Similar Trend? Just an Illusion: Why Bitcoin Today Is Fundamentally Different from 2022

- Core View: The article argues that it is erroneous to simply compare the current (early 2026) Bitcoin market to the 2022 bear market. There are fundamental differences in core aspects such as macroeconomic backdrop, technical structure, and investor composition. The current market has entered a new phase of "structural long-term holding" dominated by institutions with reduced volatility.

- Key Factors:

- Opposite Macro Environment: 2022 was characterized by high inflation and a rate-hiking cycle, whereas the current environment features slowing inflation, expectations of rate cuts, and renewed liquidity injection—a "risk-on" environment.

- Different Technical Structure: 2022 featured a weekly chart "double top" reversal structure, while the current (early 2026) decline is more likely a "bear trap," as a key price range ($80,850 - $62,000) has undergone massive accumulation.

- Shift in Investor Structure: The market has shifted from being dominated by retail investors and high-leverage speculation to being institutionally led. The launch of Bitcoin ETFs has introduced "structural long-term holders," locking up part of the supply and significantly reducing volatility.

- Significantly Lower Volatility: Bitcoin's historical volatility range has shifted from 80%-150% to the current 30%-60%, marking a fundamental change in its asset attributes.

- Stringent Conditions for a Bear Market Return: It would require simultaneously meeting harsh conditions such as a new major inflation shock, central banks restarting rate hikes/quantitative tightening, and Bitcoin decisively breaking below the $80,850 level.

Original Author: Garrett

Original Compilation: Saoirse, Foresight News

Recently, some analysts have been comparing the current Bitcoin price action to that of 2022.

Admittedly, the short-term price movements may appear somewhat similar. However, from a long-term perspective, this comparison is completely absurd.

Whether looking at long-term price patterns, macroeconomic backdrop, investor composition, or supply/demand/holding structures, the underlying logic is fundamentally different.

In financial market analysis and trading, the biggest mistake is focusing solely on short-term, surface-level statistical similarities while ignoring long-term, macro, and fundamental drivers.

Completely Opposite Macroeconomic Backdrop

In March 2022, the US was mired in high inflation and a rate-hiking cycle, driven by factors including:

- Excess liquidity during the COVID-19 pandemic;

- The ripple effects of the Ukraine crisis, which further significantly pushed inflation higher.

At that time, risk-free rates were rising continuously, liquidity was being systematically withdrawn, and financial conditions were tightening.

In such an environment, capital's primary goal was risk aversion. The Bitcoin price action we witnessed was essentially a distribution pattern at highs during a tightening cycle.

The current macro environment is precisely the opposite:

- The Ukraine conflict situation continues to ease (partly due to US efforts to lower inflation and reduce rates);

- Both the Consumer Price Index (CPI) and US risk-free rates are trending downwards;

- More importantly, the AI technology revolution has significantly increased the likelihood of the economy entering a long-term deflationary cycle. Therefore, from a larger cycle perspective, rates have entered a cutting phase;

- Central banks are re-injecting liquidity into the financial system;

- This means capital currently exhibits "risk-on" characteristics.

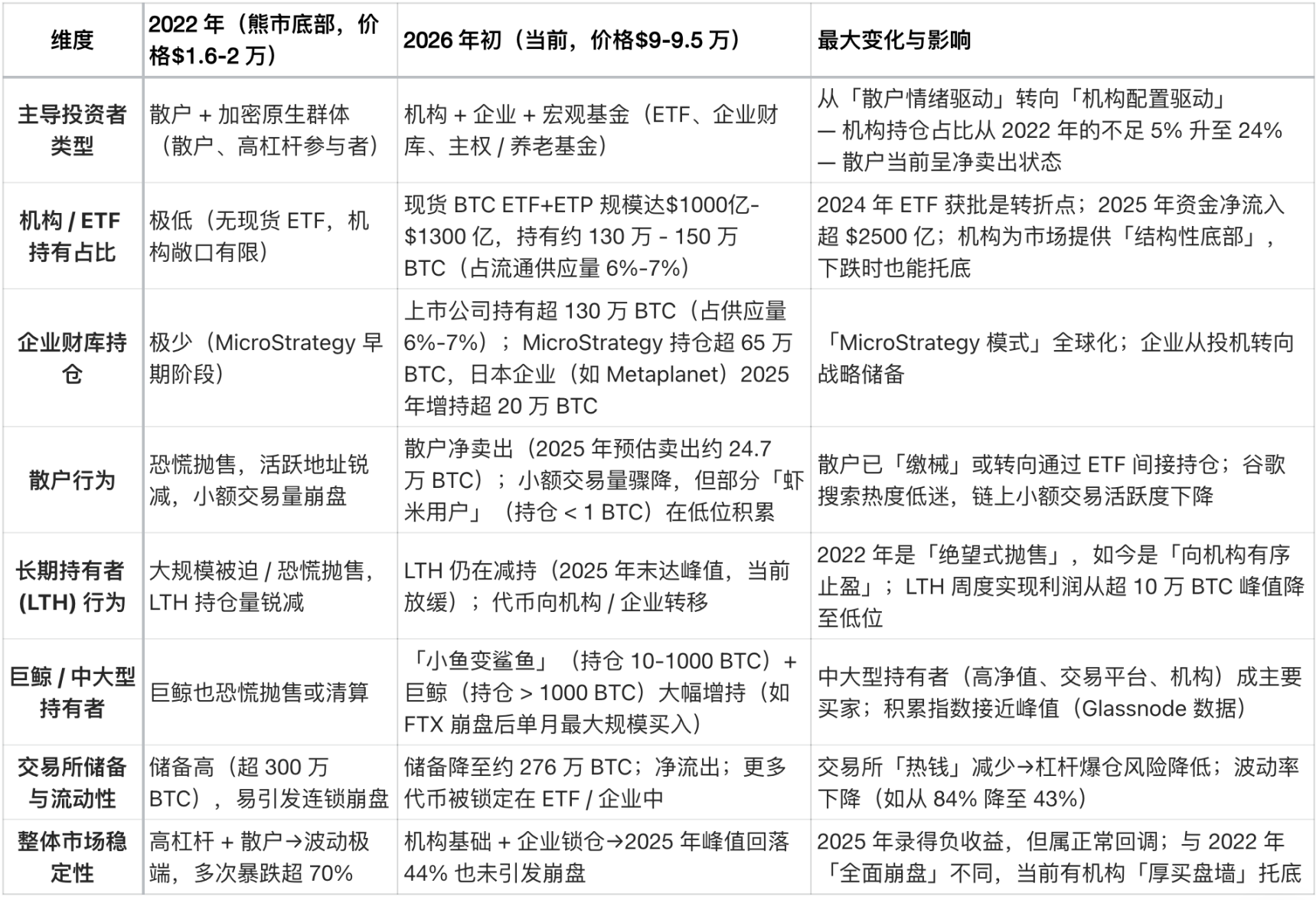

As can be seen from the chart below, since 2020, Bitcoin has shown a clear negative correlation with the year-over-year change in CPI — Bitcoin tends to fall during rising inflation cycles and tends to rise during slowing inflation cycles.

Against the backdrop of the AI-driven tech revolution, long-term deflation is highly probable — a view also shared by Elon Musk, further validating our argument.

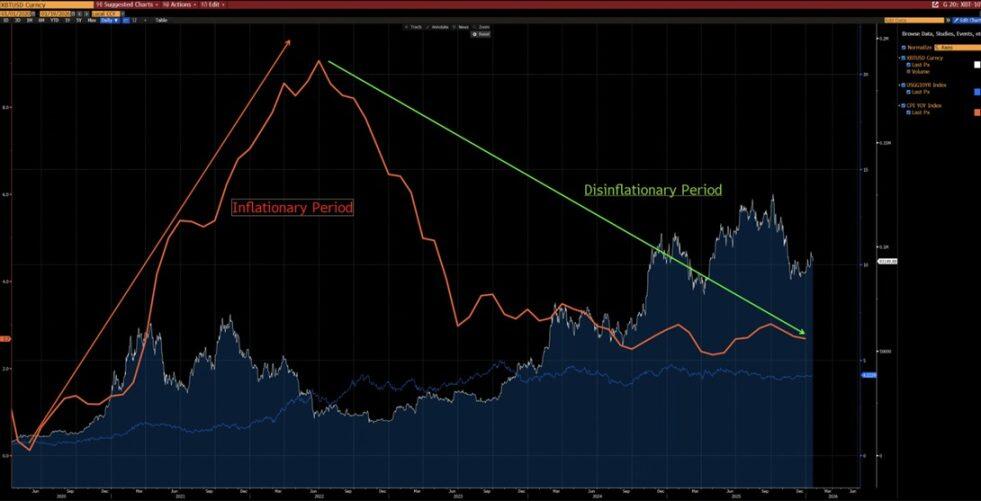

Another chart below also reveals that since 2020, Bitcoin has exhibited an extremely strong correlation with the US Liquidity Index (excluding data distortions in 2024 due to ETF inflows). Currently, the US Liquidity Index has broken above both the short-term (white line) and long-term (red line) downtrend lines — a new uptrend is emerging.

Distinctly Different Technical Structure

- 2021-2022: A weekly "M-top" pattern, which is typically associated with long-cycle market tops and tends to suppress price action for an extended period.

- 2025 (affecting early 2026 action): A weekly breakdown from the rising channel. From a probabilistic analysis, this is more likely a "bear trap" before a rebound back into the channel.

Of course, we cannot completely rule out the possibility that the current action evolves into a continuation of the 2022-style bear market. However, it is crucial to note that the $80,850-$62,000 range has previously undergone significant consolidation and distribution.

This prior accumulation process provides bullish positions with a far superior risk-reward ratio — upside potential significantly outweighs downside risk.

What Conditions Are Needed to Replicate a 2022-Style Bear Market?

To replicate a bear market like 2022, several hard conditions must be met:

- A new wave of inflationary shocks, or a major geopolitical crisis on a scale comparable to 2022;

- Central banks restarting rate hikes, or resuming balance sheet Quantitative Tightening (QT) policies;

- A decisive and sustained break below the $80,850 level for Bitcoin's price.

Until all these conditions are met, declaring a structural bear market is premature and constitutes a speculative judgment rather than a conclusion based on rational analysis.

Markedly Different Investor Structure

- 2020-2022: The market was dominated by retail investors, with limited institutional participation, especially from long-term allocators.

- Starting 2023: The launch of Bitcoin ETFs introduced "structural long-term holders," effectively locking up a portion of Bitcoin supply, significantly reducing trading activity, and notably suppressing volatility.

2023 marked a structural inflection point for Bitcoin as an asset, both from a macroeconomic and quantitative analysis perspective.

The volatility range for Bitcoin has also undergone a fundamental shift:

- Historical Volatility: 80%-150%

- Current Volatility: 30%-60%

This change signifies a fundamental shift in Bitcoin's asset attributes.

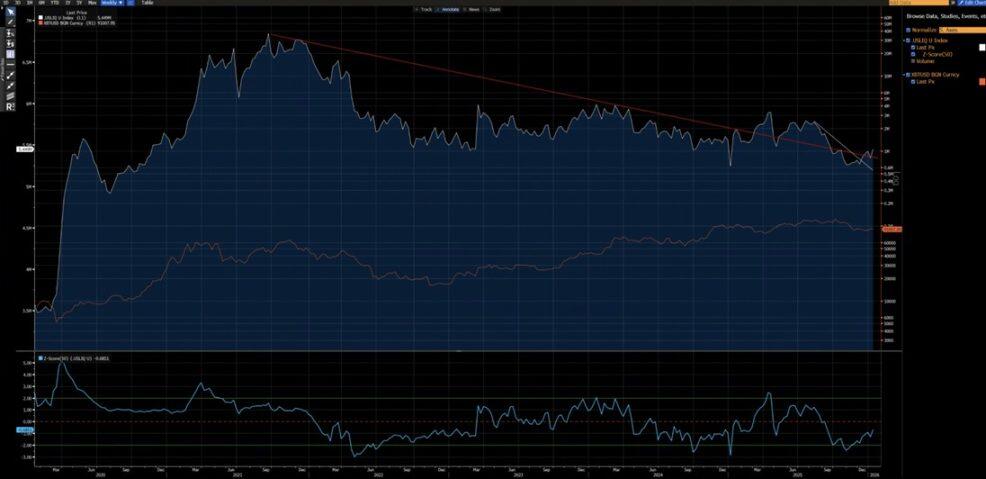

Core Structural Differences (Current vs. 2022)

The biggest difference in Bitcoin's investor structure between early 2026 and 2022 is the shift from a "retail-dominated, high-leverage speculation" market to an "institution-dominated, structural long-term holding" market.

In 2022, Bitcoin experienced a typical "crypto-native bear market," triggered by retail panic selling and cascading leverage liquidations.

Today, Bitcoin has entered a far more mature "institutional era," characterized by:

- Stable underlying demand

- Portion of supply being locked long-term

- Volatility reaching institutional-grade levels

The following is a core comparison by Grok based on on-chain data (e.g., Glassnode, Chainalysis) and institutional reports (e.g., Grayscale Investments, Bitwise, State Street) from mid-January 2026 (when Bitcoin was in the $90k-$95k range):