Is the Fed's Independence Shaking? Is Bitcoin's Safe-Haven Moment Here?

- Core View: The ECB's chief economist warns that political pressure on the Fed could undermine the credibility of the US dollar and push up term premiums. This would impact global financial markets through real yields and liquidity channels, placing Bitcoin in two starkly different macro paradigms: facing pressure under the traditional yield differential paradigm, or becoming an alternative monetary asset under the credibility risk paradigm.

- Key Elements:

- The core risk is that political pressure could force markets to reassess US assets based on governance factors (rather than fundamentals), triggering a reevaluation of the dollar's role. This institutional risk would first manifest in term premiums.

- A term premium shock could occur even without the Fed raising rates, by pushing up long-term yields and tightening financial conditions, creating downward pressure on high-duration assets like Bitcoin.

- If the dollar weakens due to governance risks, Bitcoin could act as a "release valve" or alternative currency. Its volatility would spike dramatically, with its price action depending on the dominant paradigm.

- Stablecoins are backed by safe assets like US Treasuries. A term premium shock would directly affect stablecoin yields and on-chain liquidity, making dollar risks "crypto-native."

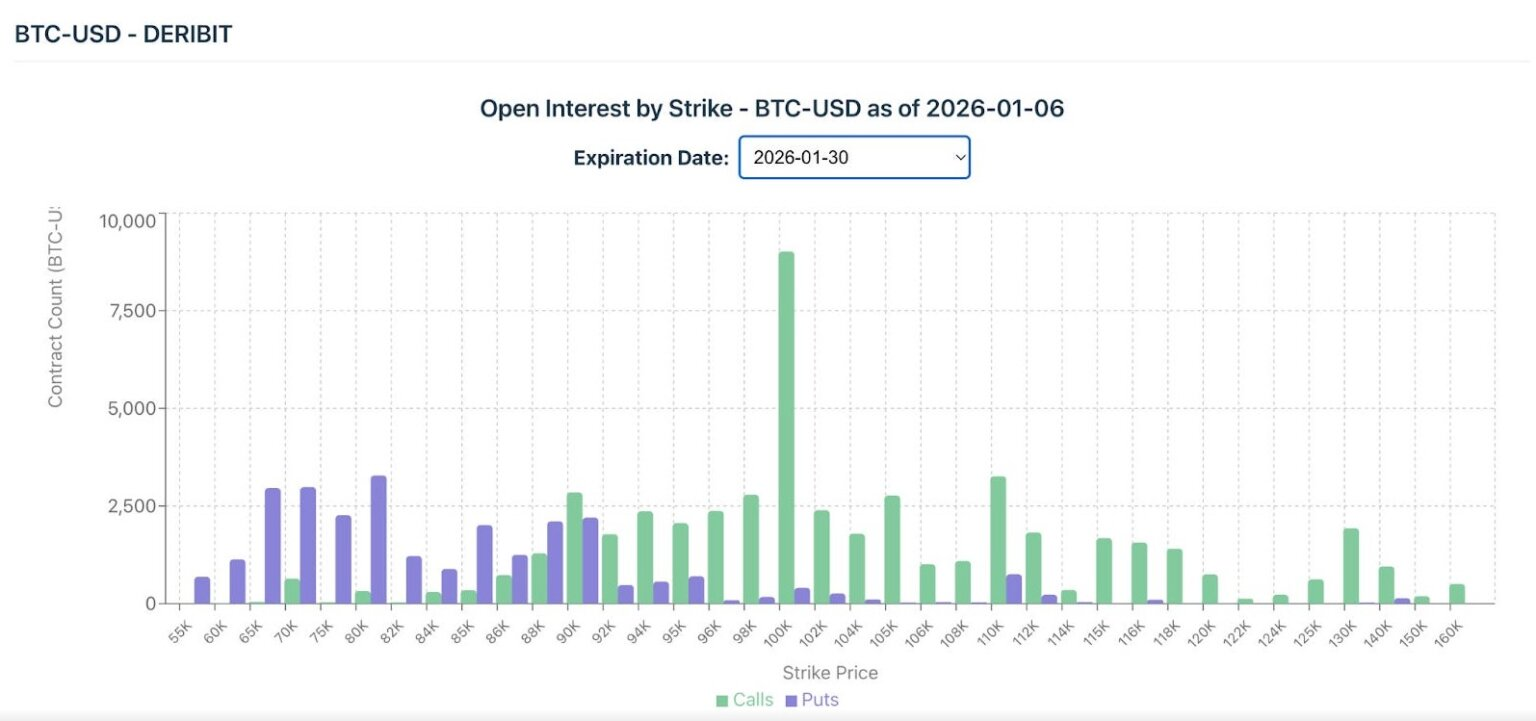

- Market indicators show Bitcoin options open interest is highly concentrated at the $100,000 strike price. Macro shocks could be amplified through leverage and Gamma dynamics, exacerbating market volatility.

Original Author: Gino Matos

Original Compilation: Shenchao TechFlow

Introduction: Against the backdrop of global macroeconomic volatility and intensifying geopolitical competition, Philip Lane, the Chief Economist of the European Central Bank (ECB), has issued a rare warning: the "tussle" between the Federal Reserve and political forces could endanger the international status of the US dollar.

This article delves into how such political pressure transmits to global financial markets through term premiums and explains why, at this moment of potential credit system instability, Bitcoin could become a final safe haven for investors.

The author combines multi-dimensional data including US Treasury yields, inflation expectations, and the stablecoin ecosystem to unpack two distinct macro paradigms that Bitcoin may face in the future.

Full Text Below:

Philip Lane, the Chief Economist of the European Central Bank (ECB), issued a warning that most market participants initially dismissed as an internal European "housekeeping matter": while the ECB can maintain its accommodative path for now, the "tussle" around the Federal Reserve's mandate independence could trigger global market turbulence by pushing up US term premiums and sparking a reassessment of the dollar's role.

Lane's framing is crucial because it identifies the specific transmission channels most impactful for Bitcoin: real yields, dollar liquidity, and the credibility framework underpinning the current macro system.

The immediate trigger for the recent market cooldown was geopolitics. As fears of a US strike on Iran subsided, the risk premium on crude oil weakened. At the time of writing, Brent crude fell to around $63.55, and West Texas Intermediate (WTI) dropped to around $59.64, retreating about 4.5% from the highs of January 14th.

This, at least temporarily, severed the chain reaction from geopolitics to inflation expectations to the bond market.

However, Lane's comments point to a different risk: not a supply shock or growth data, but political pressure imposed on the Fed, potentially forcing markets to reassess US assets based on governance factors rather than fundamentals.

The International Monetary Fund (IMF) has also emphasized in recent weeks that the Fed's independence is critical, noting that a weakening of independence would have a "negative impact on credit ratings." This type of institutional risk often manifests in term premiums and foreign exchange risk premiums before making headlines.

The term premium is the component of long-term yields that compensates investors for uncertainty and maturity risk, independent of expected future short-term rates.

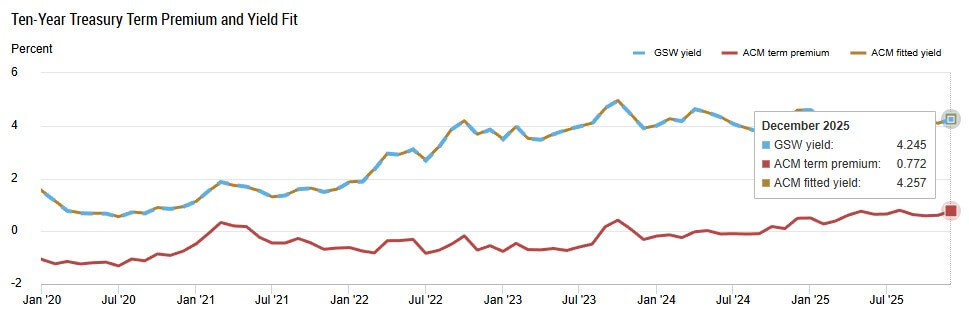

As of mid-January, the New York Fed's ACM term premium held around 0.70%, while the St. Louis Fed's (FRED) 10-year zero-coupon estimate was about 0.59%. On January 14th, the 10-year Treasury nominal yield was approximately 4.15%, the 10-year TIPS real yield was 1.86%, and the 5-year breakeven inflation expectation (as of Jan 15) was 2.36%.

By recent standards, these figures are in a stable range. But Lane's core point is that this stability could unravel quickly if markets begin pricing a "governance discount" into US assets. A term premium shock doesn't require the Fed to hike rates; it can occur when credibility is damaged, lifting long-end yields even if the policy rate stays unchanged.

Caption: The 10-year US Treasury term premium rose to 0.772% in December 2025, its highest level since 2020, with yields reaching 4.245%.

The Term Premium Channel is the Discount Rate Channel

Bitcoin resides in the same "discount rate universe" as stocks and other duration-sensitive assets.

When term premiums rise, long-end yields climb, financial conditions tighten, and liquidity premiums compress. ECB research documents how the dollar appreciates as the Fed tightens across multiple policy dimensions, making US rates the core pricing kernel for the globe.

Historically, Bitcoin's upward momentum has often come from an expansion of the liquidity premium: when real yields are low, discount rates are easy, and risk appetite is high.

A term premium shock reverses this dynamic without the Fed changing the federal funds rate. This is why Lane's argument matters for crypto, even as he was speaking to European policymakers.

On January 16th, the US Dollar Index (DXY) hovered around 99.29, near the low end of its recent range. But Lane's mention of a "reassessment of the dollar's role" opens up two distinct scenarios, not a single outcome.

In the traditional "yield differential" paradigm, higher US yields strengthen the dollar, tighten global liquidity, and pressure risk assets, including Bitcoin. Research shows crypto's correlation with macro assets is stronger post-2020, and it exhibits negative correlation with DXY in some samples.

But in a credibility risk paradigm, outcomes diverge: if investors demand a premium for US assets due to governance risk, term premiums could rise even as the dollar weakens or churns. In this case, Bitcoin would trade more like a "pressure release valve" or alternative monetary asset, especially if inflation expectations rise alongside credibility concerns.

Furthermore, Bitcoin is now more connected to equities, the AI narrative, and Fed signals than in previous cycles.

According to Farside Investors, Bitcoin ETFs saw renewed net inflows in January, totaling over $1.6 billion. Coin Metrics notes that open interest in spot options is concentrated around the $100,000 strike price expiring at the end of January.

This positioning means a macro shock could be amplified through leverage and Gamma dynamics, transforming Lane's abstract "term premium" concern into a concrete catalyst for market volatility.

Caption: Open interest for Bitcoin options expiring on January 30, 2026, shows the highest concentration of over 9,000 call contracts at the $100,000 strike price.

Stablecoin Infrastructure Makes Dollar Risk "Crypto-Native"

A significant portion of the crypto trading layer operates on dollar-denominated stablecoins, which are backed by safe assets (typically US Treasuries).

Research from the Bank for International Settlements (BIS) links stablecoins to the pricing dynamics of safe assets. This means a term premium shock isn't just some "macro vibe"; it directly permeates stablecoin yields, demand, and on-chain liquidity conditions.

When term premiums rise, the cost of holding duration increases, potentially affecting stablecoin reserve management and altering the liquidity available for risk trades. Bitcoin may not be a direct substitute for US Treasuries, but it exists in an ecosystem where Treasury pricing sets the benchmark for the definition of "risk-free."

Currently, markets see about a 95% chance the Fed holds rates steady at its January meeting, with major banks pushing back expected rate cuts to 2026.

This consensus reflects confidence in near-term policy continuity, thereby anchoring term premiums. But Lane's warning is forward-looking: if that confidence cracks, term premiums could jump 25 to 75 basis points within weeks, without any change in the funds rate.

A mechanical example: if the term premium rises 50 bps while expected short-term rates stay flat, the 10-year nominal yield could drift from 4.15% toward 4.65%, with real yields repricing in sync.

For Bitcoin, this implies tighter financial conditions and downside risk via the same channels that squeeze high-duration stocks.

However, a credibility shock triggering dollar weakness creates a completely different risk profile.

If global investors begin reducing US asset holdings on governance grounds, the dollar could weaken even as term premiums rise. In this scenario, Bitcoin's volatility would spike dramatically, and its direction would depend on whether the yield differential paradigm or the credibility risk paradigm dominates at that moment.

While academia debates Bitcoin's "inflation hedge" properties, in most risk regimes, the dominant channels remain real yields and liquidity, not simply breakeven inflation expectations.

Philip Lane's argument forces us to consider both possibilities simultaneously. This is why a "dollar repricing" is not a one-way bet, but a fork in the regime.

Watchlist

The checklist for tracking this development is clear:

At the Macro Level:

- Term Premiums

- 10-year TIPS Real Yields

- 5-year Breakeven Inflation Expectations

- The level and volatility of the US Dollar Index (DXY)

At the Crypto Level:

- Bitcoin Spot ETF Fund Flows

- Options Positioning Around Key Strikes like $100,000

- Changes in Skew Around Major Macro Events

These metrics connect Lane's warning to Bitcoin's price action without speculating on the Fed's future policy decisions.

Lane's signal was initially directed at European markets, but the "pipes" he describes are the same logic that determines Bitcoin's macro environment. The oil premium has faded, but the "governance risk" he highlighted remains.

If markets begin pricing the Fed's political tussle, the shock will not be confined to US shores. It will transmit globally via the Dollar and the Yield Curve, and Bitcoin's reaction to such a shock is often sharper and earlier than that of most traditional assets.