 token equals 10 shares), the price system can instantly become chaotic, creating discrepancies between on-chain and off-chain, leading to distortion, requiring rule changes for every corporate action. This is actually a very complex and frequent occurrence.

Netflix 1-for-10 Split on Nov 17

From the above cases, you'll see that whether for transfers or split/merge events, the most critical infrastructure is actually DTCC and NYSE/Nasdaq, not the stock token issuing company.

3. NYSE's Entry Changes the Rules

When NYSE formally enters the stock tokenization space, it's not just adding a "participant"; it means the industry's center of gravity has fundamentally shifted.

In the early stages, stock tokenization relied more on private projects for exploration: project teams issued tokens, mapped stock value, and tried to solve trading hours, cross-border, and efficiency issues. But this model's premise was—there wasn't yet a widely recognized, sufficiently authoritative "official version" in the market.

NYSE's entry precisely changes that.

Once a stock tokenization solution backed by top exchanges, clearing systems, and regulatory frameworks emerges, market choices become very pragmatic: most clearing institutions, brokers, and users will directly connect to the official system, rather than continue using privately issued stock tokens. The reason isn't complicated—the official solution is inherently more complete in underlying capabilities.

These official stock tokens often directly connect to mature clearing and custody systems, naturally supporting complex corporate actions like splits, reverse splits, dividends, voting, mergers, and additional issuances—areas where private issuance schemes have long struggled to perfect and are most prone to issues. For institutions, whether functions are comprehensive and legal responsibilities are clear is far more important than "whether it's natively on-chain."

More crucially, official endorsement itself creates a gravitational pull for liquidity. When clearing firms, market makers, banks, and large institutions all provide services around official tokens, privately issued stock tokens will inevitably face issues like insufficient liquidity, pricing discounts, and excessive trust costs. Even if they can technically continue to exist, they will gradually lose economic significance. The essence of private companies issuing stock tokens is actually building a side pool outside the massive liquidity of traditional exchanges.

Therefore, what NYSE's entry represents is not "comprehensive prosperity for stock tokenization," but a very realistic signal:

Stock tokenization is moving from "multiple parallel experiments" toward "high centralization and standardization."

In this landscape, opportunities no longer belong to projects that "issue more tokens," but to participants who can smoothly integrate into the official stock token system and build user gateways and trading experiences around it.

This is the real change in the industry after NYSE's entry.

4. Every Upgrade to the Stock Foundation Has Caused a Paradigm Shift for Brokers

Looking back at the past 100 years of stock trading history, a very clear pattern emerges: every migration in trading paradigms has given rise to entirely new forms of brokers.

The first major shift occurred before the 1970s. Back then, stock trading relied entirely on paper certificates and human intermediaries; ordinary people could hardly participate. The stock market was essentially a game for the elite. This is the scene often seen in old movies: trading floors where brokers matched orders through open outcry.

The second shift happened after the 1970s. With the establishment of DTC, stock trading began to be centrally handled by large investment banks and broker systems. Institutions like Morgan Stanley, Goldman Sachs, and Merrill Lynch started executing trades and clearing on behalf of clients. This was the era depicted in "The Wolf of Wall Street": stock trading remained professional but had opened up to a broader clientele via telephone.

The third shift emerged after the 2000s. The proliferation of internet and API-based trading completely changed the participation threshold for stock markets. Online brokers like Interactive Brokers and Robinhood rose, making stock trading truly accessible to the masses for the first time. History has repeatedly proven: once the trading model undergoes a systemic change, the broker ecosystem is inevitably reshaped. We believe that by around 2026, stock tokenization will become an irreversible trend. As settlement and delivery gradually migrate to blockchain infrastructure, the entire stock trading system will face a new window of reconstruction.

This stock tokenization system upgrade initiated by NYSE, along with stablecoin settlement systems, represents a paradigm upgrade.

And companies like our Stablestock gradually betting on the "crypto-native broker" direction in H2 2025 are essentially betting on the continued penetration of stablecoins globally. Stablecoins will, for the first time, enable an extremely large population, long excluded from the traditional financial system, to participate in global stock trading with lower barriers and less friction. We believe this is the reshaping of the next generation of brokers.

5. Final Thoughts

NYSE's entry will indeed impact some crypto-native stock token projects. Models that previously relied on "private issuance" and "unformed rules" will face higher standards, stricter comparisons, and are more likely to be marginalized. But this doesn't mean it's a systemic negative.

On the contrary, it's more like a structural reshuffle brought by industry maturation.

When stock tokenization is incorporated into more complete clearing systems and official frameworks, the real beneficiaries won't be projects issuing more assets, but areas building infrastructure around trading, settlement, and capital flow. Stablecoins will become a more important capital gateway; contracts and derivatives will gain clearer, more credible underlying assets; and crypto-friendly brokers will become key bridges connecting the traditional securities system with the on-chain world.

Competition will certainly intensify, but that doesn't mean innovation will disappear. Instead, the direction of innovation will become more pragmatic: shifting from "how to issue assets" to "how to make assets used more efficiently"; from pursuing formal on-chainization to solving real user friction in funding, trading, settlement, and holding.

If past stock tokenization was an experiment exploring boundaries, then after NYSE's entry, the industry is entering a new phase—clearer rules, more professional participants, and innovation closer to real financial needs. For projects that truly understand the logic of both finance and crypto, this isn't an endpoint, but a new starting point.