SKR Open for Claiming, Is Solana Mobile Worth Watching?

- Core Viewpoint: By issuing its native token SKR, Solana Mobile signals a strategic shift from the first-generation Saga phone's reliance on the serendipitous success of random airdrops towards building a more sustainable, token-economic-model-driven open ecosystem for mobile.

- Key Elements:

- The SKR token price fluctuated between $0.006 and $0.01 upon initial listing. Holders receiving the highest-tier airdrop saw returns exceeding 14x, but its long-term value depends on staking ratios and ecosystem development.

- SKR has an initial supply of 10 billion tokens, with a 10% inflation rate in the first year that decreases annually. This tokenomics design aims to build an ecosystem flywheel, deeply binding the interests of users, developers, and the platform.

- The core value of SKR lies in supporting the TEEPIN network. Holders can stake their tokens to "Guardians" to participate in governance and earn rewards, aiming to establish a decentralized platform security and review mechanism without a single controlling entity.

- Pre-orders for the Seeker phone have surpassed 150,000 units. Its mission is to challenge the duopoly of Apple and Google by building an open mobile platform, but it faces the significant challenge of transitioning from crypto enthusiasts to the mass market.

- The long-term challenge is whether, beyond token incentives, it can foster breakout applications with high user stickiness to sustain ecosystem activity and genuinely challenge the moats of traditional mobile ecosystems.

With Solana Mobile officially launching its native token SKR today (21st), it marks a shift in its incentive mechanism from the "random wealth effect" of the first-generation Saga phone to a more scalable and sustainable "mobile ecosystem economy" for the second-generation Seeker.

This article details the tokenomics of SKR and provides neutral observations on its long-term development: exploring the potential future challenges Solana Mobile faces, and how SKR, as a "launch lever," can drive the growth of its open platform's application ecosystem.

SKR Officially Available for Claiming, How's the Price Performance?

Solana Mobile officially opened SKR token claims today (21st). As the first native asset within the Solana ecosystem to deeply bind the interests of phone holders, developers, and protocols, SKR's launch has garnered significant market attention.

Data shows that SKR's price fluctuated between $0.006 and $0.01 in the first hour after launch. Based on the current market price at the time of writing, approximately $0.0095, the airdrop value for the lowest-tier Scout holders is $47.5; while the highest-tier Sovereign holders receive up to $7,125. Compared to the Seeker phone's pre-sale cost of around $450 to $500, this represents a maximum return of over 14x.

However, with the release of the first wave of liquidity, the market is also observing the long-term staking ratio, which will determine whether SKR can transition from short-term speculation to long-term governance momentum.

Solana Mobile's Vision and the Mission of the Second-Generation Seeker Phone

Solana Mobile states in its vision that the current mobile network ecosystem is under the long-term duopoly of Apple and Google. These two giants not only control app distribution and payment channels but also hold the power to set rules, which runs counter to the open spirit of Web3. Therefore, Solana Mobile's mission is not just to manufacture mobile hardware but to build a true alternative: an open, permissionless mobile platform.

Looking back at the viral success of the first-generation Saga phone, while somewhat serendipitous, its value largely stemmed from random airdrops by third-party projects (like the BONK token). This "blind box" style wealth effect successfully captured attention but also raised questions about the sustainability of the incentive model.

To transform these fragmented traffic flows into long-term, predictable drivers of ecosystem growth, Solana Mobile launched the second-generation Seeker phone and simultaneously initiated the Seeker Season series of ecosystem incentive programs. Seeker is not just an iteration in hardware performance; it is a ticket into the Solana Mobile ecosystem.

Since shipments began in August 2025, Seeker pre-orders have exceeded 150,000 units. Its core competitive advantage lies in the transformation of the incentive mechanism: by issuing the native token SKR, the project officially transitions from relying on third-party random rewards to an institutionalized incentive system, aiming to deeply align the interests of users, developers, and the platform.

SKR Tokenomics and the TEEPIN Architecture

According to official disclosures, SKR's initial total supply is set at 10 billion tokens, employing a linearly decreasing inflation model to balance early development and long-term stability. The first-year inflation rate is set at 10%, decreasing by 25% each subsequent year, eventually stabilizing at 2%. Solana Mobile aims to use SKR to build an interest-aligned "ecosystem flywheel" to drive the long-term development of decentralized mobile hardware and crypto application ecosystems.

The official announcement mentions that in Seeker Season 1, nearly 2 billion SKR were allocated to ecosystem contributors, accounting for 20% of the total supply. After anti-sybil review, a total of 100,908 users qualified.

User allocation tiers are as follows:

- Scout: 5,000 SKR

- Prospector: 10,000 SKR

- Vanguard: 40,000 SKR

- Luminary: 125,000 SKR

- Sovereign: 750,000 SKR

Furthermore, to incentivize early developers, 141 million SKR will be allocated to 188 developers who have listed high-quality applications on the Seeker ecosystem, with each developer receiving 750,000 SKR.

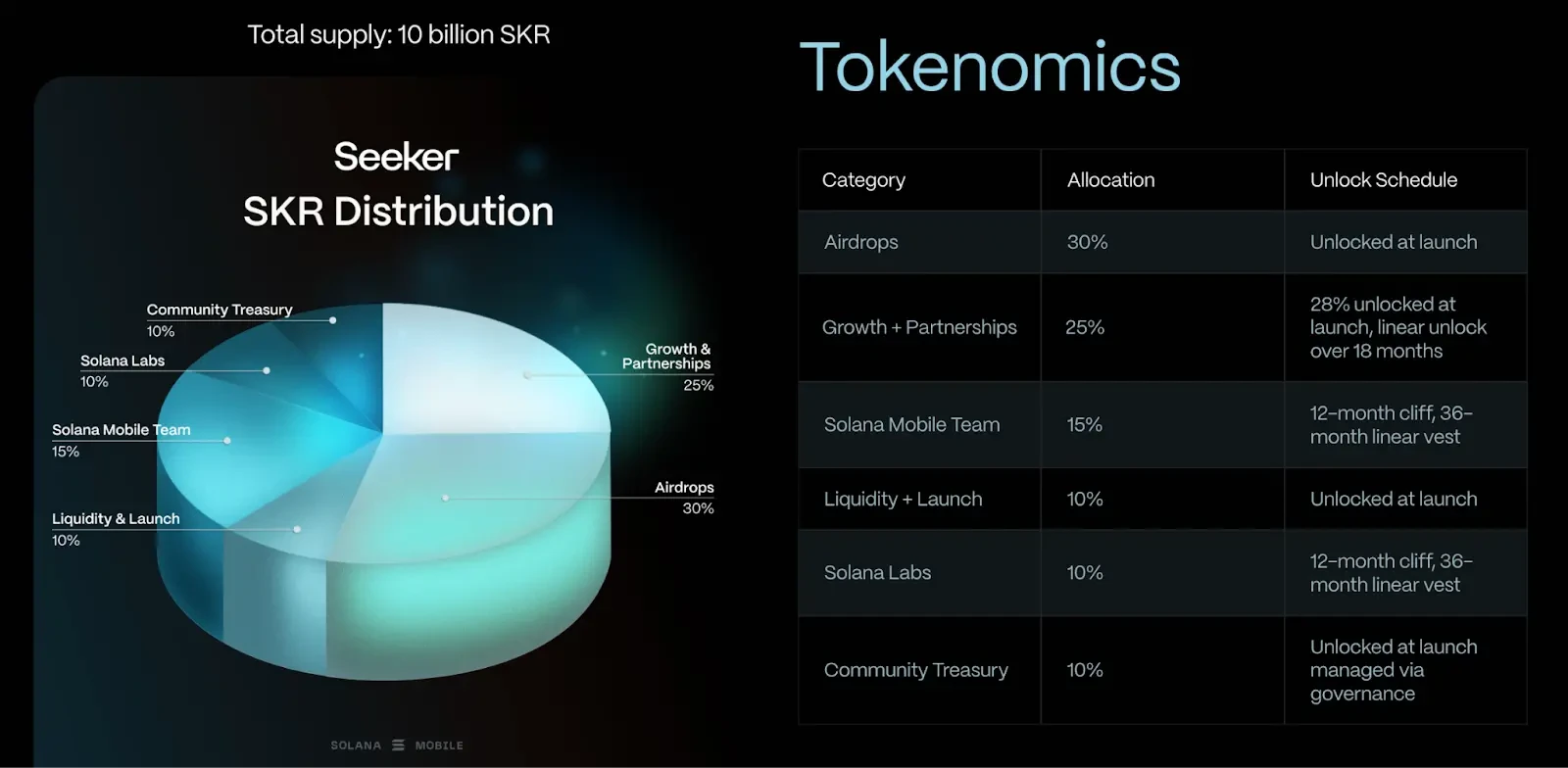

The tokenomics and lock-up periods are as follows: Airdrop allocation: 30% (unlocked at launch), Growth & Partnerships: 25% (28% unlocked at launch, the rest linearly over 18 months), Team allocation: 15% (locked for the first year, then linearly over 36 months), Liquidity & Launch: 10% (unlocked at launch), Solana Labs: 10% (locked for the first year, then linearly over 36 months), and Community Treasury: 10% (unlocked at launch, managed by governance).

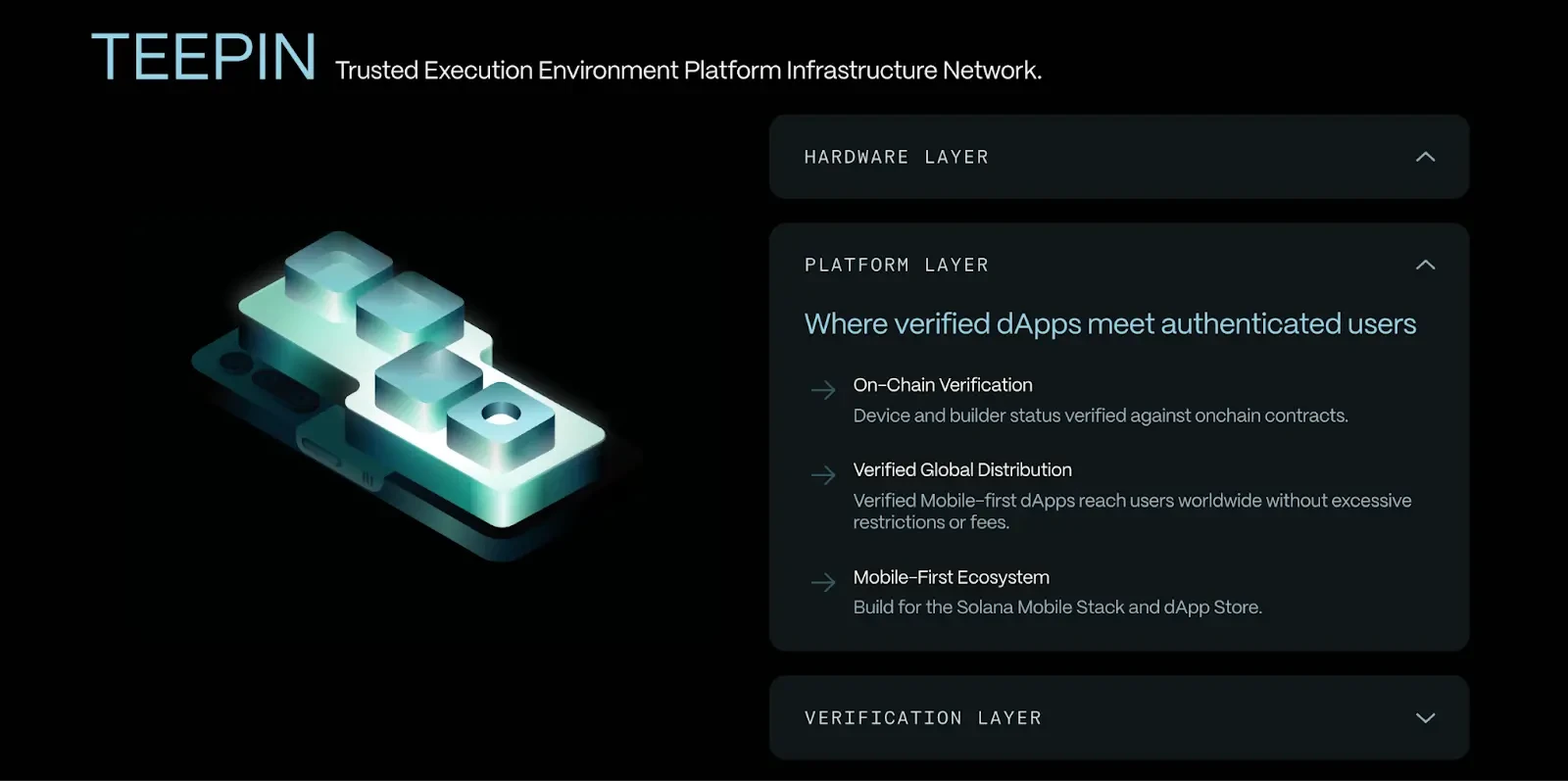

The core value of SKR lies in its support for TEEPIN (Trusted Execution Environment Platform Infrastructure Network).

In 2026, SKR holders will be able to stake their tokens to "Guardians." Guardians are operators responsible for ensuring platform security, with duties including:

- Verifying device identity: Ensuring hardware and software integrity.

- Reviewing the app store: Assessing submissions to the decentralized application store.

- Enforcing community standards: Upholding rules set by the community.

- Distributing staking rewards: Staking SKR to Guardians allows participation in governance and earning rewards for securing the network.

Teams including Anza, DoubleZero, Triton, Helius, and Jito have joined as the first Guardians. Solana Mobile notes that this multi-operator model ensures no single company can control the review or verification process, laying the foundation for an open mobile platform.

SKR Airdrop Claim, Staking, and Seeker Season 2 Outlook

With SKR officially launched, eligible users can now proceed to claim their tokens and participate in staking. After claiming, users can stake directly within the Seed Vault wallet or via the official website portal to earn rewards. Additionally, staked SKR rewards are settled and distributed every 48 hours.

Furthermore, the Seeker Season 2 campaign officially launched on the 9th of this month. The official announcement states that Season 2 will introduce more applications to its open platform and provide exclusive SKR incentive programs. Users simply need to continue using their Seeker phone, explore newly launched applications, and participate in ecosystem activities to accumulate participation data for Season 2.

From Airdrop Incentives to Ecosystem Development, Is Solana Mobile's Marathon Just Beginning?

The launch of the SKR token marks a significant strategic shift in Solana Mobile's development direction. If the success of the first-generation Saga phone began with the surprise of "random airdrops," then the evolution from Saga to Seeker represents the project's attempt to institutionalize this serendipity into a more scalable and sustainable "mobile ecosystem economy."

However, while SKR has generated immense market attention, it is still necessary to examine the potential challenges for its long-term development. The current wealth effect has successfully attracted over 150,000 seed users, but token rewards are essentially a "launch lever," not the ultimate goal of ecosystem development.

Firstly, if Solana Mobile relies solely on token incentives, it will be difficult to sustain high levels of user activity in the long term. As the early subsidy effect gradually diminishes over time, can Solana Mobile foster truly "phenomenal" applications? Without applications that solve real user needs and possess high stickiness, these 150,000 users are highly likely to migrate to other ecosystems after the reward cycle ends.

Secondly, in the intensely competitive global smartphone market, Solana Mobile faces Apple's iOS and Google's Android, which possess formidable technological moats and user stickiness. The advantages of an open platform, developer sovereignty, and censorship resistance may not necessarily translate into conditions compelling enough for average users to cross the ecosystem threshold. This will be a key consideration for whether Seeker can successfully transition from a "toy for crypto enthusiasts" to a "mainstream market tool."

The delivery of 150,000 Seeker phones is merely the starting point for Solana Mobile. The real battlefield lies in whether, within the economic framework built by SKR, it can cultivate an open application ecosystem capable of challenging the traditional giants.