Bitcoin Network Hashrate Drops 15% from Peak, Are Miners Being Lured Away by AI?

- Core View: The Bitcoin mining industry is facing severe challenges from systemic compression of profitability, leading to a significant decline in network hashrate and continuous miner capitulation. However, the industry is actively pivoting towards AI data centers to seek new avenues for growth. Historical data also suggests that Bitcoin's long-term returns are often higher following periods of hashrate decline.

- Key Elements:

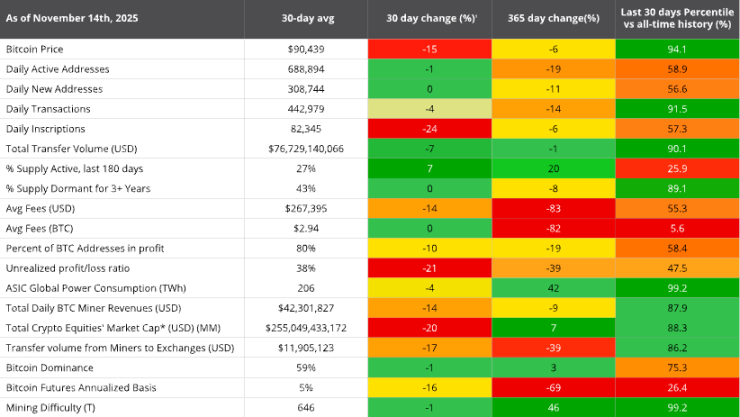

- Bitcoin network hashrate has fallen approximately 15% from its October peak, with miner capitulation persisting for nearly 60 days. Mining difficulty is expected to be adjusted downward again.

- Miner profitability continues to deteriorate. The daily block reward revenue per EH/s for December 2025 has dropped to a record low of $38,700, a significant 32% decrease year-over-year.

- The industry squeeze stems from the block subsidy halving and cost pressures driven by rapid hashrate growth. The break-even electricity price for mining rigs has notably decreased, deepening reliance on low electricity costs and operational efficiency.

- Confronted with these challenges, crypto mining facilities are leveraging their power and infrastructure advantages to actively transition towards AI cloud services or IDC power leasing models, seeking new business paradigms.

- Historical data shows that when Bitcoin's 90-day hashrate growth is negative, the probability of achieving positive returns over the next 180 days (77%) and the average return (+72%) are both significantly higher compared to periods of hashrate growth.

Original Author: ChandlerZ, Foresight News

Bitcoin's hash rate has grown approximately tenfold since 2020, but has shown a relatively significant decline in recent months.

Data shows that the Bitcoin network's hash rate has fallen about 15% from its October peak, with miner capitulation persisting for nearly 60 days. The network's average hash rate has dropped from around 1.1 ZH/s in October to about 977 EH/s, indicating that miners are shutting down machines or capitulating as profitability declines.

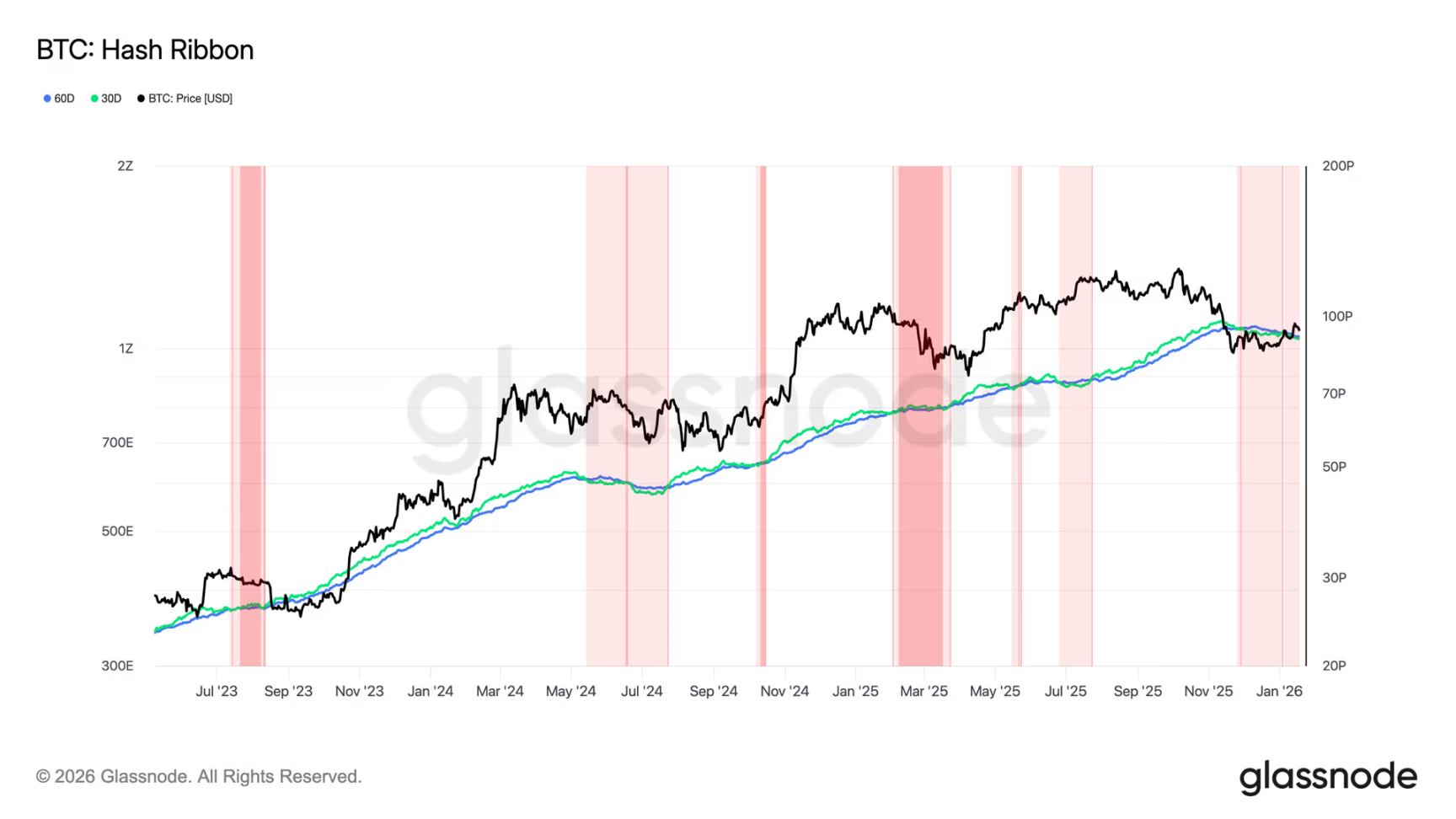

Furthermore, Glassnode's Hash Ribbons indicator reversed on November 29. This indicator tracks short-term and long-term hash rate trends to reflect miner capitulation. Currently, short-term supply pressure in the Bitcoin market may further increase. Bitcoin's mining difficulty is expected to be adjusted downward on January 22, marking the seventh decrease in the past eight adjustments, dropping to around 139 T.

Mining Profitability Declines for Five Consecutive Months

JPMorgan stated that the Bitcoin network's hash rate decreased by approximately 3% month-over-month to 1045 EH/s in December 2025, indicating some easing in miner competition, but mining profitability continues to decline.

However, data shows that in December 2025, miners' average daily block reward revenue per EH/s was $38,700, down 7% from November, down 32% year-over-year, reaching a historical low.

VanEck's report analysis suggests that the Bitcoin mining industry is experiencing significant compression. On one hand, the periodic halving of block subsidies causes a "stepwise" decline in miner revenue. On the other hand, the global hash rate has expanded at a compound growth rate of about 62% since 2020, forcing miners to continuously invest CAPEX to increase hash power to avoid being eliminated. If the coin price cannot offset the rising unit costs caused by subsidy reductions and hash rate growth, miner profits will be systematically compressed.

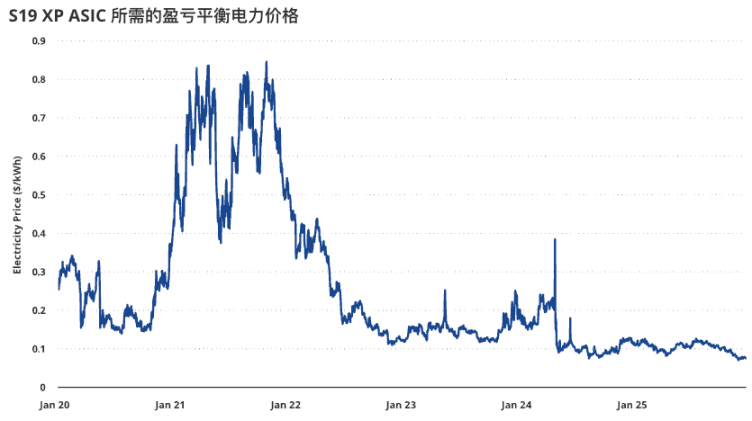

The deterioration of miner profitability can be intuitively seen from the electricity price break-even point. Taking the 2022-generation miner S19 XP as an example, its bearable break-even electricity price dropped from about $0.12/kWh in December 2024 to about $0.077/kWh in December 2025. This means that against the backdrop of recent weakness in BTC prices, the marginal economics of mining have significantly worsened, further increasing the industry's reliance on low-cost electricity resources, economies of scale, and operational efficiency.

Although the global hash rate has cumulatively increased about tenfold since 2020, based on the 30-day moving average, the network hash rate has fallen about 4% over the past 30 days, the largest decline since April 2024. Simultaneously, supply-side disruptions are also affecting the hash rate. For example, mining farms in the Xinjiang region shut down approximately 1.3GW of capacity under regulatory scrutiny, with an estimated 400,000 mining machines going offline.

Mining Farms Actively Transitioning to AI Data Centers

A Guojin Securities report shows that in the third quarter of 2025, the mining cost including depreciation for US-listed companies had risen to $112,000, exceeding the current Bitcoin price. Crypto mining farm companies possess powered-up, high-bandwidth computing infrastructure near major metropolitan areas, with electricity costs generally between 3-5 cents per kWh, making them naturally suitable for AI cloud service businesses. With the growth in AI computing demand, the transition of crypto mining farms to AI data centers is an inevitable choice.

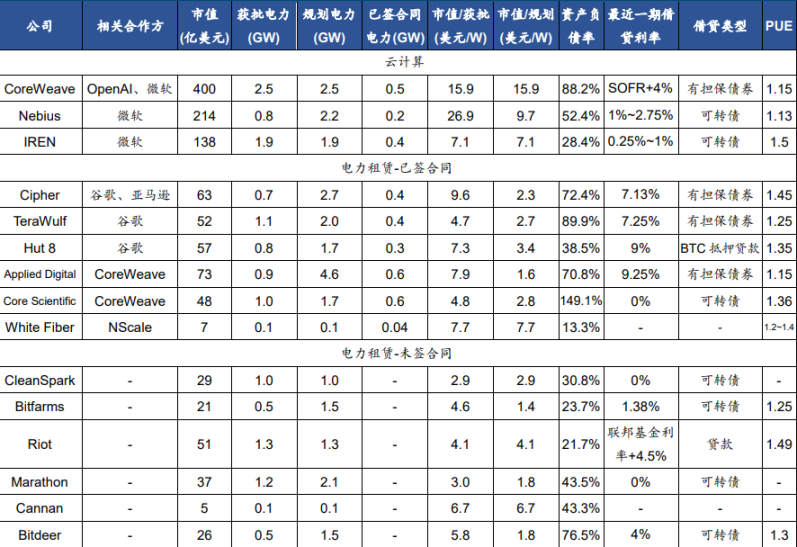

Fourteen major US-listed mining farm companies are expected to reach a power capacity of 15.6GW by 2027. Their transition business models are primarily cloud computing leasing and IDC power leasing.

Crypto mining farms transitioning to AI data centers mainly adopt two business models.

The first is similar to CoreWeave and Nebius, involving purchasing chips for cloud computing leasing. Currently, IREN employs this model. IREN has a gross power capacity of 2.91GW, corresponding to about 1.9GW of core capacity. Its market capitalization per watt is lower than CoreWeave and Nebius, and it has already partnered with Microsoft for 200MW of core capacity.

The second is a power leasing model similar to IDCs, where only the right to use the data center building and power capacity is leased, with tenants responsible for servers and electricity bills. Most crypto mining farms currently use this hosting model. Some companies have signed leasing contracts with Google, Amazon, CoreWeave, etc. Most other companies, having transitioned later, are still seeking partners.

VanEck: Hash Rate Decline Could Actually Be a Positive Factor

However, VanEck's report also suggests that the hash rate decline could be a positive factor. By comparing the 30-day change in Bitcoin's hash rate since 2014 with the expected return over the next 90 days, when Bitcoin's hash rate declines, the probability of a positive expected return is higher than when the hash rate rises. Furthermore, when Bitcoin's hash rate declines, the average 180-day expected return is about 30 basis points higher than when the hash rate rises.

When hash rate compression persists for a longer period, positive forward returns tend to be more frequent and larger in magnitude. Since 2014, during the 346 days when the 90-day hash rate growth was negative, the probability of a positive 180-day Bitcoin forward return was 77%, with an average return of +72%. In all other periods, the probability of a positive 180-day Bitcoin forward return is about 61%, with an average return of +48%.

Therefore, historically, buying BTC when the 90-day hash rate growth is negative can increase the 180-day expected return by 2400 basis points.

Even during periods of weak economics, many entities choose to continue mining. Short-term profit pressure and hash rate fluctuations are more likely to accelerate industry consolidation and concentration, and do not necessarily signify the long-term decline of the mining industry.